Vulcan Materials, Martin Marietta Forecast Gains From Stimulus

February 09 2010 - 1:40PM

Dow Jones News

Top producers of gravel, asphalt and other mainstays of heavy

construction said government stimulus spending should spur improved

demand this year, even as they reported disappointing

fourth-quarter results amid the tough economy.

"A lot of the stimulus work [on highways] that was slow getting

out of the box in key states" last year will buoy 2010 volumes,

Vulcan Materials Co. (VMC) Chief Executive Don James told analysts

on a post-earnings conference call.

In states such as Florida and California, "the vast majority of

their [stimulus-related] spending is in front of them," James

said.

Martin Marietta Materials Inc. (MLM) concurred, noting in a

prepared statement that many of its customers "began 2010 with a

project backlog that would not exist" without stimulus funding.

Among other stimulus programs, $27.5 billion was set aside for

highway projects. The money has taken longer than many suppliers

expected to work its way into actual contracts, but both Vulcan and

Martin Marietta indicated the logjam has broken.

But they predicted only small overall increases in aggregates

volume this year regardless. Residential construction is expected

to improve, albeit off a low base, but privately funded commercial

construction is forecast to remain weak.

Vulcan said it expects its aggregates volume to be flat to up 5%

in 2010, while Martin Marietta pegged its volume increase at 2% to

4%.

They reported fourth-quarter declines in aggregates volume of

23% and 24%, respectively.

Both said it will be critical for Congress to reauthorize the

federal highway bill, which expired last fall and has been

operating under a continuing resolution, and they voiced support

for a federal effort aimed at job creation.

Vulcan reported a net loss of 11 cents a share on $590 million

in revenue. Wall Street's consensus forecast called for a loss of 2

cents a share on $641 million in revenue.

Martin Marietta reported a loss of 7 cents a share on $374.7

million in revenue. Excluding items, the company said earnings came

in at 11 cents a share, but the figure still fell short of Wall

Street's forecast for earnings of 33 cents on $383 million in

revenue.

Shares of Martin Marietta were off about 6.2% in recent trading

at $74.67. Vulcan shares were off about 2.8% at $42.29.

James, of Vulcan Materials, said he expects stimulus spending to

help results through 2011.

"By that time, we expect demand from private construction

activity to be improving," he said.

-By Bob Sechler, Dow Jones Newswires; 512-394-0285;

bob.sechler@dowjones.com

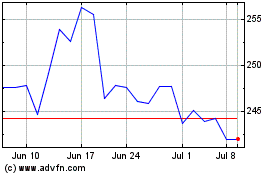

Vulcan Materials (NYSE:VMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

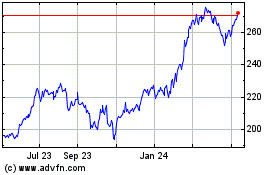

Vulcan Materials (NYSE:VMC)

Historical Stock Chart

From Apr 2023 to Apr 2024