US Industry Groups Urge Multi-Year Highway-Spending Bill

November 18 2009 - 6:14PM

Dow Jones News

A consortium of asphalt and concrete industry groups are urging

Congress to pass a new transportation bill soon because states

won't commit to highway construction without a long-term federal

spending plan.

In a letter sent to federal lawmakers Wednesday, the consortium

asked Congress to enact a new, six-year highway-spending bill

instead of extending for a second time the previous one that

initially expired at the end of September. Congress extended the

previous bill to the end of the year.

"The current lack of funding certainty in the federal highway

market is having a devastating effect on the transportation

construction industry," wrote the consortium, which include the

National Asphalt Pavement Association, or NAPA, the American

Concrete Pavement Association, the National Ready Mixed Concrete

Association, the National Stone, Sand & Gravel Association and

the Portland Cement Association.

The vast majority of U.S. roads are made out of asphalt, and

production of the road material is expected to be down 15% this

year. Producing liquid asphalt is a small business for even the

small independent refiners, but it has been a profitable niche at a

time when most refiners are posting quarterly earnings losses.

NuStar Energy (NS) Chief Executive Curt Anastasio said he is

"more bullish on demand going into 2010" for the company's two East

Coast asphalt refineries based on the stimulus money and tighter

supply of asphalt. But Anastasio and other asphalt producers say a

sustained recovery will depend on a multi-year highway bill.

Congress has no solid transportation plan to replace the

previous bill; both houses of Congress only have proposals to

extend the old one.

The House of Representatives has proposed a three-month

extension while a bipartisan group of seven senators on the Senate

Environment & Public Works Committee sent a letter Tuesday to

the committee's leadership to extend it by six months.

The Senate committee held a briefing on Wednesday with

Department of Transportation officials that revealed states are

receiving 30% less highway funding than last year, said Jay Hansen,

vice president of NAPA's government affairs.

Senator Barbara Boxer (D., Calif.), who supports the six-month

extension, also called on the Obama Administration to submit a

highway plan with a way to pay for it.

Hansen said NAPA would support a six-month plan if the time is

used to write and pass a comprehensive bill: "States are paralyzed;

[they] can't take projects to the next level without knowing where

the money would come from."

The floodgates for federal stimulus spending on highway projects

are expected to open in 2010, but that represents just a fraction

of the billions more states need for new roads and repairs, Hansen

said.

Out of the $787 billion stimulus package Congress passed early

this year, $27.5 billion was earmarked for highway and bridge

construction. Roughly 10%-15% of that money will be awarded by the

end of 2009.

The stimulus program "is fairly short lived, it's a finite

amount of money," said Neal Hickerson, spokesman for Holly Corp.

(HOC), which earns about a fifth of its revenue from liquid

asphalt. In recent weeks, construction firms Vulcan Materials Inc.

(VMC) and Granite Construction Inc. (GV), among others, were

pessimistic about their near-term prospects during their earnings

conference calls.

Road construction accounts for 85% of the asphalt demand in the

U.S., with the rest coming from roofing. Almost two-thirds of the

funding is driven by federal, state and local governments, with the

rest coming from the private sector.

In the long run, there is a great deal of pent-up demand for

building roads, but the near-term emphasis is going to be on

performing maintenance rather than big projects because of budget

constraints, said William L. Thorpe, senior vice president of Alon

USA Energy Inc.'s (ALJ) asphalt division.

For instance, California, which has been struggling with budget

shortfalls, estimated that more than a third of its roads are in

poor condition and need $6 billion for repairs, Thorpe said.

California was allocated less than half that amount under the

stimulus package. Thorpe doesn't expect trends to improve until

late next year.

-By Naureen S. Malik, Dow Jones Newswires; 212-416-4210;

naureen.malik@dowjones.com

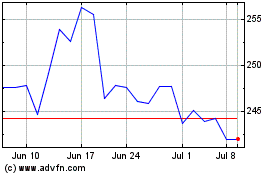

Vulcan Materials (NYSE:VMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

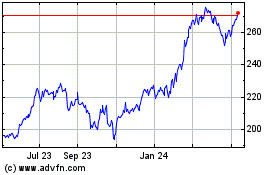

Vulcan Materials (NYSE:VMC)

Historical Stock Chart

From Apr 2023 to Apr 2024