Current Report Filing (8-k)

November 07 2016 - 4:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 2, 2016

VALERO ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-13175

|

|

74-1828067

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

One Valero Way

San Antonio, Texas

|

|

78249

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(210) 345-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

|

|

|

|

(e)

|

On November 2, 2016, Valero’s board of directors (“Board”) approved grants of long-term incentive awards to Valero’s “named executive officers” (as defined in Item 402(a)(3) of Regulation S-K). The grants were made under Valero’s 2011 Omnibus Stock Incentive Plan, and represented awards of (i) restricted shares of Valero’s common stock (“Common Stock”), and (ii) performance shares.

|

The restricted shares vest (become nonforfeitable) in equal annual installments over a period of three years beginning November 2, 2017.

The performance shares are subject to vesting in three annual increments based upon Valero’s total shareholder return (TSR) compared to its peers during one-year, two-year, and three-year performance periods (the first vesting date being in January 2018 for the performance period ending in 2017). On their vesting dates, the performance shares are payable in shares of Common Stock in amounts ranging from zero to 200 percent of the number of vested performance shares. Additional shares of Common Stock may be awarded on the vesting dates with respect to the computed value of dividend equivalents accrued (measured against the Common Stock) during the performance measurement periods, subject to Valero’s achievement of prescribed TSR rankings relative to Valero’s peers.

The specific long-term incentive grants made to Valero’s named executive officers on November 2, 2016 are listed below.

|

|

|

|

|

|

|

name and title

|

restricted shares

|

performance shares

|

|

Joseph W. Gorder, President & CEO

|

82,420

|

82,420

|

|

Michael S. Ciskowski, EVP & CFO

|

30,870

|

30,870

|

|

R. Lane Riggs, EVP-Refining Ops & Engrng

|

17,950

|

17,950

|

|

Jay D. Browning, EVP & General Counsel

|

13,410

|

13,410

|

In addition, on November 2, 2016, the Compensation Committee of the Board approved the execution and delivery by the Company of a Change of Control Severance Agreement (“Agreement”) with R. Lane Riggs, Executive Vice President–Refining Operations and Engineering. The Agreement becomes operative for a fixed three-year period when a change of control occurs. The Agreement provides generally that the officer’s terms of employment will not be materially adversely affected during the three-year period after a change of control. The foregoing description of the Agreement is not complete and is qualified in its entirety by reference to the full text of the Agreement, which is attached as Exhibit 10.02 to this Current Report and incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

|

|

|

|

10.01

|

Valero Energy Corporation 2011 Omnibus Stock Incentive Plan—incorporated by reference to Appendix A to Valero’s definitive proxy statement on Schedule 14A filed March 31, 2016 (SEC File No. 1-13175).

|

|

|

|

|

10.02

|

Change of Control Severance Agreement dated as of November 2, 2016, by and between Valero Energy Corporation and R. Lane Riggs.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

VALERO ENERGY CORPORATION

Date: November 7, 2016 by:

/s/ Jay D. Browning

Jay D. Browning

Executive Vice President and General Counsel

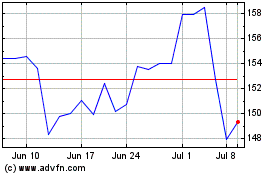

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Apr 2023 to Apr 2024