Current Report Filing (8-k)

May 13 2015 - 4:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 13, 2015

VALERO ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-13175 |

|

74-1828067 |

| (State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

| One Valero Way

San Antonio, Texas |

|

78249 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (210) 345-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

Senior management of Valero Energy Corporation (the “Company”) will

make certain investor presentations beginning as early as May 13, 2015. The slides attached to this report were prepared for management’s presentations. The slides are included in Exhibit 99.01 to this report and are incorporated

herein by reference. The slides will be available on the Company’s website at www.valero.com.

The information in this report is being furnished, not

filed, pursuant to Regulation FD. Accordingly, the information in Items 7.01 and 9.01 of this report will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless

specifically identified therein as being incorporated therein by reference. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report

is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company or any of its affiliates.

Safe Harbor Statement

Statements contained in

the exhibit to this report that state the Company’s or its management’s expectations or predictions of the future are forward-looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933, as

amended, and the Securities Exchange Act of 1934, as amended. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Factors that could affect those results

include those mentioned in the documents that the Company has filed with the Securities and Exchange Commission.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| 99.01 |

|

Slides from management presentation. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

VALERO ENERGY CORPORATION |

|

|

|

|

| Date: May 13, 2015 |

|

|

|

by: |

|

/s/ Jay D. Browning |

|

|

|

|

|

|

Jay D. Browning |

|

|

|

|

|

|

Executive Vice President and General Counsel |

3

|

|

| Investor

Presentation May 2015

Exhibit 99.01 |

|

|

| Statements

contained in this presentation that state the company’s or management’s

expectations or predictions of the future are forward– looking statements intended

to be covered by the safe harbor provisions of the Securities Act of 1933 and the

Securities Exchange Act of 1934. The words “believe,”

“expect,”

“should,”

“estimates,”

“intend,”

and other similar expressions identify forward–looking

statements. It is important to note that actual results could differ

materially from those projected in such forward–looking statements.

For more information concerning factors that could cause actual

results to differ from those expressed or forecasted, see Valero’s

annual reports on Form 10-K and quarterly reports on Form 10-Q, filed

with the Securities and Exchange Commission, and available on

Valero’s website at www.valero.com.

2

Safe Harbor Statement |

|

|

| 3

Who We Are

World’s Largest Independent Refiner

•

15 refineries, 2.9 million barrels per day (BPD) of high-complexity throughput

capacity •

Greater

than

70%

of

refining

capacity

located

in

U.S.

Gulf

Coast

and

Mid-Continent

•

Approximately 10,000 employees

Large Logistics Infrastructure with Focus on Growth

•

General partner and majority owner of Valero Energy Partners LP (NYSE: VLP), a

growth-oriented, fee-based master limited partnership (MLP)

•

Significant inventory of logistics assets within Valero

Wholesale Fuels Marketer

•

Approximately 7,400 marketing sites in U.S., Canada, United Kingdom, and Ireland

•

Brands include Valero, Ultramar, Texaco, Shamrock, Diamond Shamrock, and Beacon

One of North America’s Largest Renewable Fuels Producers

•

11 corn ethanol plants, 1.3 billion gallons per year (85,000 BPD) production capacity

•

Operator

and

50%

owner

of

Diamond

Green

Diesel

joint

venture

–

10,800

BPD

renewable diesel production capacity |

|

|

| 4

Assets Concentrated in Advantaged

Locations

Refinery

Capacities (MBPD)

Nelson

Index

Throughput

Crude

Corpus Christi

325

205

19.9

Houston

175

90

15.4

Meraux

135

125

9.7

Port Arthur

375

335

12.4

St. Charles

290

215

16.0

Texas City

260

225

11.1

Three Rivers

100

89

13.2

Gulf Coast

1,660

1,284

14.0

Ardmore

90

86

12.1

McKee

180

168

9.5

Memphis

195

180

7.9

Mid-Con

465

434

9.3

Pembroke

270

210

10.1

Quebec City

235

230

7.7

North Atlantic

505

440

8.9

Benicia

170

145

16.1

Wilmington

135

85

15.9

West Coast

305

230

16.0

Total or Avg

2,935

2,388

12.4 |

|

|

| 5

Key Market Trends

U.S. and Canadian crude oil, natural gas, and natural gas liquids

(NGLs) production growth is providing cost advantages to

North American refiners

-

Lower crude prices may temporarily constrain production growth rate

Location-advantaged refiners in U.S. Gulf Coast, Mid-Continent,

and Canada benefit from resource advantages and/or export

opportunities

Global refined products demand growth is expected to continue

-

Expect lower prices to consumers will drive product demand growth

|

|

|

| 6

Production Growth Provides Resource

Advantage to North American Refiners

Source: DOE (for 2015, data through February)

Source: DOE (for 2015, data through February) |

|

|

| 7

Global Petroleum Demand Projected to Grow

Source: Consultant (EIA and IEA) and Valero estimates. Consultant annual estimates

generally updated 6 to 12 months after year end. Emerging markets in Latin

America, Middle East, Africa, and Asia lead demand growth

|

|

|

| Source:

DOE Petroleum Supply Monthly data as of February 2015; Latin America includes South and Central America plus Mexico.

U. S. Product Exports By Destination

12 Month Moving Average

U. S. Product Exports By Source

8

U.S. Is Growing Product Exports Market Share

Refiners in U.S. Gulf Coast are the largest source of products exported to Latin

America and countries in the Atlantic Basin |

|

|

| Strategy to

Enhance Stockholder Returns Operations

Excellence

Capital Returns to

Stockholders

Disciplined Capital

Investments

Unlocking Asset

Value

•

Demonstrate commitment to safe and reliable operations

•

Continuously improve our excellent operating performance

•

Optimize margins with refining system’s feedstock and product

markets flexibility

•

Disciplined capital allocation

•

Seek to increase cash returns through dividend growth

•

Reduce shares outstanding and concentrate future value per share

via stock buybacks

•

Rigorous investment management and execution process

•

Invest to grow logistics assets and reduce feedstock costs

•

Evaluate investments to upgrade natural gas and natural gas liquids

•

Opportunistic renewable fuels investments

•

Grow Valero Energy Partners LP and realize value for Valero

•

Execute accelerated drop-down strategy and evaluate other

potential MLP-able earnings streams

9 |

|

|

| Persistent

Focus Drives Results in Safety, Environmental, and Regulatory Compliance

Operations Excellence

10

(1)Source: U.S. Bureau of Labor Statistics.

All 2014 values are estimates.

Statistics are for refining only. |

|

|

| 11

Excellent Operating Performance through

Continuous Improvements

Source:

Solomon

Associates

and

Valero

Energy,

includes

Pembroke

and

Meraux

•

Reliability drives safe and

profitable operations

Seven of our refineries are first

quartile in mechanical availability

•

Initiated new reliability programs

and investments beginning mid-

2000s

•

Significant gains made in

operations benchmarks since

2008, particularly in mechanical

availability

•

Personnel committed to

excellence |

|

|

| Sustained

high availability and favorable margin environment enable higher capacity utilization

rates 12

Investments, Operations Excellence, and

Commercial Optimization Drive High Utilization

System-wide mechanical

availability near 1

quartile since 2011

st |

|

|

| 13

Refinery Feedstock Flexibility Enables

Margin Optimization

•

Refining and logistics growth

investments enhance our

capability to adjust feedstocks

and optimize margins

•

Able to shift feed slate as price

environment changes

•

Expect additional light crude

flexibility with completion of

Houston and Corpus Christi

topper units currently under

construction

Valero’s Gulf Coast Region Quarterly

Feedstock Mix 2010 –

2015

(1)

(1) 2015 through March 31. |

|

|

| 14

Capital Allocation Framework Emphasizes

Discipline and Stockholder Returns

Dividend Growth

•

Focus on sustainability

•

Increase competition

for cash flow versus

reinvestments (growth

capex and acquisitions)

Sustaining Capex

•

Estimate $1.5 billion or

lower annual “stay-in-

business”

spend

•

Key to safe and

reliable operations

Debt and Cash

•

Maintain investment

grade credit rating

•

Target 20% to 30%

debt-to-cap ratio

(1)

Stock Buybacks

•

Flexibility to return

cash, reduce share

count, and manage

capital employed

•

Increase competition

versus reinvestments

Growth Capex

•

Prioritize higher-value,

higher-growth

opportunities that

enhance future

returns

Acquisitions

•

Evaluate accretion

versus stock buybacks

•

Enhance future

returns

“Non-Discretionary”

“Discretionary”

Capital Returns to Stockholders

(1) Debt-to-cap ratio based on total debt reduced by $2 billion cash balance

|

|

|

| 15

Increasing Dividends and Stock Buybacks

•

Increased dividend by 45% in

1Q15 versus 4Q14

•

Regular dividend increases over

last three years

•

Accelerated stock buybacks

beginning in 2013

•

Approximately $1.2 billion of

stock repurchase authorization at

end of 1Q15

Targeting >50% total payout ratio

of earnings in 2015 via dividends

and stock buybacks

*2015 through May 11 |

|

|

| 16

Advancing Growth Investments While

Managing Capital Spending Lower

(1) Excludes estimated placeholder for methanol project of $150 million in 2015 and $300

million in 2016 as evaluation remains in progress •

Logistics growth spending increases after completion of crude toppers in 2016

•

Expect nearly all logistics growth investments to be eligible for drop-down to VLP

Disciplined Capital Investment |

|

|

| Pipelines

•

Connection to Centurion pipeline in Childress, TX and incremental 40 to

50 MBPD Midland-priced crude as substitute for Cushing-priced crude

primarily at the McKee refinery

•

Expect Diamond Pipeline to supply Memphis refinery via Cushing, with

start up in 1H17

Tanks, Docks, and Vessels

•

Tanks and vessels to supply crude to Quebec City refinery post-Enbridge

Line 9B reversal expected in 2Q15

•

Commissioned

new

Corpus

Christi

dock

in

3Q14

and

tanks

for

crude

oil

loading in April 2015

17

Logistics Investments Enhance Valero’s

Feedstock Flexibility and Export Capability

Rail

•

Purchased 5,320 CPC-1232 railcars; received 4,964 through April 2015

•

Expect new railcars to serve long-term needs in ethanol and asphalt

•

Crude unloading facilities at Quebec City, St. Charles, and Port

Arthur |

|

|

| 18

Crude Topper Investments Very Attractive

Estimate $500 million annual EBITDA for combined projects in 2014 price environment

•

160 MBPD new topping capacity

designed to process up to 50 API

domestic sweet crude

Should lower feedstock cost by

generating 55 MBPD low sulfur

resid

Expect increase in net throughput

capacity of 105 MBPD

•

Expect startup in 1H16

•

Expect 50% IRR on 2014 prices, >25%

IRR with Brent and LLS even

•

Corpus Christi: Estimated $350 MM

capex for 70 MBPD capacity

•

Houston: Estimated $400 MM capex

for 90 MBPD capacity

Incremental Volume

(MBPD)

Feeds

Eagle Ford crude

160

Low sulfur atmos resid

(55)

Products

LPG

3.3

Propylene

1.3

BTX

0.4

Naphtha (at export prices)

40

Gasoline

12

Jet

39

Diesel

13

Resid

(3)

Combined Projects Estimates

Total investment

(1)

$750 MM

Annual EBITDA contribution

(2)

$500 MM

Unlevered IRR on total spend

(2)

50%

See Appendix for assumptions.

(1)

Excluding interest and overhead allocation

(2)

Estimates based on 2014 full year average prices; EBITDA = operating income before

deduction for depreciation and amortization expense |

|

|

| 19

Investments in Natural Gas and NGLs Upgrading

Hydrocracker

Expansions

Evaluating

Methanol Plant at

St. Charles

Evaluating Houston

Alkylation Unit

•

1.6 –

1.7 million tonnes per year production (36 –

38 MBPD)

•

Leverages existing assets to reduce capital requirement

compared to grassroots facility

•

Continuing to evaluate capital costs and project economics

•

Expect investment decision in 2Q15; startup in 2018 if approved

•

12.5 MBPD capacity

•

Upgrades low-cost NGLs to premium-priced alkylate

•

Continuing to evaluate capital costs and project economics

•

Expect investment decision in 2015; startup in 2018 if approved

•

Increase distillate yield partially from hydrogen via natural gas

•

Completed Meraux’s 20 MBPD capacity expansion in 4Q14;

expect approximately $90 million annual EBITDA contribution

at 2014

(1)

prices on total investment of approx. $260 million

•

30 MBPD total capacity addition at Port Arthur and St. Charles

in progress; expect startup in 2H15

(1) 2014 full year average prices; see project details in Appendix

|

|

|

| 20

Sponsored MLP Valero Energy Partners (NYSE:VLP)

Growth-oriented

logistics MLP with

100% fee-based

revenues

•

Valero owns entire 2% general partner interest, all

incentive distribution rights, and 69.6% LP interest

•

High-quality assets integrated with Valero’s refining system

•

Primary vehicle to grow Valero’s midstream investments

•

Provides access to lower cost capital

Unlocking Asset Value |

|

|

| 21

VLP Delivering Growth

VLP is on target to acquire $1 billion of assets from VLO in 2015

See Appendix for reconciliation of estimated 2015 EBITDA to net income.

•

1 acquisition –

Texas Crude

Systems Business in July 2014

for $154 million

•

2 acquisition –

Houston and

St. Charles Terminal Services

Business in March 2015 for

$671 million

•

Plan to grow VLP’s 4Q15

annualized EBITDA to

approximately $200 million

•

Targeting approximately 25%

CAGR for LP distributions

through 2017

st

nd |

|

|

| 22

Significant Inventory of Estimated MLP

Eligible EBITDA at Valero

Fuels distribution would provide incremental EBITDA if selected

(1) Assumes total cost of $900 MM and 10x EBITDA multiple on VLO’s share.

|

|

|

| 23

Estimated Inventory of Eligible MLP Assets

(1) Includes assets that have other joint venture or minority interests.

Pipelines

(1)

•

Over 1,200 miles of active pipelines

•

Expect start-up of 440-mile Diamond Pipeline from Cushing to Memphis refinery in

1H17

Racks, Terminals, and Storage

(1)

•

Over 100 million barrels of active shell capacity for crude and products

•

139 truck rack bays

Rail

•

Three crude unloading facilities with estimated total capacity of 150 MBPD

•

Purchased CPC-1232 railcars expected to serve long-term needs in ethanol and

asphalt

Marine

(1)

•

51 docks

•

Two Panamax class vessels

Fuels Distribution

•

Evaluating qualifying volumes and commercial structure as potential drop-down

candidate |

|

|

| 24

We Believe VLO Is an Excellent Investment

•

Majority of capacity has access to cost-advantaged crude, natural

gas, NGLs, and corn

•

Proven operations excellence

•

Emphasis on capital allocation to stockholders

•

Discipline and rigor in capital projects and M&A selection and

execution

•

Unlocking value through growth in MLP-able assets and drop-

downs to VLP

•

Excellent ethanol investments and operations

•

Focus on valuation multiple expansion |

|

|

| 25

Appendix

Topic

Pages

Valero 2014 Highlights and 2015 Goals

26-27

Ethanol Segment

28

Capital Spending and Key Investment Details

29-39

Valero Energy Partners LP

40-41

Refining Operations Highlights

42-46

Macro Outlook and Key Margin Drivers

47-53

Global Demand and Refining Capacity

54-58

U.S. Fundamentals and DOE Data

59-68

International Fundamentals

69-70

Non-GAAP Reconciliations

71

IR Contacts

72 |

|

|

| 26

Key 2014 Highlights

Operations Excellence

•

Achieved record annual system refinery capacity utilization of approximately 96% in 2014

•

Increased average consumption of price-advantaged North American light sweet crudes in

2014 by approximately 200 MBPD compared to 2013

•

Reduced Quebec refinery’s crude costs by $3/bbl versus Brent from premium of

approximately $2/bbl in 2013 to discount of approximately $1/bbl in 2014

•

Secured attractively priced term-supply of WTI Midland for Mid-Continent

refineries •

Increased gasoline and diesel exports by 49 MBPD, or approximately 18%, in 2014 versus

2013 •

Launched Top Tier gasoline in wholesale marketing system

•

Achieved record $835 million annual Ethanol segment EBITDA

Capital Returns to Stockholders

•

Increased cash returned to stockholders through dividends and buybacks by $460 million in

2014, or 33%, versus 2013 Disciplined Capital Investments

•

Completed and started up Meraux hydrocracker conversion project in 4Q14

•

Secured capital efficient Diamond Pipeline option and supply to Memphis refinery with crude

from Cushing •

Started

up

90

MBPD

of

total

crude

rail

unloading

capacity

at

St.

Charles

and

Port

Arthur

•

Acquired

idled

ethanol

plant

in

Mt.

Vernon,

Indiana

at

less

than

15%

of

replacement

cost

and

restarted

facility

within

five months

Unlocking Asset Value

•

Grew VLP via first drop-down acquisition of $154 million purchase price on July 1,

2014 Other

•

Diamond

Green

Diesel

JV

benefitted

by

approximately

$126

million

on

retroactive

reinstatement

of

Blenders

Tax

Credit |

|

|

| 27

Key Goals Expected in 2015

Operations Excellence

•

Start up Montreal crude terminal with the Enbridge Line 9B reversal and lower Quebec

refinery’s crude costs versus Brent compared to 2014

•

Grow product export market share and increase branded wholesale fuels volume

Capital Returns to Stockholders

•

Increase total payout ratio of earnings over 2014’s 50% payout level

Disciplined Capital Investments

•

Complete Houston and Corpus Christi toppers on time and on budget

•

Make

final

investment

decisions

on

methanol

plant

at

St.

Charles

refinery

and

alkylation

unit

at

Houston refinery; if approved, share strategic rationale with investors

•

Complete 25 MBPD McKee CDU capacity expansion

•

Complete 30 MBPD total hydrocracker capacity expansions at Port Arthur and St. Charles

•

Gain permit approval to construct Benicia crude rail unloading facility

Unlocking Asset Value

•

Grow the size of identified MLP-able EBITDA available for drop-downs to VLP

•

Execute $1 billion of drop-down transactions to VLP |

|

|

| 28

Ethanol Investments Have Performed Well

Note: See Appendix for reconciliation of EBITDA to GAAP results.

Outstanding

Cash

Generation

Excellent

Acquisitions

Competitive

Advantages

•

11 plants acquired between

2Q09 and 1Q14 for $794MM,

less than 35% of replacement

value

•

1.3 billion gallons total

annual production

•

Scale and location in corn

belt

•

Operational best practices

transferred from refining

•

Low capital investment

•

$2.3 billion cumulative

EBITDA generated since

acquisitions

•

$167 million cumulative

capex excluding acquisition

costs |

|

|

| 29

Refining & Renewables Capital Focused on

Capturing Benefits of Key Long-Term Trends

•

Advantaged crude processing optimizes feedstock flexibility, mainly for light crudes

•

Hydrocracking increases production of high-margin distillates

•

Petchems, methanol, and hydrocracking upgrade natural gas or NGLs to higher value liquids

|

|

|

| 30

Allocating Significant Growth Capital to Logistics

•

Railcars spending declines as receipt of railcars order concludes

•

Future spending focuses on pipelines |

|

|

| Gated

Investment Management Process 31

•

Development costs increase as project progresses through the phases

•

NPV and IRR of future cash flows per price forecasts and operating plans evaluated

•

“Target”

IRR hurdle rate ranges, which can change depending on the project and

market conditions:

Refining growth projects, target >=50% in Phase 1 to >=30% in Phase 3

Cost savings projects, target >=12% in Phase 3

Logistics projects, target pre-tax >=12% in Phase 3 + refinery benefits

|

|

|

| 32

McKee Diesel Recovery Improvement and

CDU Expansion Startup Expected in 2H15

Incremental Volume

(MBPD)

Feeds

WTI

25

Products

LPG

0.4

Benzene concentrate

0.3

Gasoline

12

Jet

-

Diesel

12

Resid

0.6

Project Estimates

Total investment

$140 MM

Annual EBITDA contribution

(1)

$100 MM

Unlevered IRR on total spend

(1)

45%

Investment Highlights

•

Adding 25 MBPD crude unit capacity

and parallel light ends processing

train

•

Expect to improve yields and

volume gain by recovering diesel

from FCC and HCU feeds

•

Expect to increase diesel and

gasoline production on price-

advantaged crude

•

Expect to reduce energy

consumption via heat integration

Status

•

Diesel recovery and benefits started

in mid-2014; expect crude

expansion start-up in 2H15

(1)

Estimates based on 2014 full year average prices; EBITDA = operating income before

deduction for depreciation and amortization expense |

|

|

| 33

Meraux Hydrocracker Conversion

Completed December 2014

Incremental Volume

(MBPD)

Feeds

Purchased hydrogen

(MMSCFD)

13

Products (MBPD)

Gasoline

5

Jet

-

Diesel

19

HSVGO

2

Unconverted gasoil

(23)

Fuel oil

-

Project Estimates

Total investment

$260 MM

Annual EBITDA contribution

(1)

$90 MM

Unlevered IRR on total spend

(1)

25%

(1)

Estimates based on 2014 full year average prices; EBITDA = operating income before

deduction for depreciation and amortization expense

Investment Highlights

•

Converted hydrotreater into high-

pressure hydrocracker and

repurposed old FCC gas plant for

additional LPG recovery

•

Expect to upgrade 23 MBPD gasoil

and low-cost hydrogen (via natural

gas) mainly into high quality diesel

•

Expect to increase refinery distillate

yield versus gasoline (Gas/Diesel

ratio drops from 0.72 to 0.59)

•

Expect to increase refinery liquid

volume yield by 1.8%

•

Avoided compliance capex on FCC

Status

•

Project started up in Dec 2014 and is

operating well |

|

|

| 34

Houston and Corpus Christi Crude Topping

Units Expected Online in 1st Half of 2016

Project Estimates

Total investment

$350 MM

Annual EBITDA contribution

(1)

$260 MM

Unlevered IRR on total spend

(1)

55%

Estimates

Incremental Volume (MBPD)

Feeds

Eagle Ford crude

90

Low sulfur atmos resid

(29)

Distillate

(2)

Butane

(2)

Hydrogen (MMSCFD)

3

Products

LPG

0.8

Propylene

0.4

Naphtha

24

Gasoline

5

Jet

23

Diesel

4

Slurry

0.2

Project Estimates

Total investment

$400 MM

Annual EBITDA contribution

(1)

$240 MM

Unlevered IRR on total spend

(1)

45%

Corpus Christi

Houston

(1)

Estimates based on 2014 full year average prices; EBITDA = operating income before deduction

for depreciation and amortization expense Estimates

Incremental Volume (MBPD)

Feeds

Eagle Ford crude

70

Low sulfur atmos resid

(24)

Products

LPG

2.5

Propylene

0.9

BTX

0.4

Naphtha

16

Gasoline

7

Jet

16

Diesel

9

Resid

(3) |

|

|

| 35

Diamond Pipeline

Project Estimates

Total investment

(1)

$484 MM

Cumulative spend through 2014

Zero

Annual EBITDA contribution

(2)

$46 MM

Unlevered pre-tax IRR on total spend

at least 12%

(1)

Includes additional Valero cost for pipeline connection at Memphis refinery

(2)

EBITDA = Operating income before deduction for depreciation and amortization expense

Investment Highlights

•

Valero holds option until January

2016 to acquire 50% interest in

pipeline

•

Increases Memphis refinery’s crude

supply flexibility via connection to

Cushing and economic crudes

•

Provides direct control over crude

blend quality

•

Grows Valero’s inventory of assets

eligible for VLP drop-down in

capital-efficient manner

•

Expect completion in 1H17 or earlier |

|

|

| 36

Estimated Key Price Sensitivities on Project

Economics

Change

in

Estimated

EBITDA

(1)

Relative

to

2014

(2)

Prices

($millions/year)

McKee Diesel

Recovery & CDU

Expansion

Meraux HCU

Expansion

Corpus

Christi

Topper

Houston

Topper

ICE Brent, +$1/bbl

none

$0.8

$0.4

none

ICE Brent –

WTI, +$1/bbl

$5.5

none

None

none

ICE Brent –

LLS, +$1/bbl

N/A

none

$25.6

$32.9

Group 3 CBOB –

ICE Brent, +$1/bbl

$2.0

N/A

N/A

N/A

Group 3 ULSD –

ICE Brent, +$1/bbl

$5.5

N/A

N/A

N/A

USGC CBOB –

ICE Brent, +$1/bbl

N/A

$1.7

$2.4

$2.4

USGC ULSD –

ICE Brent, +$1/bbl

N/A

$6.8

$9.0

$9.9

Natural gas (Houston Ship Channel), +$1/mmBtu

-$0.7

-$1.9

-$4.3

-$3.2

Naphtha –

ICE Brent, +$1/bbl

N/A

none

$5.8

$8.8

LSVGO –

ICE Brent, + $1/bbl

N/A

-$7.3

$3.1

$5.2

Total investment IRR, +10% cost

-6%

N/A

-5%

-4%

(1)

Operating income before deduction for depreciation and amortization expense

(2)

2014 full year average

Note: Margin drivers shown are not inclusive of all feedstocks and products in economic

models. Estimated economic sensitivities can not be accurately interpolated or extrapolated solely

from the estimated key price sensitivities shown above. |

|

|

| 37

Project Price Set Assumptions

Driver ($/bbl)

2014 Average

ICE Brent

99.49

ICE Brent –

WTI

6.35

ICE Brent –

LLS

2.75

USGC CBOB –

ICE Brent

3.52

G3 CBOB –

WTI

12.27

USGC ULSD –

ICE Brent

14.25

G3 ULSD –

WTI

23.88

Natural gas (Houston Ship Channel, $/mmBtu)

4.34

Naphtha –

ICE Brent

-0.67

LSVGO –

ICE Brent

8.86 |

|

|

|

•

Approximately half of benefits visible in

margin capture rate increase of >4%

and balance of benefits in 100 MBPD

throughput volume increase from

feedstocks and new gas plant

•

Benefits visible in U.S. Gulf Coast

region reported results improvement

from 4Q12 to 3Q14

38

Port Arthur and St. Charles Hydrocrackers

Performing Better Than Expected

•

120 MBPD of combined new capacity

successfully started end of 2012 and

mid-2013

•

Designed to produce high-quality

distillates from low-quality feedstocks

and natural gas

•

Realized annual EBITDA estimated at

$800 million for trailing 4-quarters

3Q14

•

Compares to $780 million implied by

disclosed guidance model

(1)

(1) See page 39 for details and assumptions. |

|

|

| 39

Port Arthur and St. Charles Hydrocrackers

Performance Details

Benefits Realized in Reported Results

Trailing 4 Quarters

$mm, except /bbl amounts

4Q12

3Q14

Increase

Gulf Coast Capture Rate

58.8%

63.2%

4.4%

x Gulf Coast Indicator/bbl, trailing 4Q 3Q14

$19

= Extra margin captured/bbl

$0.83

x Gulf Coast volume, trailing 4Q 3Q14 MPBD

1,586

x Annualized Days

365

= Benefit from higher Capture Rate

$483

Gulf Coast Throughput Volume MBPD

1,488

1,586

98

x Gulf Coast Indicator/bbl, trailing 4Q 3Q14

$19

x Gulf Coast Capture Rate, trailing 4Q 3Q14

63%

x Annualized Days

365

= Benefit from higher Volume

$429

Total Benefit from Hydrocracker Projects

$912

Less: estimated operating costs before depreciation and amort. exp.

-110

= EBITDA (estimated)

$802

Key Assumptions

•

Market

prices

for

trailing

4

quarters

as

of

3Q14

applied

to

guidance

model

disclosed

by

Valero

in

February

2012

to

estimate

$780

million

in

EBITDA

•

Gulf Coast capture rate increase based on average of trailing 4 quarters reported margin per

barrel (excluding cost of RINs allocated in results at $0.30/bbl for 4Q12 and $0.40/bbl

for 4Q13 averages) divided by Gulf Coast indicator margin •

Gulf Coast LPGs pricing based on propane

•

Many factors can influence our reported margins including, but not limited to, charges,

yields, pricing, timing and ratability, secondary costs, other allocations, hedging,

and GAAP inventory costing methods •

EBITDA = operating income before deduction for depreciation and amortization expense

|

|

|

| 40

Drop Down of Houston and St. Charles

Terminal Services Business to VLP

Operations

•

Crude oil, intermediates, and refined

petroleum product terminaling services

in Houston, Texas and Norco, Louisiana

3.6 million barrels of storage capacity on the

Houston ship channel

10 million barrels of storage on the Mississippi

River

•

10-year terminaling agreements with

VLO subsidiaries

•

Over 85% of revenue is contractually

obligated by minimum volume

commitments

•

Expected to contribute $75 million of

EBITDA annually

Financing

•

$671 million transaction closed on

March 1, 2015

•

$411 million in cash to VLO

$211 million in cash from VLP’s balance sheet

$200 million under VLP’s revolving credit facility

•

$160 million 5-year subordinated loan

agreement with VLO

•

$100 million issuance of VLP units to

VLO

1,908,100 million common units

38,941 general partner units

Common and general partner units allocated in

proportion to allow general partner to maintain

its 2 percent interest

Transaction puts Valero on track to achieve $1 billion in drop-down transactions in

2015 |

|

|

| 41

Valero’s GP Interest in VLP Nearing the

“High Splits”

Target Quarterly Distribution per Unit

Marginal Percentage Interest in Distributions

Unitholders

GP

Minimum quarterly

$0.2125

98%

2%

First target

above $0.2125 up to $0.244375

98%

2%

Second target

above $0.244375 up to $0.265625

85%

15%

Third target

above $0.265625 up to $0.31875

75%

25%

Thereafter

$0.31875

50%

50%

•

1Q15 distribution at $0.2775 per unit

•

Valero’s GP interest in VLP expected to reach 50% split in 2015, payable in 2016, based on

accelerated drop-down strategy |

|

|

| 42

Valero’s Light Crude Processing Capacity in

North America

(1) Actual light crude consumption less than capacity due to turnaround maintenance and

economics. Includes imported foreign sweet crudes.

McKee Crude Unit Expansion

•

25 MBPD additional capacity

expected in 2H15

•

Distillate recovery improvements

Houston Crude Topper

•

90 MBPD capacity expected 1H16

•

Displaces 30 MBPD intermediate

feedstock purchases

Corpus Christi Crude Topper

•

70 MBPD capacity expected 1H16

•

Displaces 25 MBPD intermediate

feedstock purchases |

|

|

| 43

Valero Leads Peers in Total

Location-Advantaged Crude Capacity

Source: Company 10-K reports. Crude distillation capacity based on geographic

location. Access to lower cost North American crude benefits refiners in

Mid-Continent, Gulf Coast, and Eastern Canada; product export opportunities for Gulf

Coast and Canada |

|

|

| 44

Expect Quebec City Refinery to Have Cost-Advantaged

Access to 100% North American Crude in 2015

Shifted to cost-advantaged crudes via rail and foreign flagged ships from USGC, with

additional savings expected from deliveries on Enbridge Line 9B beginning in 3Q15

|

|

|

| 45

U.S. Natural Gas Provides Opex and

Feedstock Cost Advantages

Note: Estimated per barrel cost of 864,000 mmBtu/day of natural gas consumption at 92%

refinery throughput capacity utilization, or 2.7 MMBPD. $1.3 billion

higher pre-tax

annual costs

$2.8 billion

higher pre-tax

annual costs

Valero’s refining operations consume approximately 864,000 mmBtu/day of

natural

gas, split almost equally between operating expense and cost of goods sold

Significant annual pre-tax cost savings compared to refiners in Europe or Asia

|

|

|

| 46

Capacity to Export Additional Product

Opportunities to expand U.S. Gulf

Coast export capability for gasoline

to 308 MBPD and diesel to 472

MBPD

Export markets pull volume from

U.S., enabling high refinery

utilization and improved margins

Supported by global refined

products demand growth

Logistics investments also support

segregation |

|

|

| Long-Term

Macro Market Expectations Global Outlook

U.S. Economy and

Petroleum Demand

North American

Resource

Advantage

International Export

Markets

•

Economic activity and total petroleum demand increases

•

Transportation fuels demand grows

•

Refining capacity growth slows after 2015; utilization stabilizes then

expected to increase

•

Refinery rationalization pressure continues in Europe, Japan, and Australia

•

Economic growth strengthens over next five years, which stimulates refined

product demand

•

Diesel and jet fuel demand continues to strengthen

•

Gasoline demand continues to recover moderately, expected to strengthen

near-term with lower prices

•

Natural gas production growth still attractive and development continues

•

Crude production growth continues, but tempered with lower prices

•

North American refiners maintain competitive advantage

•

Broad lifting of crude export ban not expected for several years, if ever

•

U.S. continues to be an advantaged net exporter of products

•

Atlantic Basin market continues to grow, with increasing demand from

Latin America and Africa

•

U.S. Gulf Coast is strategically positioned with globally competitive assets

47 |

|

|

| 48

U.S. and Canadian Production Growth Provides

Crude Cost Advantage to North American Refiners

Source: EIA, Consultants, company announcements and Valero estimates; 2015 U.S. Crude imports

as of February 2015 |

|

|

| Estimated

Crude Oil Transportation Costs |

|

|

| 50

Crude Oil Differentials Versus ICE Brent

Source: Argus; 2Q15 through May 1. LLS prices are roll adjusted.

|

|

|

| 51

Valero’s Regional Refining Indicator Margins

Source: Argus; 2Q15 through May 1. |

|

|

|

•

Gulf Coast Indicator: (GC Colonial 85 CBOB A grade-

LLS) x 60% + (GC ULSD 10ppm

Colonial Pipeline prompt -

LLS) x 40% + (LLS -

Maya Formula Pricing) x 40% + (LLS -

Mars Month 1) x 40%

•

Midcontinent Indicator: [(Group 3 CBOB prompt -

WTI Month 1) x 60% + (Group 3

ULSD 10ppm prompt -

WTI Month 1) x 40%] x 60% + [(GC Colonial 85 CBOB A grade

prompt -

LLS) x 60% + (GC ULSD 10ppm Colonial Pipeline -

LLS) x 40%] x 40%

•

West Coast Indicator: (San Fran CARBOB Gasoline Month 1 -

ANS USWC Month 1) x

60% + (San Fran EPA 10 ppm Diesel pipeline -

ANS USWC Month 1) x 40% + 10%

(ANS –

West Coast High Sulfur Vacuum Gasoil cargo prompt)

•

North Atlantic Indicator: (NYH Conv 87 Gasoline Prompt –

ICE Brent) x 50% + (NYH

ULSD 15 ppm cargo prompt –

ICE Brent) x 50%

•

LLS prices are Month 1, adjusted for complex roll

•

Prior to 2010, GC Colonial 85 CBOB is substituted for GC 87 Conventional

•

Prior to 4Q13, Group 3 Conventional 87 gasoline substituted for Group 3 CBOB

52

Regional Indicator Margins Defined |

|

|

| 53

Low Cost U.S. Natural Gas Provides

Competitive Advantage

Sources: Argus and Bloomberg. Japan LNG through Feb 28, 2015; U.S. and Europe through

May 5, 2015. Natural gas price converted to barrels using factor of 6.05x

•

U.S. natural gas is significantly discounted to Brent on an energy equivalent basis

•

Prices expected to remain low and disconnected from global oil and gas markets

for foreseeable future |

|

|

| 54

U.S. Refining Capacity Is Globally Competitive and

Continues to Take Market Share

Source: EIA and IEA (U.S. data through February 2015, Europe data through March

2015) Source: EIA (2015 data through February)

•

U.S. flipped from importer to exporter on lower local product demand and higher refinery

utilization, particularly in PADDS 2, 3, and 4, driven by structural cost advantages

for crude oil and natural gas

•

Gulf Coast refineries have gained export market share in the Atlantic Basin

|

|

|

| 55

World Refinery Capacity Growth

Source:

Consultantand

Valero

estimates;

Net

Global

Refinery

Additions

=

New

Capacity

+

Restarts

–

Announced

Closures

•

New capacity additions expected in Asia and the Middle East

•

Announced

new

capacity

in

Latin

America

likely

to

be

smaller

and

start

later

than

planned

•

Capacity rationalization expected to continue in Europe |

|

|

| 56

Capacity Rationalization in Atlantic Basin

Sources: Industry and Consultant reports and Valero estimates

•

Marginal refiners continue to rationalize capacity

•

Closures in the last few years have been focused in Japan, Australia, and Europe

|

|

|

| Location

Owner

CDU Capacity

Closed (MBPD)

Year

Closed

Location

Owner

CDU Capacity

Closed (MBPD)

Year

Closed

Perth Amboy, NJ

Chevron

80

2008

Rome, Italy

Total/Erg

88

2012

Bakersfield, CA

Big West

65

2008

Fawley, U.K.*

ExxonMobil

80

2012

Ingolstadt, Germany*

Bayernoil

102

2008

Paramo, Czech Republic

Unipetrol

20

2012

Yabucoa, Puerto Rico

Shell Yabucoa, Inc.

76

2008

St. Croix, USVI

Hovensa

350

2012

Westville, NJ

Sunoco

145

2009

San Nicholas, Aruba

Valero

235

2012

Bloomfield, NM

Western

17

2009

Lisichansk, Ukraine

TNK-BP

175

2012

North Pole, AK*

Flint Hills Resources

85

2009

Clyde, Australia

Shell

75

2012

Teesside, UK

Petroplus

117

2009

Port Reading, NJ

Hess

2013

Gonfreville L'Orcher, France*

Total

90

2009

Dartmouth, Canada

Imperial Oil

88

2013

Dunkirk, France

Total

140

2009

Harburg, Germany

Shell

107

2013

Toyama, Japan

Nihonkai Oil

57

2009

Porto Marghera, Italy

ENI

80

2013

Yorktown, VA

Western

65

2010

Sakaide, Japan

Cosmo Oil

140

2013

Montreal, Canada

Shell

130

2010

North Pole, AK

Flint Hills Resources

80

2014

Reichstett, France

Petroplus

85

2010

Mantova, Italy

MOL

69

2014

Wilhelmshaven, Germany

ConocoPhillips

260

2010

Stanlow, U.K.*

Essar

101

2014

Sodegaura, Japan*

Fuji Oil

50

2010

Milford Haven, U.K.

Murphy

130

2014

Oita, Japan*

JX Holdings

24

2010

Yokkaichi, Japan*

Cosmo Oil

43

2014

Mizushima, Japan*

JX Holdings

110

2010

Tokuyama, Japan

Idemitsu Kosan

114

2014

Negishi, Japan*

JX Holdings

70

2010

Kurnell, Australia

Caltex

135

2014

Kashima, Japan*

JX Holdings

18

2010

Kawasaki, Japan*

Tonen-General

67

2014

Marcus Hook, PA

Sunoco

175

2011

Wakayama, Japan*

Tonen-General

38

2014

St. Croix, USVI*

Hovensa

150

2011

Muroran, Japan

JX Holdings

180

2014

Arpechim, Romania

OMV Petrom

70

2011

Chiba, Japan*

Kyokuto Petroleum Ltd.

23

2014

Cremona, Italy

Tamoil

94

2011

Kaohsiung, Taiwan

Chinese Petroleum Corp.

200

2015

Ogimachi, Japan

Toa/Showa Shell

120

2011

Bulwer Island, Australia

BP

102

2015

Fushun, China

Fushun Petrochem.

70

2011

Chiba, Japan*

Idemitsu Kosan

20

2015

Paramount, CA

Alon

90

2012

Kawasaki, Japan*

Tonen-General

10

2015

North Pole, AK*

Flint Hills Resources

48

2012

Nishirara, Okinawa

Petrobras/Nansei Sekiyu

100

2015

Berre L'Etang, France

LyondellBasell

105

2012

Collombey, Switzerland

Tamoil

55

2015

Coryton, U.K.

Petroplus

175

2012

Lindsey, U.K.*

Total

110

2016

Petit Couronne, France

Petroplus

160

2012

La Mede, France

Total

159

2016

57

Global Refining Capacity Rationalization

*Partial closure of refinery captured in capacity. Note: This data represents

refineries currently closed, ownership may choose to restart or sell listed refinery.

Sources: Industry and Consultant reports, Valero estimates, and direct and public

disclosure by each owner. |

|

|

| 58

Global Refining Capacity For Sale or Under

Strategic Review

Location

Owner

CDU Capacity (MBPD)

Lytton, Australia

Caltex

109

Nishihara, Japan

Petrobras/Sumitomo

95

Inchon, Korea

SK Energy

270

Whitegate, Ireland

Phillips 66

71

Barbers Point, HI

Chevron

54

Pasadena, TX

Petrobras

100

Bahia Blanca, Argentina

Petrobras

31

Gothenburg, Sweden

Shell

80

Port Dickson, Malaysia

Shell

156

Livorno

ENI

106

Taranto

ENI

120

Mazeikiai, Lithuania

PKN

190

Okinawa, Japan

Petrobras/Nansei Sekiyu

100

Falconara, Italy

API

80

Hamburg, Germany

Tamoil

78

Collombey, Switzerland

Tamoil

72

Chiba, Japan

Cosmo Oil

240

Chiba, Japan

TonenGeneral

152

Sources: Direct and public disclosure by each owner |

|

|

| 59

U.S. Crude Fundamentals

Source: DOE weekly data through May 1, 2015 |

|

|

| 60

U.S. Gasoline Fundamentals

USGC Brent Gasoline Crack (per bbl)

U.S. Gasoline Demand (mmbpd)

Source: Argus; 2015 weekly data through May 1

Source: DOE monthly data through Feb 2015; 2015 weekly data through May 1

Source: DOE monthly data through Feb 2015; 2015 weekly data through May 1

U.S. Net Imports of Gasoline and Blendstocks (mbpd)

Source: DOE monthly data through Feb 2015

U.S. Gasoline Days of Supply |

|

|

| 61

U.S. Distillate Fundamentals

USGC Brent ULSD Crack (per bbl)

U.S. Distillate Demand (mmbpd)

Source: Argus; 2015 weekly data through May 1

Source: DOE monthly data through Feb 2015; 2015 weekly data through May 1

Source: DOE monthly data through Feb 2015; 2015 weekly data through May 1

Source: DOE monthly data through Feb 2015; 2015 weekly data through May 1

U.S. Distillate Days of Supply

U.S. Distillate Net Imports (mbpd) |

|

|

| 62

U.S. Transport Indicators |

|

|

| 63

U.S. Transport Indicators: Trucking |

|

|

| Note:

Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE, and other oxygenates)

Source: DOE Petroleum Supply Monthly data through February 2015. 4 Week

Average estimate from Weekly Petroleum Statistics Report and Valero estimates. 64

Increase in U.S. Gasoline Exports |

|

|

| Decrease in

U.S. Gasoline Imports Note: Gasoline represents all finished gasoline plus all

blendstocks (including ethanol, MTBE, and other oxygenates) Source: DOE Petroleum

Supply Monthly data through February 2015. 4 Week Average estimate from Weekly Petroleum Statistics Report and Valero estimates.

65 |

|

|

| Source: DOE

Petroleum Supply Monthly with data through February 2015. 4 Week Average estimate from Weekly Petroleum Statistics Report

66

Increase in U.S. Diesel Exports

12 Month Moving Average, MBPD |

|

|

| 67

U.S. Is Net Refined Products Exporter

U.S. Demand for Refined Products and Net Trade

MMBPD

U.S. Petroleum Demand Excluding Ethanol and Non-Refinery NGL’s

(Refined Product Demand)

Net Imports

Net

Exports

Implied Total Production of

U.S. Refined Products

Implied Production of U.S. Refined

Products for Domestic Use

Valero’s share of U.S. exports has averaged 20% to 25% over the past few years

Note: Implied production = Petroleum demand excluding ethanol and non-refinery NGLs minus

product net imports. Source: EIA, Consultant and Valero estimates; data through February 2015 |

|

|

| 68

U.S. Shifted to Net Exporter

Note: Gasoline represents all finished gasoline plus all blendstocks (including ethanol,

MTBE, and other oxygenates) Source: DOE Petroleum Supply Monthly data through

February 2015 •

Net refined products exports increased from 335 MBPD in 2010 to 2,504 MBPD in 2015

•

Diesel net exports averaged 919 MBPD in 2014; 651 MBPD in 2015 (Jan-Feb)

•

Gasoline

net

exports

averaged

66

MBPD

in

2014;

199

MBPD

in

2015

(Jan

–

Feb)

•

Gasoline and blendstocks have shifted to net exports |

|

|

| 69

Mexico Statistics

Diesel Gross Imports (MBPD)

Source: PEMEX, latest data February 2015

Gasoline Gross Imports (MBPD)

Crude Unit Throughput (MBPD)

Crude Unit Utilization |

|

|

| 70

Decrease in Venezuelan Exports to the U.S.

Source: EIA, February 2015 |

|

|

| 71

Non-GAAP Reconciliations

Ethanol (millions)

2Q09 –

4Q09

2010

2011

2012

2013

2014

1Q15

Cumulative

Operating income

$165

$209

$396

$(47)

$491

$786

$12

$2,012

+ Depreciation and

amortization expense

$18

$36

$39

$42

$45

$49

$13

$242

= EBITDA

$183

$245

$435

$(5)

$536

$835

$25

$2,254

Forecasted

(thousands)

Full Year Beginning

March 1, 2015 Valero

Partners Houston and

Louisiana

Net income

$37,300

+ Interest expenses

18,100

+ Income tax expense

400

+ Depreciation expense

$20,000

= EBITDA

$75,800

Reconciliation of VLO Ethanol Operating Income to EBITDA

Reconciliation of VLP Forecasted Net Income to EBITDA

Three Months Ended

Three Months Ended

December 31, 2014

December 31, 2015

(millions)

As Reported

Annualized (x4)

Forecasted

Annualized

(x4)

Net income

$19

$76

$32

$128

Plus:

Depreciation expense

5

18

11

44

Interest expense

(1)

-

1

7

28

Income tax expense

-

-

-

-

EBITDA

$24

$95

$50

$200

Reconciliation of VLP Net Income Under GAAP to EBITDA

(1) Interest expense and cash interest paid both include commitment fees to be paid on

VLP’s revolving credit facility. Interest expense also includes the amortization

of estimated deferred issuance costs to be incurred in connection with establishing VLP’s revolving credit

facility. |

|

|

| Investor

Relations Contacts 72

For more information, please contact:

John Locke

Executive Director, Investor Relations

210-345-3077

john.locke@valero.com

Karen Ngo

Manager, Investor Relations

210-345-4574

karen.ngo@valero.com |

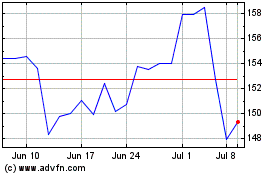

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Apr 2023 to Apr 2024