Report of Foreign Issuer (6-k)

March 02 2017 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2017

Commission File Number: 001-14475

TELEFÔNICA BRASIL S.A.

(Exact name of registrant as specified in its charter)

TELEFONICA BRAZIL S.A.

(Translation of registrant’s name into English)

Av. Eng° Luís Carlos Berrini, 1376 - 28º andar

São Paulo, S.P.

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

TELEFÔNICA BRASIL S.A.

Publicly-held Company

CNPJ/MF 02.558.157/0001-62 - NIRE 35.3.0015881-4

MINUTES OF THE 315

th

MEETING OF THE BOARD OF DIRECTORS OF

TELEFÔNICA BRASIL S.A.

1. DATE, TIME AND PLACE:

March 2, 2017, at 6 p.m.,

at Telefônica Brasil S.A. (“Company”) headquarters, located at Av. Eng.

Luiz Carlos Berrini, 1376, Cidade Monções, capital of the State of São Paulo.

2. CALL NOTICE AND ATTENDANCE:

The call notice was waived as all members of the Board of Directors who subscribe to these minutes attended the Meeting, pursuant to article 19, paragraph 4 of the Company's Bylaws.

3. PRESIDING BOARD:

Eduardo Navarro de Carvalho, Chairman of the Board of Directors and Breno Rodrigo Pacheco de Oliveira, Secretary of the Board of Directors.

4. DELIVERY OF SHARES MAINTAINED IN TREASURY FOR COMPLIANCE WITH JUDICIAL DECISIONS:

The Company's Board of Directors unanimously approved the delivery of up to 1,000,000 (one million) preferred shares issued by the Company that are held in treasury in the future, to be acquired by the Company under the current Share Buyback Program, in order to comply with judicial decisions already rendered or to be rendered – in legal proceedings related to the so-called telephony expansion plans.

The resolution hereby approved shall be carried out in accordance with the terms and conditions mentioned in

Annex I

of the present minutes.

5. CLOSING:

Since there was no other business to be transacted, the meeting was closed and these minutes were drawn-up by the Secretary of the Board of Directors, which were approved and signed by the Directors present to the meeting, being following transcribed in the proper book. (aa) Eduardo Navarro de Carvalho – Chairman of the Board of Directors; Members of the Board of Directors: Ángel Vilá Boix; Antonio Carlos Valente da Silva; Antonio Gonçalves de Oliveira; Francisco Javier de Paz Mancho; José María Del Rey Osorio; Luis Francisco Javier Bastida Ibargüen; Luiz Fernando Furlan; Narcís Serra Serra; Ramiro Sánchez de Lerín Garcia-Ovies; Roberto Oliveira de Lima and Sonia Julia Sulzbeck Villalobos. Secretary of the Board of Directors: Breno Rodrigo Pacheco de Oliveira.

Continuation of Minutes of the 315th MBD of 03.02.17 Page

1

/

2

TELEFÔNICA BRASIL S.A.

Publicly-held Company

CNPJ/MF 02.558.157/0001-62 - NIRE 35.3.0015881-4

MINUTES OF THE 315

th

MEETING OF THE BOARD OF DIRECTORS OF

TELEFÔNICA BRASIL S.A.

I hereby certify that this is a faithful copy of the minutes of the 315

th

meeting of the Board of Directors of Telefônica Brasil S.A., held on March 2, 2017, which was drawn-up in the proper book.

|

|

|

|

Breno Rodrigo Pacheco de Oliveira

|

|

|

Secretary of the Board of Directors

|

|

|

|

|

|

|

|

|

|

|

|

Continuation of Minutes of the 315th MBD of 03.02.17 Page

2

/

5

TELEFÔNICA BRASIL S.A.

Publicly-held Company

CNPJ/MF 02.558.157/0001-62 - NIRE 35.3.0015881-4

MINUTES OF THE 315

th

MEETING OF THE BOARD OF DIRECTORS OF

TELEFÔNICA BRASIL S.A.

Annex I

Annex 30-XXXVI of CVM Instruction 480/09, as amended

Trading of Own Shares

1. Justify in detail the objective and expected economic effects of the operation:

Delivery of a certain number of preferred shares issued by the Company, to be acquired in the future by the Company within the current Share Buyback Program, in order to comply with judicial decisions already rendered or that may be rendered in the context of lawsuits related to the so-called telephony expansion plans.

2. Inform the amounts of (i) outstanding shares and (ii) shares already held in treasury:

The number of Company’s shares (i) outstanding is 31,609,446 common shares and 415,111,003 preferred shares, disregarding the shares held by controlling shareholders, by persons related to them, and by the management, in accordance with applicable regulations; and (ii) held in treasury is 2,290,164 common shares and 339 preferred shares.

3. Inform the number of shares that may be acquired or sold:

Up to 1,000,000 preferred shares that are held in treasury in the future may be delivered. The maximum number of preferred shares to be delivered in this context corresponds to approximately 0.059% of the Company's capital stock and 0.089% of the preferred shares issued by the Company.

4. Describe the main characteristics of the derivative instruments that the company may use, if any:

Not applicable.

Continuation of Minutes of the 315th MBD of 03.02.17 Page

3

/

5

TELEFÔNICA BRASIL S.A.

Publicly-held Company

CNPJ/MF 02.558.157/0001-62 - NIRE 35.3.0015881-4

MINUTES OF THE 315

th

MEETING OF THE BOARD OF DIRECTORS OF

TELEFÔNICA BRASIL S.A.

5. Describe, if any, any agreements or voting guidelines that exist between the company and the counterparty of the transactions:

Not applicable.

6. In the case of transactions carried out outside organized securities markets, inform: a. The maximum (minimum) price by which the shares will be acquired (sold); and b. If applicable, the reasons justifying the transaction at prices more than 10% (ten percent) higher, in the case of acquisition, or more than 10% (ten percent) lower, in the case of sale, to the average of the quoted price, weighted by the volume, in the previous ten (10) trading sessions:

The preferred shares issued by the Company will be delivered at the prevailing market price at the time of delivery, in accordance with the applicable regulations.

7. Inform, if any, the impacts that the negotiation will have on the composition of the share control or the administrative structure of the company:

Not applicable.

8. Identify the counterparties, if known, and, in the case of a party related to the company, as defined by the accounting rules that deal with this subject, also provide the information required by art. 8

th

of CVM Instruction 481, of December 17, 2009:

The preferred shares will be delivered to the beneficiaries of judicial decisions already rendered or to be rendered in connection with lawsuits related to the so-called telephony expansion plans, whose individual qualifications have been deemed appropriate in the course of the respective enforcement actions.

9. Indicate the allocation of resources received, if applicable:

Not applicable, considering that the delivery of preferred shares will be performed in the context of lawsuits.

10. Indicate the maximum period for the settlement of authorized transactions:

Continuation of Minutes of the 315th MBD of 03.02.17 Page

4

/

5

TELEFÔNICA BRASIL S.A.

Publicly-held Company

CNPJ/MF 02.558.157/0001-62 - NIRE 35.3.0015881-4

MINUTES OF THE 315

th

MEETING OF THE BOARD OF DIRECTORS OF

TELEFÔNICA BRASIL S.A.

Considering that the preferred shares will be delivered to the beneficiaries of judicial decisions, deliveries can be made during the judgments within each action.

11. Identify institutions that will act as intermediaries, if any:

The operation will be carried out through Bradesco Corretora S.A. CTVM, headquartered at Avenida Paulista, 1450 / 7º floor - São Paulo/SP.

12. Specify the resources available to be used, in the form of art. 7

th

, paragraph 1, of CVM Instruction 567 of September 17, 2015:

Not applicable.

13. Specify the reasons why the members of the Board of Directors feel comfortable that the repurchase of shares will not affect the fulfillment of the obligations assumed with creditors nor the payment of mandatory, fixed or minimum dividends:

Not applicable.

* * * * *

Continuation of Minutes of the 315th MBD of 03.02.17 Page

5

/

5

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

TELEFÔNICA BRASIL S.A.

|

|

Date:

|

March 2, 2017

|

|

By:

|

/s/

Luis Carlos da Costa Plaster

|

|

|

|

|

|

Name:

|

Luis Carlos da Costa Plaster

|

|

|

|

|

|

Title:

|

Investor Relations Director

|

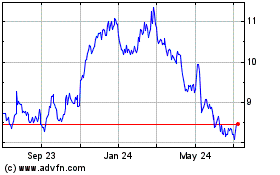

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

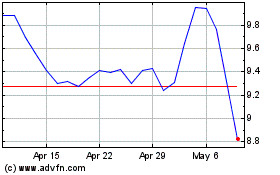

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024