- Universal Music Group: continued

strong performance

- Canal+ Group: strong international

performance and the turnaround in France underway

- Successful integration of

Gameloft

Regulatory News:

Vivendi (Paris:VIV):

2016 key figures1

Changeyear-on-year

Change at constant currencyand perimeter2

year-on-year

€10,819 M +0.5% -0.2%

IFRS measures

€1,194 M -2.9%

- Earnings from continuing operations attributable to Vivendi

SA shareowners

€1,236 M +77.0%

- Earnings attributable to Vivendi SA shareowners3

€1,256 M -35.0%

Adjusted

measures4

€853 M -19.6% -18.5%

€724 M -23.2% -21.5%

€755 M +8.4% Cash

€1.1bn

- Cash flow from operations (CFFO)4

€729M -18.3%

- Cash flow from operations after interests and taxes

(CFAIT)4

-€69 M in 2015 and +€341 M in

2016

Return to shareholders €4.2bn

- Dividends paid

- Share buyback

€2.6bn €1.6bn

Vivendi's Supervisory Board met today under the chairmanship of

Vincent Bolloré and reviewed the Group’s Consolidated Financial

Statements for the year ended December 31, 2016, which were

approved by the Management Board on February 16, 2017.

In the Financial Statements:

- Revenues remained relatively stable at

€10.8 billion, reflecting the contrasting results in the

Group’s business segments:

- Strong increase in Universal Music

Group’s (UMG) revenues (+4.4% at constant rate and perimeter).

UMG’s revenues continued to grow (+3.4%) in the fourth quarter of

2016, despite an unfavorable seasonality effect.

- Decrease in Canal Group’s revenues

(-4.2% at constant rate and perimeter) due to the decline of the

performances of the pay-TV segment in France and Studiocanal, even

though international operations continued to grow strongly (+6.8%),

particularly in Africa (+19.9%).

- EBIT of €1,194 million, down 2.9%.

-Earnings attributable to Vivendi SA shareowners of €1,256

million, down 35%, of which earnings attributable to Vivendi SA

shareowners from continuing operations, after non-controlling

interests of €1,236 million, up 77.0%.

As of December 31, 2016, the net cash position amounted

to €1.1 billion, bearing in mind that the return to

shareholders was particularly large in 2016, amounting to

€4.2 billion.

Vivendi strategy

Vivendi is building a global content and media group, a very

attractive business sector in the 3rd millennium. It owns powerful

and complementary assets in this industry, which it gets to work

together in order to extract greater value from them. The Group

owns the three most widely consumed forms of content in the world:

music, video games and audiovisual, and holds leading positions in

the three most dynamic sectors of the creative industries: music

with Universal Music Group, video games with Gameloft and

audiovisual with Canal+ Group.

Alongside its content creation capacity, Vivendi has its own

distribution capabilities and, to ensure its content gets maximum

exposure, establishes partnerships with telecom operators and

invests in digital and physical distribution networks.

The Group therefore relies on two growth drivers: creation and

distribution. Producing and distributing relevant content requires

in-depth consumer knowledge, data leveraging and supporting the

shift to mobile advertising.

This ambitious strategy is made possible thanks to its main

shareholder, the family-owned Bolloré Group

(it will hold 29% of voting rights in April 2017), which

provides the long-term stability that is needed.

Outlook

In 2017, revenues should increase by more than 5% and, thanks to

the measures taken in 2016, EBITA should increase by around

25%.

Dividend and share repurchases

The Management Board confirmed to the Supervisory Board that

this year it would propose the distribution of an ordinary dividend

of €0.40 per share with respect to 2016. While building a group

creating high long-term value, the cash flow generated by Vivendi

allows the Group to provide a 2% yield on its shares (2.35% with

the closing stock price of February 22, 2017).

Furthermore, the Group may continue to undertake share

repurchases depending on market conditions.

Comments on Business Key Financials

Universal Music Group

Universal Music Group’s (UMG) revenues amounted to €5,267

million, up 4.4% at constant currency compared to 2015 (+3.1% on an

actual basis), driven by growth across all divisions.

Recorded music revenues grew 2.9% at constant currency thanks to

the growth in subscription and streaming revenues (+57.9 %), which

more than offset the decline in both download and physical

sales.

Music publishing revenues grew 6.7% at constant currency, also

driven by increased subscription and streaming revenues, as well as

growth in synchronization and performance income.

Merchandising and other revenues were up 16.1% at constant

currency thanks to stronger touring activity.

Recorded music best sellers for the year included new releases

from Drake, Rihanna, Ariana Grande and The Rolling Stones, as well

as carryover sales from Justin Bieber.

UMG’s income from operations amounted to €687 million, up 10.7%

at constant currency compared to 2015 (+9.8% on an actual basis).

This favorable performance reflected the benefit of both revenue

growth and cost savings.

UMG’s EBITA amounted to €644 million, up 9.1% at constant

currency compared to 2015 (+8.4% on an actual basis). EBITA

included legal settlement income and restructuring charges in 2016

and 2015.

In recent months, UMG entered into several agreements with the

estate of the late artist Prince and NPG Records Inc., becoming the

home for Prince’s music publishing, merchandise and much of his

recorded music. UMG is now the exclusive worldwide publishing

administrator for all of the artist's released and unreleased songs

and the exclusive worldwide branding and licensing partner. It also

holds the exclusive licensing rights to certain of his NPG

recordings, including some Grammy-winning songs, as well as the

right to compile and release albums from his unreleased

recordings.

Canal+ Group

Canal+ Group revenues amounted to €5,253 million, down 4.7%

compared to 2015.

Revenues from pay-TV operations in mainland France were down

6.1% year-on-year. This change was primarily due to a decline of

the individual subscriber base (down 492,000 year-on-year to 5.25

million subscribers), despite a strong improvement in business

performance towards the end of the year following the launch of the

new Canal offers in mid-November 2016. Moreover, Canal+ Group

entered into agreements with Free and Orange during the fourth

quarter of 2016 pursuant to which the Canal TV offer can be

included in the set-top boxes of these operators (only the fiber

offer for Orange).

Revenues from pay-TV international operations grew by 5.7%

compared to 2015, thanks to continued growth in the subscriber

base, particularly in Africa where the year-on-year increase

amounted to 692,000 to reach nearly 2.8 million subscribers at

the end of December 2016.

At the end of December 2016, Canal+ Group had increased its

subscriber base to approximately 11.5 million individual

subscribers and 2.9 million Free and Orange customers under the

aforementioned partnerships.

Advertising revenues from free-to-air channels in mainland

France were up 6.9% year-on-year, notably thanks to C8, which was

the most watched DTT channel in France and the fifth most watched

channel overall at the end of 2016. Among its primary target

audience of 25-49 year old, C8 was the fourth most watched French

channel with an average share of 4.4% in 2016.

Studiocanal's revenues amounted to €416 million, down 26.1%

compared to the record high achieved in 2015, which benefited from

exceptional performances with the success of several movies,

including Paddington, Shaun the Sheep, Imitation Game, Legend and

Hunger Games.

Canal+ Group's income from operations amounted to

€303 million, compared to €542 million in 2015, and EBITA

amounted to €240 million, compared to €454 million in

2015. This change was mainly due to the decline in the individual

subscriber base in mainland France (excluding wholesale agreements)

and content investments.

EBITA from Canal+ channels in France5 amounted to a

€399 million loss, compared to a €264 million loss in

2015.

Gameloft

Gameloft’s revenues amounted to €132 million for the second

half of 2016. As a reminder, Vivendi has fully consolidated

Gameloft since June 29, 2016; Gameloft’s revenues amounted to

€125 million for the first half of 2016.

Gameloft’s dynamic growth accelerated compared to the first half

of 2016. Gameloft’s operations in the second half of the year were

notably driven by the strong development of its mobile advertising

agency, Gameloft Advertising Solutions. The continued long-term

success of games such as Asphalt 8: Airborne, Dungeon Hunter 5,

Dragon Mania Legends, March of Empires and Modern Combat 5:

Blackout and the successful launch of Disney Magic Kingdoms in 2016

also contributed to a strong second half performance. Gameloft

benefited from improved monetization of services for existing games

and from a more efficient and targeted user acquisition policy.

Year-end was especially dynamic for Gameloft, with sales reaching a

historic high of €69 million for the fourth quarter of

2016.

The games released in 2016 accounted for 14% of Gameloft’s sales

during the second half of 2016. Disney Magic Kingdoms in particular

has been a stand out since its launch by Gameloft in March 2016,

notably in Japan where the game, which is distributed in

partnership with GungHo, was the most downloaded game on iOS and

Google Play upon its release.

During the second half of 2016, two thirds of Gameloft’s sales

were generated by internally developed franchises which continue to

grow as a percentage of sales. Gameloft franchises represented 57%

of sales in 2013, 60% in 2014, 64% in 2015, and 67% in the second

half of 2016. The goal is to continue to create new franchises

every year and, at the same time, to strengthen the appeal of the

existing franchises.

Gameloft’s income from operations amounted to €10 million

for the second half of 2016 thanks to a sharp increase in revenues

and fewer operating costs. The income from operations’ margin stood

at 7.6%, a level that Gameloft had not achieved since the second

half of 2013.

Gameloft’s EBITA amounted to €7 million for the second half

of 2016.

Vivendi Village

Vivendi Village’s revenues amounted to €111 million, a 10.9%

increase compared to 2015 (+14.7% at constant currency and +3.8% at

constant currency and perimeter). Over the same period, Vivendi

Village’s income from operations and EBITA amounted to losses of €7

million and €9 million, respectively. Vivendi Village continues to

serve as a lab for experimentation and a launch pad for new

projects for the entire Group thanks in particular to the

flexibility offered by small organizational structures.

Vivendi Ticketing generated revenues of €52 million in 2016 and

significantly improved its income from operations (+11.8% compared

to 2015).

MyBestPro (web-based expert counseling) continued to perform

well in 2016 with an 11.3% increase in revenues and a 23.5%

increase in income from operations compared to 2015.

Despite a difficult environment following the November 2016

Paris bombings, L’Olympia almost maintained the same level of

revenues in 2016 as the year before by increasing its initiatives,

in particular partnerships and events. The Théâtre de L’Œuvre in

Paris was re-launched in October 2016 with an original program

line-up.

Since early 2017, Olympia Production has coproduced the

ambitious tour of Slimane, the 2016 winner of the The Voice France.

CanalOlympia has successfully opened three new cinema and

entertainment venues in Africa since the beginning of the year and

will open a fourth one in Burkina Faso on February 24, 2017.

New Initiatives: Dailymotion and Vivendi

Content

Revenues generated by New Initiatives, which groups together

Dailymotion (since June 30, 2015) and Vivendi Content, amounted to

€103 million, compared to €43 million in 2015.

Dailymotion, a global video platform with 300 million unique

users per month and 3 billion video views, began a major

transformation plan in 2016. Over the past few months, Dailymotion

has strengthened its technical infrastructure, optimized its

monetization tools, improved the quality of its audience and taken

measures to remove explicit content incompatible with its new

premium positioning. Dailymotion intends to offer its users a

new experience allowing them to better discover and watch videos,

including live videos, directly related to their individual

interests and desires. To do this, Dailymotion will rely on the

content provided by the hundreds of contributors (publishers, media

groups) around the world with whom it has established partnerships.

This new experience will be available in the second quarter of

2017, with the worldwide launch of a completely revamped user

interface for all screen types, particularly mobile screens, which

will mark an important step in Dailymotion’s transformation.

Vivendi Content is a business dedicated to developing new

content formats aimed at an international audience in close

collaboration with the Group’s other businesses. It includes

Studio+, an offer of short premium digital series specifically

designed for mobile devices which was launched in Latin America and

Europe during the fourth quarter of 2016, and Vivendi Entertainment

which produces original formats for television shows. Vivendi

Content also includes the Group’s initiatives in the field of

e-sports.

New Initiatives’ income from operations amounted to a €44

million loss in 2016, compared to an €18 million loss in 2015.

EBITA amounted to a €56 million loss, compared to a €20 million

loss in 2015.

Notes1 In compliance with IFRS 5, GVT (sold in 2015), has

been reported as a discontinued operation. In practice, income and

charges from this business have been reported as follows:

- GVT’s contribution, until its effective

divestiture on May 28, 2015, to each line of Vivendi’s Consolidated

Statement of Earnings has been reported on the line “Earnings from

discontinued operations”; and

- the share of net income and the capital

gain recognized as a result of the divestiture have been excluded

from Vivendi’s adjusted net income.

2 Constant perimeter reflects the impacts of the acquisitions of

Dailymotion on June 30, 2015, Radionomy on December 17, 2015,

Alterna’TV (Thema America) on April 7, 2016, Gameloft on June 29,

2016 and the licence of the Paddington Bear on June 30, 2016.3 A

reconciliation of EBIT to EBITA and to income from operations, as

well as a reconciliation of earnings attributable to Vivendi SA

shareowners to adjusted net income, are presented in Appendix IV.4

Non-GAAP measures.5 Relates to the six premium channels: Canal+,

Canal+ Cinéma, Canal+ Sport, Canal+ Séries, Canal+ Family and

Canal+ Décalé.

Note: This press release contains audited consolidated

earnings established under IFRS, which were approved by Vivendi’s

Management Board on February 16, 2017, reviewed by the Vivendi

Audit Committee February 20, 2017, and by Vivendi’s Supervisory

Board on February 23, 2017.

For additional information, please refer to the “Financial

Report and audited Consolidated Financial Statements for the year

ended December 31, 2016” which will be released later online

on Vivendi’s website (www.vivendi.com).

About VivendiVivendi is an integrated media and content

group. The company operates businesses throughout the media value

chain, from talent discovery to the creation, production and

distribution of content. Universal Music Group is engaged in

recorded music, music publishing and merchandising. It owns more

than 50 labels covering all genres. Canal+ Group is engaged in

pay-TV in France, as well as in Africa, Poland and Vietnam. Its

subsidiary Studiocanal is a leading European player in production,

sales and distribution of movies and TV series. Gameloft is a

worldwide leader in mobile games, with 2 million games downloaded

per day.Vivendi Village, groups together Vivendi Ticketing (in the

United Kingdom, the United States and France), MyBestPro (expert

counseling), Watchever (subscription streaming services), Radionomy

(digital radio), the venues L’Olympia and Theâtre de L‘Œuvre in

Paris, and CanalOlympia in Africa, as well as Olympia Production.

With 3 billion videos viewed each month, Dailymotion is one of

the biggest video content aggregation and distribution platforms in

the world. www.vivendi.com, www.cultureswithvivendi.com

Important DisclaimersCautionary Note Regarding

Forward-Looking Statements. This press release contains

forward-looking statements with respect to the financial condition,

results of operations, business, strategy, plans and outlook of

Vivendi, including the impact of certain transactions and the

payment of dividends and distributions, as well as share

repurchases. Although Vivendi believes that such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including, but not limited to, the risks related to

antitrust and other regulatory approvals as well as any other

approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des Marchés Financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des Marchés Financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Unsponsored ADRs. Vivendi does not sponsor an American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

ANALYST CONFERENCE CALL

Speakers:Arnaud de PuyfontaineChief Executive

OfficerHervé PhilippeMember of the Management Board and

Chief Financial Officer

Date: Thursday February 23, 20176:00pm Paris time –

5:00pm London time – 12:00pm New York time

Media invited on a listen-only basis.The conference

will be held in English.

Internet: The conference can be followed on the Internet

at: www.vivendi.com (audiocast)

Numbers to dial:UK +44 (0)330 336 9105US +1

719-457-2086France +33 (0) 1 76 77 22 74Access code : 727 93 21

(EN) / 427 42 74 (FR)

Numbers for replay:UK +44 (0) 207 984 7568US +1

719-457-0820France +33 (0) 1 70 48 00 94Access code : 727 93

21(EN) / 427 42 74 (FR)

On our website www.vivendi.com will be available dial-in

numbers for the conference call and for replay (14 days), an audio

webcast and the slides of the presentation.

APPENDIX I

VIVENDI

CONSOLIDATED STATEMENT OF EARNINGS

(IFRS, audited)

Three

months ended December 31,

%Change

Year ended December 31,

%Change

2016 2015 2016 2015

3,107 3,147 -

1.2% Revenues 10,819 10,762 + 0.5%

(2,112) (1,959) Cost of revenues (6,829) (6,555) (903) (944)

Selling, general and administrative expenses excluding amortization

of intangible assets acquired through business combinations (3,172)

(3,163) (32) (37) Restructuring charges (94) (102) (55) (104)

Amortization of intangible assets acquired through business

combinations (223) (408) (23) (2) Impairment losses on intangible

assets acquired through business combinations (23) (3) - - Reversal

of reserve related to the Liberty Media litigation in the United

States 240 - 4 34 Other income 661 745 (70) (7) Other charges (185)

(45)

(84) 128 na EBIT 1,194

1,231 - 2.9% 81 (3) Income from equity affiliates 169

(10) (13) (6) Interest (40) (30) 19 17 Income from investments 47

52 8 1 Other financial income 31 16 (29) 9 Other financial charges

(69) (73)

(18) 146 na Earnings from

continuing operations before provision for income taxes

1,332 1,186 + 12.3% 73 - Provision for income

taxes (77) (441)

55 146 - 62.2% Earnings

from continuing operations 1,255 745 +

68.4% 22 (3) Earnings from discontinued operations 20 1,233

77 143 - 46.8% Earnings 1,275

1,978 - 35.6% 4 (1) Non-controlling interests (19)

(46)

81 142 - 43.4% Earnings attributable

to Vivendi SA shareowners 1,256 1,932 -

35.0% 59 145 - 59.1%

of which earnings from

continuing operations attributable to Vivendi SA shareowners

1,236 699 + 77.0% 0.06 0.10 Earnings

attributable to Vivendi SA shareowners per share - basic (in euros)

0.99 1.42 0.05 0.10 Earnings attributable to Vivendi SA shareowners

per share - diluted (in euros) 0.95 1.41

In millions of euros, except per share

amounts.

na: not applicable.

Nota:

As a reminder, GVT (sold in 2015) has been reported as a

discontinued operation in compliance with IFRS 5. In practice,

income and charges from this business has been reported as

follows:

- GVT’s contribution, until its effective

divestiture on May 28, 2015, to each line of Vivendi’s Consolidated

Statement of Earnings as well as any capital gain recognized has

been reported on the line “Earnings from discontinued operations”;

and

- the share of net income and the capital

gain recognized as a result of such divestiture have been excluded

from Vivendi’s adjusted net income.

For any additional information, please refer to the “Financial

Report and Audited Consolidated Financial Statements for the year

ended December 31, 2016“, which will be released online later on

Vivendi’s website (www.vivendi.com).

APPENDIX II

VIVENDI

ADJUSTED STATEMENT OF EARNINGS

(IFRS, audited)

Three

months ended December 31,

%Change

Year ended December 31,

%Change

2016 2015 2016 2015

3,107 3,147 -

1.2% Revenues 10,819 10,762 +

0.5% 123 304 - 59.7% Income from

operations 853 1,061 - 19.6% 60

207 - 71.4% EBITA 724 942 -

23.2% 74 (3) Income from equity affiliates 214 (10) (13) (6)

Interest (40) (30) 19 17 Income from investments 47 52 140 215 -

34.9% Adjusted earnings from continuing operations before provision

for income taxes 945 954 - 1.0% (13) (15) Provision for income

taxes (162) (199) 127 200 - 36.9% Adjusted net income before

non-controlling interests 783 755 + 3.6% 3 (4) Non-controlling

interests (28) (58)

130 196 - 33.8%

Adjusted net income 755 697 + 8.4%

0.10 0.14 Adjusted net income per share - basic (in euros)

0.59 0.51 0.10 0.14 Adjusted net income per share - diluted (in

euros) 0.54 0.51

In millions of euros, except per share

amounts.

The reconciliation of EBIT to EBITA and to income from

operations, as well as of earnings attributable to Vivendi SA

shareowners to adjusted net income is presented in the Appendix

IV.

APPENDIX III

VIVENDI

REVENUES, INCOME FROM OPERATIONS AND

EBITA

BY BUSINESS SEGMENT

(IFRS, audited)

Three months ended December 31, (in millions of

euros) 2016 2015 % Change

% Change atconstantcurrency

% Change atconstantcurrency andperimeter

(a)

Revenues Universal Music Group 1,644 1,616 +1.7% +3.4% +3.4%

Canal+ Group 1,351 1,479 -8.6% -8.0% -8.2% Gameloft 69 - na na na

Vivendi Village 33 27 +22.9% +29.3% +19.2% New Initiatives 27 25

+4.3% +4.3% +4.3% Elimination of intersegment transactions (17) - x

8,8 x 8,8 x 8,8

Total Vivendi 3,107 3,147

-1.2% +0.1% -2.4% Income from

operations Universal Music Group 296 348 -15.0% -14.6% -14.6%

Canal+ Group (136) (12) x 11.1 x 11.2 x 11.2 Gameloft 6 - na na na

Vivendi Village 2 1 x 2.2 x 3.1 x 3.4 New Initiatives (19) (8) x

2.2 x 2.2 x 2.2 Corporate (26) (25) -8.5% -8.1% -8.1%

Total

Vivendi 123 304 -59.7% -58.8%

-61.4% EBITA Universal Music Group 291 334

-13.0% -12.9% -12.9% Canal+ Group (187) (96) -94.4% -95.9% -96.5%

Gameloft 5 - na na na Vivendi Village - 1 na na na New Initiatives

(21) (10) x 2.1 x 2.1 x 2.1 Corporate (28) (22) -29.4% -28.9%

-28.9%

Total Vivendi 60 207 -71.4%

-70.6% -73.5%

APPENDIX III (Cont’d)

VIVENDI

REVENUES, INCOME FROM OPERATIONS AND

EBITA

BY BUSINESS SEGMENT

(IFRS, audited)

Year ended December 31, (in millions of euros) 2016

2015 % Change

% Change atconstantcurrency

% Change atconstantcurrency andperimeter

(a)

Revenues Universal Music Group

5,267 5,108 +3.1% +4.4% +4.4% Canal+ Group 5,253 5,513 -4.7% -4.1%

-4.2% Gameloft 132 - na na na Vivendi Village 111 100 +10.9% +14.7%

+3.8% New Initiatives 103 43 x 2.4 x 2.4 +51.6% Elimination of

intersegment transactions (47) (2) na na na

Total Vivendi

10,819 10,762 +0.5% +1.5% -0.2%

Income from operations Universal Music Group 687 626

+9.8% +10.7% +10.7% Canal+ Group 303 542 -44.1% -44.0% -44.2%

Gameloft 10 - na na na Vivendi Village (7) 10 na na na New

Initiatives (44) (18) x 2.4 x 2.4 -78.0% Corporate (96) (99) +2.3%

+2.3% +2.3%

Total Vivendi 853 1,061

-19.6% -18.8% -18.5% EBITA

Universal Music Group 644 593 +8.4% +9.1% +9.1% Canal+ Group 240

454 -47.1% -46.9% -47.1% Gameloft 7 - na na na Vivendi Village (9)

9 na na na New Initiatives (56) (20) x 2.8 x 2.8 x 2.2 Corporate

(102) (94) -8.4% -8.4% -8.4%

Total Vivendi 724

942 -23.2% -22.5% -21.5%

na: not applicable.

a. Constant perimeter reflects the impacts of the following

acquisitions:

- Alterna’TV, renamed Thema America

(April 7, 2016) and Paddington (June 30, 2016) by Canal+

Group;

- Gameloft (June 29, 2016);

- Radionomy within Vivendi Village

(December 17, 2015); and

- Dailymotion within New Initiatives

(June 30, 2015).

The reconciliation of EBIT to EBITA and to income from

operations is presented in the Appendix IV.

APPENDIX IV

VIVENDI

RECONCILIATION OF NON-GAAP MEASURES

IN STATEMENT OF EARNINGS

(IFRS, audited)

Income from operations, adjusted earnings before interest and

income taxes (EBITA), and adjusted net income, non-GAAP measures,

should be considered in addition to, and not as a substitute for,

other GAAP measures of operating and financial performance. Vivendi

considers these to be relevant indicators of the group’s operating

and financial performance. Vivendi Management uses income from

operations, EBITA and adjusted net income for reporting, management

and planning purposes because they provide a better illustration of

the underlying performance of continuing operations by excluding

most non-recurring and non-operating items.

Year ended December 31, (in millions of euros) 2016

2015

EBIT (a) 1,194 1,231 Adjustments

Amortization of intangible assets acquired through business

combinations 223 408 Impairment losses on intangible assets

acquired through business combinations (a) 23 3 Reversal of reserve

related to the Liberty Media litigation in the United States (a)

(240) - Other income (a) (661) (745) Other charges (a) 185 45

EBITA 724 942 Adjustments Restructuring

charges (a) 94 102 Charges related to equity-settled share-based

compensation plans 14 16 Other non-current operating charges and

income 21 1

Income from operations 853 1,061

Year ended December 31, (in millions of euros) 2016

2015

Earnings attributable to Vivendi SA shareowners

(a) 1,256 1,932 Adjustments Amortization of

intangible assets acquired through business combinations 223 408

Impairment losses on intangible assets acquired through business

combinations (a) 23 3 Reversal of reserve related to the Liberty

Media litigation in the United States (a) (240) - Other income (a)

(661) (745) Other charges (a) 185 45 Amortization of intangible

assets related to equity affiliates 45 - Other financial income (a)

(31) (16) Other financial charges (a) 69 73 Earnings from

discontinued operations (a) (20) (1,233) Change in deferred tax

asset related to Vivendi SA's French Tax Group and to the

Consolidated Global Profit Tax Systems (33) 42 Income taxes related

to the sale of the 20% interest in Numericable-SFR - 124 Net income

taxes related to the sales of GVT and Telefonica Brasil shares - 63

Non-recurring items related to provision for income taxes 16 145

Provision for income taxes on adjustments (68) (132)

Non-controlling interests on adjustments (9) (12)

Adjusted net

income 755 697

As reported in the Consolidated Statement of Earnings.

APPENDIX V

VIVENDI

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

(IFRS, audited)

(in millions of euros) December 31,

2016 December 31, 2015

ASSETS Goodwill 10,987 10,177

Non-current content assets 2,169 2,286 Other intangible assets 310

224 Property, plant and equipment 671 737 Investments in equity

affiliates 4,416 3,435 Non-current financial assets 3,900 4,132

Deferred tax assets 752 622

Non-current assets 23,205

21,613 Inventories 123 117 Current tax receivables

536 653 Current content assets 1,054 1,088 Trade accounts

receivable and other 2,273 2,139 Current financial assets 1,102

1,111 Cash and cash equivalents 4,072 8,225

Current assets

9,160 13,333 TOTAL ASSETS

32,365 34,946 EQUITY AND LIABILITIES

Share capital 7,079 7,526 Additional paid-in capital 4,238 5,343

Treasury shares (473) (702) Retained earnings and other 8,539 8,687

Vivendi SA shareowners' equity 19,383 20,854

Non-controlling interests 229 232

Total equity 19,612

21,086 Non-current provisions 1,785 2,679 Long-term

borrowings and other financial liabilities 2,977 1,555 Deferred tax

liabilities 726 705 Other non-current liabilities 126 105

Non-current liabilities 5,614 5,044

Current provisions 356 363 Short-term borrowings and other

financial liabilities 1,104 1,383 Trade accounts payable and other

5,614 6,737 Current tax payables 65 333

Current liabilities

7,139 8,816 Total liabilities

12,753 13,860 TOTAL EQUITY AND

LIABILITIES 32,365 34,946

APPENDIX VI

VIVENDI

CONSOLIDATED STATEMENT OF CASH FLOWS

(IFRS, audited)

Year ended December 31, (in millions of euros) 2016

2015

Operating activities EBIT 1,194 1,231

Adjustments (203) (38) Content investments, net (55) 157

Gross

cash provided by operating activities before income tax paid

936 1,350 Other changes in net working capital (7)

(226)

Net cash provided by operating activities before income

tax paid 929 1,124 Income tax (paid)/received,

net (271) (1,037)

Net cash provided by operating activities of

continuing operations 658 87 Net cash provided

by operating activities of discontinued operations -

153 Net cash provided by operating activities

658 240 Investing activities Capital

expenditures (235) (247) Purchases of consolidated companies, after

acquired cash (553) (359) Investments in equity affiliates (772)

(19) Increase in financial assets (2,759) (3,549)

Investments (4,319) (4,174) Proceeds from

sales of property, plant, equipment and intangible assets 2 1

Proceeds from sales of consolidated companies, after divested cash

3 4,032 Disposal of equity affiliates 1 268 Decrease in financial

assets 1,967 4,713

Divestitures 1,973 9,014

Dividends received from equity affiliates 8 5 Dividends received

from unconsolidated companies 25 9

Net cash provided by/(used

for) investing activities of continuing operations

(2,313) 4,854 Net cash provided by/(used for)

investing activities of discontinued operations -

(262) Net cash provided by/(used for) investing

activities (2,313) 4,592 Financing

activities Net proceeds from issuance of common shares in

connection with Vivendi SA's share-based compensation plans 81 273

Sales/(purchases) of Vivendi SA's treasury shares (1,623) (492)

Distributions to Vivendi SA's shareowners (2,588) (2,727) Other

transactions with shareowners (3) (534) Dividends paid by

consolidated companies to their non-controlling interests (34) (46)

Transactions with shareowners (4,167) (3,526)

Setting up of long-term borrowings and increase in other long-term

financial liabilities 2,101 8 Principal payment on long-term

borrowings and decrease in other long-term financial liabilities

(16) (2) Principal payment on short-term borrowings (557) (126)

Other changes in short-term borrowings and other financial

liabilities 260 6 Interest paid, net (40) (30) Other cash items

related to financial activities (77) 106

Transactions on

borrowings and other financial liabilities 1,671

(38) Net cash provided by/(used for) financing activities

of continuing operations (2,496) (3,564) Net

cash provided by/(used for) financing activities of discontinued

operations - 69 Net cash provided by/(used

for) financing activities (2,496) (3,495)

Foreign currency translation adjustments of continuing operations

(2) 3 Foreign currency translation adjustments of discontinued

operations - (8)

Change in cash and cash equivalents

(4,153) 1,332 Reclassification of discontinued

operations' cash and cash equivalents - 48

Cash and cash equivalents At beginning of the

period

8,225 6,845 At end of the period

4,072

8,225

Nota : As a reminder, in compliance with IFRS 5, GVT

(sold on May 28, 2015) has been reported as a discontinued

operation.

APPENDIX VII

VIVENDI

SELECTED KEY CONSOLIDATED FINANCIAL DATA FOR

THE LAST FIVE YEARS

(IFRS, audited)

Vivendi deconsolidated GVT, SFR, Maroc Telecom group and

Activision Blizzard as from May 28, 2015,

November 27, 2014, May 14, 2014, and October 11,

2013, respectively, i.e., the date of their effective sale by

Vivendi. In compliance with IFRS 5, these businesses have been

reported as discontinued operations for the relevant periods as set

out in the table of selected key consolidated financial data below

in respect of data reflected in the Consolidated Statement of

Earnings and Consolidated Statement of Cash Flows.

Year ended December 31, 2016 2015 2014 2013

2012

Consolidated

data

Revenues 10,819 10,762 10,089 10,252 9,597 EBIT 1,194

1,231 736 637 (1,131) Earnings attributable to Vivendi SA

shareowners 1,256 1,932 4,744 1,967 179 of which earnings from

continuing operations attributable to Vivendi SA shareowners 1,236

699 (290) 43 (1,565) Income from operations (a) 853 1,061

1,108 1,131 na EBITA (a) 724 942 999 955 1,074 Adjusted net income

(a) 755 697 626 454 318 Net Cash Position/(Financial Net

Debt) (a) 1,068 6,422 4,637 (11,097) (13,419) Total equity 19,612

21,086 22,988 19,030 21,291 of which Vivendi SA shareowners' equity

19,383 20,854 22,606 17,457 18,325 Cash flow from operations

(CFFO) (a) 729 892 843 894 846 Cash flow from operations after

interest and income tax paid (CFAIT) (a) 341 (69) 421 503 772

Financial investments (4,084) (3,927) (1,244) (107) (1,689)

Financial divestments 1,971 9,013 17,807 3,471 201 Dividends

paid by Vivendi SA to its shareholders 2,588 (b) 2,727 (c) 1,348

(d) 1,325 1,245 Purchases/(sales) of Vivendi SA's treasury shares

1,623 492 32 - 18

Per share

data

Weighted average number of shares outstanding 1,272.6

1,361.5 1,345.8 1,330.6 1,298.9

Adjusted net income per

share 0.59 0.51 0.46 0.34

0.24 Number of shares outstanding at the end of the

period (excluding treasury shares) 1,259.5 1,342.3 1,351.6 1,339.6

1,322.5 Equity per share, attributable to Vivendi SA shareowners

15.39 15.54 16.73 13.03 13.86

Dividends per share

paid 2.00 (b)

2.00 (c)

1.00 (d)

1.00 1.00

In millions of euros, number of shares in millions, data per

share in euros.

na: not applicable.

a. The non-GAAP measures of Income from operations, EBITA,

Adjusted net income, Net Cash Position (or Financial Net Debt),

Cash flow from operations (CFFO) and Cash flow from operations

after interest and income tax paid (CFAIT) should be considered in

addition to, and not as a substitute for, other GAAP measures of

operating and financial performance as presented in the

Consolidated Financial Statements and the related Notes, or as

described in this Financial Report. Vivendi considers these to be

relevant indicators of the group’s operating and financial

performance. Each of these indicators is defined in the appropriate

section of this Financial Report or in its Appendix. In addition,

it should be noted that other companies may have definitions and

calculations for these indicators that differ from those used by

Vivendi, thereby affecting comparability.

b. On April 21, 2016, Vivendi’s General Shareholders’ Meeting

approved the payment of an ordinary dividend of €3 per share with

respect to fiscal year 2015, i.e., an aggregate dividend payment of

€3,951 million. This amount included €2,588 million paid

in 2016: €1,318 million for the second interim dividend of €1

per share, paid on February 3, 2016, and €1,270 million

representing the balance of €1 per share, paid on April 28,

2016.

c. In 2015, Vivendi paid the dividend with respect to fiscal

year 2014 (€1 per share, i.e., €1,363 million) and a first interim

dividend with respect to fiscal year 2015 (€1 per share, i.e.,

€1,364 million).

d. On June 30, 2014, Vivendi SA paid an ordinary dividend of €1

per share to its shareholders from additional paid-in capital,

treated as a return of capital distribution to shareholders.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170223006310/en/

VivendiMediaParisJean-Louis Erneux, +33

(0)1 71 71 15 84Solange Maulini, +33 (0) 1 71 71 11

73orLondonTim Burt (Teneo Strategy), +44 20 7240

2486orInvestor RelationsParisLaurent Mairot, +33 (0)

1 71 71 35 13Julien Dellys, +33 (0) 1 71 71 13 30

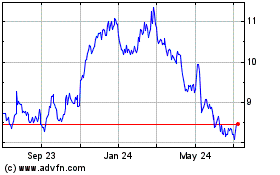

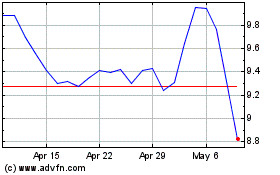

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024