UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2015

Commission File Number: 001-14475

TELEFÔNICA BRASIL S.A.

(Exact name of registrant as specified in its charter)

TELEFONICA BRAZIL S.A.

(Translation of registrant’s name into English)

Av. Eng° Luís Carlos Berrini, 1376 - 28º andar

São Paulo, S.P.

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

TELEFÔNICA BRASIL S.A.

PUBLICLY-HELD COMPANY

CNPJ MF 02.558.157/0001-62 - NIRE 35.3.001.5881-4

MINUTES OF THE 273rd MEETING OF THE BOARD OF DIRECTORS

1. DATE, HOUR AND VENUE: May 12th, 2015, at 12:30 p.m., at the office of Telefônica Brasil S.A. (“Company”), located at Av. Eng. Luiz Carlos Berrini, 1376, Cidade Monções neighborhood, , City of São Paulo, State of São Paulo.

2. CHAIRMAN AND SECRETARY: Antonio Carlos Valente da Silva, Chairman of the Board of Directors; and Breno Rodrigo Pacheco de Oliveira, Secretary of the Board of Directors.

3. PARTICIPANTS: Directors of Telefônica Brasil S.A. ("Telefônica Brasil" or "Company") that subscribed the minutes, with quorum required for installation and deliberation. The Board member, Mr. Eduardo Navarro de Carvalho, participated by video conference in Madrid, Spain and the Director Mr. Narcis Serra Serra participated by conference call from New York, United States of America; still, the Directors Luciano Carvalho Ventura, Luiz Fernando Furlan and Roberto Oliveira de Lima were represented by the Chairman, Mr. Antonio Carlos Valente da Silva, on behalf of vote, all as permitted by Article 19, paragraphs 3 and 4 of the Bylaws. Were also present, pursuant to Article 163, paragraph 3 of Law 6,404/76, as amended ("Law of Corporations"), Messrs. Flávio Stamm, Cremênio Mendola Netto and Charles Edwards Allen representatives of the Company’s Fiscal Council.

4. DISCUSSIONS AND RESOLUTIONS:

The Chairman explained that, as it was known to all, the purpose of the meeting was to know and decide on the acts and actions related to the implementation of the transaction approved at the 252nd Meeting of the Board of Directors held on August 27, 2014, related to the operation of acquisition, by the Company, of all shares of GVT Participações S.A., anonymous society duly incorporated under the laws of the Federative Republic of Brazil, registered in the CNPJ/MF under nº 10.242.813/0001-41, headquartered in the City of São Paulo, State of São Paulo, at Av. Brigadeiro Faria Lima, 4300, 9th floor ("GVTPar"), due to the closure of the Public Offering for Primary Distribution of Shares, held simultaneously in Brazil in unorganized over the counter market and abroad to raise funds needed to finance this acquisition, approved in accordance with the Board of Directors' meetings held on April 28th and May 4th, 2015.

In addition, the Chairman informed that the transaction for the acquisition of GVTPar was submitted to appraisal and approval of Agência Nacional de Telecomunicações - ANATEL, which approved pursuant to Act No. 448 of January 22, 2015, published in the Official Gazette of January 26, 2015, and Conselho Administrativo de Defesa Econômica - CADE, which approved it in the 61st ordinary session of judgement of CADE’s Court, held on March 25, 2015, published in the Official Gazette of March 31, 2015.

After the clarifications, the members of the Board of Directors approved the documents related to the transaction and following matters:

4.1. For unanimously decision of those present or represented at the Meeting members, ratify,ad referendum of the Company’s General Shareholders' Meeting to resolve on the matter, the hiring, by the Board, of the specialized evaluation company Planconsult Planejamento e Consultoria Ltda., enrolled with the CNPJ/MF under No. 51.163.798/0001-23 ("Planconsult"), to prepare the appraisal report of the value of the shares issued by GVTPar, based on its economic value on December 31, 2014 (i) for the purposes of Article 256 of Law of Corporations and (ii) for purposes of determining the Company's capital increase resulting from the incorporation of GVTPar’s shares, under Article 252 of the Law of Corporations ("Appraisal Report");

4.2. For unanimously decision of those present or represented at the Meeting members, appreciate the Appraisal Report and recommend, based on such document and the other clarifications related to the transaction, the approval by the Company's General Shareholders' Meeting, in accordance with the first paragraph of Article 256 of the Law of Corporations, of the acquisition of all shares of GVTPar, controller of Global Village Telecom S.A. (“GVT”), under the Stock Purchase Agreement and Other Covenants ("Agreement") and other related documents, entered into between the Company, Vivendi S.A., Société d’Investissement et de Gestion 72 S.A., Société d’Investissement et de Gestion 108 SAS (“FrHolding108”), Telefónica, S.A., and, as intervening parties, GVTPar and GVT, dated September 18, 2014, which celebration was authorized by the Board at the 254th Meeting of this body held on September 18, 2014.

4.3. For unanimously decision of those present or represented at the Meeting members, approve, ad referendum of the Company's General Shareholders' Meeting to resolve on the matter, the terms and conditions of the Share Incorporation Protocol and Justification Instrument of GVTPar by the Company ("Protocol"), in accordance with Articles 224, 225 and 252 of the Law of Corporations, which establishes the general terms and conditions of the merger of GVTPar’s shares provided in the Agreement, including, without limitation, the exchange ratio of GVTPar’s shares by new shares to be issued by the Company and granted to the controller of GVTPar, which was agreed between the Parties to the Agreement as independent parties as a result of negotiations between them. The Board noted Itaú BBA S.A. , financial institutions hired by the Telefonica Brasil to express their opinions on the value attributed to GVTPar’s shares and the amount to be paid by the Telefonica Brasil in consideration for GVTPar’s shares (including the portion to be paid in shares issued by the Telefonica Brasil representing 12% of the Company), issued an opinion concluding that the value of the cash installment and the portion to be paid in shares of Telefonica Brazil, representing 12% of share capital, traded by Telefonica Brazil with Vivendi, considered the operation fair, from a financial point of view, to the shareholders of Telefonica Brasil. Also Banco Morgan Stanley SA, a financial institution hired by Telefonica Brasil, issued letter opinion (fairness opinion) concluded that, based on the assumptions contained therein, the amount to be paid by Telefonica Brazil in consideration for shares of GVTPar (including installment be paid in shares of Telefonica Brasil) under the Purchase and Sale Agreement is fair from a financial point of view to Telefonica Brasil. Thus, approving the terms and conditions of the intended incorporation, and being aware of the existence of favorable opinion issued by the Fiscal Board, the Directors authorized the Company's management to celebrate the referred Protocol under the constant draft of this instrument as its Annex I.

4.4 For unanimously decision of those present or represented at the Meeting members, approve, ad referendum of the Company’s General Shareholders' Meeting to resolve on the matter, the Appraisal Report constant of this instrument as its Annex II, which determined

the value that was the basis to establish the amount of the Company's capital increase resulting from the incorporation of GVTPar, under Article 252, paragraph 1, in conjunction with Article 8, both of the Law of Corporations.

4.5. For unanimously decision of those present or represented at the Meeting members, to approve, ad referendum of the Company's General Shareholders' Meeting to resolve on the matter, the incorporation of shares issued by GVTPar by the Company and its implementation, with the conversion of GVTPar as a wholly-owned subsidiary of the Company and the consequent increase of the capital stock of the Company and amendment to the wording of Article 5 of its Bylaws, by reason of the merger of shares and adapting it to the Company's capital increase deliberated by the Board of Directors;

4.5.1. In addition, was approved by unanimously decision of those present or represented at the Meeting members, the submission to the General Shareholders’ Meeting of the proposal to increase the capital of the Company in the amount of R$ R$9,666,021,061.26 (nine billion, six hundred sixty-six million, twenty-one thousand, sixty-one reais and twenty-six cents), through the issuance of 68,597,306 (sixty-eight million, five hundred and ninety-seven thousand, three hundred and six) common shares and 134,320,885 (one hundred thirty-four million, three hundred and twenty thousand, eight hundred and eighty-five) preferred shares, nominative, no par value, due to the incorporation of shares resolved herein and in accordance with the Protocol, and the consequent amendment of Article 5 of the Bylaws as a result of such increase. Thus, the Company's capital stock will be increased from the current R$ 53,905,394,803.83 (fifty-three billion, nine hundred and five million, three hundred ninety-four thousand, eight hundred and three reais and eighty three cents) to 63,571,415,865.09 (sixty three billion, five hundred seventy-one million, four hundred and fifteen thousand, eight hundred and sixty-five reais and nine cents), represented by 571,644,217 (five hundred seventy-one million, six hundred and forty-four thousand, two hundred and seventeen) common shares and 1,119,340,706 (one billion, one hundred and nineteen million, three hundred forty thousand seven hundred and six) preferred shares, nominative, no par value. Because of this proposes that the caput of Article 5 of the Company's Bylaws is amended to become effective with the following wording:

“Article 5 - The subscribed capital stock, fully paid-up is R$ 63,571,415,865.09 (sixty three billion, five hundred seventy-one million, four hundred and fifteen thousand, eight hundred and sixty-five reais and nine cents), divided into 1,690,984,923 (one billion, six hundred and ninety million, nine hundred and eighty-four thousand, nine hundred twenty-three), shares, of which 571,644,217 (five hundred seventy-one million six hundred and forty-four thousand, two hundred and seventeen) are common shares and 1,119,340,706 (one billion, one hundred and nineteen million, three hundred and forty thousand, seven hundred and six) are preferred shares, all of them are non-par, book-entry shares.”

4.6. The Board also approved by unanimously decision of those present or represented at the Meeting members, the submission to the General Shareholders’ Meeting of the proposed restructuring of the Company's management structure, including the change in the minimum number of Directors, four (4) to 3 (three), and the extinction of the role of General and Executive Officer, whose functions will be incorporated in the Chief Executive Officer’s functions, and the consequent amendment of Articles 20, 22 and 23 of the Company's Bylaws in order to reflect this restructuring, as well as the subsection XXVIII

Article 17 of the Company's Bylaws, which deals with the jurisdiction of the Board of Directors with regard to internal audit.

4.7. Finally, the Directors decided to submit to the General Shareholders' Meeting the proposal made by the controller, to the election for the vacant position since March 25, 2015 of Mr. Amos Genish, Israeli, married, economist, bearer of RNE No. V305047-D (SIAPRO DELEMAF/PR), CPF/MF under No. 009.194.169-50, resident and domiciled in the City of Curitiba, State of Paraná, with business address at Av. Dr. Dario Lopes dos Santos, 2197, 7th floor, Jardim Botânico, CEP 80210-010, as member of the Board of Directors of the Company, to replace Mr. Paulo Cesar Pereira Teixeira.

4.8. The Directors, as a result of the resolutions taken herein, approved by unanimously decision of those present or represented at the Meeting members, the convening of the General Shareholders’ Meeting to address the issues resolved and authorized above, and authorized the Company's officers to perform all acts that may be necessary to formalize the resolutions adopted above.

4.9. It was recorded by the Board as announced on September 25, 2014 that shareholders holders of common and preferred shares as of September 19, 2014 that dissent from the resolutions to be passed at the General Shareholders’ Meeting to be convened to decide on the matters object of this meeting, shall be entitled to withdraw from the Company upon reimbursement of the value of its shares.

It was determined that the reimbursement amount per share to be paid in the exercise of withdrawal rights determined based on the net worth constant on the Company’s financial statements for the year ended December 31, 2014, corresponding R$40.02 per share and will be deducted the amount per share corresponding to the amount of dividend declared on January 30, 2015 and April 9, 2015, since the amount of declared dividends composed the profit and therefore the book value per share at December 31, 2014. Therefore, the reimbursement amount to be paid to the dissenting shareholders of the resolutions of the General Shareholders’ Meeting to be convened to address the issues object of this meeting corresponding to the book value per share at December 31, 2014, is R$37.55 per common share or preferred share. The Board determined that the additional information about the withdrawal rights will be timely informed to the public through a Notice to Shareholders.

5. CLOSING: With nothing else to address, the Meeting was adjourned and this minutes was drafted by the Board’s Secretary, which was approved and signed by the attending Directors, and drafted in the book of minutes. São Paulo, May 12, 2015. (aa) Antonio Carlos Valente da Silva - Chairman of the Board of Directors; Santiago Fernández Valbuena - Vice-Chairman of the Board of Directors; Antonio Gonçalves de Oliveira; Eduardo Navarro de Carvalho; Francisco Javier de Paz Mancho; José Fernando de Almansa Moreno-Barreda; Luis Javier Bastida Ibarguen; Narcís Serra Serra; represented by the Chairman, Mr. Antonio Carlos Valente da Silva, the Directors Luciano Carvalho Ventura, Luiz Fernando Furlan; and Roberto Oliveira de Lima; the Secretary of the Board of Directors: Breno Rodrigo Pacheco de Oliveira.

I certify that this is a true copy of the minutes of 273rd meeting of the Board of Directors held in May 12, 2015, drawn up in proper book.

(Signature page of the 273rd Meeting of the Board of Directors of Telefônica Brasil S.A., held in May 12th, 2015, at 12 p.m.)

______________________________

Breno Rodrigo Pacheco de Oliveira

Secretary of the Board of Directors

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

TELEFÔNICA BRASIL S.A. |

|

Date: |

May 13, 2015 |

|

By: |

/s/ Luis Carlos da Costa Plaster |

|

|

|

|

|

Name: |

Luis Carlos da Costa Plaster |

|

|

|

|

|

Title: |

Investor Relations Director |

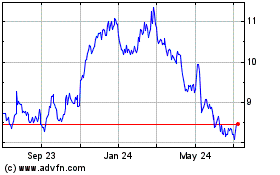

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

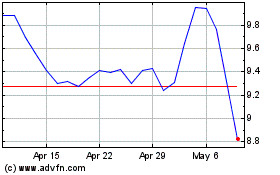

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024