Regulatory News:

Vivendi (Paris:VIV):

Note: This press release contains

non audited consolidated earnings established under IFRS, which

were approved by Vivendi’s Management Board on May 5, 2015, and

reviewed by the Audit Committee on May 6, 2015, and by the

Supervisory Board on May 12, 2015.

First quarter 2015Key

figures1

Change year-on-year

Change at constant currency and perimeter2

year-on-year

€2,492M

+7.5%

+2.5%

€117M

+17.1%

- Earnings attributable to Vivendi

shareowners3

€33M

NA4

€218M +7.0%

+3.1%

€218M +17.9%

+14.1%

€136M +24.1%

+€4.6bn5 vs. +€4.6bn as of December 31,

2014

1 In compliance with IFRS 5, SFR and Maroc Telecom (businesses

sold in 2014), as well as GVT (in the process of being sold) have

been reported as discontinued operations. In practice, income and

charges from these businesses have been reported as follow:

- their contribution until the effective

divestiture, if any, to each line of Vivendi’s Consolidated

Statement of Earnings (before non-controlling interests) has been

reported on the line “Earnings from discontinued operations”;

- their share of net income has been

excluded from Vivendi’s adjusted net income.

2 Constant perimeter reflects the following changes made in the

consolidation scope: acquisitions of Mediaserv (on February 13,

2014) and Thema (on October 28, 2014) at Canal+ Group.3 For the

reconciliation of EBIT to EBITA and to income from operations, as

well as of earnings attributable to Vivendi SA shareowners to

adjusted net income, see Appendix V.4 Not comparable due to the

sale of Maroc Telecom and SFR in 2014 (qualified as discontinued

operations in 2014 as per IFRS 5).5 Excluding the partial

redemption by GVT of its loan for €0.3bn, as per IFRS5.

Vivendi's Supervisory Board met today under the chairmanship of

Vincent Bolloré and reviewed the Group’s condensed financial

statements for the first quarter of 2015, which were approved by

the Management Board on May 5, 2015.

Vivendi posted increased operating results for the first quarter

of 2015.

Canal + Group’s operations were supported by the good

performances of its entities outside of France, its free-to-air

channels in France and of Studiocanal. Universal Music Group (UMG)

benefited from the growth in recorded music and music publishing.

At Vivendi Village, Vivendi Ticketing in the United Kingdom and

Wengo registered a very satisfactory first quarter.

In this context, Vivendi‘s income from operations increased by

7.0% (3.1% at constant currency and perimeter) compared to the

first quarter of 2014 thanks to the performance of UMG’s music

repertoire and the transformation plan implemented by

Watchever.

Earnings attributable to Vivendi SA shareowners amounted to €33

million, compared to €431 million for the first quarter of 2014.

This amount included earnings for discontinued operations for €584

million during the first quarter of 2014, compared to €17 million

for the first quarter of 2015. This situation will continue

throughout 2015.

Adjusted net income, representing the economic performance of

business segments, grew 24.1% to €136 million compared to the first

quarter of 2014, thanks to the increase in income from operations,

the increase in income received from investments and the decrease

in interest expense, partially offset by the increase in income tax

expense.

Moreover, Vivendi’s balance sheet is solid. The net cash stood

at €4.6 billion5 as of March 31, 2015.

On April 7, 2015, Vivendi entered into exclusive negotiations

with Orange for the acquisition of an 80% interest in Dailymotion

for €217 million.

On May 6, 2015, the Group completed the sale of its 20% interest

in Numericable-SFR for €3.8 billion. €1.8 billion has already been

received; the remaining balance will be received no later than

April 7, 2016.

Proposed public tender offer on SECP

Given that since 2009, French law permits Vivendi to increase

its interest in Société d’Edition de Canal Plus (SECP), and because

a large number of its shareholders have requested it, today

Vivendi’s Supervisory Board authorized a proposed public tender

offer on SECP, in which Vivendi indirectly controls 48.5% of the

share capital, at a price of €7.60 per share after the payment of a

€0.25 dividend per SECP share on April 29, 2015 (see separate press

release).

Comments on Key Financial Consolidated

Indicators

A/ Analysis of the consolidated income statement

changes

In compliance with IFRS 5, SFR and Maroc Telecom (businesses

sold in 2014) as well as GVT (in the process of being sold), have

been reported as discontinued operations. In practice, income and

charges from these businesses have been reported as follows:

- their contribution until the effective

divestiture, if any, to each line of Vivendi’s Consolidated

Statement of Earnings (before non-controlling interests) has been

reported on the line “Earnings from discontinued operations”;

- their share of net income has been

excluded from Vivendi’s adjusted net income.

Revenues were €2,492 million, compared to

€2,317 million for the first quarter of 2014 (a 7.5% growth,

or +2.5% at constant currency and perimeter2).

EBIT was €117 million, compared to €100 million

for the first quarter of 2014, a 17.1% increase.

Earnings attributable to Vivendi SA shareowners amounted

to €33 million (or €0.02 per share), compared to

€431 million (or €0.32 per share) for the first quarter

of 2014.

- Earnings attributable to Vivendi SA

shareowners for continuing operations, after non-controlling

interests (Canal+ Group, Universal Music Group and Vivendi

Village, as well as Corporate) was a €16 million profit for

the first quarter of 2015, compared to a €10 million loss for

the first quarter of 2014, a €26 million favorable change.

This change primarily reflected the €17 million increase in

EBIT, the €6 million decrease in interest expense and the

€9 million in dividends received from Activision Blizzard,

partially offset by the €9 million increase in income tax

expense.

- Earnings attributable to Vivendi SA

shareowners for discontinued operations, after

non-controlling interests amounted to €17 million for the

first quarter of 2015, compared to €441 million for the same

period in 2014, a €424 million decrease. For the first quarter

of 2014, earnings notably included SFR, Maroc Telecom and GVT’s

contributions, as well as the gain on the change in value of the

remaining interest in Activision Blizzard.

B/ Analysis of adjusted net income changes

As a result of the application of IFRS 5 to SFR, Maroc Telecom

and GVT, the Adjusted Statement of Earnings presents the results of

Canal+ Group, Universal Music Group (UMG) and Vivendi Village’s

activities, as well as Corporate costs.

Income from operations was €218 million, compared to

€204 million for the first quarter of 2014, a 7.0% increase.

At constant currency, income from operations increased by

€8 million (+4.0%) and primarily reflected the improved

operating performance of Vivendi Village (+€24 million),

thanks to the cost management at Watchever since the second half of

2014, and of Universal Music Group (+€17 million), mainly

attributable to strong recorded music sales.

EBITA was €218 million, compared to

€185 million for the first quarter of 2014, a 17.9% increase.

At constant currency, EBITA increased by 15.1% (+14.1% at constant

currency and perimeter). Restructuring charges, incurred by

Universal Music Group, amounted to €7 million, compared to

€6 million for the first quarter of 2014. The change in EBITA

primarily reflected the increase in income from operations.

Interest was an expense of €5 million, compared to

€11 million for the first quarter of 2014, a 56.4% improvement

thanks in particular to lower interest expenses on bonds partially

offset by lower income received from financings granted to SFR.

Income taxes in adjusted net income were a net charge of

€61 million, compared to €40 million for the first

quarter of 2014. The effective tax rate reported to adjusted net

income was at 27.6%.

Adjusted net income attributable to non-controlling

interests remained stable at €19 million and included

non-controlling interests of Société d’Edition de Canal Plus,

Canal+ Overseas and nc+.

Adjusted net income was €136 million (or €0.10 per

share), compared to €109 million for the first quarter of 2014

(€0.08 per share), a 24.1% increase. This increase

resulted from the increase in EBITA (+€33 million), the

decrease in interest expense (+€6 million) and dividends

received from Activision Blizzard (+€9 million), partially

offset by the increase in income tax expense

(-€21 million).

Comments on Business Highlights

Canal+ Group

Canal+ Group’s revenues amounted to €1,370 million, a 4.0%

increase (+2.5% at constant currency and perimeter) compared to the

first quarter of 2014.

Canal+ Group had a total of 15.2 million subscriptions, an

increase of 605,000 year-on-year, thanks to the strong performance

of Canal+ in Africa and Vietnam, and Canalplay in mainland

France.

Revenues from pay-TV operations in mainland France were nearly

stable year-on-year, in a difficult economic environment.

International pay-TV revenues were up 13.9% compared to the first

quarter of 2014, thanks to the continuous growth of the subscriber

base.

Advertising revenues from free-to-air channels benefited from

growing audience ratings at D8 and i>Télé.

Studiocanal’s revenues grew significantly thanks to successful

theatrical releases, including Paddington, Imitation Game and Shaun

the sheep.

Canal+ Group’s EBITA was €165 million, compared to €175 million

for the first quarter of 2014. This change resulted from an

increased investment in sport content (exclusive Eurosport channel

on Canalsat and secured rights to the National French Rugby

Championship’s “TOP 14” on Canal+), partially offset by a favorable

effect related to the release schedule of the French soccer league

1 and by the favorable outcome of a tax litigation during the first

quarter of 2014.

Income from operations was €154 million, compared to €179

million for the first quarter of 2014.

On March 16, 2015, Canal+ Group jointly announced with ITI Group

the sale of their controlling interest in TVN, Poland’s leading

private media company, to Scripps Networks Interactive Inc.

Universal Music Group

Universal Music Group’s (UMG) revenues were €1,097 million, up

2.3% at constant currency and perimeter (+11.6% at actual currency)

compared to the first quarter of 2014, driven by growth in both

recorded music and music publishing.

Recorded music revenues grew 2.4% at constant currency and

perimeter thanks to strong new release and carryover sales. Growth

in subscription and streaming revenues more than offset the decline

in both digital download sales and physical sales. Music publishing

revenues grew 3.0% at constant currency and perimeter, also driven

by increasing subscription and streaming revenues.

Recorded music best sellers for the first quarter of 2015

included the Fifty Shades of Grey soundtrack, strong carryover

sales from Taylor Swift and Sam Smith and new releases from Drake,

Madonna and Kendrick Lamar.

UMG’s EBITA was €82 million, up 39.3% at constant currency and

perimeter (+45.6% at actual currency) compared to the first quarter

of 2014. The favorable performance reflected the benefit of both

revenue growth and mix, as the continued transition to digital

sales, improved licensing income and a lower proportion of sales

from distributed repertoire all helped margins.

UMG’s income from operations was €88 million, up 26.1% at

constant currency and perimeter (+32.8% at actual currency)

compared to the first quarter of 2014 after adjusting out higher

restructuring and integration charges in the first quarter of

2014.

Vivendi Village

Vivendi Village’s revenues were €25 million, mainly driven by

the growth in operations at Vivendi Ticketing and at Wengo, an

online personal consulting services marketplace.

Vivendi Ticketing’s revenues grew 6.6% compared to the first

quarter of 2014. This growth was mainly driven by See Tickets in

the United Kingdom. Among the platforms managed by Wengo,

RDVmedicaux.com stood out with a strong increase in traffic (x4)

during the quarter.

Vivendi Village’s EBITA, like the income from operations, both

of which amounted to €4 million, turned positive during the first

quarter of 2015 thanks to the transformation plan implemented by

the subscription video-on-demand service, Watchever.

In March 2015, Watchever entered into a distribution agreement

with Telefonica and its brand O2 to market its services in

Germany.

Discontinued operation: GVT

GVT’s revenues were €458 million, a 10.1% increase at constant

currency compared to the first quarter of 2014. This performance

was driven by continuous growth of the core segment (retail and

SME), which increased by 10.7% at constant currency year-on-year;

including a 39.2% increase in pay-TV revenues. This service, which

now represents 15.9% of GVT’s total revenues, had 912,570 pay-TV

subscribers, reflecting a 28.6% increase compared to the first

quarter of 2014.

GVT’s EBITDA was €180 million, an 11.3% increase at constant

currency compared to the first quarter of 2014. Its EBITDA margin

reached 39.3% (39.9% for its telecom activities alone), which is

the highest margin in the Brazilian telecom operator market.

The completion of the GVT sale is expected to occur at the end

of May 2015.

For additional information, please refer to the “Financial

Report and Unaudited Condensed Financial Statements for the first

quarter ended March 31, 2015”, which will be released later online

on Vivendi’s website (www.vivendi.com).

About Vivendi

Vivendi groups together leaders in content and media. Canal+

Group is the French leader in pay-TV, also operating in

French-speaking Africa, Poland and Vietnam; its subsidiary

Studiocanal is a leading European player in production,

acquisition, distribution and international film and TV series

sales. Universal Music Group is the world leader in music. Vivendi

Village brings together Vivendi Ticketing, Wengo (expert

counseling), Watchever (subscription video-on-demand) and the

Paris-based concert hall L’Olympia. In addition, Vivendi currently

owns GVT a fixed very high-speed broadband, fixed-line telephony

and pay-TV services operator in Brazil.

www.vivendi.com

Important Disclaimers

Cautionary Note Regarding Forward Looking Statements. This press

release contains forward-looking statements with respect to the

financial condition, results of operations, business, strategy,

plans and outlook of Vivendi, including the impact of certain

transactions and the payment of dividends and distributions as well

as share repurchases. Although Vivendi believes that such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance. Actual

results may differ materially from the forward-looking statements

as a result of a number of risks and uncertainties, many of which

are outside our control, including but not limited to the risks

related to antitrust and other regulatory approvals as well as any

other approvals which may be required in connection with certain

transactions and the risks described in the documents Vivendi filed

with the Autorité des Marchés Financiers (French securities

regulator), which are also available in English on Vivendi's

website (www.vivendi.com). Investors and security holders may

obtain a free copy of documents filed by Vivendi with the Autorité

des Marchés Financiers at www.amf-france.org, or directly from

Vivendi. Accordingly, we caution you against relying on forward

looking statements. These forward-looking statements are made as of

the date of this press release and Vivendi disclaims any intention

or obligation to provide, update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Unsponsored ADRs. Vivendi does not sponsor an American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

ANALYST CONFERENCE CALL (in English, with French

translation)

SpeakersArnaud de Puyfontaine, Chief Executive

Officer and Chairman of the Management BoardHervé Philippe,

Member of the Management Board and Chief Financial Officer

Date: May 12, 20156:00 pm Paris time – 5:00 pm London

time – 12:00 pm New York time

Media invited on a listen-only basis.

Internet: The conference can be followed on the Internet

at: www.vivendi.com (audiocast)

Numbers to dial:United Kingdom: +44 (0) 203 427 19 18 -

code 625 70 92United States of America: +1 646 254 33 65 – code 625

70 92France: +33 (0) 176 77 22 22 – code: 260 96 80

Numbers for replay:United Kingdom: +44 (0) 203 427 05 98

– code 625 70 92United States of America: +1 347 366 9565 – code

625 70 92France: +33 (0) 174 20 28 00 – code: 260 96 80

On our website www.vivendi.com will be available dial-in

numbers for the conference call and for replay (14 days), an audio

webcast and the slides of the presentation.

APPENDIX

IVIVENDICONSOLIDATED STATEMENT OF

EARNINGS(IFRS, unaudited)

1st Quarter 2015 1st

Quarter 2014 % Change

Revenues 2,492

2,317 + 7.5 % Cost of revenues (1,510 ) (1,448

) Selling, general and administrative expenses excluding

amortization of intangible assets acquired through business

combinations (757 ) (678 ) Restructuring charges (7 ) (6 )

Amortization of intangible assets acquired through business

combinations (98 ) (83 ) Other income 1 - Other

charges (4 ) (2 )

EBIT 117 100

+ 17.1 % Income from equity affiliates (6 ) (6

) Interest (5 ) (11 ) Income from investments 9 -

Other financial income 12 3 Other financial charges

(18 ) (15 )

Earnings from continuing operations

before provision for income taxes 109 71 +

53.3 % Provision for income taxes (76 ) (67 )

Earnings from continuing operations 33

4 Earnings from discontinued operations 17 584

Earnings 50 588 Non-controlling

interests (17 ) (157 )

Earnings attributable to

Vivendi SA shareowners 33 431 of

which earnings from continuing operations attributable to Vivendi

SA shareowners 16 (10 ) Earnings

attributable to Vivendi SA shareowners per share - basic 0.02 0.32

Earnings attributable to Vivendi SA shareowners per share - diluted

0.02 0.32

In millions of euros, per share amounts in

euros.

Nota:

In compliance with IFRS 5, SFR and Maroc Telecom (businesses

sold in 2014), as well as GVT (in the process of being sold) have

been reported as discontinued operations.

In practice, income and charges from these three businesses have

been reported as follows:

- their contribution until the effective

divestiture, if any, to each line of Vivendi’s Consolidated

Statement of Earnings (before non-controlling interests) has been

grouped under the line “Earnings from discontinued operations”;

and

- their share of net income has been

excluded from Vivendi’s adjusted net income.

For any additional information, please refer to “Financial

Report and Unaudited Condensed Financial Statements for the first

quarter ended March 31, 2015”, which will be released online later

on Vivendi’s website (www.vivendi.com).

APPENDIX

IIVIVENDIADJUSTED STATEMENT OF EARNINGS(IFRS,

unaudited)

1st Quarter 2015 1st

Quarter 2014 % Change

Revenues 2,492

2,317 + 7.5 % Income from operations

(IFO) 218 204 + 7.0 %

EBITA 218 185 + 17.9 %

Income from equity affiliates (6 ) (6 ) Interest (5 ) (11 )

Income from investments 9 - Adjusted earnings

from continuing operations before provision for income taxes 216

168 + 28.5 % Provision for income taxes (61 ) (40 )

Adjusted net income before non-controlling interests 155 128

+ 20.8 % Non-controlling interests (19 ) (19 )

Adjusted net income 136 109 +

24.1 % Adjusted net income per share - basic 0.10

0.08 + 22.9 % Adjusted net income per share - diluted 0.10 0.08 +

23.2 %

In millions of euros, per share amounts in

euros.

The reconciliation of EBIT to EBITA (adjusted earnings before

interest and income taxes) and to income from operations, as well

as of earnings attributable to Vivendi SA shareowners to adjusted

net income is presented in the Appendix V.

Nota:

According to the application of IFRS 5 to SFR and Maroc Telecom

(businesses sold in 2014), as well as GVT (in the process of being

sold), the Adjusted Statement of Earnings presents the results of

Canal+ Group, Universal Music Group and Vivendi Village’s

operations, as well as Corporate costs.

APPENDIX

IIIVIVENDIREVENUES, INCOME FROM OPERATIONS (IFO) AND

EBITA BY BUSINESS SEGMENT(IFRS, unaudited)

1st Quarter ended March 31, (in millions of

euros) 2015 2014 % Change % Change at constant

currency % Change at constant currency and perimeter (a)

Revenues Canal+ Group 1,370 1,317 +4.0 % +3.6 % +2.5

% Universal Music Group 1,097 984 +11.6 % +2.0 % +2.3 % Vivendi

Village 25 21

Elimination of intersegment transactions - (5 )

Total Vivendi

2,492 2,317 +7.5 %

+3.2 % +2.5 % Income from

operations (IFO) Canal+ Group 154 179 -14.1 % -14.7 % -15.7 %

Universal Music Group 88 66 +32.8 % +25.2 % +26.1 % Vivendi Village

4 (20 ) Corporate (28 ) (21 )

Total Vivendi 218 204

+7.0 % +4.0 % +3.1 %

EBITA Canal+ Group 165 175 -5.6 % -6.2 % -7.3

% Universal Music Group 82 56 +45.6 % +38.1 % +39.3 % Vivendi

Village 4 (20 )

Corporate (33 ) (26 )

Total Vivendi 218

185 +17.9 % +15.1

% +14.1 %

Reconciliations of EBIT to EBITA and to income from operations,

as well as of earnings attributable to Vivendi SA shareowners to

adjusted net income are presented in Appendix V.

a. Constant perimeter reflects the following changes made in

consolidation scope:

- acquisitions of Mediaserv (on February

13, 2014) and Thema (on October 28, 2014) at Canal+ Group;

- managerial transfer of The Olympia

music hall from UMG to Vivendi Village (on January 1, 2015).

APPENDIX

IVVIVENDICONSOLIDATED STATEMENT OF FINANCIAL

POSITION(IFRS, unaudited)

(in millions of euros) March 31, 2015

December 31, 2014 (unaudited)

ASSETS Goodwill

9,898 9,329 Non-current content assets 2,668 2,550 Other intangible

assets 225 229 Property, plant and equipment 718 717 Investments in

equity affiliates 313 306 Non-current financial assets 6,290 6,144

Deferred tax assets 716 710

Non-current assets

20,828 19,985 Inventories 123

114 Current tax receivables 554 234 Current content assets 1,024

1,135 Trade accounts receivable and other 1,906 1,983 Current

financial assets 242 49 Cash and cash equivalents 6,931

6,845

10,780 10,360 Assets of discontinued

businesses 5,193 5,393

Current assets

15,973 15,753 TOTAL ASSETS

36,801 35,738 EQUITY AND

LIABILITIES Share capital 7,442 7,434 Additional paid-in

capital 5,152 5,160 Treasury shares (1 ) (1 ) Retained earnings and

other 10,631 10,013

Vivendi SA shareowners'

equity 23,224 22,606 Non-controlling interests

403 382

Total equity 23,627

22,988 Non-current provisions 2,865 2,888 Long-term

borrowings and other financial liabilities 2,079 2,074 Deferred tax

liabilities 702 657 Other non-current liabilities 116 121

Non-current liabilities 5,762 5,740

Current provisions 267 290 Short-term borrowings and other

financial liabilities 215 273 Trade accounts payable and other

5,440 5,306 Current tax payables 153 47

6,075

5,916 Liabilities associated with assets of discontinued

businesses 1,337 1,094

Current liabilities

7,412 7,010 Total liabilities

13,174 12,750 TOTAL EQUITY AND

LIABILITIES 36,801 35,738

VIVENDIRECONCILIATION OF NON-GAAP

MEASURES IN STATEMENT OF EARNINGS(IFRS, unaudited)

Income from operations (IFO), adjusted earnings before interest

and income taxes (EBITA), and adjusted net income, non-GAAP

measures, should be considered in addition to, and not as a

substitute for, other GAAP measures of operating and financial

performance and Vivendi considers that they are relevant indicators

to assess the group’s operating and financial performance. Vivendi

Management uses income from operations, EBITA and adjusted net

income for reporting, management and planning purposes because they

better illustrate the underlying performance of continuing

operations by excluding most non-recurring and non-operating

items.

1st Quarter ended March 31, (in millions of euros)

2015 2014

EBIT (a) 117 100

Adjustments Amortization of intangible assets acquired through

business combinations 98 83 Impairment losses on intangible assets

acquired through business combinations (a) - - Other income (a) (1

) - Other charges (a) 4 2

EBITA 218

185 Adjustments Restructuring charges 7 6 Charges related to

equity-settled share-based compensation plans 2 8 Other non-current

operating charges and income (9 ) 5

Income from operations

(IFO) 218 204 1st Quarter

ended March 31, (in millions of euros) 2015 2014

Earnings attributable to Vivendi SA shareowners (a)

33 431 Adjustments Amortization of intangible assets

acquired through business combinations 98 83 Other income (a) (1 )

- Other charges (a) 4 2 Other financial income (a) (12 ) (3 ) Other

financial charges (a) 18 15 Earnings from discontinued operations

(a) (17 ) (584 ) Change in deferred tax asset related to Vivendi

SA's French Tax Group and to the Consolidated Global Profit Tax

Systems 44 49 Non-recurring items related to provision for income

taxes 2 5 Provision for income taxes on adjustments (31 ) (27 )

Non-controlling interests on adjustments (2 ) 138

Adjusted net income 136 109

a. As reported in the Consolidated Statement of Earnings.

VivendiMediaParisJean-Louis Erneux, +33 (0)1 71 71

15 84Solange Maulini, +33 (0) 1 71 71 11 73orNew

York(Kekst)Jim Fingeroth, +1-212-521-4819Dawn Dover),

+1-212-521-4817orLondon(StockWell)Tim Burt, +44 20 7240

2486orInvestor RelationsParisLaurent Mairot, +33 (0)

1 71 71 35 13Chi-Chung Lo, +33 (0) 1 71 71 11 88

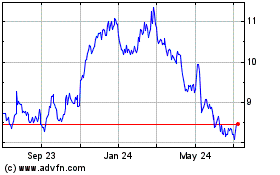

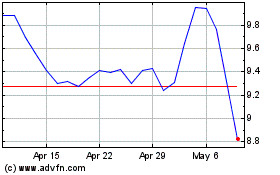

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024