Report of Foreign Issuer (6-k)

March 26 2015 - 11:20AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2015

Commission File Number: 001-14475

TELEFÔNICA BRASIL S.A.

(Exact name of registrant as specified in its charter)

TELEFONICA BRAZIL S.A.

(Translation of registrant’s name into English)

Av. Eng° Luís Carlos Berrini, 1376 - 28º andar

São Paulo, S.P.

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

TELEFÔNICA BRASIL S.A.

1. Press Release dated March 26, 2015 entitled “Telefônica Brasil Announces Launch of Equity Offering”

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TELEFÔNICA BRASIL S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ Luis Carlos da Costa Plaster |

|

|

|

Name: |

Luis Carlos da Costa Plaster |

|

|

|

Title: |

Investor Relations Director |

Date: March 26, 2015

3

Exhibit 1

TELEFÔNICA BRASIL S.A.

Publicly-held Company

CNPJ MF 02.558.157/0001-62 - NIRE 35.3.001.5881-4

TELEFÔNICA BRASIL ANNOUNCES LAUNCH OF EQUITY OFFERING

São Paulo, March 26, 2015 — Telefônica Brasil S.A. (NYSE: VIV; BOVESPA: VIVT3.ON and VIVT4.PN) (“Telefônica Brasil”) announced today the launch of an offering of 219,950,615 preferred shares (or up to 7,746,660 preferred shares if the international and Brazilian underwriters’ options to purchase additional shares are exercised in full) as part of a global offering, which consists of an international offering in the United States and other countries outside Brazil and a concurrent offering of common shares and preferred shares in Brazil. Preferred shares offered in the global offering may be offered directly or in the form of American Depositary Shares (“ADSs”), each of which represents one preferred share of Telefônica Brasil.

Holders of Telefônica Brasil’s preferred shares as of April 1, 2015 will be given the opportunity to subscribe for preferred shares in the Brazilian offering on a priority basis at the public offering price. The priority subscription procedure will not be made available to holders of ADSs or to shareholders located in jurisdictions in which such offering would be unlawful. The number of preferred shares available for sale in the global offering to investors will be reduced to the extent that existing shareholders of Telefônica Brasil subscribe on the priority basis for preferred shares in the Brazilian offering.

Telefônica Brasil intends to use the net proceeds from the global offering to (1) fund the cash portion of the GVT acquisition, which is expected to close by mid-2015, (2) repay GVT’s loans with a related party, and (3) adjust its capital structure in order to maintain liquidity.

Itau BBA, Morgan Stanley, BofA Merrill Lynch and Santander are acting as global coordinators and Bradesco BBI, BTG Pactual, Credit Suisse, Goldman, Sachs & Co., HSBC and J.P. Morgan are acting as joint bookrunners in connection with the international offering.

The international offering is being made pursuant to an effective registration statement (including a base prospectus) on Form F-3 filed with the U.S. Securities and Exchange Commission (“SEC”) on March 26, 2015. A copy of the preliminary prospectus supplement and accompanying base prospectus relating to the international offering may be obtained by contacting Itaú BBA, 767 Fifth Avenue, 50th Floor, New York, NY 10153, attention: Investment Banking Department — Equity Capital Markets; Morgan Stanley & Co. LLC, 180 Varick Street, 2nd Floor, New York, NY 10014 attention: Prospectus Department; BofA Merrill Lynch, 222 Broadway, New York, NY 10038, attention: Prospectus Department, email: dg.prospectus_requests@baml.com; Santander Investment Securities Inc., ECM Department, 45 East 53rd Street, New York, NY 10022, attention: Elias Ehrlich. Alternatively, you may access these documents for free by visiting the SEC’s website at www.sec.gov.

Alberto Manuel Horcajo Aguirre

Investor Relations Officer

Telefônica Brasil S.A. — Investor Relations

Tel: +55 11 3430-3687

Email: ir.br@telefonica.com

Available information: www.telefonica.com.br/ir

Important Information

The international offering in the United States and other countries outside Brazil does not include an offering of common shares. The common shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act of 1933, as amended.

This press release shall not constitute an offer to sell nor an offer to buy any securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful.

2

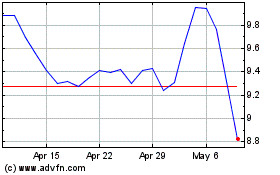

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

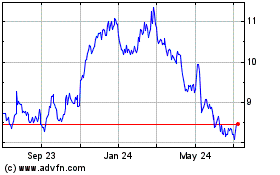

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024