Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on March 26, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TELEFÔNICA BRASIL S.A.

(Exact name of Registrant as specified in its charter)

TELEFÔNICA BRAZIL S.A.

(Translation of Registrant's name into English)

|

|

|

The Federative Republic of Brazil

(State or other jurisdiction of

incorporation or organization) |

|

Not Applicable

(I.R.S. Employer

Identification Number) |

Avenida Engenheiro Luís Carlos Berrini, 1376, 28° andar

04571-936 São Paulo, SP, Brazil

55-11-3430-3687

(Address and telephone number of Registrant's principal executive offices)

National Corporate Research, Ltd.

10 East 40th Street, 10th floor

New York, NY 10016

+1 (800) 221-0102 (US Customers)

+1 (212) 947-7200 (International Customers)

(Name, Address and Telephone Number of Agent For Service)

With a copy to:

Andrés V. Gil, Esq.

Maurice Blanco, Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Tel: (212) 450-4000

Fax: (212) 701-5800

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, check the following box. ý

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Title of each class of securities

to be registered

|

|

Amount to be

registered

|

|

Proposed maximum

aggregate price

per unit

|

|

Proposed maximum

aggregate offering

price

|

|

Amount of

registration fee

|

| |

Preferred shares, without par value(1) |

|

(2) |

|

(2) |

|

(2) |

|

(2) |

|

- (1)

- The

preferred shares may be represented by American Depositary Shares (as evidenced by American Depositary Receipts), each representing one preferred share,

which are registered under the Securities Act of 1933. A separate registration statement on Form F-6 (File No. 333-201244) was filed on December 23, 2014 and effective

immediately. The registration statement on Form F-6 relates to the registration of American Depositary Shares, evidenced by the American Depositary Receipts issued upon deposit of preferred

shares registered hereby.

- (2)

- An

indeterminate amount of preferred shares to be offered at indeterminate prices is being registered pursuant to this registration statement. The

registrant is deferring payment of the registration fee pursuant to Rule 456(b) and is omitting this information in reliance on Rule 456(b) and Rule 457(r).

Table of Contents

PROSPECTUS

TELEFÔNICA BRASIL S.A.

Preferred Shares and American Depositary Shares Representing Preferred Shares

We may offer the securities described in this prospectus from time to time in amounts, at prices and on terms to be determined at or prior to the

time of the offering. We refer to the preferred shares and the American Depositary Shares, or ADSs, each representing one preferred share, collectively as the "securities."

This

prospectus describes the general manner in which our securities may be offered using this prospectus. We will provide specific terms and offering prices of these securities in

supplements to this prospectus. You should read this prospectus and the accompanying prospectus supplements carefully before you invest.

We

may offer the securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or directly to investors, on a continuous or

delayed basis or through any combination of these methods. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering. The net

proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Our

preferred shares are listed on the São Paulo Stock Exchange (BM&FBOVESPA S.A.—Bolsa de Valores Mercadorias e

Futuros), or the BM&FBOVESPA, under the symbol "VIVT4" and our ADSs are listed on the New York Stock Exchange under the symbol "VIV."

Investing in our securities involves risks. You should carefully review the "Risk Factors" section set forth on page 2 of this prospectus

and in our most recent annual report on Form 20-F, which is incorporated by reference herein, as well as in any other recently filed reports and the risk factors, if any, set forth in the

relevant prospectus supplement.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE

SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is March 26, 2015

Table of Contents

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus and in any prospectus

supplement. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell or to buy only the

securities referred to herein, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information in this prospectus or any prospectus supplement

is accurate as of any date other than the date on the front of those documents. The terms "Telefônica Brasil," "we," "us," "our," "our company" and "the company" mean

Telefônica Brasil S.A. and its consolidated subsidiaries, unless otherwise indicated or the context otherwise requires.

TABLE OF CONTENTS

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that we filed with the U.S. Securities and Exchange Commission,

or the SEC, using a "shelf" registration process. Under this shelf process, we may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus

provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of

that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should carefully read both this prospectus and any applicable prospectus

supplement together with additional information described under the heading "Where You Can Find More Information" before deciding to invest in any of the securities being offered. This prospectus does

not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement,

including the exhibits thereto. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the

prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document

incorporated by reference in this prospectus or any prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier statement.

Neither

the delivery of this prospectus nor any sale made under it implies that there has been no change in our affairs or that the information in this prospectus is correct as of any

date after the date of this prospectus. You should not assume that the information in this prospectus, including any information incorporated in this prospectus by reference, the accompanying

prospectus supplement or any free writing prospectus prepared by us, is accurate as of any date other than the date on the front of those documents. Our business, financial condition, results of

operations and prospects may have changed since that date.

All

references to "real," "reais" or "R$" are to the currency of Brazil. All references to

"U.S. dollar," "U.S. dollars" or "US$" are to the currency of the United States of America. We have made rounding adjustments to reach some of the figures included in this prospectus. As a result,

numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

WHERE YOU CAN FIND MORE INFORMATION

We file annual and other reports with the SEC under the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. You may

read and copy this information at the following location of the SEC:

Public

Reference Room

100 F Street, N.E.

Washington, D.C. 20549

You

may also obtain copies of this information by mail from the Public Reference Section of the SEC, 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. You may

obtain information on the operation of the SEC's Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports and other information

about issuers like us who file electronically with the SEC. The address of the website is http://www.sec.gov. You may also read and copy certain documents we submit to the New York Stock Exchange at

its offices at 11 Wall Street, New York, New York 10005. We maintain an Internet website at http://www.telefonica.com.br. Information contained on this website is not part of this prospectus or any

accompanying prospectus supplement.

ii

Table of Contents

We

are a "foreign private issuer" as defined under Rule 405 of the U.S. Securities Act of 1933, as amended, or the Securities Act. As a result, although we are subject to the

informational requirements of the Exchange Act as a foreign private issuer, we are exempt from certain informational requirements of the Exchange Act which domestic issuers are subject to, including

the proxy rules under Section 14 of the Exchange Act, the insider reporting and short-profit provisions under Section 16 of the Exchange Act and the requirement to file current reports

on Form 8-K upon the occurrence of certain material events. We are also subject to the informational requirements of the BM&FBOVESPA and the Brazilian Securities Commission

(Comissão de Valores Mobiliários), or the CVM. You are invited to read and copy reports, statements or other information,

other than confidential filings, that we have filed with the BM&FBOVESPA and the CVM. Our public filings with the BM&FBOVESPA are electronically available from the BM&FBOVESPA's Internet website at

http://www.bmfbovespa.com.br. Information contained on this website is not part this prospectus, or any accompanying prospectus supplement.

iii

Table of Contents

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to "incorporate by reference" information into this prospectus. This means that we can disclose important information

to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus, except for any information

superseded by information that is included directly in this document or incorporated by reference subsequent to the date of this document.

We

incorporate by reference into this prospectus the following documents listed below, which we have already filed with or furnished to the SEC:

- (1)

- our

annual report on Form 20-F for the year ended December 31, 2014 filed on February 27, 2015 and any amendments thereto;

- (2)

- our

report on Form 6-K furnished on March 26, 2015 containing GVT's consolidated financial statements as of and for the years ended

December 31, 2014 and 2013;

- (3)

- our

registration statement on Form F-6 filed on December 23, 2014; and

- (4)

- the

description of our preferred shares set forth under "Additional Information" in Part I, Item 10 of our annual report on Form 20-F

for the year ended December 31, 2014, which supersedes in full the description of our preferred shares set forth under "Description of Securities To Be Registered" in Part II,

Item 14 of our registration statement on Form 20-F filed on September 18, 1998, as amended on November 2, 1998.

All

subsequent reports that we file on Form 20-F under the Exchange Act after the date of this prospectus and prior to the termination of the offering shall also be deemed to be

incorporated by reference into this prospectus and to be a part hereof from the date of filing such documents. We may also incorporate by reference any other Form 6-K that we submit to the SEC

after the date of this prospectus and prior to the termination of this offering by identifying in such Form 6-K that it is being incorporated by reference into this prospectus.

We

will provide without charge to each person to whom this prospectus has been delivered, upon the written or oral request of any such person to us, a copy of any or all of the documents

referred to above that have been or may be incorporated into this prospectus by reference, including exhibits to such documents. Requests for such copies should be directed to:

Telefônica

Brasil S.A.

Avenida Engenheiro Luis Carlos Berrini, 1376, 28th floor

04571-936 São Paulo, SP, Brazil

phone: + 55 (11) 3430-3687

email: ir.br@telefonica.com

iv

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this prospectus in relation to our plans, forecasts, expectations regarding future events, strategies, and

projections, are forward-looking statements which involve risks and uncertainties and which are therefore not guarantees of future results. Our estimates and forward-looking statements are mainly

based on our current expectations and estimates on projections of future events and trends, which affect or may affect our businesses and results of operations. Although we believe that these

estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several uncertainties and are made in light of information currently available to us. Our estimates

and forward-looking statements may be influenced by the following factors, among others:

- •

- the size and growth rate of the Brazilian telecommunications market;

- •

- the accuracy of our estimated demand forecasts;

- •

- our ability to successfully execute our strategic initiatives and capital expenditure plans;

- •

- our ability to secure and maintain telecommunications spectrum and infrastructure licenses, rights-of-way and other regulatory

approvals;

- •

- our ability to comply with the terms of our concession agreements;

- •

- decisions by applicable regulatory authorities to terminate, modify or renew our concession agreements or the terms thereof;

- •

- new telecommunications regulations or changes to existing regulations;

- •

- technological advancements in our industry and our ability to successfully implement them in a timely manner;

- •

- our ability to consummate the GVT acquisition (as described herein) or, if consummated, to successfully integrate GVT's operations or

to realize expected benefits;

- •

- network completion and product development schedules;

- •

- the level of success of competing networks, products and services;

- •

- the possible requirement to record impairment charges relating to goodwill and long-lived assets;

- •

- increased competition in the Brazilian telecommunications sector;

- •

- the cost and availability of financing;

- •

- uncertainties relating to political and economic conditions in Brazil as well as those of other emerging markets;

- •

- inflation, interest rate and exchange rate risks;

- •

- the Brazilian government's policies regarding the telecommunications industry;

- •

- the Brazilian government's tax policy;

- •

- the Brazilian government's political instability;

- •

- adverse decisions in ongoing litigation;

- •

- regulatory and legal developments affecting the telecommunications industry in Brazil; and

- •

- other risk factors discussed under "Risk Factors" in Part I, Item 3.D. of our most recent annual report on

Form 20-F incorporated by reference herein.

v

Table of Contents

The

words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect" and similar words are intended to identify estimates and forward-looking statements.

Estimates and forward-looking statements speak only as of the date they were made, and we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new

information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Our future results may differ

materially from those expressed in these estimates and forward-looking statements. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in

this prospectus supplement might not occur and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, inclusive of, but not

limited to, the factors mentioned above. As a result of these risks and uncertainties, investors should not base their decisions to invest in this offering on these estimates or forward-looking

statements.

vi

Table of Contents

TELEFÔNICA BRASIL S.A.

Overview

We are the leading mobile telecommunications company in Brazil (28.5% market share as of December 31, 2014, based on accesses),

with a particularly strong position in postpaid mobile services (41.8% market share as of December 31, 2014, based on accesses). We are also the leading fixed telecommunications company (in

terms of market share) in the state of São Paulo, where we began our business as a fixed telephone service provider pursuant to our concession agreement. During the year ended

December 31, 2014, we reached almost 60% market share in ultra-fast broadband accesses with speeds higher than 34 Mbps in the state of São Paulo.

According

to ANATEL's customer service performance index, we are the highest-quality mobile operator in Brazil, among the largest mobile operators. Our Vivo brand, under

which we market our mobile services, is among the most recognized brands in Brazil. The quality of our services and strength of our brand recognition enable us to, on average, achieve higher prices

relative to our competition and, as a result, generally earn higher margins. As of December 31, 2014, our average revenue per mobile user, or ARPU, of R$23.7 represented a significant premium

relative to the average of our main competitors, which is R$16.8. In 2014, we captured 56.3% of the net additions of 8.3 million in the postpaid mobile segment. We offer our clients a complete

portfolio of products, including mobile and fixed voice, mobile data, fixed broadband, ultra-fast broadband, or UBB (based on our Fiber to the Home infrastructure, or FTTH), Pay TV, information

technology and digital services (such as e-health, cloud and financial services). We also have the most extensive distribution network among our competitors, with more than 300 of our own stores and

additional physical distribution points of sale where our clients can obtain certain services, such as purchasing credit for prepaid phones.

We

seek to continue to increase our operating margins by focusing on developing and growing our portfolio of products so that they comprise an integrated portfolio of services. As part

of this strategy, we are in the process of acquiring GVT, a high-growth telecommunications company in Brazil that offers high-speed broadband, fixed telephone and Pay TV services primarily to high

income customers across its target market, primarily located outside the state of São Paulo.

1

Table of Contents

RISK FACTORS

An investment in our securities involves significant risks. Before purchasing any securities, you should carefully consider and

evaluate all of the information included and incorporated by reference in this prospectus and the applicable prospectus supplement, including the risk factors incorporated by reference from our most

recent annual report on Form 20-F, as updated by other reports and documents we file with the SEC after the date of this prospectus that are incorporated by reference herein or in the

applicable prospectus supplement. Our business, results of operations or financial condition could be adversely affected by any of these risks or by additional risks and uncertainties not currently

known to us or that we currently consider immaterial.

2

Table of Contents

USE OF PROCEEDS

Unless otherwise indicated in an accompanying prospectus supplement, we intend to use the net proceeds from the sale of securities for

general corporate purposes.

3

Table of Contents

CAPITALIZATION

The following table sets forth our consolidated capitalization at December 31, 2014 based on our consolidated financial

statements prepared in accordance with IFRS.

This

table should be read in conjunction with, and is qualified in its entirety by reference to, our consolidated financial statements and the related notes thereto incorporated by

reference in this prospectus.

|

|

|

|

|

|

|

|

|

|

At December 31, 2014 |

|

|

|

(in millions of R$)

|

|

(in millions of US$)(1)

|

|

Indebtedness: |

|

|

|

|

|

|

|

Current loans, financing, leases and debentures |

|

|

2,264.5 |

|

|

852.5 |

|

Noncurrent loans, financing, leases and debentures |

|

|

5,534.7 |

|

|

2,083.7 |

|

Total indebtedness |

|

|

7,799.3 |

|

|

2,936.3 |

|

Equity: |

|

|

|

|

|

|

|

Capital stock |

|

|

37,798.1 |

|

|

14,230.1 |

|

Premium on acquisition of non-controlling interest |

|

|

(70.4 |

) |

|

(26.5 |

) |

Capital reserves |

|

|

2,686.9 |

|

|

1,011.6 |

|

Profit reserves |

|

|

1,534.5 |

|

|

577.7 |

|

Additional proposed dividends(2) |

|

|

2,768.6 |

|

|

1,042.3 |

|

Other comprehensive income |

|

|

232.5 |

|

|

87.5 |

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

|

44,950.1 |

|

|

16,922.7 |

|

|

|

|

|

|

|

|

|

|

Total capitalization(3) |

|

|

52,749.4 |

|

|

19,859.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- (1)

- Converted

for convenience only using the commercial offer rate as reported by the Central Bank on December 31, 2014 for reais into U.S. dollars of R$2.6562 per U.S.$1.00.

- (2)

- On

January 30, 2015, our board of directors approved the distribution of dividends in the amount of R$2,750.0 million with respect to the

fourth quarter of 2014 to holders of shares as of February 10, 2015. In addition, our board of directors expects to submit an additional dividend distribution for approval by our shareholders

in the amount of R$18.6 million. Both distributions of dividends will be paid by December 31, 2015.

- (3)

- Corresponds

to total indebtedness plus total shareholders' equity.

There

have been no material changes to our total capitalization, loans and financings and total shareholders' equity since December 31, 2014 other than as described above.

4

Table of Contents

EXCHANGE RATES

The Brazilian foreign exchange system allows the purchase and sale of foreign currency by any person or legal entity, regardless of the

amount, subject to certain regulatory procedures.

Since

1999, the Brazilian Central Bank has allowed the real/U.S. dollar exchange rate to float freely and during this period, the real/U.S. dollar exchange rate

has experienced frequent and substantial variations in relation to the U.S. dollar and other foreign currencies. Between

2000 and 2002, the real depreciated significantly against the U.S. dollar, reaching an exchange rate of R$3.533 per US$1.00 at the end of 2002. Between

2003 and mid-2008, the real appreciated significantly against the U.S. dollar due to the stabilization of the Brazilian macroeconomic environment and a

substantial increase in foreign investment in Brazil, with the real appreciating to R$1.559 per US$1.00 in August 2008. Particularly as a result of the

crisis in the global financial markets from mid-2008, the real depreciated by 31.9% against the U.S. dollar during 2008 and closed the year at R$2.337

per US$1.00. As of December 31, 2014, 2013, 2012, 2011 and 2010, the exchange rate was R$2.6562 per US$1.00, R$2.343 per US$1.00, R$2.044 per US$1.00, R$1.876 per US$1.00 and R$1.666 per

US$1.00, respectively. As of March 25, 2015, the exchange rate was R$3.1476 per US$1.00.

The

Brazilian Central Bank has intervened occasionally to attempt to control instability in foreign exchange rates. We cannot predict whether the Brazilian Central Bank or the Brazilian

federal government will continue to allow the real to float freely or will intervene in the exchange rate market by re-implementing a currency band

system or otherwise. The real may depreciate or appreciate substantially against the U.S. dollar in the future.

The

following tables set forth the selling rate, expressed in reais per U.S. dollar (R$/US$), for the periods indicated, as reported by

the Brazilian Central Bank:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange Rates of R$ per US$1.00 |

|

|

|

Period-End |

|

Average(1) |

|

High |

|

Low |

|

Year ended December 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

1.6662 |

|

|

1.7589 |

|

|

1.8811 |

|

|

1.6554 |

|

2011 |

|

|

1.8758 |

|

|

1.6709 |

|

|

1.9016 |

|

|

1.5345 |

|

2012 |

|

|

2.0435 |

|

|

1.9588 |

|

|

2.1121 |

|

|

1.7024 |

|

2013 |

|

|

2.3426 |

|

|

2.1741 |

|

|

2.4457 |

|

|

1.9528 |

|

2014 |

|

|

2.6562 |

|

|

2.3599 |

|

|

2.7403 |

|

|

2.1974 |

|

Month |

|

|

|

|

|

|

|

|

|

|

|

|

|

September 2014 |

|

|

2.4510 |

|

|

2.3329 |

|

|

2.4522 |

|

|

2.2319 |

|

October 2014 |

|

|

2.4442 |

|

|

2.4483 |

|

|

2.5341 |

|

|

2.3914 |

|

November 2014 |

|

|

2.5601 |

|

|

2.5484 |

|

|

2.6136 |

|

|

2.4839 |

|

December 2014 |

|

|

2.6562 |

|

|

2.6386 |

|

|

2.7403 |

|

|

2.5607 |

|

January 2015 |

|

|

2.6623 |

|

|

2.6342 |

|

|

2.7107 |

|

|

2.5754 |

|

February 2015 |

|

|

2.8782 |

|

|

2.8165 |

|

|

2.8811 |

|

|

2.6894 |

|

March 2015 (through March 25) |

|

|

3.1476 |

|

|

3.1213 |

|

|

3.2683 |

|

|

2.8655 |

|

Source: Brazilian Central Bank.

- (1)

- Annually,

represents the average of the exchange rates on the last day of each month during the periods presented; monthly, represents the average of the

end-of-day exchange rates during the periods presented.

5

Table of Contents

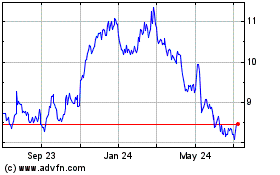

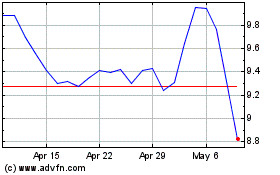

PRICE HISTORY

Our preferred shares began trading on BM&FBOVESPA, on September 21, 1998 and are traded on BM&FBOVESPA under the symbol "VIVT4"

(formerly "TLPP4"). Our common shares trade under the symbol "VIVT3" (formerly "TLPP3"). At December 31, 2014, we had approximately 1,125.6 million common and preferred shares held by

approximately 2.3 million common and preferred shareholders.

In

the United States, the preferred shares trade in the form of American Depositary Receipts, or ADRs, each representing one preferred share, issued by Citibank N.A, as depositary,

pursuant to a Deposit Agreement, among us, the depositary and the registered holders and beneficial owners from time to time of ADRs. The ADRs commenced trading on the NYSE on November 16, 1998

and are traded on NYSE under the symbol "VIV" (formerly "TSP"). The following table sets forth the reported high and low closing sales prices for ADRs on the NYSE for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NYSE |

|

BM&FBOVESPA |

|

BM&FBOVESPA |

|

|

|

HIGH |

|

LOW |

|

HIGH |

|

LOW |

|

HIGH |

|

LOW |

|

|

|

(in US$ per

ADS)

|

|

(in reais per

preferred share)

|

|

(in reais per

common share)

|

|

Year ended: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2010 |

|

|

24.53 |

|

|

22.70 |

|

|

42.03 |

|

|

38.60 |

|

|

39.30 |

|

|

36.22 |

|

December 31, 2011 |

|

|

28.33 |

|

|

25.74 |

|

|

52.97 |

|

|

47.47 |

|

|

48.00 |

|

|

43.50 |

|

December 31, 2012 |

|

|

31.22 |

|

|

21.17 |

|

|

56.92 |

|

|

43.45 |

|

|

51.69 |

|

|

37.53 |

|

December 31, 2013 |

|

|

27.66 |

|

|

17.94 |

|

|

54.89 |

|

|

41.66 |

|

|

48.45 |

|

|

38.24 |

|

December 31, 2014 |

|

|

22.34 |

|

|

16.74 |

|

|

52.51 |

|

|

42.00 |

|

|

43.52 |

|

|

36.60 |

|

Year ended December 31, 2013: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter |

|

|

27.66 |

|

|

24.32 |

|

|

54.12 |

|

|

48.14 |

|

|

48.24 |

|

|

43.00 |

|

Second quarter |

|

|

26.94 |

|

|

21.74 |

|

|

54.89 |

|

|

48.29 |

|

|

48.45 |

|

|

43.55 |

|

Third quarter |

|

|

23.50 |

|

|

19.68 |

|

|

51.50 |

|

|

45.85 |

|

|

45.50 |

|

|

41.00 |

|

Fourth quarter |

|

|

22.94 |

|

|

17.94 |

|

|

50.12 |

|

|

41.66 |

|

|

44.15 |

|

|

38.24 |

|

Year ended December 31, 2014: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter |

|

|

21.24 |

|

|

17.97 |

|

|

48.03 |

|

|

42.22 |

|

|

42.00 |

|

|

37.16 |

|

Second quarter |

|

|

21.47 |

|

|

19.90 |

|

|

47.47 |

|

|

43.81 |

|

|

41.80 |

|

|

37.13 |

|

Third quarter |

|

|

22.34 |

|

|

18.42 |

|

|

51.30 |

|

|

42.00 |

|

|

43.12 |

|

|

36.60 |

|

Fourth quarter |

|

|

20.90 |

|

|

16.74 |

|

|

52.51 |

|

|

45.56 |

|

|

43.52 |

|

|

37.60 |

|

Month ended: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2014 |

|

|

22.34 |

|

|

19.64 |

|

|

51.30 |

|

|

48.00 |

|

|

43.12 |

|

|

39.60 |

|

October 31, 2014 |

|

|

20.44 |

|

|

18.29 |

|

|

50.61 |

|

|

46.29 |

|

|

42.96 |

|

|

38.23 |

|

November 30, 2014 |

|

|

20.90 |

|

|

19.07 |

|

|

52.51 |

|

|

48.49 |

|

|

43.52 |

|

|

40.00 |

|

December 31, 2014 |

|

|

19.40 |

|

|

16.74 |

|

|

49.50 |

|

|

45.56 |

|

|

42.15 |

|

|

37.60 |

|

January 31, 2015 |

|

|

20.27 |

|

|

16.80 |

|

|

52.25 |

|

|

45.67 |

|

|

43.30 |

|

|

36.15 |

|

February 28, 2015 |

|

|

19.40 |

|

|

17.75 |

|

|

54.14 |

|

|

50.80 |

|

|

44.50 |

|

|

40.96 |

|

March 31, 2015 (through March 25) |

|

|

18.09 |

|

|

15.35 |

|

|

53.35 |

|

|

49.00 |

|

|

43.00 |

|

|

39.75 |

|

6

Table of Contents

DESCRIPTION OF CAPITAL STOCK

The following information describes our common shares and preferred shares and provisions of our bylaws and of the Brazilian Corporate

Law. This description is only a summary. You should read and refer to our bylaws (estatuto social) incorporated by reference in the registration

statement of which this prospectus is a part and our annual report on Form 20-F.

Description of Our Bylaws

The following is a summary of the material provisions of our bylaws and of the Brazilian Corporate Law. In Brazil, a company's bylaws

(estatuto social) are the principal governing document of a corporation (sociedade

anônima).

We are registered with the Board of Trade of São Paulo (Junta Comercial de São

Paulo), or JUCESP, under No. 35.3.001588-14. We have been duly registered with the CVM under No. 17671 since August 19, 1998. Our headquarters are located

in the city of São Paulo, state of São Paulo, Brazil. Our company has a perpetual existence.

As

of December 31, 2014, we had outstanding share capital of R$37,798,109,745.03, comprised of 1,125,601,930 total shares, consisting of 381,587,111 issued common shares and

744,014,819 issued preferred shares. All of our outstanding share capital is fully paid and non-assessable. All of our shares are without par value. Under the Brazilian Corporate Law, and in

accordance with Law 10,303/01 considering that we were a publicly held company before 2001, the aggregate number of our non-voting and limited voting preferred shares may not exceed two thirds of our

total outstanding share capital. In addition, our board of directors is authorized to increase our share capital up to 1,850,000,000 common or preferred shares without amendment to our bylaws. Any

increase of our share capital above that limit must be approved by a general extraordinary shareholders meeting.

As

of December 31, 2014, 251,440 common shares were held by us (treasury shares) at a book value per share of R$40.02. As of December 31, 2014, 2,081,246 preferred shares

were held by us (treasury shares) at a book value per share of R$40.02. On February 24, 2015, our board of directors approved the cancellation of all treasury shares held by us, which were

subsequently cancelled.

As

of the date of this prospectus, there are no persons to whom any capital of the company or any of our subsidiaries is under option or agreed conditionally or unconditionally to be put

under option.

During the past three years, we have not issued any common or preferred shares or increased or decreased our capital stock.

Under Article 2 of our bylaws, our corporate purposes are:

- •

- to offer telecommunications services and all activities required or useful for the operation of these services, in conformity with our

concessions, authorizations and permits;

- •

- to participate in the capital of other companies whose business purpose is also related to the telecommunication industry in Brazil;

- •

- to organize wholly owned subsidiaries for the performance of activities that are consistent with our corporate purposes and

recommended to be decentralized;

7

Table of Contents

- •

- to import, or promote the importation of, goods and services that are necessary to the performance of activities consistent with our

corporate purposes;

- •

- to provide technical assistance services to other telecommunications companies engaging in activities of common interest;

- •

- to perform study and research activities aimed at the development of the telecommunications sector;

- •

- to enter into contracts and agreements with other telecommunications companies or other persons or entities to assure the operations

of our services, with no loss of its attributions and responsibilities;

- •

- to perform other activities related to those assigned by the Brazilian National Telecommunications Agency

(Agência Nacional de Telecomunicações), or ANATEL; and

- •

- to commercialize equipment and materials necessary or useful to telecommunications services.

Our board of directors and board of executive officers are responsible for the management of our company. Under our bylaws, any matters

subject to the approval of our board of directors (conselho de administração) can be approved only by an absolute majority

of votes of the present members of our board of directors with a majority of members currently in office. Under our bylaws, our board of directors may only deliberate if a majority of its members are

present at a duly convened meeting.

The members of our board of directors are elected at general meetings of shareholders and the members of our board of executive

officers are elected at the meeting of the board of directors, each for concurrent three-year terms. The tenure of the members of the board of directors and board of executive officers will be

conditioned on such members signing the respective instrument and complying with applicable legal requirements.

Brazilian Corporate Law no longer requires ownership of shares in order for a person to qualify as a member of the board of directors

of a corporation. However, our bylaws require that our directors own shares of our company. The Brazilian Corporate Law requires each of our executive officers to be residents of Brazil. Members of

our board of directors are not required to be residents of Brazil; however, their tenure is conditioned on the appointment of a representative who resides in Brazil with powers to receive service of

process in proceedings initiated against such member based on the corporate legislation, by means of a power-of-attorney valid for at least three years after the termination of the term of such

director.

All members of our board of directors and board of executive officers owe fiduciary duties to us and all of our shareholders.

Under

the Brazilian Corporate Law, if one of our directors or one of our executive officers has a conflict of interest with our company in connection with any proposed transaction, such

director or executive officer may not vote in any decision of our board of directors or of our board of executive officers, as the case may be, regarding such transaction and must disclose the nature

and extent of his conflicting interest for inclusion in the minutes of the applicable meeting.

8

Table of Contents

Any

transaction in which one of our directors or executive officers may have an interest can only be approved on reasonable and fair terms and conditions that are no more favorable than

the terms and conditions prevailing in the market or offered by third parties. If any such transaction does not meet this requirement, then the Brazilian Corporate Law provides that the transaction

may be nullified and the interested director or executive officer must return to us any benefits or other advantages that he obtained from, or as result of, such transaction. Under the Brazilian

Corporate Law and upon the request of a shareholder who owns at least 5.0% of our total share capital, our directors and executive officers must reveal to our shareholders at an ordinary meeting of

our shareholders certain transactions and circumstances that may give rise to a conflict of interest. In addition, our company (through the approval of the majority of our share capital) or

shareholders who own 5.0% or more of our share capital may bring an action for civil liability against directors and executive officers for any losses caused to us as a result of a conflict of

interest.

Under our bylaws, our common shareholders approve the aggregate compensation payable to our directors, executive officers and members

of our fiscal council. Subject to this approval, our board of directors establishes the compensation of its members and of our executive officers.

Neither the Brazilian Corporate Law nor our bylaws establish any mandatory retirement age for our directors or executive officers.

Under the Brazilian Corporate Law, since October 2001, as per Law 10,303, the number of issued and outstanding non-voting shares or

shares with limited voting rights, such as our preferred shares, may not exceed fifty percent of our total outstanding share capital, and not two thirds. However, according to the same law, companies

that were already incorporated before said law went into effect were permitted to maintain the previous requirements. Therefore, in accordance with Law 10,303/01, considering that we were a publicly

held company incorporated before 2001, the number of our issued and outstanding non-voting shares or shares with limited voting rights, such as our preferred shares, may not exceed two thirds of our

total outstanding share capital.

Each

of our common shares entitles its holder to one vote at our annual and extraordinary shareholders' meetings. Holders of our common shares are not entitled to any preference in

respect of our dividends or other distributions or otherwise in case of our liquidation.

Our

preferred shares are non-voting, except in limited circumstances. They are given priority in the reimbursement of capital, without premium, and are entitled to receive a dividend 10%

higher than that attributable to common shares. See "—Voting Rights" for information regarding the voting rights of our preferred shares and "—Dividends—Dividend

Preference of Preferred Shares" for information regarding the distribution preferences of our preferred shares.

Under the Brazilian Corporate Law, we must hold an annual shareholders' meeting by April 30 of each year in order

to:

- •

- approve or reject the financial statements submitted by our board of executive officers and approved by our board of directors,

including any recommendation by our board of directors for the allocation of net profit and distribution of dividends;

9

Table of Contents

- •

- elect members of our board of directors (upon expiration of their three-year terms) and members of our fiscal council, subject to the

right of preferred shareholders and minority common shareholders to elect members of our board of directors and our fiscal council; and

- •

- approve the monetary adjustment of our share capital.

In

addition to the annual shareholders' meetings, holders of our common shares have the power to determine any matters related to changes in our corporate purposes and to pass any

resolutions they deem necessary to protect and enhance our development whenever our interests so require, by means of extraordinary shareholders' meetings.

We

convene our shareholders' meetings, including our annual shareholders' meeting, by publishing a notice in two Brazilian newspapers. On the first call of any meeting, the notice must

be published no fewer than three times, beginning at least 15 calendar days prior to the scheduled meeting date. On the second call of any meeting, the notice must be published no fewer than three

times, beginning at least 8 calendar days prior to the scheduled meeting date. According to our bylaws, for meetings involving deliberations described under article 136 of the Brazilian

Corporate Law, which include (i) the creation of preferred shares or a disproportionate increase of an existing class of our preferred shares relative to the other classes of our preferred

shares, other than to the extent permitted by our bylaws; (ii) a change of a priority, preference, right, privilege or condition of redemption or amortization of any class of our preferred

shares, or the creation of a preferred class of shares with rights and/or conditions superior to an existing class of our preferred shares; (iii) decrease in the mandatory dividend;

(iv) merger into another company or consolidation with another company; (v) our participation in a centralized group of companies; (vi) change in our corporate purpose;

(vii) dissolving or liquidating our company or canceling any ongoing liquidation of our company; and (viii) spinning-off of all or any part of our company, the notice must be published

at least 30 calendar days prior to the scheduled meeting date and on the second call at least 10 calendar days prior to the scheduled meeting date. The notice must contain the meeting's place, date,

time, agenda and, in the case of a proposed amendment to our bylaws, a description of the subject matter of the proposed amendment.

Our

board of directors may convene a shareholders' meeting. Under the Brazilian Corporate Law, shareholders' meetings also may be convened by our shareholders as

follows:

- •

- by any of our shareholders if, under certain circumstances set forth in the Brazilian Corporate Law, our directors do not convene a

shareholders' meeting required by law within 60 days;

- •

- by shareholders holding at least 5% of our total share capital if, after a period of eight days, our directors fail to call a

shareholders' meeting that has been requested by such shareholders by means of a duly reasoned request that indicates the subject matter; and

- •

- by shareholders holding at least 5% of either our total voting share capital or our total non-voting share capital, if after a period

of eight days, our directors fail to call a shareholders' meeting for the purpose of appointing a fiscal council that has been requested by such shareholders.

In

addition, our fiscal council may convene an ordinary shareholders' meeting if our board of directors does not convene an annual shareholders' meeting within 30 days or an

extraordinary shareholders' meeting at any other time to consider any urgent and serious matters.

Each

shareholders' meeting is presided over by the chairman of the board of directors, who is responsible for choosing a secretary of the meeting. In case of absence of the chairman of

the board of directors at the shareholders' meeting, the shareholders may choose, among those present, the chairman and the secretary of the meeting. A shareholder may be represented at a

shareholders' meeting by an attorney-in-fact appointed by the shareholder less than one year before the meeting. The attorney-in-fact must be a shareholder, a member of our board of directors, a

member of our board of

10

Table of Contents

executive

officers, a lawyer or a financial institution, and the power of attorney appointing the attorney-in-fact must comply with certain formalities set forth under Brazilian law. To be admitted to

a shareholders' meeting, a person must produce proof of his or her shareholder status or a valid power of attorney.

In

order to convene a shareholders' meeting, shareholders representing at least 25% of our issued voting share capital must be present on first call. However, shareholders representing

at least two thirds of our issued voting share capital must be present at a shareholders' meeting called to amend our bylaws. If a quorum is not present, our board of directors may issue a second call

by publishing a notice as described above at least eight calendar days prior to the scheduled meeting. Except as otherwise provided by law, the quorum requirements do not apply to a meeting held on

the second call, and the shareholders' meetings may be convened with the presence of shareholders representing any number of shares (subject to the voting requirements for certain matters described

below). A shareholder without a right to vote may attend a shareholders' meeting and take part in the discussion of matters submitted for consideration.

Under the Brazilian Corporate Law and our bylaws, each of our common shares entitles its holder to one vote at our shareholders'

meetings. Our preferred shares generally do not confer voting rights, except in limited circumstances described below. Holders of preferred shares are only entitled to attend and to discuss, but not

to vote on, the issues discussed at our general shareholders' meetings. Whenever the shares of any class of share capital are entitled to vote, each share is entitled to one vote.

Except as otherwise provided by law, resolutions of a shareholders' meeting are passed by a simple majority vote of the holders of our

common shares present or represented at the meeting, without taking abstentions into account. Under the Brazilian Corporate Law, the approval of shareholders representing at least half of our voting

shares is required for the types of action described below:

- •

- creating preferred shares or disproportionately increasing an existing class of our preferred shares relative to the other classes of

our preferred shares, other than to the extent permitted by our bylaws;

- •

- changing a priority, preference, right, privilege or condition of redemption or amortization of any class of our preferred shares or

creating a new class of preferred shares that has a priority, preference, right, condition or redemption or amortization superior to an existing class of our preferred shares;

- •

- reducing the mandatory dividend set forth in our bylaws;

- •

- changing our corporate purpose;

- •

- merging our company with another company, or consolidating our company, subject to the conditions set forth in the Brazilian Corporate

Law;

- •

- transferring all of our shares to another company, known as an "incorporação de

ações" under the Brazilian Corporate Law;

- •

- participating in a centralized group of companies (grupo de sociedades) as defined

under the Brazilian Corporate Law and subject to the conditions set forth in the Brazilian Corporate Law;

- •

- dissolving or liquidating our company or canceling any ongoing liquidation of our company; and

- •

- spinning-off of all or any part of our company.

11

Table of Contents

Decisions on the transformation of our company into another form of company require the unanimous approval of our shareholders, including the holders of our

preferred shares.

Our

company is required to give effect to shareholders agreements that contain provisions regarding the purchase or sale of our shares, preemptive rights to acquire our shares, the

exercise of the right to vote or the power to control our company, if these agreements are filed with our headquarters. Brazilian Corporate Law requires the chairman of any shareholder or board of

directors meeting to disregard any vote taken by any of the parties to any shareholders agreement that has been duly filed with our company that violates the provisions of any such agreement. In the

event that a shareholder that is party to a shareholders agreement (or a director appointed by such shareholder) is absent from any shareholders' or board of directors' meeting or abstains from

voting, the other party or parties to that shareholders agreement have the right to vote the shares of the absent or abstaining shareholder (or on behalf of the absent director) in compliance with

that shareholders agreement.

Under

the Brazilian Corporate Law, neither our bylaws nor actions taken at a shareholders' meeting may deprive any of our shareholders of certain specific rights,

including:

- •

- the right to participate in the distribution of our profits;

- •

- the right to participate in any remaining residual assets in the event of our liquidation;

- •

- the right to supervise the management of our corporate business as specified in the Brazilian Corporate Law;

- •

- the right to preemptive rights in the event of an issuance of our shares, debentures convertible into our shares or subscription

bonuses, except with respect to a public offering of our securities; and

- •

- the right to withdraw from our company under the circumstances specified in the Brazilian Corporate Law.

Shareholders holding shares representing not less than 5% of our voting shares at our shareholders' meeting have the right to request

that we adopt a cumulative voting procedure to elect the members of the board of directors. This procedure must be requested by the required number of shareholders at least 48 hours prior to a

shareholders' meeting.

Under

the Brazilian Corporate Law, shareholders that are not controlling shareholders, but that together hold either:

- •

- non-voting preferred shares representing at least 10% of our total share capital; or

- •

- common shares representing at least 15% of our voting capital have the right to appoint one member to our board of directors at our

shareholders' meeting. If no group of our common or preferred shareholders meets the thresholds described above, shareholders holding preferred shares or common shares representing at least 10% of our

total share capital are entitled to combine their holdings to appoint one member to our board of directors.

In

the event that minority holders of common shares and/or holders of non-voting preferred shares elect a director and the cumulative voting procedures described above are also used, our

controlling shareholders always retain the right to elect at least one member more than the number of members elected by the other shareholders, regardless of the total number of members of our board

of directors.

The

shareholders seeking to exercise these minority rights must prove that they have held their shares for not less than three months preceding the shareholders' meeting at which the

director will be

12

Table of Contents

appointed.

Any directors appointed by the non-controlling shareholders have the right to veto for cause the selection of our independent registered public accounting firm.

In

accordance with the Brazilian Corporate Law, the holders of preferred shares without voting rights or with restricted voting rights are entitled to elect one member and an alternate

to our fiscal council in a separate election. Minority shareholders have the same right as long as they jointly represent 10% or more of the voting shares. The other shareholders with the right to

vote may elect the remaining members and alternates, who, in any event, must number more than the directors and alternates elected by the holders of the non-voting preferred shares and the minority

shareholders. If a separate election and a cumulative voting procedure are held jointly, the votes granted by the shares under the separate election cannot be used by the relevant shareholder for the

cumulative voting procedures and vice versa.

The appointment of one member of our statutory fiscal council takes places at the annual ordinary general shareholders' meeting, upon

separate vote of the holders of preferred shares, for the position available at the fiscal council. The election of a member of the board of directors by preferred shareholders also occurs on a

separate vote, with no participation of the controlling shareholder.

Brazilian

Corporate Law provides that certain non-voting shares, such as our preferred shares, shall be entitled to voting rights in the event a corporation fails for three consecutive

fiscal years to pay any fixed or minimum dividends to which non-voting shares are entitled. In this case, the voting rights of these shares shall extend until the date on which the payment of the

accrued and unpaid dividend is made.

According

to our bylaws, preferred shares are entitled to full voting rights with respect to:

- •

- the election of one member to the board of directors and fiscal council in a separate vote;

- •

- bylaw modifications that seek to limit preferred shareholders' voting rights in respect of selecting new Board members in a straight

vote;

- •

- any agreements for the rendering of management services (including technical assistance services) between us and any foreign affiliate

of our controlling shareholder;

- •

- any agreements with related parties, in which the terms and conditions established are more onerous to our company than those normally

adopted by the market in agreements of the same type;

- •

- resolutions amending or revoking article 9, sole paragraph of Article 11, and article 30 of our bylaws; and

- •

- any resolution submitted to the general shareholders meeting during our liquidation process.

Under

the Brazilian Corporate Law, the following actions require ratification by the majority of issued and outstanding shares of the affected class within one year from the

shareholders' meeting at which the common shareholders approve the action:

- •

- the creation of preferred shares or a disproportionate increase of an existing class of our preferred shares relative to the other

classes of our preferred shares, other than to the extent permitted by our bylaws;

- •

- a change of a priority, preference, right, privilege or condition of redemption or amortization of any class of our preferred shares;

or

- •

- the creation of a new class of preferred shares that has a priority, preference, right, condition or redemption or amortization

superior to an existing class of our preferred shares.

13

Table of Contents

This

meeting would be called by publication of a notice in two Brazilian newspapers during three days, at least 30 days before the meeting. However, it would not generally require

any other form of notice.

We may be liquidated in accordance with the provisions of Brazilian law. In the event of our extrajudicial liquidation, a shareholders'

meeting will determine the manner of our liquidation, appoint our liquidator and our fiscal council that will function during the liquidation period.

Upon

our liquidation, our preferred shares will be given preference in the reimbursement of capital, without premium.

Each shareholder has a general preemptive right to subscribe for shares of the same class in any capital increase, in an amount

sufficient to keep the same proportional participation of such shareholder in the total capital of the corporation. A minimum period of 30 days following the publication of the capital increase

notice shall be observed by the corporation for the exercise of the preemptive right by the shareholder. The right of participation in capital increases is assignable under Brazilian Corporate Law. In

the event of a capital increase that would maintain or increase the proportion of capital represented by preferred shares, holders of ADSs, or of preferred shares, would have the preemptive right to

subscribe only to our newly issued preferred shares. In the event of a capital increase that would reduce the proportion of capital represented by preferred shares, holders of ADSs, or of preferred

shares, would have the preemptive right to subscribe to our newly issued preferred shares in proportion to their shareholdings and to our newly issued common shares only to the extent necessary to

prevent dilution of their interest.

However,

holders of our ADSs may not be able to exercise the preemptive rights relating to our shares underlying their ADSs unless a registration statement under the Securities Act is

effective with respect to those rights or an exemption from the registration requirements of the Securities Act is available. We are not obligated to file a registration statement with respect

to the shares relating to these preemptive rights or to take any other action to make preemptive rights available to holders of our ADSs, and we may not file any such registration statement.

In

addition, a publicly held company whose bylaws authorize capital increases may provide for the issuance of stock, debentures convertible into stock or subscription bonuses without

granting any preemptive rights to existing shareholders or decreasing the term for the shareholders to exercise their preemptive rights, as long as the placement of such securities is

made:

- •

- upon sale on a stock exchange or public subscription;

- •

- through an exchange of shares in a public offering, with the purpose of acquiring control of another company; or

- •

- for the use of certain tax incentives but only when such placement is made without granting preemptive rights.

Redemption, Amortization, Tender Offers and Rights of Withdrawal

Our bylaws or our shareholders at a shareholders' meeting may authorize us to use our profits or reserves to redeem or amortize our

shares in accordance with conditions and procedures established for such redemption or amortization. The Brazilian Corporate Law defines "redemption" (resgate de

ações) as the payment of the value of the shares in order to permanently remove such shares from circulation, with or without a corresponding

reduction of our share capital. The Brazilian Corporate Law defines

14

Table of Contents

"amortization"

(amortização) as the distribution to the shareholders, without a corresponding capital reduction, of

amounts that they would otherwise receive if we were liquidated. If an amortization distribution has been paid prior to our liquidation, then upon our liquidation, the shareholders who did not receive

an amortization distribution will have a preference equal to the amount of the amortization distribution in the distribution of our capital.

The

Brazilian Corporate Law authorizes us to redeem shares not held by our controlling shareholders, if, after a tender offer effected as a consequence of delisting, our controlling

shareholders increase their participation in our total share capital to more than 95%. The redemption price in such case would be the same price paid for our shares in any such tender offer.

The

Brazilian Corporate Law and our bylaws also require the acquirer of control (in case of a change of control) or the controller (in case of delisting or a substantial reduction in

liquidity of our shares) to make a tender offer for the acquisition of the shares held by minority shareholders under certain circumstances described below under "—Mandatory Tender

Offers." The shareholder can also withdraw its capital from our company under certain circumstances described below under "—Rights of Withdrawal."

The Brazilian Corporate Law requires the launching of a tender offer at a purchase price equal to fair value for all outstanding shares

in order to cancel the registration of our company as a publicly held company or in case of a substantial reduction in the liquidity of our shares as a result of purchases by our controlling

shareholders.

If

our controlling shareholders enter into a transaction which results in a change of control of our company, the controlling shareholders must include in the documentation of the

transaction an obligation of the acquirer to launch a tender offer for the purchase of all our common shares for, at least, 80% of the price per share paid to the controlling shareholders. The tender

offer must be submitted to the CVM within 30 days from the date of execution of the definitive documents of sale of the shares.

The Brazilian Corporate Law provides that, in certain limited circumstances, a dissenting shareholder may withdraw its equity interest

from our company and be reimbursed by us for the value of our common or preferred shares that it then holds.

This

right of withdrawal may be exercised by dissenting shareholders in the event that shareholders with voting rights authorize:

- (i)

- the

creation of preferred shares or a disproportionate increase of an existing class of our preferred shares relative to the other classes of our preferred

shares, other than to the extent permitted by our bylaws;

- (ii)

- a

change of a priority, preference, right, privilege or condition of redemption or amortization of any class of our preferred shares;

- (iii)

- a

reduction of the mandatory dividend set forth in our bylaws;

- (iv)

- merger

into another company or consolidation with another company;

- (v)

- our

participation in a centralized group of companies (grupo de sociedades);

- (vi)

- a

change in our corporate purpose; or

- (vii)

- spinning-off

of the company

15

Table of Contents

In

addition, we note that:

- •

- in items (i) and (ii), only the holders of shares of the affected type or class will be entitled to redemption;

- •

- in items (iv) and (v), the holders of shares of a type or class with liquidity and dispersion in the market will not have the

right to redemption; and

- •

- in item (vii), the dissenting shareholders shall only have a right of redemption if the spinning off implies in: (1) a

change in the corporate purpose (except if the spun-off assets revert to a company whose main purpose is the same as ours), (2) a reduction of the mandatory dividend, or

(3) participation in a group of companies.

Dissenting

shareholders are also entitled to withdraw in the event that the entity resulting from a merger or spin-off does not have its shares listed in an exchange or traded in the

secondary market within 120 days from the shareholders' meeting that approved the relevant merger or spin-off.

Notwithstanding

the above, in the event that we are consolidated or merged with another company, become part of a centralized group of companies, or acquire the control of another

company for a price in excess of certain limits imposed by the Brazilian Corporate Law, holders of any type or class of our shares or the shares of the resulting entity that have minimal market

liquidity and are dispersed among a sufficient number of shareholders will not have the right to withdraw. For this purpose, shares that are part of general indices representative of portfolios of

securities traded in Brazil or abroad are considered liquid, and sufficient dispersion will exist if the controlling shareholder, the parent company or other companies under its control hold less than

half of the total number of outstanding shares of

that type or class. In case of a spin-off, the right of withdrawal will only exist if (1) there is a significant change in the corporate purpose, (2) there is a reduction in the

mandatory dividend, or (3) the spin-off results in our participation in a centralized group of companies.

Only

shareholders who own shares on the date of publication of the first notice convening the relevant shareholders' meeting or the press release concerning the relevant transaction is

published, whichever is earlier, will be entitled to withdrawal rights.

The

redemption of shares arising out of the exercise of any withdrawal rights would be made at the book value per share, determined on the basis of our most recent audited balance sheet

approved by our shareholders. If the shareholders' meeting approving the action that gave rise to withdrawal rights occurred more than 60 days after the date of the most recent approved audited

balance sheet, a shareholder may demand that its shares be valued on the basis of a balance sheet prepared specifically for this purpose.

The

right of withdrawal lapses 30 days after the date of publication of the minutes of the shareholders' meeting that approved the action that gave rise to withdrawal rights.

Within ten days following the expiration of the term to exercise the withdrawal rights mentioned above, the company may call a shareholders' meeting to confirm or reconsider any resolution giving rise

to withdrawal if we believe that the withdrawal of shares of dissenting shareholders would jeopardize our financial stability.

Neither Brazilian law nor our bylaws require any capital calls. Our shareholders' liability for capital calls is limited to the payment

of the issue price of any shares subscribed or acquired.

Shareholders that own 5% or more of our outstanding share capital have the right to inspect our corporate records, including

shareholders' lists, corporate minutes, financial records and other documents of our company, if (1) we or any of our officers or directors have committed any act

16

Table of Contents

contrary

to Brazilian law or our bylaws, or (2) there are grounds to suspect that there are material irregularities in our company. However, in either case, the shareholder that desires to

inspect our corporate records must obtain a court order authorizing the inspection.

Brazilian regulations require that (1) each of our controlling shareholders, directly or indirectly, (2) shareholders who

have elected members of our board of directors or fiscal council, and (3) any person or group of persons representing a person that has directly or indirectly acquired or sold an interest

corresponding to at least 5% of the total number of our shares of any type or class to disclose its or their share ownership or divestment to us, and we are responsible for transmitting such

information to the CVM and the market. In addition, if a share acquisition results in, or is made with the intention of, change of control or company's management structure, as well as acquisitions

that cause the obligation of performing a tender offer, the persons acquiring such number of shares are required to publish a statement containing certain required information about such acquisition.

Our

controlling shareholders, shareholders that appoint members of our board of directors or fiscal council and members of our board of directors, board of executive officers or fiscal

council must file a statement of any change in their holdings of our shares with the CVM and the Brazilian stock exchanges on which our securities are traded.

Our preferred shares and common shares are in book-entry form, registered in the name of each shareholder or its nominee. The transfer

of our shares is governed by Article 35 of the Brazilian Corporate Law, which provides that a transfer of shares is effected by our transfer agent by an entry made by the transfer agent in its

books, upon presentation of valid written share transfer instructions to us by a transferor or its representative. When preferred shares or common shares are acquired or sold on a Brazilian stock

exchange, the transfer is effected on the records of our transfer agent by a representative of a brokerage firm or the stock exchange's clearing

system. The transfer agent also performs all the services of safe-keeping of our shares. Transfers of our shares by a non-Brazilian investor are made in the same manner and are executed on the

investor's behalf by the investor's local agent. If the original investment was registered with the Central Bank pursuant to foreign investment regulations, the non-Brazilian investor is also required

to amend, if necessary, through its local agent, the electronic certificate of registration to reflect the new ownership.

The

BM&FBOVESPA operates a central clearing system. A holder of our shares may choose, at its discretion, to participate in this system, and all shares that such shareholder elects to be