Updated Financials Reflect Positive Impact

of Reduced MSA Payment Estimates

Vector Group Ltd. (NYSE:VGR) today announced updates to its

previously issued fourth quarter and full-year 2015 financial

results to reflect the positive impact of changes in estimates

relating to the Master Settlement Agreement (“MSA”). The changes in

the Company’s Tobacco segment’s operations primarily resulted from

an updated calculation of the Company’s 2015 MSA liability, which

occurred after the initial receipt of a preliminary calculation

from the MSA’s Independent Auditor. Additional changes result from

a recent state court decision of a long-standing dispute related to

the MSA and the adjustment of a promotional accrual.

Impact on GAAP Financial Results

The impact on Vector Group’s previously reported Condensed

Consolidated Statement of Operations, which was previously included

as Table 1 to the Company's Press Release issued on February 29,

2016, is as follows:

- Revenues increased by $766,000 in both

the fourth quarter and full-year ended December 31, 2015;

- Cost of sales declined by $1.936

million in both the fourth quarter and full-year ended December 31,

2015;

- Operating income increased by $2.702

million in both the fourth quarter in full-year ended December 31,

2015;

- Income tax expense increased by $1.181

million in both the fourth quarter and full-year ended December 31,

2015;

- Net income increased $1.521 million in

both the fourth quarter and full-year ended December 31, 2015;

and,

- Earnings per diluted common share

attributable to Vector Group increased from $0.05 to $0.06 for the

quarter and from $0.48 to $0.49 for the year ended December 31,

2015.

Impact on Non-GAAP Financial Results

The impact on Vector Group's previously reported Non-GAAP

Financial Results in Tables 2 - 6 of the Company's press release

issued on February 29, 2016 is summarized below. There were no

changes to Tables 7 - 10 in the Company's press release issued on

February 29, 2016.

- Pro-forma Adjusted Revenues has been

updated to $430.8 million for the fourth-quarter (from $430.0

million) and $1.659 billion (from $1.658 billion) for the full-year

ended December 31, 2015;

- Pro-forma Adjusted EBITDA attributed to

Vector Group has been updated to $58.4 million (from $55.2 million)

for the fourth quarter and $245.9 million (from $242.7 million) for

the full-year ended December 31, 2015;

- Pro-forma Adjusted Net Income has been

updated to $16.4 million (from $14.6 million) for the fourth

quarter and $72.5 million (from $70.6 million) for the full-year

ended December 31, 2015;

- Pro-forma Adjusted Earnings per diluted

common share has been updated to $0.13 (from $0.12) for the fourth

quarter and $0.60 (from $0.58) for the full-year ended December 31,

2015;

- Pro-forma Adjusted Operating Income has

been updated to $54.3 million (from $51.0 million) and $232.0

million (from $228.8 million) for the full-year ended December 31,

2015; and,

- Tobacco Adjusted Operating Income has

been updated to $61.2 million (from $57.9 million) and $234.0

million (from $230.7 million).

Vector Group Ltd.’s Annual Report on Form 10-K is being filed

shortly and will include these adjustments.

The following is an updated report of Vector Group Ltd.’s fourth

quarter and full-year 2015 financial results, which impacts

both.

GAAP Financial Results

Fourth quarter 2015 revenues were $430.3 million, compared to

revenues of $417.6 million in the fourth quarter of 2014. The

Company recorded operating income of $31.0 million in the fourth

quarter of 2015, compared to operating income of $47.1 million in

the fourth quarter of 2014. Net income attributed to Vector Group

Ltd. for the 2015 fourth quarter was $7.9 million, or $0.06 per

diluted common share, compared to net income of $12.2 million, or

$0.11 per diluted common share, in the 2014 fourth quarter.

For the year ended December 31, 2015, revenues

were $1.66 billion, compared to $1.59 billion for

the year ended December 31, 2014. The Company recorded operating

income of $199.9 million for the year ended December 31,

2015, compared to operating income of $212.4 million for

the 2014 year. Net income attributed to Vector Group Ltd. for

the year ended December 31, 2015 was $59.2 million,

or $0.49 per diluted common share, compared to net income

of $36.9 million, or $0.33 per diluted common share,

for the year ended December 31, 2014.

Non-GAAP Financial Results

Non-GAAP financial results also include adjustments for purchase

accounting associated with the Company's acquisition of its

additional 20.59% interest in Douglas Elliman Realty, LLC in

December 2013, litigation settlement and judgment expenses in the

Tobacco segment, settlements of long-standing disputes related to

the Master Settlement Agreement in the Tobacco segment,

restructuring and pension curtailment expense in the Tobacco

segment, non-cash stock compensation expense (for purposes of

Pro-forma Adjusted EBITDA only) and non-cash interest items

associated with the Company's convertible debt. Reconciliations of

non-GAAP financial results to the comparable GAAP financial results

for the three months and year ended December 31, 2015 and 2014 are

included in Tables 2 through 10.

Three months ended December 31, 2015 compared to the three

months ended December 31, 2014

Fourth quarter 2015 Pro-forma Adjusted Revenues (as described in

Table 2 attached hereto) were $430.8 million compared to $417.7

million in 2014. The increase was primarily due to an increase in

Pro-forma Adjusted Revenues in the Real Estate segment of $16.8

million offset by declines in the Company's Tobacco and E-cigarette

segments.

Pro-forma Adjusted EBITDA attributed to Vector Group (as

described below and in Table 3 attached hereto) were $58.4 million

for the fourth quarter of 2015 as compared to $53.2 million for the

fourth quarter of 2014. The increase in Pro-forma Adjusted EBITDA

attributed to Vector Group for the three months ended December 31,

2015 was primarily attributable to higher profits in the Tobacco

segment.

Pro-forma Adjusted Net Income (as described below and in Table 4

attached hereto) was $16.4 million or $0.13 per diluted share for

the three months ended December 31, 2015 and $12.5 million or $0.11

per diluted share for the three months ended December 31, 2014.

Pro-forma Adjusted Operating Income (as described below and in

Table 5 attached hereto) was $54.3 million for the three months

ended December 31, 2015 and $49.6 million for the three months

ended December 31, 2014.

Year ended December 31, 2015 compared to the year

ended December 31, 2014

For the year ended December 31, 2015 Pro-forma

Adjusted Revenues (as described in Table 2 attached hereto)

were $1.66 billion compared to $1.59

billion in 2014. The increase was primarily due to an

increase in Pro-forma Adjusted Revenues of $80.1 million in the

Real Estate segment offset by a decline of $10.6 million from the

E-cigarette segment.

Pro-forma Adjusted EBITDA attributed to Vector Group (as

described below and in Table 3 attached hereto) was $245.9

million for the year ended December 31, 2015 as

compared to $226.9 million for the year ended

December 31, 2014. The increase in Pro-forma Adjusted EBITDA

attributed to Vector Group was primarily attributable to higher

profits in the Tobacco segment. This was offset by a decline of

Pro-forma Adjusted EBITDA from the Real Estate segment.

Pro-forma Adjusted Net Income (as described below and in Table 4

attached hereto) was $72.5 million or $0.60 per

diluted share for the year ended December 31,

2015 and $63.8 million or $0.57 per

diluted share for the year ended December 31, 2014.

Pro-forma Adjusted Operating Income (as described below and in

Table 5 attached hereto) was $232.0 million for

the year ended December 31, 2015 and $222.0

million for the year ended December 31, 2014.

Tobacco Segment Financial Results

For the fourth quarter 2015, the Tobacco segment had revenues of

$270.6 million, compared to $272.8 million for the fourth quarter

2014. The decline in revenues was primarily due to a 0.2% decline

in unit sales volume partially offset by favorable net pricing

variances.

Tobacco Adjusted Operating Income (described below and included

in Table 6 attached hereto) for the fourth quarter 2015 and 2014

was $61.2 million and $52.5 million, respectively.

For the year ended December 31, 2015, the Tobacco

segment had revenues of $1.018 billion, compared

to $1.021 billion for the year ended

December 31, 2014. The decline in revenues was primarily due

to a 1.9% decline in unit sales volume partially offset by

favorable net pricing variances.

Tobacco Adjusted Operating Income (described below and included

in Table 6 attached hereto) for the year ended

December 31, 2015 and 2014 was $234.0

million and $200.2 million, respectively.

For the three months and year ended December 31, 2015, the

Tobacco segment had conventional cigarette sales of approximately

2.35 billion and 8.69 billion units compared to 2.36 billion and

8.86 billion units for the three months and year ended December 31,

2014.

Real Estate Segment Financial Results

For the fourth quarter 2015, the Real Estate segment had

Pro-forma Adjusted Revenues of $163.0 million, compared to $146.3

million for the fourth quarter 2014. The increase in revenues was

primarily due to an increase in revenues at Douglas Elliman. For

the fourth quarter 2015, Real Estate Pro-forma Adjusted EBITDA

attributed to the Company were $3.9 million, compared to $6.2

million for the fourth quarter 2014.

For the year ended December 31, 2015, the Real Estate

segment had Pro-forma Adjusted Revenues of $643.3 million, compared

to $563.2 million for the year ended December 31, 2014. The

increase in revenues was primarily due to an increase in revenues

at Douglas Elliman. For the year ended December 31, 2015, Real

Estate Pro-forma Adjusted EBITDA attributed to the Company were

$26.8 million, compared to $40.2 million for the year ended

December 31, 2014.

Douglas Elliman's results are included in Vector Group Ltd.'s

Real Estate segment and Douglas Elliman continued its strong growth

by reporting increases in its Pro-Forma Adjusted Revenues of 17.3%

for the year ended December 31, 2015 from the comparable 2014

period. During 2015, Douglas Elliman continued to make strategic

investments by bolstering its development marketing division and

incurring increased advertising and marketing expenses to

strengthen the long-term value of the Douglas Elliman brand.

Douglas Elliman's Pro-Forma Adjusted Revenues for the fourth

quarter 2015 were $161.2 million, compared to $144.6 million for

the fourth quarter 2014. For the fourth quarter 2015, Douglas

Elliman's Pro-forma Adjusted EBITDA were $5.9 million ($4.1 million

attributed to the Company), compared to $6.1 million ($4.3 million

attributed to the Company) for the fourth quarter 2014.

Douglas Elliman's Pro-Forma Adjusted Revenues for the year ended

December 31, 2015 were $637.0 million, compared to $543.2

million for the year ended December 31, 2014. For the year

ended December 31, 2015, Douglas Elliman's Pro-forma Adjusted

EBITDA were $35.7 million ($25.2 million attributed to the

Company), compared to $50.7 million ($35.8 million attributed to

the Company) for the year ended December 31, 2014.

For the fourth quarter and year ended December 31, 2015, Douglas

Elliman achieved closed sales of approximately $6.2 billion and

$22.4 billion, compared to $4.9 billion and $18.2 billion for the

three months and year ended December 31, 2014.

During the year ended December 31, 2014, the Company identified

material weaknesses in internal controls over financial reporting

at Douglas Elliman related to the effectiveness of its monitoring

process under Section 404 of the Sarbanes-Oxley Act of 2002. The

Company has concluded certain of these material weaknesses have

continued in 2015. Vector Group is continuing to take measures

associated with remediation of these weaknesses, including engaging

service providers that may be necessary and advisable, to address

these weaknesses.

E-cigarettes Segment Financial Results

For the fourth quarter 2015, the E-cigarette segment had

Pro-forma Adjusted Revenues of negative $2.9 million and a loss of

Pro-forma Adjusted EBITDA of $5.3 million compared to Pro-forma

Adjusted Revenues of negative $1.4 million and a loss of Pro-forma

Adjusted EBITDA of $6.0 million for the fourth quarter 2014.

For the year ended December 31, 2015, the E-cigarette segment

had Pro-forma Adjusted Revenues of negative $2.0 million and a loss

of Pro-forma Adjusted EBITDA of $13.0 million compared to Pro-forma

Adjusted Revenues of $8.6 million and a loss of Pro-forma Adjusted

EBITDA of $13.1 million for the year ended December 31, 2014.

Retroactive Adjustment to Previously Reported Results

During the fourth quarter of 2015, the Company adopted the

equity method of accounting for its investments in Ladenburg

Thalmann Financial Services Inc. and Castle Brands Inc. because the

Company determined that it had significant influence over these

investments. The Company had previously accounted for these

investments under the cost method as part of "Investments Available

for Sale". In accordance with Generally Accepted Accounting

Principles, the Company has adjusted its previously issued

financial statements, retroactively, as if the equity method of

accounting had been in effect since inception of each of these

investments.

Non-GAAP Financial Measures

Pro-forma Adjusted Revenues, Pro-forma Adjusted EBITDA,

Pro-forma Adjusted Net Income, Pro-forma Adjusted Operating Income,

Tobacco Adjusted Operating Income, New Valley LLC Pro-forma

Adjusted Revenues, New Valley LLC Pro-forma Adjusted EBITDA,

Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas Elliman

Realty, LLC Adjusted EBITDA (hereafter referred to as "the Non-GAAP

Financial Measures") are financial measures not prepared in

accordance with generally accepted accounting principles (“GAAP”).

The Company believes that the Non-GAAP Financial Measures are

important measures that supplement discussions and analysis of its

results of operations and enhances an understanding of its

operating performance. The Company believes the Non-GAAP Financial

Measures provide investors and analysts with a useful measure of

operating results unaffected by differences in capital structures,

capital investment cycles and ages of related assets among

otherwise comparable companies. Management uses the Non-GAAP

Financial Measures as measures to review and assess operating

performance of the Company's business, and management and investors

should review both the overall performance (GAAP net income) and

the operating performance (the Non-GAAP Financial Measures) of the

Company's business. While management considers the Non-GAAP

Financial Measures to be important, they should be considered in

addition to, but not as substitutes for or superior to, other

measures of financial performance prepared in accordance with GAAP,

such as operating income, net income and cash flows from

operations. In addition, the Non-GAAP Financial Measures are

susceptible to varying calculations and the Company's measurement

of the Non-GAAP Financial Measures may not be comparable to those

of other companies. Attached hereto as Tables 2 through 10 is

information relating to the Company's the Non-GAAP Financial

Measures for the three months and years ended December 31,

2015 and 2014.

[Financial Tables Follow]

TABLE 1 VECTOR GROUP LTD. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars in

Thousands, Except Per Share Amounts)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 (Unaudited) (Unaudited) Revenues

Tobacco* $ 270,616 $ 272,791 $

1,017,761 $ 1,021,259 Real estate 162,565 146,187 641,406

561,467 E-Cigarettes (2,851 ) (1,388 ) (1,970 ) 8,589 Total

revenues 430,330 417,590 1,657,197 1,591,315 Expenses: Cost

of sales: Tobacco* 191,585 198,058 697,900 735,725 Real estate

100,981 92,497 410,287 354,028 E-Cigarettes 22 950

1,540 7,307 Total cost of sales 292,588 291,505

1,109,727 1,097,060 Operating, selling, administrative and

general expenses 86,772 78,199 320,221 279,342 Litigation,

settlement and judgment expense 14,229 750 20,072 2,475

Restructuring charges 5,709 — 7,257 —

Operating income 31,032 47,136 199,920 212,438 Other income

(expenses): Interest expense (24,286 ) (37,321 ) (120,691 )

(160,991 ) Change in fair value of derivatives embedded within

convertible debt 5,695 11,962 24,455 19,409 Acceleration of

interest expense related to debt conversion — (93 ) — (5,205 )

Equity in earnings from real estate ventures 723 1,101 2,001 4,103

Equity in (losses) earnings from investments (26 ) 926 (2,681 )

3,140 Gain (loss) on sale of investment securities available for

sale (880 ) 27 11,138 (11 ) Impairment of investment securities

available for sale (635 ) — (12,846 ) — Other, net 1,308

2,535 6,409 9,396 Income before provision for

income taxes 12,931 26,273 107,705 82,279 Income tax expense 3,494

12,681 41,233 33,165 Net income

9,437 13,592 66,472 49,114 Net (income) loss attributed to

non-controlling interest (1,533 ) (1,377 ) (7,274 ) (12,258 )

Net income attributed to Vector Group Ltd. $ 7,904

$ 12,215 $ 59,198 $

36,856 Per basic common share: Net income

applicable to common shares attributed to Vector Group Ltd. $

0.06 $ 0.11 $ 0.49 $

0.33 Per diluted common share: Net

income applicable to common shares attributed to Vector Group Ltd.

$ 0.06 $ 0.11 $ 0.49 $

0.33 Cash distributions declared per share $

0.40 $ 0.38 $ 1.54 $

1.47

* Revenues and Cost of goods sold include excise taxes of

$118,342, $118,652, $439,647 and $446,086 respectively.

TABLE 2 VECTOR GROUP LTD. AND

SUBSIDIARIES RECONCILIATION OF PRO-FORMA ADJUSTED

REVENUES (Unaudited)

(Dollars in

Thousands)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 Revenues $ 430,330

$ 417,590 $ 1,657,197 $

1,591,315 Purchase accounting adjustments (a) 481 85

1,925 1,768 Total adjustments 481 85 1,925 1,768

Pro-forma Adjusted Revenues (b) $ 430,811 $

417,675 $ 1,659,122 $ 1,593,083

Pro-forma Adjusted Revenues by Segment Tobacco (b) $

270,616 $ 272,791 $ 1,017,761 $ 1,021,259 E-cigarettes (2,851 )

(1,388 ) (1,970 ) 8,589 Real Estate (c) 163,046 146,272 643,331

563,235 Corporate and Other — — — — Total (b)

$ 430,811 $ 417,675 $ 1,659,122

$ 1,593,083 a. Amounts represent

purchase accounting adjustments recorded in the periods presented

in connection with the increase of the Company's ownership of

Douglas Elliman Realty, LLC, which occurred in 2013. b.

Includes excise taxes of $118,342,

$118,652, $439,647, and $446,086 for the quarter and year ended

December 31, 2015 and 2014, respectively.

c. Includes Pro-forma Adjusted Revenues from Douglas Elliman

Realty, LLC $161,193, $144,564, $637,000, and $543,230 for the

quarter and year ended December 31, 2015 and 2014, respectively.

TABLE 3 VECTOR GROUP LTD. AND

SUBSIDIARIES COMPUTATION OF PRO-FORMA ADJUSTED EBITDA

(Unaudited)

(Dollars in

Thousands)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 Net income attributed to Vector

Group Ltd. $ 7,904 $ 12,215 $ 59,198

$ 36,856 Interest expense 24,286 37,321 120,691

160,991 Income tax expense 3,494 12,681 41,233 33,165 Net income

attributed to non-controlling interest 1,533 1,377 7,274 12,258

Depreciation and amortization 6,258 5,900 25,654

24,499 EBITDA $ 43,475 $ 69,494 $ 254,050 $ 267,769

Change in fair value of derivatives embedded within convertible

debt (a) (5,695 ) (11,962 ) (24,455 ) (19,409 ) Equity in losses

(earnings) from investments (b) 26 (926 ) 2,681 (3,140 ) Loss

(gain) on sale of investment securities available for sale 880 (27

) (11,138 ) 11 Impairment of investment securities available for

sale 635 — 12,846 — Equity in earnings from real estate ventures

(c) (723 ) (1,101 ) (2,001 ) (4,103 ) Pension settlement charge — —

1,607 — Acceleration of interest expense related to debt conversion

— 93 — 5,205 Stock-based compensation expense (d) 1,972 1,224 5,620

3,251 Litigation settlement and judgment expense (e) 14,229 750

20,072 2,475 Impact of MSA settlement (f) 1,357 — (4,364 ) (1,419 )

Restructuring charges 5,709 — 7,257 — Purchase accounting

adjustments (g) 379 465 1,435 1,478 Other, net (1,308 ) (2,535 )

(6,409 ) (9,396 ) Pro-forma Adjusted EBITDA $ 60,936 $ 55,475 $

257,201 $ 242,722 Pro-forma Adjusted EBITDA attributed to

non-controlling interest (2,535 ) (2,244 ) (11,267 ) (15,858 )

Pro-forma Adjusted EBITDA attributed to Vector Group Ltd. $

58,401 $ 53,231 $ 245,934 $

226,864

Pro-forma Adjusted EBITDA by

Segment Tobacco $ 63,800 $ 54,882 $ 245,374 $ 211,168

E-cigarettes (5,327 ) (6,023 ) (13,037 ) (13,124 ) Real Estate (h)

6,413 8,447 38,111 56,036 Corporate and Other (3,950 ) (1,831 )

(13,247 ) (11,358 ) Total $ 60,936 $ 55,475

$ 257,201 $ 242,722

Pro-forma Adjusted EBITDA Attributed to Vector Group by

Segment Tobacco $ 63,800 $ 54,882 $ 245,374 $ 211,168

E-cigarettes (5,327 ) (6,023 ) (13,037 ) (13,124 ) Real Estate (i)

3,878 6,203 26,844 40,178 Corporate and Other (3,950 ) (1,831 )

(13,247 ) (11,358 ) Total $ 58,401 $ 53,231

$ 245,934 $ 226,864

a. Represents income or losses recognized from

changes in the fair value of the derivatives embedded in the

Company's convertible debt. b. Represents income or losses

recognized from investments that the Company accounts for under the

equity method. c. Represents equity income (loss) recognized from

the Company's investment in certain real estate businesses that are

not consolidated in its financial results. d. Represents

amortization of stock-based compensation. e.

Represents accruals for settlements of

judgment expenses in the Engle progeny tobacco litigation.

f. Represents the Company's tobacco segment's settlement of a

long-standing dispute related to the Master Settlement Agreement.

g. Amounts represent purchase accounting adjustments recorded in

the periods presented in connection with the increase of the

Company's ownership of Douglas Elliman Realty, LLC, which occurred

in 2013. h. Includes Pro-forma Adjusted EBITDA for Douglas Elliman

Realty, LLC of $5,855, $6,125, $35,740,and $50,655 for the quarter

and year ended December 31, 2015 and 2014, respectively. Amounts

reported in this footnote reflect 100% of Douglas Elliman Realty,

LLC's entire Pro-forma Adjusted EBITDA. i. Includes Pro-forma

Adjusted EBITDA for Douglas Elliman Realty, LLC less

non-controlling interest of $4,133, $4,324, $25,229, and $35,757

the quarter and year ended December 31, 2015 and 2014,

respectively. Amounts reported in this footnote have adjusted

Douglas Elliman Realty, LLC's Pro-forma Adjusted EBITDA for

non-controlling interest.

TABLE 4

VECTOR GROUP LTD. AND SUBSIDIARIES RECONCILIATION OF

PRO-FORMA ADJUSTED NET INCOME (Unaudited)

(Dollars in

Thousands, Except Per Share Amounts)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 Net income attributed to Vector

Group Ltd. $ 7,904 $ 12,215 $ 59,198

$ 36,856 Acceleration of interest expense

related to debt conversion — 93 — 5,205 Change in fair value of

derivatives embedded within convertible debt (5,695 ) (11,962 )

(24,455 ) (19,409 ) Non-cash amortization of debt discount on

convertible debt 7,565 9,744 27,211 51,472 Litigation settlement

and judgment expense (a) 14,229 750 20,072 2,475 Pension settlement

charge — — 1,607 — Interest expense capitalized to real estate

ventures (9,928 ) — (9,928 ) — Impact of MSA settlement (b) 1,357 —

(4,364 ) (1,419 ) Restructuring charges 5,709 — 7,257 —

Out-of-period adjustment related to Douglas Elliman acquisition in

2013 (c) — — — (1,231 ) Douglas Elliman Realty, LLC purchase

accounting adjustments (d) 1,358 1,189 5,303

6,019 Total adjustments 14,595 (186 ) 22,703 43,112

Tax expense related to adjustments (6,073 ) 77 (9,447 ) (17,827 )

Adjustments to income tax expense due to purchase accounting (e) —

365 — 1,670 Pro-forma Adjusted Net

Income attributed to Vector Group Ltd. $ 16,426 $

12,471 $ 72,454 $ 63,811

Per diluted common share: Pro-forma Adjusted Net

Income applicable to common shares attributed to Vector Group Ltd.

$ 0.13 $ 0.11 $ 0.60 $

0.57 a.

Represents accruals for settlements of

judgment expenses in the Engle progeny tobacco litigation.

b. Represents the Company's tobacco segment's settlement of a

long-standing dispute related to the Master Settlement Agreement.

c. Represents an out-of-period adjustment related to a non-accrual

of a receivable from Douglas Elliman Realty in the fourth quarter

of 2013 and would have increased the Company's gain on acquisition

of Douglas Elliman in 2013. d. Represents 70.59% of purchase

accounting adjustments in the periods presented for assets acquired

in connection with the increase of the Company's ownership of

Douglas Elliman Realty, LLC, which occurred in 2013. e. Represents

adjustments to income tax expense due to a change in the Company's

marginal income tax rate from 40.6% to 41.35% as a result of its

acquisition of 20.59% of Douglas Elliman Realty, LLC on December

13, 2013.

TABLE 5 VECTOR

GROUP LTD. AND SUBSIDIARIES RECONCILIATION OF PRO-FORMA

ADJUSTED OPERATING INCOME (Unaudited)

(Dollars in

Thousands)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 Operating income $

31,032 $ 47,136 $ 199,920 $

212,438 Litigation settlement and judgment expense (a)

14,229 750 20,072 2,475 Pension settlement charge — — 1,607 —

Restructuring expense 5,709 — 7,257 — Impact of MSA settlement (b)

1,357 — (4,364 ) (1,419 ) Douglas Elliman Realty, LLC purchase

accounting adjustments (c) 1,925 1,684 7,513

8,527 Total adjustments 23,220 2,434 32,085 9,583

Pro-forma Adjusted Operating Income (d) $ 54,252 $

49,570 $ 232,005 $ 222,021

a.

Represents accruals for settlements of

judgment expenses in the Engle progeny tobacco litigation.

b. Represents the Company's tobacco segment's settlement of a

long-standing dispute related to the Master Settlement Agreement.

c. Amounts represent purchase accounting adjustments recorded in

the periods presented in connection with the increase of the

Company's ownership of Douglas Elliman Realty, LLC, which occurred

in 2013. d. Does not include a reduction for 29.41% non-controlling

interest in Douglas Elliman Realty, LLC.

TABLE 6 VECTOR GROUP LTD. AND SUBSIDIARIES

RECONCILIATION OF TOBACCO ADJUSTED OPERATING INCOME

(Unaudited)

(Dollars in

Thousands)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 Operating income from tobacco

segment $ 39,878 $ 51,724 $ 209,393

$ 199,119 Litigation settlement and judgment

expense (a) 14,229 750 20,072 2,475 Pension settlement charge — —

1,607 — Restructuring expense 5,709 — 7,257 — Impact of MSA

settlement (b) 1,357 — (4,364 ) (1,419 ) Total

adjustments 21,295 750 24,572 1,056 Tobacco Adjusted

Operating Income $ 61,173 $ 52,474 $

233,965 $ 200,175

a.

Represents accruals for settlements of

judgment expenses in the Engle progeny tobacco litigation.

b. Represents the Company's tobacco segment's settlement of a

long-standing dispute related to the Master Settlement Agreement.

TABLE 7 VECTOR GROUP LTD. AND

SUBSIDIARIES ANALYSIS OF NEW VALLEY LLC PRO-FORMA ADJUSTED

REVENUES (Unaudited)

(Dollars in

Thousands)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 New Valley LLC revenues $

162,565 $ 146,187 $ 641,406 $

561,467 Purchase accounting adjustments (a) 481

85 1,925 1,768 Total adjustments 481 85 1,925

1,768 New Valley LLC Pro-forma Adjusted Revenues (b) $

163,046 $ 146,272 $ 643,331

$ 563,235 a. Amounts represent

purchase accounting adjustments recorded in connection with the

increase of the Company's ownership of Douglas Elliman Realty,

LLC., which occurred in 2013. b. Includes Pro-forma Adjusted

Revenues from Douglas Elliman Realty, LLC of $161,193, $144,564,

$637,000, and $543,230 for the quarter and year ended December 31,

2015 and 2014, respectively.

TABLE 8

VECTOR GROUP LTD. AND SUBSIDIARIES COMPUTATION OF NEW

VALLEY LLC PRO-FORMA ADJUSTED EBITDA (Unaudited)

(Dollars in

Thousands)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 Net income attributed to Vector

Group Ltd. from subsidiary non-guarantors (a) $ 1,453

$ 3,759 $ 11,668 $ 21,420 Interest

expense (a) 3 1 7 41 Income tax expense (a) 986 2,008 8,890 17,428

Net income attributed to non-controlling interest (a) 1,533 1,377

7,274 12,258 Depreciation and amortization 3,217 2,495

12,589 12,204 EBITDA $ 7,192 $ 9,640 $ 40,428

$ 63,351 Income from non-guarantors other than New Valley 25 7 91

93 Equity in earnings from real estate ventures (b) (723 ) (1,101 )

(2,001 ) (4,103 ) Purchase accounting adjustments (c) 379 465 1,435

1,478 Other, net (468 ) (489 ) (1,754 ) (4,786 ) Pro-forma Adjusted

EBITDA $ 6,405 $ 8,522 $ 38,199 $ 56,033 Pro-forma Adjusted EBITDA

attributed to non-controlling interest (2,535 ) (2,244 ) (11,267 )

(15,858 ) Pro-forma Adjusted EBITDA attributed to New Valley LLC $

3,870 $ 6,278 $ 26,932 $

40,175 Pro-forma Adjusted EBITDA by Segment

Real Estate (d) $ 6,413 $ 8,447 $ 38,111 $ 56,036 Corporate and

Other (8 ) 75 88 (3 ) Total (f) $ 6,405

$ 8,522 $ 38,199 $ 56,033

Pro-forma Adjusted EBITDA Attributed to New Valley LLC by

Segment Real Estate (e) $ 3,878 $ 6,203 $ 26,844 $ 40,178 Corporate

and Other (8 ) 74 88 (3 ) Total (f) $ 3,870

$ 6,277 $ 26,932 $ 40,175

a. Amounts are derived from Vector

Group Ltd.'s Consolidated Financial Statements. See Note entitled

"Vector Group Ltd.'s Condensed Consolidating Financial Information"

contained in Vector Group Ltd.'s Form 10-K and Form 10-Q for the

year ended December 31, 2014 and the quarterly period ended

December 31, 2015. b. Represents equity income (loss) recognized

from the Company's investment in certain real estate businesses

that are not consolidated in its financial results. c. Amounts

represent purchase accounting adjustments recorded in the periods

presented in connection with the increase of the Company's

ownership of Douglas Elliman Realty, LLC, which occurred in 2013.

d. Includes Pro-forma Adjusted EBITDA for Douglas Elliman Realty,

LLC of $5,855, $6,125, $35,740, and $50,655 for the quarter and

year ended December 31, 2015 and 2014, respectively. Amounts

reported in this footnote reflect 100% of Douglas Elliman Realty,

LLC's entire Pro-forma Adjusted EBITDA. e. Includes Pro-forma

Adjusted EBITDA for Douglas Elliman Realty, LLC less

non-controlling interest of $4,133, $4,324, $25,229, and $35,757

for the quarter and year ended December 31, 2015 and 2014,

respectively. Amounts reported in this footnote have adjusted

Douglas Elliman Realty, LLC's Pro-forma Adjusted EBITDA for

non-controlling interest. f. New Valley's Pro-forma Adjusted EBITDA

does not include an allocation of Vector Group Ltd.'s "Corporate

and Other" segment's expenses (for purposes of computing Pro-Forma

Adjusted EBITDA contained in Table 3 of this press release) of

$3,950, $1,831, $13,247 and $11,358 for the quarter and year ended

December 31, 2015 and 2014, respectively.

TABLE 9 VECTOR GROUP LTD. AND SUBSIDIARIES

ANALYSIS OF DOUGLAS ELLIMAN REALTY, LLC PRO-FORMA ADJUSTED

REVENUES (Unaudited)

(Dollars in

Thousands)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 Douglas Elliman Realty, LLC

revenues $ 160,712 $ 144,479 $ 635,075

$ 541,462 Purchase accounting adjustments (a) 481

85 1,925 1,768 Total adjustments 481 85 1,925

1,768 Douglas Elliman Realty, LLC Pro-forma Adjusted

Revenues $ 161,193 $ 144,564 $

637,000 $ 543,230 a. Amounts

represent purchase accounting adjustments recorded in the periods

presented in connection with the increase of the Company's

ownership of Douglas Elliman Realty, LLC, which occurred in 2013.

TABLE 10 VECTOR GROUP LTD. AND

SUBSIDIARIES COMPUTATION OF DOUGLAS ELLIMAN REALTY, LLC

PRO-FORMA ADJUSTED EBITDA (Unaudited)

(Dollars in

Thousands)

Three Months Ended Year ended December 31, December 31, 2015

2014 2015 2014 Net income attributed to

Douglas Elliman Realty, LLC $ 2,450 $ 4,682 $

22,163 $ 38,414 Interest expense 1 1 4 38 Income tax

expense (45 ) 273 831 1,374 Depreciation and amortization 3,148

2,430 12,343 11,855 Douglas Elliman

Realty, LLC EBITDA $ 5,554 $ 7,386 $ 35,341 $ 51,681 Equity (loss)

income from real estate ventures (a) (37 ) (24 ) (945 ) (110 )

Purchase accounting adjustments (b) 379 (1,218 ) 1,435 1,478 Other,

net (41 ) (19 ) (91 ) (2,394 ) Douglas Elliman Realty, LLC

Pro-forma Adjusted EBITDA $ 5,855 $ 6,125

$ 35,740 $ 50,655

a. Represents equity income recognized from the Company's

investment in certain real estate businesses that are not

consolidated in its financial results. b. Amounts represent

purchase accounting adjustments recorded in the periods presented

in connection with the increase of the Company's ownership of

Douglas Elliman Realty, LLC, which occurred in 2013.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160308006480/en/

Sard Verbinnen & CoEmily Deissler/Benjamin

Spicehandler/Spencer Waybright212-687-8080orSard Verbinnen & Co

- EuropeJonathan Doorley/Conrad Harrington+44 (0)20 3178

8914orVector Group Ltd.J. Bryant Kirkland III305-579-8000

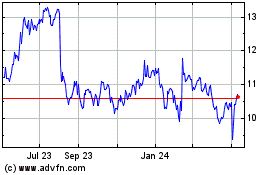

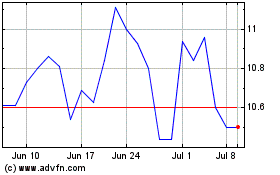

Vector (NYSE:VGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vector (NYSE:VGR)

Historical Stock Chart

From Apr 2023 to Apr 2024