Current Report Filing (8-k)

October 06 2015 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 5, 2015

(Exact Name of Registrant as Specified in Its Charter)

|

|

DELAWARE |

(State or Other Jurisdiction of Incorporation) |

|

| | |

1-5759 | | 65-0949535 |

(Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

4400 Biscayne Boulevard, Miami, Florida | | 33137 |

(Address of Principal Executive Offices) | | (Zip Code) |

|

|

(305) 579-8000 |

(Registrant’s Telephone Number, Including Area Code) |

|

|

(Not Applicable) |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.05 Costs Associated with Exit or Disposal Activities.

On October 5, 2015, we commenced a restructuring of the tobacco operations of Liggett Group LLC and Liggett Vector Brands LLC, our sales, marketing and distribution agents for our Liggett and Vector Tobacco Inc. subsidiaries, respectively. Liggett Vector Brands is realigning its sales force and adjusting its business model to more efficiently serve its chain and independent accounts nationwide. In connection with the restructuring, the total workforce of our tobacco segment is expected to decline by approximately 95 full time employees (or about 17% of the workforce of our tobacco segment) by the end of 2015. As a result of these actions, we expect to recognize pre-tax restructuring charges during the third and fourth quarters of 2015 aggregating approximately $6 million. These charges are currently estimated to include approximately $1 million relating to employee severance and benefit costs, approximately $4 million for non-cash pension benefit related costs and $1 million in other associated costs. We estimate $10 million of annual cost savings from the restructuring and plan to reinvest the entire amount of cost savings into the tobacco segment's promotional and marketing programs.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements, which involve risk and uncertainties. The Company’s estimates of the costs and savings of the restructuring and the timing of various events are based on a number of assumptions and actual results may differ materially from estimates discussed in this Item 2.05. The words "anticipate", "could", “believe,” “expect,” “estimate,” “may,” “will,” “could,” “plan,” or “continue” and similar expressions are intended to identify forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, as updated in the Report on Form 10-Q for the quarterly period ended June 30, 2015. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Current Report on Form 8-K. The Company undertakes no obligation to (and expressly disclaims any obligation to) revise or update any forward-looking statement, whether as a result of new information, subsequent events, or otherwise (except as may be required by law), in order to reflect any event or circumstance which may arise after the date of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| VECTOR GROUP LTD. |

| |

| By: | /s/ J. Bryant Kirkland III |

| | J. Bryant Kirkland III |

| | Vice President, Treasurer and Chief Financial Officer |

Date: October 6, 2015

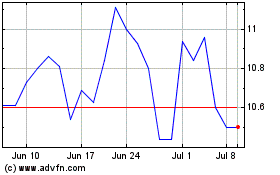

Vector (NYSE:VGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

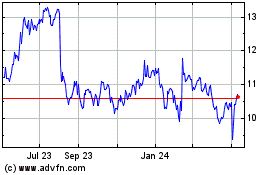

Vector (NYSE:VGR)

Historical Stock Chart

From Apr 2023 to Apr 2024