Vector Group Ltd. (NYSE:VGR) today announced financial results

for the fourth quarter and year ended December 31, 2014.

On December 13, 2013, Vector Group increased its ownership of

Douglas Elliman Realty, LLC from 50% to 70.59%. Consequently, after

December 13, 2013, Vector Group consolidates the operations and

financial position of Douglas Elliman Realty in its financial

statements. It had previously accounted for its interest in Douglas

Elliman under the equity method of accounting.

GAAP Financial Results

Fourth quarter 2014 revenues were $417.6 million, compared to

revenues of $299.6 million in the fourth quarter of 2013. The

increase in revenues in 2014 was primarily due to the acquisition

and consolidated presentation of Douglas Elliman. The Company

recorded operating income of $47.4 million in the fourth quarter of

2014, compared to operating income of $62.0 million in the fourth

quarter of 2013. Net income attributed to Vector Group Ltd. for the

2014 fourth quarter was $11.6 million, or $0.11 per diluted common

share, compared to net income of $64.0 million, or $0.59 per

diluted common share, in the 2013 fourth quarter.

For the year ended December 31, 2014, revenues were $1.6

billion, compared to $1.1 billion for 2013. The increase in

revenues in 2014 was primarily due to the acquisition and

consolidated presentation of Douglas Elliman. The Company recorded

operating income of $213.4 million for 2014 , compared to operating

income of $112.0 million for 2013. Net income attributed to Vector

Group Ltd. for 2014 was $37.0 million, or $0.35 per diluted common

share, compared to net income of $38.9 million, or $0.39 per

diluted common share, for 2013.

Non-GAAP Financial Results

The Company's non-GAAP financial results are presented assuming

the Company's acquisition of its additional 20.59% interest in

Douglas Elliman Realty, LLC, and the related purchase accounting

adjustments, occurred prior to January 1, 2013. Non-GAAP financial

results also include adjustments for litigation settlement and

judgment expenses in the Company's tobacco business, a one-time

charge in 2013 related to the extinguishment of the Company's 11%

Senior Secured Notes, non-cash stock compensation expense (for

purposes of Pro-forma Adjusted EBITDA only), and non-cash interest

items associated with the Company's convertible debt.

Reconciliations of non-GAAP financial results to the comparable

GAAP financial results for the three and twelve months ended

December 31, 2014 and 2013 are included in Tables 2 through

10.

Three months ended December 31, 2014 compared to the three

months ended December 31, 2013

Fourth quarter 2014 Pro-forma Adjusted Revenues (as described in

Table 2 attached hereto) were $417.7 million compared to $401.7

million in 2013. The increase was primarily due to an increase in

Pro-forma Adjusted Revenues from the Company's tobacco segment of

$19.5 million and an increase in Pro-forma Adjusted Revenues at

Douglas Elliman of $18.7 million. These increases were offset by

the absence of $22.7 million in revenues in 2014 from the 2013 sale

of lots at the Company's Escena development in Palm Springs,

California.

Pro-forma Adjusted EBITDA attributed to Vector Group (as

described below and in Table 3 attached hereto) was $53.5 million

for the fourth quarter of 2014 as compared to $76.3 million for the

fourth quarter of 2013. The decline in Pro-forma Adjusted EBITDA

attributed to Vector Group for the three months ended December 31,

2014 was primarily attributable to the absence of a $20.2 million

gain from the sale of lots at the Company's Escena development in

Palm Springs, California, which occurred during the three months

ended December 31, 2013 as well as increased losses from the

Company’s E-cigarette segment in the 2014 period. This decline was

offset by higher profits in the tobacco segment.

Pro-forma Adjusted Net Income (as described below and in Table 4

attached hereto) was $11.9 million or $0.11 per diluted share for

the three months ended December 31, 2014 and $37.2 million or $0.35

per diluted share for the three months ended December 31, 2013.

Pro-forma Adjusted Operating Income (as described below and in

Table 5 attached hereto) was $49.8 million for the three months

ended December 31, 2014 and $75.8 million for the three months

ended December 31, 2013.

Twelve months ended December 31, 2014 compared to the

twelve months ended December 31, 2013

For the year ended December 31, 2014 Pro-forma Adjusted Revenues

(as described in Table 2 attached hereto) were $1.59 billion

compared to $1.50 billion in 2013. The increase was primarily due

to an increase in real estate revenues at Douglas Elliman.

Pro-forma Adjusted EBITDA attributed to Vector Group (as

described below and in Table 3 attached hereto) was $227.8 million

for the year ended December 31, 2014 as compared to $236.4 million

for the twelve-month period of 2013. The decline in Pro-forma

Adjusted EBITDA attributed to Vector Group for the twelve months

ended December 31, 2014 was primarily attributable to the absence

of a $20.2 million gain from the sale of lots at the Company's

Escena development in Palm Springs, California, which occurred

during the three months ended December 31, 2013 and increased

losses from the Company’s E-cigarette segment in 2014. This decline

was offset by higher profits in the tobacco segment and from the

Company’s 70.59% interest in Douglas Elliman Realty, LLC.

Pro-forma Adjusted Net Income (as described below and in Table 4

attached hereto) was $63.9 million or $0.60 per diluted share for

the year ended December 31, 2014 and $84.0 million or $0.85 per

diluted share for the year ended December 31, 2013.

Pro-forma Adjusted Operating Income (as described below and in

Table 5 attached hereto) was $223.0 million for the year ended

December 31, 2014 and $232.6 million for the year ended December

31, 2013.

Tobacco Business Financial Results

For the fourth quarter 2014, the Company's tobacco business had

revenues of $272.8 million, compared to $253.3 million for the

fourth quarter 2013. The increase in revenues was primarily due to

a 4.6% increase in unit sales volume and by favorable net pricing

variances. Tobacco Adjusted Operating Income (described below and

included in Table 6 attached hereto) for the fourth quarter 2014

and 2013 was $52.5 million and $49.3 million, respectively.

For the year ended December 31, 2014, the Company's tobacco

business had revenues of $1.021 billion, compared to $1.014 billion

for the year ended December 31, 2013. The increase in revenues was

primarily due to 3.1% favorable net pricing variances offset by a

2.3% decline in unit sales volume. Tobacco Adjusted Operating

Income (described below and included in Table 6 attached hereto)

for the year ended December 31, 2014 and 2013 was $200.2 million

and $189.3 million, respectively.

For the fourth quarter and year ended December 31, 2014, the

Company's tobacco business had conventional cigarette sales of

approximately 2.36 billion units and 8.86 billion units,

respectively, compared to 2.25 billion units and 9.07 billion units

for the fourth quarter and year ended December 31, 2013.

Real Estate Business Financial Results

For the fourth quarter 2014, the Company's real estate segment

had Pro-forma Adjusted Revenues of $146.3 million, compared to

$148.4 million for the fourth quarter 2013. For the year ended

December 31, 2014, the Company's real estate segment's Pro-forma

Adjusted Revenues were $563.2 million compared to $483.4 million

for the year ended December 31, 2013. The increase in revenues was

primarily due to an increase in revenues at Douglas Elliman

combined with the sale of the Company's Indian Creek property. For

the fourth quarter 2014, Real Estate Pro-forma Adjusted EBITDA

attributed to the Company were $6.2 million, compared to $28.9

million for the fourth quarter 2013. For the year ended December

31, 2014, Real Estate Pro-forma Adjusted EBITDA attributed to the

Company were $40.2 million, compared to $51.1 million for the year

ended December 31, 2013.

Douglas Elliman's results are included in the Real Estate

segment and it continued to post strong growth with increases in

Pro-Forma Adjusted Revenues of 14.9% and 18.9% for the three and

twelve months ended December 31, 2014 , respectively, from the

comparable 2013 periods. Additionally, Douglas Elliman continued to

make strategic investments in 2014 by expanding into new markets,

bolstering its development marketing division and incurring

increased advertising and marketing expenses to strengthen the

long-term value of the Douglas Elliman brand name.

Douglas Elliman's Pro-Forma Adjusted Revenues for the fourth

quarter 2014 were $144.6 million, compared to $125.8 million for

the fourth quarter 2013. For the year ended December 31, 2014,

Douglas Elliman's Pro-forma Adjusted Revenues were $543.2 million

compared to $456.9 million for the year ended December 31, 2013.

For the fourth quarter 2014, Douglas Elliman's Pro-forma Adjusted

EBITDA were $6.1 million ($4.3 million attributed to the Company),

compared to $13.2 million ($9.3 million attributed to the Company)

for the fourth quarter 2013. For the year ended December 31, 2014,

Douglas Elliman's Pro-forma Adjusted EBITDA were $50.7 million

($35.8 million attributed to the Company), compared to $45.7

million ($32.3 million attributed to the Company) for the year

ended December 31, 2013.

For the fourth quarter and year ended December 31, 2014, Douglas

Elliman achieved closed sales of approximately $4.9 billion and

$18.2 billion, respectively, compared to $4.0 billion and $14.8

billion for the fourth quarter and year ended December 31,

2013.

In 2014, the Company was required under Section 404 of the

Sarbanes-Oxley Act of 2002 to complete an assessment of internal

controls of Douglas Elliman Realty, LLC, which became a

consolidated subsidiary of the Company on December 13, 2013. In the

Company’s assessment, it has identified material weaknesses in

internal controls over financial reporting at Douglas Elliman

related to the effectiveness of its monitoring process for

evaluating its financial reporting. Vector Group is beginning the

evaluation process associated with remediation of these weaknesses

and will continue to take measures, including engaging service

providers that may be necessary and advisable, to address these

weaknesses.

E-cigarettes

For the fourth quarter 2014, the Company's E-cigarette segment

had Pro-forma Adjusted Revenues of negative $1.4 million and a loss

of Pro-forma Adjusted EBITDA of $6.0 million. The negative revenues

of $1.4 million in the Company’s E-Cigarette segment for the three

months ended December 31, 2014 are the result of a

newly-established sales returns allowance of $2.7 million because

of the rapid decline of disposable e-cigarette sales in the U.S.

market. For the year ended December 31, 2014, the Company's

E-cigarette segment had Pro-forma Adjusted Revenues of $8.6 million

and a loss of Pro-forma Adjusted EBITDA of $13.1 million.

The Company's E-cigarette segment did not have any revenues in

the 2013 periods and reported a loss from Pro-forma Adjusted EBITDA

of approximately $459,000 and $1.0 million for the three months and

year ended December 31, 2013.

As a result of the amount of operating losses in the Company's

E-cigarette segment, effective as of September 30, 2014, when

compared to the remaining components of the Company's Corporate and

Other segment, the Company has reevaluated its operating segments

and has separated the operations of the Company's E-cigarette

segment from the Corporate and Other segment for previously

reported 2014 periods and from the Tobacco segment for the

previously reported 2013 periods. Thus, information reported prior

to September 30, 2014 has been recast to conform to the current

presentation. This change did not have an impact to the Company's

historical consolidated results.

Non-GAAP Financial Measures

Pro-forma Adjusted Revenues, Pro-forma Adjusted EBITDA,

Pro-forma Adjusted Net Income, Pro-forma Adjusted Operating Income,

Tobacco Adjusted Operating Income, New Valley LLC Pro-forma

Adjusted Revenues, New Valley LLC Pro-forma Adjusted EBITDA,

Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas Elliman

Realty, LLC Adjusted EBITDA are financial measures not prepared in

accordance with generally accepted accounting principles (“GAAP”).

The Company believes that Pro-forma Adjusted Revenues, Pro-forma

Adjusted EBITDA, Pro-forma Adjusted Net Income, Pro-forma Adjusted

Operating Income, Tobacco Adjusted Operating Income, New Valley LLC

Pro-forma Adjusted Revenues, New Valley LLC Pro-forma Adjusted

EBITDA, Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas

Elliman Realty, LLC Adjusted EBITDA are important measures that

supplement discussions and analysis of its results of operations

and enhances an understanding of its operating performance. The

Company believes Pro-forma Adjusted Revenues, Pro-forma Adjusted

EBITDA, Pro-forma Adjusted Net Income, Pro-forma Adjusted Operating

Income, Tobacco Adjusted Operating Income, New Valley LLC Pro-forma

Adjusted Revenues, New Valley LLC Pro-forma Adjusted EBITDA,

Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas Elliman

Realty, LLC Adjusted EBITDA provide investors and analysts with a

useful measure of operating results unaffected by differences in

capital structures, capital investment cycles and ages of related

assets among otherwise comparable companies. Management uses

Pro-forma Adjusted Revenues, Pro-forma Adjusted EBITDA, Pro-forma

Adjusted Net Income, Pro-forma Adjusted Operating Income, Tobacco

Adjusted Operating Income, New Valley LLC Pro-forma Adjusted

Revenues, New Valley LLC Pro-forma Adjusted EBITDA, Douglas Elliman

Realty, LLC Adjusted Revenues, and Douglas Elliman Realty, LLC

Adjusted EBITDA as measures to review and assess operating

performance of the Company's business, and management and investors

should review both the overall performance (GAAP net income) and

the operating performance (Pro-forma Adjusted Revenues, Pro-forma

Adjusted EBITDA, Pro-forma Adjusted Net Income, Pro-forma Adjusted

Operating Income, Tobacco Adjusted Operating Income, New Valley LLC

Pro-forma Adjusted Revenues, New Valley LLC Pro-forma Adjusted

EBITDA, Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas

Elliman Realty, LLC Adjusted EBITDA) of the Company's business.

While management considers Pro-forma Adjusted Revenues, Pro-forma

Adjusted EBITDA, Pro-forma Adjusted Net Income, Pro-forma Adjusted

Operating Income, Tobacco Adjusted Operating Income, New Valley LLC

Pro-forma Adjusted Revenues, New Valley LLC Pro-forma Adjusted

EBITDA, Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas

Elliman Realty, LLC Adjusted EBITDA to be important, they should be

considered in addition to, but not as substitutes for or superior

to, other measures of financial performance prepared in accordance

with GAAP, such as operating income, net income and cash flows from

operations. In addition, Pro-forma Adjusted Revenues, Pro-forma

Adjusted EBITDA, Pro-forma Adjusted Net Income, Pro-forma Adjusted

Operating Income, Tobacco Adjusted Operating Income, New Valley LLC

Pro-forma Adjusted Revenues, New Valley LLC Pro-forma Adjusted

EBITDA, Douglas Elliman Realty, LLC Adjusted Revenues, and Douglas

Elliman Realty, LLC Adjusted EBITDA are susceptible to varying

calculations and the Company's measurement of Pro-forma Adjusted

Revenues, Pro-forma Adjusted EBITDA, Pro-forma Adjusted Net Income,

Pro-forma Adjusted Operating Income, Tobacco Adjusted Operating

Income, New Valley LLC Pro-forma Adjusted Revenues, New Valley LLC

Pro-forma Adjusted EBITDA, Douglas Elliman Realty, LLC Adjusted

Revenues, and Douglas Elliman Realty, LLC Adjusted EBITDA may not

be comparable to those of other companies. Attached hereto as

Tables 2 through 10 is information relating to the Company's

Pro-forma Adjusted Revenues, Pro-forma Adjusted EBITDA, Pro-forma

Adjusted Net Income, Pro-forma Adjusted Operating Income, Tobacco

Adjusted Operating Income, New Valley LLC Pro-forma Adjusted

Revenues, New Valley LLC Pro-forma Adjusted EBITDA, Douglas Elliman

Realty, LLC Adjusted Revenues, and Douglas Elliman Realty, LLC

Adjusted EBITDA for the three and twelve months ended

December 31, 2014 and 2013.

Conference Call to Discuss Fourth Quarter and Full Year 2014

Results

As previously announced, the Company will host a conference call

and webcast on Monday, March 2, 2015 at 9:30 A.M. (ET) to

discuss fourth quarter and full year 2014 results. Investors can

access the call by dialing 800-859-8150 and entering

78148193 as the conference ID number. The call will also be

available via live webcast at www.investorcalendar.com. Webcast participants

should allot extra time to register before the webcast begins.

A replay of the call will be available shortly after the call

ends on March 2, 2015 through March 13, 2015. To access the

replay, dial 877-656-8905 and enter 78148193 as the conference ID

number. The archived webcast will also be available at www.investorcalendar.com for one year.

Vector Group is a holding company that indirectly

owns Liggett Group LLC, Vector Tobacco

Inc. and Zoom E-Cigs LLC and directly owns New

Valley LLC, which owns a controlling interest in Douglas

Elliman Realty, LLC. Additional information concerning the company

is available on the Company's website, www.VectorGroupLtd.com.

[Financial Tables Follow]

TABLE 1

VECTOR GROUP LTD. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars in

Thousands, Except Per Share Amounts)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013

(Unaudited) (Unaudited) Revenues Tobacco* $ 272,791 $ 253,303 $

1,021,259 $ 1,014,341 Real estate 146,187 46,282 561,467 65,580

E-Cigarettes (1,388 ) — 8,589 — Total revenues

417,590 299,585 1,591,315 1,079,921 Expenses: Cost of sales:

Tobacco* 198,058 181,016 735,725 729,393 Real estate 92,497 21,558

354,028 37,638 E-Cigarettes 950 — 7,307 —

Total cost of sales 291,505 202,574 1,097,060 767,031

Operating, selling, administrative and general expenses 77,961

34,833 278,392 112,748 Litigation settlement and judgment expense

750 193 2,475 88,106 Operating income

47,374 61,985 213,388 112,036 Other income (expenses):

Interest expense (37,321 ) (33,102 ) (160,991 ) (132,147 ) Loss on

extinguishment of debt — — — (21,458 ) Change in fair value of

derivatives embedded within convertible debt 11,962 10,636 19,409

18,935 Acceleration of interest expense related to debt conversion

(93 ) (12,414 ) (5,205 ) (12,414 ) Equity income from real estate

ventures 1,101 6,151 4,103 22,925 Equity (loss) income on long-term

investments (220 ) 1,296 1,242 2,066 Gain (loss) on sale of

investment securities available for sale 27 42 (11 ) 5,152 Gain on

acquisition of Douglas Elliman — 60,842 — 60,842 Other, net 2,385

2,399 10,552 7,550 Income before

provision for income taxes 25,215 97,835 82,487 63,487 Income tax

expense 12,244 34,082 33,251 24,795

Net income 12,971 63,753 49,236 38,692 Net (income)

loss attributed to non-controlling interest (1,377 ) 252

(12,258 ) 252 Net income attributed to Vector Group

Ltd. $ 11,594 $ 64,005 $ 36,978 $ 38,944

Per basic common share: Net income applicable

to common shares attributed to Vector Group Ltd. $ 0.11 $

0.64 $ 0.35 $ 0.39 Per diluted common

share: Net income applicable to common shares attributed to

Vector Group Ltd. $ 0.11 $ 0.59 $ 0.35 $ 0.39

Cash distributions and dividends declared per share $

0.40 $ 0.38 $ 1.54 $ 1.47

* Revenues and Cost of goods sold

include excise taxes of $118,652, $113,409, $446,086 and $456,703,

respectively.

TABLE 2

VECTOR GROUP LTD. AND

SUBSIDIARIES

RECONCILIATION OF PRO-FORMA ADJUSTED

REVENUES

(Unaudited)

(Dollars in

Thousands)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013

Revenues $ 417,590 $ 299,585 $ 1,591,315 $ 1,079,921

Reclassification of revenues as a result

of the consolidation of Douglas Elliman (a)

— 100,732 — 416,453 Purchase accounting adjustments (b) 85

1,357 1,768 1,357 Total adjustments 85 102,089 1,768

417,810 Pro-forma Adjusted Revenues $ 417,675 $

401,674 $ 1,593,083 $ 1,497,731

Pro-forma

Adjusted Revenues by Segment Tobacco $ 272,791 $ 253,303 $

1,021,259 $ 1,014,341 E-cigarettes (1,388 ) — 8,589 — Real Estate

(c) 146,272 148,371 563,235 483,390 Corporate and Other — —

— — Total $ 417,675 $ 401,674 $

1,593,083 $ 1,497,731 a. Represents revenues

of Douglas Elliman Realty, LLC in the respective 2013 periods. On

December 13, 2013, the Company increased its ownership of Douglas

Elliman Realty, LLC from 50% to 70.59%. Consequently, after

December 13, 2013, the Company consolidates the operations and

financial position of Douglas Elliman Realty, LLC in its financial

statements. The Company had previously accounted for its interest

in Douglas Elliman Realty, LLC under the equity method and revenues

from Douglas Elliman Realty, LLC were not included in the Company's

revenues. b. Amounts represent one-time purchase accounting

adjustments to fair value for deferred revenues recorded in

connection with the increase of the Company's ownership of Douglas

Elliman Realty, LLC on December 13, 2013. c. Includes Pro-Forma

Adjusted Revenues from Douglas Elliman Realty, LLC of $144,564,

$125,820, $543,230, and $456,909 for the three months and years

ended December 31, 2014 and 2013, respectively.

TABLE 3

VECTOR GROUP LTD. AND

SUBSIDIARIES

COMPUTATION OF PRO-FORMA

ADJUSTED EBITDA

(Unaudited)

(Dollars in

Thousands)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013

Net income attributed to Vector Group Ltd. $ 11,594 $ 64,005

$ 36,978 $ 38,944 Interest expense 37,321 33,102 160,991 132,147

Income tax expense 12,244 34,082 33,251 24,795 Net income (loss)

attributed to non-controlling interest 1,377 (252 ) 12,258 (252 )

Depreciation and amortization 5,900 4,626 24,499

12,631 EBITDA $ 68,436 $ 135,563 $ 267,977 $ 208,265

Change in fair value of derivatives embedded within convertible

debt (a) (11,962 ) (10,636 ) (19,409 ) (18,935 ) Equity (gain) loss

on long-term investments (b) 220 (1,296 ) (1,242 ) (2,066 ) (Gain)

loss on sale of investment securities available for sale (27 ) (42

) 11 (5,152 ) Equity income from real estate ventures (c) (1,101 )

(6,151 ) (4,103 ) (22,925 ) Loss on extinguishment of debt — — —

21,458 Acceleration of interest expense related to debt conversion

93 12,414 5,205 12,414 Stock-based compensation expense (d) 1,224

586 3,251 2,519 Litigation settlement and judgment expense (e) 750

193 2,475 88,106 Impact of MSA Settlement (f) — (860 ) (1,419 )

(11,823 ) Gain on acquisition of Douglas Elliman — (60,842 ) —

(60,842 ) Reclassification of EBITDA as a result of the

consolidation of Douglas Elliman (g) — 13,804 — 46,640 Purchase

accounting adjustments 465 — 1,478 — Other, net (2,385 ) (2,399 )

(10,552 ) (7,550 ) Pro-forma Adjusted EBITDA $ 55,713 $ 80,334 $

243,672 $ 250,109 Pro-forma Adjusted EBITDA attributed to

non-controlling interest (2,244 ) (4,060 ) (15,858 ) (13,717 )

Pro-forma Adjusted EBITDA attributed to Vector Group Ltd. $ 53,469

$ 76,274 $ 227,814 $ 236,392

Pro-forma Adjusted EBITDA by Segment Tobacco $ 54,882 $

51,746 $ 211,168 $ 198,866 E-cigarettes (6,023 ) (459 ) (13,124 )

(1,019 ) Real Estate (h) 8,447 32,983 56,036 64,866 Corporate and

Other (1,593 ) (3,936 ) (10,408 ) (12,604 ) Total $ 55,713 $

80,334 $ 243,672 $ 250,109

Pro-forma

Adjusted EBITDA Attributed to Vector Group by Segment Tobacco $

54,882 $ 51,746 $ 211,168 $ 198,866 E-cigarettes (6,023 ) (459 )

(13,124 ) (1,019 ) Real Estate (i) 6,203 28,923 40,178 51,149

Corporate and Other (1,593 ) (3,936 ) (10,408 ) (12,604 ) Total $

53,469 $ 76,274 $ 227,814 $ 236,392

a. Represents income or losses recognized from

changes in the fair value of the derivatives embedded in the

Company's convertible debt. b. Represents income or losses

recognized on long-term investments that the Company accounts for

under the equity method. c. Represents equity income recognized

from the Company's investment in certain real estate businesses

that are not consolidated in its financial results. d. Represents

amortization of stock-based compensation. e. Represents accrual for

a settlement of an Engle progeny judgment. f. Represents the

Company's tobacco business's settlement of a long-standing dispute

related to the Master Settlement Agreement. g. Represents Adjusted

EBITDA of Douglas Elliman Realty, LLC in the respective 2013

periods. On December 13, 2013, the Company increased its ownership

of Douglas Elliman Realty, LLC from 50% to 70.59%. Consequently,

after December 13, 2013, the Company consolidates the operations

and financial position of Douglas Elliman Realty, LLC in its

financial statements . The Company had previously accounted for its

interest in Douglas Elliman Realty, LLC under the equity method,

and operating income as well as depreciation and amortization

expense from Douglas Elliman Realty, LLC were not included in the

Company's Adjusted EBITDA. h. Includes Pro-forma Adjusted EBITDA

for Douglas Elliman Realty, LLC of $6,125, $13,169, $50,655 and

$45,710 for the three months and years ended December 31, 2014 and

2013, respectively. Amounts reported in this footnote reflect 100%

of Douglas Elliman Realty, LLC's entire Pro-forma Adjusted EBITDA.

i. Includes Pro-forma Adjusted EBITDA for Douglas Elliman Realty,

LLC less non-controlling interest of $4,324, $9,297, $35,757 and

$32,267 the three months and years ended December 31, 2014 and

2013, respectively. Amounts reported in this footnote have adjusted

Douglas Elliman Realty, LLC's Pro-forma Adjusted EBITDA for

non-controlling interest.

TABLE 4

VECTOR GROUP LTD. AND

SUBSIDIARIES

RECONCILIATION OF PRO-FORMA ADJUSTED

NET INCOME

(Unaudited)

(Dollars in

Thousands, Except Per Share Amounts)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013

Net income attributed to Vector Group Ltd. $ 11,594 $ 64,005

$ 36,978 $ 38,944 Acceleration of interest expense related

to debt conversion 93 12,414 5,205 12,414 Change in fair value of

derivatives embedded within convertible debt (11,962 ) (10,636 )

(19,409 ) (18,935 ) Non-cash amortization of debt discount on

convertible debt 9,744 10,946 51,472 36,378 Loss on extinguishment

of 11% Senior Secured Notes due 2015 — — — 21,458 Litigation

settlement and judgment expense (a) 750 193 2,475 88,106 Impact of

MSA Settlement (b) — (860 ) (1,419 ) (11,823 ) Interest income from

MSA Settlement (c) — — — (1,971 ) Gain on acquisition of Douglas

Elliman Realty, LLC (d) — (60,842 ) — (60,842 )

Adjustment to reflect additional 20.59% of

net income fromDouglas Elliman Realty, LLC (e)

— 2,467 — 8,557 Out-of-period adjustment related to Douglas Elliman

acquisition in 2013 (f) — — (1,231 ) — Douglas Elliman Realty, LLC

purchase accounting adjustments (g) 1,189 1,165 6,019

1,165 Total adjustments (186 ) (45,153 ) 43,112

74,507 Tax expense related to adjustments 77 18,332 (17,827

) (29,467 ) Adjustments to income tax expense due to purchase

accounting (h) 365 — 1,670 —

Pro-forma Adjusted Net Income attributed to

Vector Group Ltd. $ 11,850 $ 37,184 $ 63,933 $

83,984 Per diluted common share:

Pro-forma Adjusted Net Income applicable

to common sharesattributed to Vector Group Ltd.

$ 0.11 $ 0.35 $ 0.60 $ 0.85

a.

Represents accrual for a settlement of an Engle progeny

judgment. b. Represents the Company's tobacco segment's settlement

of a long-standing dispute related to the Master Settlement

Agreement.

c.

Represents interest income on the Company's tobacco segment's

settlement of a long-standing dispute related to the Master

Settlement Agreement. d. Represents gain associated with the

increase of ownership of Douglas Elliman Realty, LLC. e. Represents

20.59% of Douglas Elliman Realty LLC's net income in the respective

2013 periods. On December 13, 2013, the Company increased its

ownership of Douglas Elliman Realty, LLC from 50% to 70.59%.

Consequently, after December 13, 2013, the Company includes an

additional 20.59% of Adjusted Net Income from Douglas Elliman

Realty, LLC in the Company's Adjusted Net Income. f. Represents an

out-of-period adjustment related to a non-accrual of a receivable

from Douglas Elliman in the fourth quarter of 2013 and would have

increased the Company’s gain on acquisition of Douglas Elliman in

2013. g. Represents 70.59% of one-time purchase accounting

adjustments to fair value for assets acquired in connection with

the increase of the Company's ownership of Douglas Elliman Realty,

LLC on December 13, 2013.

h.

Represents adjustments to income tax expense due to a change in the

Company's marginal income tax rate from 40.6% to 41.35% as a result

of its acquisition of 20.59% of Douglas Elliman Realty, LLC on

December 13, 2013.

TABLE 5

VECTOR GROUP LTD. AND

SUBSIDIARIES

RECONCILIATION OF PRO-FORMA ADJUSTED

OPERATING INCOME

(Unaudited)

(Dollars in

Thousands)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013

Operating income $ 47,374 $ 61,985 $ 213,388 $

112,036 Litigation settlement and judgment expense (a) 750

193 2,475 88,106 Impact of MSA Settlement (b) — (860 ) (1,419 )

(11,823 )

Reclassification of operating income as a

result of the consolidation ofDouglas Elliman Realty, LLC (c)

— 12,873 — 42,598 Douglas Elliman purchase accounting adjustments

(d) 1,684 1,650 8,527 1,650 Total

adjustments 2,434 13,856 9,583 120,531 Pro-forma Adjusted

Operating Income (e) $ 49,808 $ 75,841 $ 222,971

$ 232,567 a. Represents accrual for a

settlement of an Engle progeny judgment. b. Represents the

Company's tobacco segment's settlement of a long-standing dispute

related to the Master Settlement Agreement. c. Represents Adjusted

Operating Income of Douglas Elliman Realty, LLC in the respective

2013 periods. On December 13, 2013, the Company increased its

ownership of Douglas Elliman Realty, LLC from 50% to 70.59%.

Consequently, after December 13, 2013, the Company consolidates the

operations and financial position of Douglas Elliman Realty in its

financial statements. The Company had previously accounted for its

interest in Douglas Elliman under the equity method and operating

income from Douglas Elliman Realty, LLC was not included in the

Company's operating income. d. Amounts represent one-time purchase

accounting adjustments to fair value for assets acquired in

connection with the increase of the Company's ownership of Douglas

Elliman Realty, LLC on December 13, 2013. e. Does not include a

reduction for 29.41% non-controlling interest in Douglas Elliman

Realty, LLC.

TABLE 6

VECTOR GROUP LTD. AND

SUBSIDIARIES

RECONCILIATION OF TOBACCO ADJUSTED

OPERATING INCOME

(Unaudited)

(Dollars in

Thousands)

Three Months Ended Twelve Months Ended December 31, December 31,

2014 2013 2014 2013

Operating income from tobacco business $ 51,724 $

49,999 $ 199,119 $ 113,039 Litigation settlement and

judgment expense (a) 750 193 2,475 88,106 Impact of MSA Settlement

(b) — (860 ) (1,419 ) (11,823 ) Total adjustments 750 (667 )

1,056 76,283 Tobacco Adjusted Operating Income $ 52,474

$ 49,332 $ 200,175 $ 189,322 a.

Represents accruals for settlements of judgments in the

Engle progeny tobacco litigation. b. Represents the Company's

tobacco segment's settlement of a long-standing dispute related to

the Master Settlement Agreement.

TABLE 7

VECTOR GROUP LTD. AND

SUBSIDIARIES

ANALYSIS OF NEW VALLEY LLC PRO-FORMA

ADJUSTED REVENUES

(Unaudited)

(Dollars in

Thousands)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013

New Valley LLC revenues $ 146,187 $ 46,282 $ 561,467

$ 65,580

Reclassification of revenues as a result

of the consolidation ofDouglas Elliman (a)

— 100,732 — 416,453 Purchase accounting adjustments (b) 85

1,357 1,768 1,357 Total adjustments 85 102,089 1,768

417,810 New Valley LLC Pro-forma Adjusted Revenues (c) $

146,272 $ 148,371 $ 563,235 $ 483,390

a. Represents revenues of Douglas Elliman Realty, LLC for

the respective three month periods. For the last twelve months

ended June 30, 2014, represents revenues of Douglas Elliman Realty,

LLC from July 1, 2013 to December 13, 2013. For the year ended

December 31, 2013, represents revenues of Douglas Elliman Realty,

LLC for the period from January 1, 2013 to December 13, 2013. On

December 13, 2013, the Company increased its ownership of Douglas

Elliman Realty, LLC from 50% to 70.59%. Consequently, after

December 13, 2013, the Company consolidates the operations and

financial position of Douglas Elliman Realty, LLC in its financial

statements. The Company had previously accounted for its interest

in Douglas Elliman Realty, LLC under the equity method and revenues

from Douglas Elliman Realty, LLC were not included in the Company's

revenues. b. Amounts represent one-time purchase accounting

adjustments to fair value for deferred revenues recorded in

connection with the increase of the Company's ownership of Douglas

Elliman Realty, LLC on December 13, 2013. c. Includes Pro-forma

Adjusted Revenues from Douglas Elliman Realty, LLC of $144,564,

$125,820, $543,230, and $456,909 for the three months and years

ended December 31, 2014 and 2013, respectively.

TABLE 8

VECTOR GROUP LTD. AND

SUBSIDIARIES

COMPUTATION OF NEW VALLEY LLC PRO-FORMA

ADJUSTED EBITDA

(Unaudited)

(Dollars in

Thousands)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013

Net income attributed to Vector Group Ltd. from subsidiary

non-guarantors (a) $ 3,759 $ 50,286 $ 21,420 $ 59,422 Interest

expense (a) 1 4 41 14 Income tax expense (a) 2,008 34,394 17,428

40,740 Net income (loss) attributed to non-controlling interest (a)

1,377 (252 ) 12,258 (252 ) Depreciation and amortization 2,495

1,981 12,204 2,421 EBITDA $ 9,640 $

86,413 $ 63,351 $ 102,345 Income from non-guarantors other than New

Valley 7 36 93 131 Equity income from real estate ventures (b)

(1,101 ) (6,151 ) (4,103 ) (22,925 ) Gain on acquisition of Douglas

Elliman — (60,842 ) — (60,842 ) Reclassification of EBITDA as a

result of the consolidation of Douglas Elliman (c) — 13,804 —

46,640 Purchase accounting adjustments 465 — 1,478 — Other, net

(489 ) (222 ) (4,786 ) (348 ) Pro-forma Adjusted EBITDA $ 8,522 $

33,038 $ 56,033 $ 65,001 Pro-forma Adjusted EBITDA attributed to

non-controlling interest (2,244 ) (4,060 ) (15,858 ) (13,717 )

Pro-forma Adjusted EBITDA attributed to New Valley LLC $ 6,278

$ 28,978 $ 40,175 $ 51,284

Pro-forma Adjusted EBITDA by Segment Real Estate (d) $ 8,447 $

32,983 $ 56,036 $ 64,866 Corporate and Other 75 55 (3

) 135 Total (f) $ 8,522 $ 33,038 $ 56,033

$ 65,001 Pro-forma Adjusted EBITDA Attributed

to New Valley LLC by Segment Real Estate (e) $ 6,203 $ 28,923 $

40,178 $ 51,149 Corporate and Other 74 55 (3 ) 135

Total (f) $ 6,277 $ 28,978 $ 40,175 $

51,284 a. Amounts are derived from Vector

Group Ltd.'s Consolidated Financial Statements. See Note entitled

"Vector Group Ltd.'s Condensed Consolidating Financial Information"

contained in Vector Group Ltd.'s Form 10-K for each respective

period. b. Represents equity income recognized from the Company's

investment in certain real estate businesses that are not

consolidated in its financial results.

c.

Represents EBITDA of Douglas Elliman Realty, LLC for all periods

prior to December 13, 2013. On December 13, 2013, the Company

increased its ownership of Douglas Elliman Realty, LLC from 50% to

70.59%. Consequently, after December 13, 2013, the Company

consolidates the operations and financial position of Douglas

Elliman Realty, LLC in its financial statements. The Company had

previously accounted for its interest in Douglas Elliman Realty,

LLC under the equity method, and operating income as well as

depreciation and amortization expense from Douglas Elliman Realty,

LLC, were not included in the Company's Adjusted EBITDA. d.

Includes Pro-forma Adjusted EBITDA for Douglas Elliman Realty, LLC

of $6,125, $13,169, $50,655 and $45,710 for the three months and

years ended December 31, 2014 and 2013, respectively. Amounts

reported in this footnote reflect 100% of Douglas Elliman Realty,

LLC's entire Pro-forma Adjusted EBITDA. e. Includes Pro-forma

Adjusted EBITDA for Douglas Elliman Realty, LLC less

non-controlling interest of $4,324, $9,297, $35,757 and $32,267 the

three months and years ended December 31, 2014 and 2013,

respectively. Amounts reported in this footnote have adjusted

Douglas Elliman Realty, LLC's Pro-forma Adjusted EBITDA for

non-controlling interest. f. New Valley's Pro-forma Adjusted EBITDA

does not include an allocation of Vector Group Ltd.'s "Corporate

and Other" segment's expenses of $1,593, $3,936, $10,408, and

$12,604 for t the three months and years ended December 31, 2014

and 2013, respectively.

TABLE 9

VECTOR GROUP LTD. AND

SUBSIDIARIES

ANALYSIS OF DOUGLAS ELLIMAN REALTY, LLC

PRO-FORMA ADJUSTED REVENUES

(Unaudited)

(Dollars in

Thousands)

Twelve Months Ended December 31, 2014 2013

Douglas Elliman Realty, LLC revenues $ 541,462

$ 436,935 Real estate brokerage revenues reclassified from

Vector Group Ltd. (a) — 18,617 Purchase accounting adjustments (b)

1,768 1,357 Total adjustments 1,768 19,974 Douglas

Elliman Realty, LLC Pro-forma Adjusted Revenues $ 543,230 $

456,909 a. Revenues from Douglas Elliman Florida,

LLC, which was a subsidiary of Vector from prior to January 1, 2013

to December 13, 2013 and acquired by Douglas Elliman Realty, LLC in

December 2013. b. Amounts represent one-time purchase accounting

adjustments to fair value for deferred revenues recorded in

connection with the increase of the Company's ownership of Douglas

Elliman Realty, LLC on December 13, 2013.

TABLE 10

VECTOR GROUP LTD. AND

SUBSIDIARIES

COMPUTATION OF DOUGLAS ELLIMAN REALTY,

LLC PRO-FORMA ADJUSTED EBITDA

(Unaudited)

(Dollars in

Thousands)

Twelve Months Ended December 31, 2014 2013

Net income attributed to Douglas Elliman Realty, LLC

$ 38,414 $ 38,095 Interest expense 38 18 Income tax expense

1,374 996 Depreciation and amortization 11,855 6,209

Douglas Elliman Realty, LLC EBITDA $ 51,681 $ 45,318 Equity income

from real estate ventures (a) (110 ) (57 ) Purchase accounting

adjustments 1,478 1,357 Income from Douglas Elliman Florida LLC —

(930 ) Other, net (2,394 ) 22 Douglas Elliman Realty, LLC

Pro-forma Adjusted EBITDA $ 50,655 $ 45,710 a.

Represents equity income recognized from the Company's

investment in certain real estate businesses that are not

consolidated in its financial results.

Sard Verbinnen & CoPaul Caminiti/Emily Deissler/Benjamin

Spicehandler/Spencer Waybright212-687-8080orVector Group Ltd.J.

Bryant Kirkland III305-579-8000

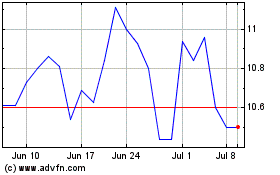

Vector (NYSE:VGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

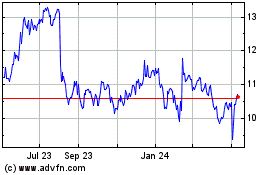

Vector (NYSE:VGR)

Historical Stock Chart

From Apr 2023 to Apr 2024