Cost Of Cotton May Lead Apparel Companies To Raise Prices

September 29 2010 - 3:31PM

Dow Jones News

Cotton's march past $1 a pound will prompt many apparel makers

and retailers to mitigate the extra manufacturing cost with price

increases, despite continuing signs of belt-tightening among

consumers.

Price increases are a "tool everyone will implement," said

Kenneth Stumphauzer, a Sterne, Agee & Leach analyst.

Uncooperative weather in key cotton-producing regions has

squeezed inventories since the beginning of the year. Prices rose

as cotton fields flooded in Pakistan, and heavy rains in China, the

world's No. 1 grower and importer, threatened planting acreage and

the harvest. Export quotas in India and Brazil only exacerbated the

supply issues.

Yet certain companies will be able to shoulder higher cotton

costs more easily than others.

Those, like Gildan Activewear Inc. (GIL, GIL.T) and Hanesbrands

Inc. (HBI), that manufacture such all-cotton products as socks,

T-shirts and underwear will have less wiggle room in their cost

structures. Others, like VF Corp. (VFC) and Warnaco Group Inc.

(WRC), manufacture clothing with man-made fiber and cotton blends

and may not face the same pressures.

For Gildan, whose signature products include blank cotton

T-shirts, the commodity is a larger component of costs than it is

for some of its peers. When cotton hovered around 65 cents a pound,

it represented about a third of Gildan's cost of goods sold, Chief

Financial Officer Laurence Sellyn said. As cotton prices rise, that

portion will increase.

The company raised prices through its wholesale channel in July

and again in September, a cumulative bump of about 6%. Sellyn

confirmed that price increases in the second half of fiscal 2011

are "realistic" if cotton stays at current levels.

Still, Gildan may be better poised to handle cost increases due

to its lower overhead for labor. The company has manufacturing

sites in Central America and the Caribbean basin, which helps it

duck the panoply of woes facing Asian manufacturers: currency and

wage increases, labor shortages and high transportation costs,

among others.

Moreover, Gildan has locked in cotton prices six to nine months

in advance, so its costs don't reflect current cotton prices. The

company set prices for the upcoming December quarter at just below

80 cents a pound, and targets March-quarter prices in the low- to

mid-80-cent range.

As for Hanesbrands Inc. (HBI), cotton makes up a little more

than 10% of its cost of goods sold and contributes to about 7% to

8% of sales, according to Sterne, Agee's Stumphauzer. The company

will have to implement a price increase of 2% to 3% to offset the

rising cost of cotton, he said, and won't get pushback from

retailers.

The company wasn't immediately available for comment but in July

said that, due to high cotton, energy and labor costs, it would

raise prices in the third and fourth quarters of 2010, with the

majority of price boosts beginning in 2011.

On the retail side, Abercrombie & Fitch Co. (ANF) may not be

able to deal with price increases as gracefully as others. Its

eventual concession to mark down clothing was a boon for sales in

the recession, so reverting to higher prices won't likely be the

company's impulse fix-it for high cotton costs. Still, cost cuts

over the past year may help.

Given Abercrombie's "clout," it likely won't use cheaper fabrics

and therefore risk quality, said Robert Samuels, an analyst at

Phoenix Partners Group.

The coup de grace could be cotton prices' eventual reversion

back to the mean, with near-term prices possibly returning to a

low-90-cent range. High prices in September are "extraordinarily

rare literally right in front of the harvest," said Sharon Johnson,

a cotton analyst at First Capitol Group in Atlanta. With about

747,000 bales picked and ginned, U.S. production is already about

two to three times higher than in the three previous years, and a

month from now supply will look "very, very different," said

Johnson.

-By Rachel Rosenthal, Dow Jones Newswires; 212-416-2263;

rachel.rosenthal@dowjones.com

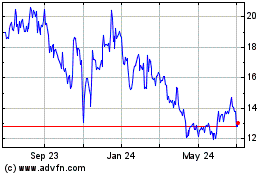

VF (NYSE:VFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

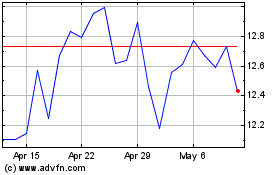

VF (NYSE:VFC)

Historical Stock Chart

From Apr 2023 to Apr 2024