Report of Foreign Issuer (6-k)

November 28 2016 - 4:48PM

Edgar (US Regulatory)

United

States

Securities and

Exchange Commission

Washington, D.C.

20549

FORM 6-K

Report

of Foreign Private Issuer

Pursuant to Rule

13a-16 or 15d-16

of

the

Securities

Exchange Act of 1934

For

the month of

November

2016

Vale S.A.

Avenida das

Américas, No. 700 – Bloco 8, Sala 218

22640-100 Rio de

Janeiro, RJ, Brazil

(Address of principal executive

office)

(Indicate by check

mark whether the registrant files or will file annual reports under

cover of Form 20-F or Form 40-F.)

(Check

One) Form 20-F

☒

Form 40-F ☐

(Indicate by check

mark if the registrant is submitting the Form 6-K in

paper

as permitted by

Regulation S-T Rule 101(b)(1))

(Check

One) Yes

☐

No

☒

(Indicate by check

mark if the registrant is submitting the Form 6-K in

paper

as permitted by

Regulation S-T Rule 101(b)(7))

(Check

One) Yes

☐

No

☒

(Indicate by check

mark whether the registrant by furnishing the information contained

in this Form is also thereby furnishing information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.)

(Check

One) Yes

☐

No

☒

(If

“Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b).

82-

.)

Vale approves payment of shareholder

remuneration

Rio de Janeiro, November 28

th

,

2016 – Vale S.A. (Vale) informs that its Executive Board

proposed and its Board of Directors approved the payment of

shareholder remuneration as an anticipation of the mandatory

distribution of 2016 results, totaling the gross amount of R$

856,975,000.00 (US$ 250 million), equals to R$ 0.166293936 (US$

0.048511898) per common or preferred share in circulation as of

November 25

th

,

2016 (5,153,374,926 shares).

The payment of R$ 856,975,000.00 will be made as of December

16

th

,

2016, fully in the form of interest on equity. The values in

Brazilian reais were obtained from the conversion of US dollar

value into Brazillian reais using the exchange rate for the sale of

US dollar (Ptax - Option 5 code), as informed by the Central Bank

of Brazil on November 25

th

,

2016 of R$ 3.4279 per US dollar.

The record date for the owners of shares traded on the BM&F

Bovespa is December 1

st

,

2016. The record date for the holders of American Depositary

Receipts (ADRs) traded on the New York Stock Exchange (NYSE) and

Euronext Paris is on December 6

th

,

2016. All shareholders on these respective record dates will have

the right to shareholder remuneration.

The holders of ADRs will receive the payment through Citibank N.A.,

the depositary agent for the ADRs, on December

23

rd

,

2016.

Vale shares will start trading ex-dividend on BM&FBovespa, NYSE

and Euronext Paris as of December 2

nd

,

2016.

The approval is in accordance with the new shareholder remuneration

policy that gives the optionality to the Executive Board to propose

to the Board of Directors, based on the analysis of the

Company’s cash flows and the availability of profits or

reserves of profits, distribution to shareholders of remuneration

at any time of the year.

The improved outlook for our business and the better than expected

cash flow generation supports the approved payment without

compromising the goal of reducing indebtedness.

For

further information, please contact:

+55-21-3485-3900

Andre

Figueiredo: andre.figueiredo@vale.com

Carla Albano Miller:

carla.albano@vale.com

Fernando Mascarenhas:

fernando.mascarenhas@vale.com

Andrea Gutman:

andrea.gutman@vale.com

Bruno Siqueira:

bruno.siqueira@vale.com

Claudia Rodrigues:

claudia.rodrigues@vale.com

Denise Caruncho:

denise.caruncho@vale.com

Mariano Szachtman:

mariano.szachtman@vale.com

Renata Capanema:

renata.capanema@vale.com

This press

release may include statements that present Vale’s

expectations about future events or results. All statements, when

based upon expectations about the future, involve various risks and

uncertainties. Vale cannot guarantee that such statements will

prove correct. These risks and uncertainties include factors

related to the following: (a) the countries where we operate,

especially Brazil and Canada; (b) the global economy; (c) the

capital markets; (d) the mining and metals prices and their

dependence on global industrial production, which is cyclical by

nature; and (e) global competition in the markets in which Vale

operates. To obtain further information on factors that may lead to

results different from those forecast by Vale, please consult the

reports Vale files with the U.S. Securities and Exchange Commission

(SEC), the Brazilian Comissão de Valores Mobiliários

(CVM), and the French Autorité des Marchés Financiers

(AMF), and in particular the factors discussed under

“Forward-Looking Statements” and “Risk

Factors” in Vale’s annual report on Form

20-F.

Signatures

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

|

|

|

|

|

Date

November 28,

2016

|

By:

|

/s/

André

Figueiredo

|

|

|

|

|

Director of

Investor Relations

|

|

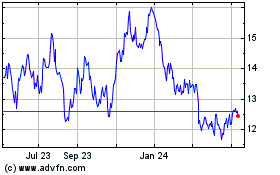

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

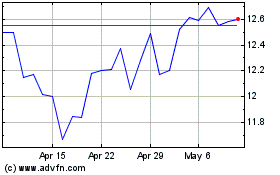

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024