Report of Foreign Issuer (6-k)

September 02 2016 - 2:09PM

Edgar (US Regulatory)

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

September 2016

Vale S.A.

Avenida das Américas, No. 700 — Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F

x

Form 40-F

o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes

o

No

x

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes

o

No

x

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(Check One) Yes

o

No

x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

X

|

|

XVI Analyst & Investor Tour The comeback of a leader

|

|

|

2 This presentation may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM), and the French Autorité des Marchés Financiers (AMF), and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F. Disclaimer

|

|

|

3 1. Market outlook 2. Ferrous minerals competitiveness 3. Closing remarks 4. Q&A session Agenda

|

|

|

4 Market outlook Peter Poppinga

|

|

|

5 Credit easing and public FAI have helped kick-start the property market Monthly overall credit Fixed Asset Investment Share in GDP %y/y 3mma with seasonal adjustment Growth, %y/y 3 mma Total Infrastructure Real Estate Industry Local Government Bonds Corporate bonds 50 25 40 20 30 15 20 10 10 5 0 0 -10 -5 Jan-15Apr-15 Jul-15 Oct-15Jan-16Apr-16 Jul-16 Jan-15Apr-15 Jul-15 Oct-15Jan-16Apr-16 Jul-16 The expansion of credit in China with the record issuance of local government bonds and RMB loans to households, primarily composed of mortgage loans, helped to support FAI recovery Credit helped to boost the Real Estate market and to keep the growth of infrastructure investments, thus positively impacting steel demand Sources: UBS and CEIC Off-balance sheet credit RMB & FX loans Overall credit

|

|

|

6 Property has responded to government stimulus and should continue stable, as a result of the inventory reduction Property sales and new construction Property inventory in China % y/y, 3 mma Months of sales T1 Cities T2 Cities T3 Cities Property sales Property new starts 50 35 g 40 30 30 25 20 20 10 0 15 -10 10 -20 5 -30 -40 0 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Source: UBS, WIND Stock in Tier 3 continues droppin

|

|

|

7 The surge in demand boosted steel prices and margins, thus motivating mills to increase steel production Steel price in China Profitability and utlization of Chinese steel mills RMB/ton % Blast Furnace Operating Rate % of steel mills making profits (RHS) Rebar spot Tangshan Billet 97% 90% 3,500 75% 92% 3,000 60% 87% 2,500 45% 82% 2,000 30% 77% 1,500 15% 72% 0% 1,000 Source: CISA, Mysteel Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Utilization rate Aug-13 Dec-13 May-14 Sep-14 Feb-15 Jun-15 Nov-15 Mar-16 Aug-16 Share of profitable mills

|

|

|

8 Steel inventory throughout the supply chain is at a low level, despite the increase in steel production Steel inventory held by mills Steel trader inventory Mt Mt CISA mill inventory 24 19 12 22 11 17 20 10 15 18 9 16 13 8 14 11 7 12 9 6 10 8 7 5 Jan Apr Jul Oct Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Stock at mills is still at a healthy/low level Stock at traders dropped responding to good demand and steel prices, but it is expected to increase, as traders restock ahead of seasonal peak in construction Source: CISA, Mysteel CISA mill inventory, mt Days of prod'n 2013 2014 2015 2016 (mt)

|

|

|

9 The total iron ore stock remained stable throughout the chain, despite the increase in port inventories Iron ore inventory throughout the supply chain Iron ore inventory throughout the supply chain Million tons Days of consumption Mill owned stock Trader stock Domestic mines stock Mill owned stock Trader stock Domestic mines stock Average 160 60 140 50 120 40 100 80 30 60 20 40 10 20 0 0 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 Total stock level measured in million tons has been stable since 4Q15 Stock level measured by days of consumption has decreased as steel production picked-up in 2Q16 Source: Vale Market Intel

|

|

|

10 On the supply side, Chinese domestic concentrate in 2016 is expected to drop ~20% vs. 2015 based on seaborne ore competitiveness Domestic Iron ore concentrate production1 Highlights Million tons • Vale estimates a reduction of 44 Mt of Chinese domestic production in 2016 vs. 2015 -22% - More than 50% of the expected reduction will occur at the coastal provinces, mostly in Hebei (14 Mt) and Liaoning (9 Mt) 201 - The remaining expected reduction will occur in the inland provinces, mostly in Sichuan (4 Mt), Anhui (3 Mt), Inner Mongolia (3 Mt) and Shanxi (2 Mt) • A reduction of 26 Mt2 already occurred in 1H16 vs. 1H15, supporting Vale’s estimate for the annual reduction 2015 2016E 1 62% Fe wmt 2 Reduction of 26Mt estimated based on the balance of steel production, seaborne imports and iron ore inventories Source: Vale Market Intel 157

|

|

|

11 Looking ahead, the expectations for Chinese steel production improved, potentially absorbing additional iron ore supply Seaborne1 & Chinese iron ore supply Crude steel production Mt Mt Ex-China crude steel production Chinese crude steel production Chinese Domestic Production Iron Ore Seaborne Trade 1,742 1,734 1,729 1,709 1,676 1,685 1,659 1,631 1,637 1,610 1,623 1,612 2015 2016E 2017E 2018E 2019E 2020E 2015 2016E 2017E 2018E 2019E 2020E 1 Seaborne market, including pellets. Source: World Steel Association and Vale. 899 878 855 819 836 816 807 810 804 804 796 801 135 122 120 149 157 201

|

|

|

12 Maintaining the current balance of supply and demand Iron ore supply/demand balance expected for 2017 Supply change in iron ore seaborne market, 2017 Mt Mt Percentage of seaborne and Chinese supply Net addition in the seaborne market Australia 48 18 Change in Chinese domestic supply Brazil -8 28 40 India Total change 4 Change in global demand1 Others -12 -2 Potential oversupply 1.7% 28 48 Total 1 It also accounts for change in stock between production and consumption of Chinese concentrate. In 2017 increase of pig iron production expected of ~1.5%. Source: Vale’s Market Intelligence

|

|

|

13 Ferrous minerals competitiveness Peter Poppinga

|

|

|

14 Ferrous Minerals competitiveness Operational overview Future developments •Ferrous minerals overview •Vale Day commitment accomplishment •Key initiatives for further enhancing competitiveness •Expected outcome

|

|

|

15 Ferrous Minerals competitiveness Operational overview Future developments •Ferrous minerals overview •Vale Day commitment accomplishment •Key initiatives for further enhancing competitiveness •Expected outcome

|

|

|

16 Sustainability is a major factor in Vale’s company and business decisions Health and Safety1 Environment1 Local development2 Safety management 21% reduction in the number of accidents Water resources 85% of recycle and reuse in the process Social and environmental investment US$ 800 million of funds invested Risk management 17% reduction in the number of incidents with Atmospheric emissions 19% reduction in particulate emissions in pelletizing plants Favoring local regions Increase of 8% in local purchases, totaling 72% high potential impact 1 Values of Ferrous Minerals business segment, 2015 vs. 2014 2 Values for Vale

|

|

|

17 Vale’s integrated supply chain offers operational flexibility to maximize margins 22 mines in 4 integrated production systems 12 pelletizing plants (Brazil and Oman) 2 DCs and 5 blending ports and 124 ships (90% chartered) 3 railways and 4 ports in Brazil

|

|

|

18 Current mineral reserves sustain 2020’s production level for more than 30 years Iron ore reserves, proven and probable1, in billion tons 17.5 5.5 5.0 Southeastern Southern Northern Total ¹ Tonnages are stated as of December 2015 and in billions of metric wet tons of run-of-mine. Moisture contents stated in Vale 20F Form. Source: Vale’s 20F Form 6.9

|

|

|

19 Vale has a lower depletion rate than its main peers, needing lower replacement capex in the future project Vale will not invest in replacement projects until 2022 and has enough brownfield options to replace its production, with the lowest capital intensity of the industry ¹ Considering production volumes of 2016 ² Absolute capital disbursement to implement the projects ³ Only in 2022 Source: Vale internal data and JP Morgan report Company Depletion (Mt) 5-7yr view Proportion of production¹ Replacement capex estimate² (US$ billion) Type of Vale 14³ 4% 0.3 - 0.4 Brownfield Peer 1 50 15% 2.0 - 3.5 Greenfield Peer 2 80 31% 1.6 - 3.2 Brownfield Peer 3 25 15% 1.0 - 1.5 Greenfield Total 169 15% 4.9 - 8.6

|

|

|

20 Vale progressed significantly on the 5 key initiatives presented at its 2015 Vale Day Ramp-up of N4WS, N5S extension and construction of S11D 1 2 Further reduction of all-in costs landed in China Broadening of the “Brazilian Blend Fines” commercial opportunities 3 Blending and investment deferral 4 5 Management of capacity to maximize margins

|

|

|

21 Vale’s initiatives boosted Ferrous Minerals EBITDA by US$ 2.1 billion in 1H16 vs. 1H14, partly offsetting lower prices Ferrous Minerals EBITDA 1H14 X 1H16, US$ million 7,208 7,836 US$ 2.1 bi 698 1,068 641 72 3,873 1,057 784 1,607 EBITDA 1H14 Price FX Bunker Commercial initiatives Volume CFR Freight Sales 1 Cost saving initiatives Others EBITDA 1H16 1 Volume impact of higher CFR sales

|

|

|

22 Costs reduced significantly with the ramp-up of new mines and productivity gains and will decrease further with the start-up of S11D 1 2 Northern system production cost1 S11D mine and plant physical progress 3 R$ / t % 4 5 -10% 92 37.8 78 1H15 1H16 Oct 31, 2015 Dec 31, 2015 Jul 31, 2016 1 Includes mine, railway and the discharge at port Commercial shipments expected to begin in January 2017 The ramp-up of N4WS and N5S extension mines improved the productivity at Carajás 33.9 80

|

|

|

23 Vale’s indicators improved, optimizing the operations and enhancing the cost reduction 1 2 Operational indicators evolution 1H16 vs. 2014, % 3 4 5 Operational efficiency at 1 Off-highway trucks 2 Mean-time between failures 3 Pelletizing: impact on operational efficiency of 1H16 due to stop at Fábrica plant and two lines at Oman Mine -32% Strip Ratio -1% Operational efficiency of OHT¹ +23% Operational rate of OHT¹ -3% Haulage distance +42% Reliability (MTBF²) of OHT¹ +14% Average speed of OHT¹ Processing Plant +6% Operational efficiency +3% Production rate at plant -8% Pellet plants³ Railway and Port 0% Locomotives productivity +7% Shipment rate

|

|

|

24 The iron ore fines and pellets cash breakeven1 on a landed in China basis were further reduced 1 2 Iron ore and pellets cash breakeven1 C1 cash cost2 in BRL 3 US$ / dmt R$ / t 4 5 Breakeven EBITDA Sustaining -15% -54% 65.6 54.5 4Q14 4Q15 2Q16 4Q14 4Q15 2Q16 1 Including sustaining investment 2 C1 cash cost at the port (mine, plant, railroad and port) C1 cash cost2 reduction goes beyond the exchange rate variation Management of freight portfolio was the main contributor for the cash breakeven reduction -2% 47.046.1 -8% 33.030.3 55.2 30.9 28.5

|

|

|

25 Vale is adjusting quality and blending capabilities to maximize premiums, thus shaping its supply to any market scenario 1 2 Product premiums and discounts evolution¹ Sales volumes of Brazilian Blend Fines 3 Million tons US$/t 4 5 IOCJ 16 12 8 4 0 -4 -8 -12 -16 +90% 17 2H15 1H16 perceived value as market dynamics² changes 1 Relative to the 62% Fe reference 2 Better steel margins and higher coal prices driving the need for higher productivity at the blast furnaces Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 IOCJ premium recent increase reflects its The off-shore blending capacity is expected to increase, bringing more flexibility to the integrated supply chain 9 BRBF premium 58% Fe LAPS discount 58% Fe MB

|

|

|

26 Vale has been adjusting its production to market conditions in order to maximize margins 1 2 Iron ore production guidance for 2016 Iron ore production guidance for 2017 3 Million tons Million tons 4 5 Production range Production range 411 380 - 400 376 2014 Vale Day guidance 2015 Vale Day guidance Current guidance 2014 Vale Day guidance 2015 Vale Day guidance Current guidance 340 - 350Lower range of 340-350 Lower than 380

|

|

|

27 These productivity and cost reduction efforts have placed the company in a new competitive position Iron ore and pellets cash breakeven landed in China1 , US$/dmt C1 costs Freight and Distribution Others² Sustaining 2014 2015 +33% 71.2 38.0 34.1 32.1 Peer 1 Peer 2 Vale Peer 3 Peer 1 Peer 2Vale Peer 3 1 Considers: [Cash cost + Royalties + freight + distribution + expenses (SG&A + R&D + pre-operating and stoppage expenses) + moisture, adjusted for quality and pellets premiums, + sustaining investments] / [iron ore sales volume (ex ROM and third parties)] 2 Includes royalties, expenses, moisture, quality and pellets adjustments +18% 41.4 15.9 3.4 4.9 7.1 3.5 16.0 12.9 11.3 5.4 5.9 5.2 20.1 16.1 14.9 14.9 63.1 4.2 26.5 51.5 47.5 8.6 10.9 5.4 5.8 14.7 22.6 12.3 8.7 8.3 31.8 9.9 23.0 20.9 19.5 1H16 Peer 1 Peer 2ValePeer 3 +8% 28.530.030.731.0 4.3 11.3 3.3 7.1 12.2 6.6 4.0 4.3 3.7 14.3 14.9 14.5 12.8

|

|

|

28 Making Vale the company with the highest EBITDA generation in the iron ore business in 1H16 Iron ore – EBITDA¹, US$ billion Vale Peer 1 Peer 2 Peer 3 Platts IODEX iron ore price average (US$/t) 8.1 6.2 6.1 4.8 4.1 3.9 3.7 3.4 2.8 1.9 1H14 2H14 1H15 2H15 1H16 111.5 50.7 52.1 82.4 60.4 ¹ Underlying EBITDA of iron ore, pellets, ROM and other ferrous for Vale’s figures. Source: Financial reports of Vale and Peers 7.2 4.1 2.4 2.8 3.5 3.1 2.7 1.41.3 1.1

|

|

|

29 As a result of all the initiatives, Vale’s iron ore operations delivered a consistent improvement Iron ore – EBITDA¹ per ton, US$/t Vale Peer 1 Peer 2 Peer 3 Gap to most 21.2 18.3 67.9 13.9 1H14 2H14 1H15 2H15 1H16 1 Underlying EBITDA of iron ore, pellets, ROM and other ferrous for Vale’s figures. Source: Financial reports of Vale and Peers 49.6 62.7competitive peer, US$/t 7.0 45.2 45.01.1 35.1 31.3 31.9 24.0 17.818.0 23.9 24.524.3 24.0 25.4 22.2 17.5 15.7 13.2

|

|

|

30 Ferrous Minerals competitiveness Operational overview Future developments •Ferrous minerals overview •Vale Day commitment accomplishment •Key initiatives for further enhancing competitiveness •Expected outcome

|

|

|

31 Vale will deliver on 5 key initiatives to remain competitive in a sustainable way in any price scenario Increase operational efficiency thus further reducing costs 1 2 Enhance price realization Optimize its integrated global supply chain 3 Review mine and production plan, increasing the proportion of dry processing 4 5 Ramp up successfully the S11D project

|

|

|

32 Initiatives are underway to increase operational efficiency and productivity, to reduce costs and to extend life cycle of equipment 1 2 Impact on: C1 cash cost Sustaining capex Freight and Distribution costs 3 4 5 Testing/Concept Implementation of system to schedule operations Semi-automation of locomotives Reduction of strip ratio Optimization of truck fleet Replacement of trucks by conveyor belts Increase of life cycle of mine’s equipment Under development Recovery of hematite from tailings Implemented/Ongoing Automation of mineoptimize the vessel fleet

|

|

|

33 The impact of these initiatives will be tracked by key performance indicators 1 2 3 4 5 + / / + 1 Strip ratio: (waste / ROM) Port (USD / t) Railway (USD / t) Metallic recovery (%) Plant (USD / t) Strip ratio1 + 1 (waste + ROM / ROM) C1 cash cost (USD / t) Mass recovery (t prod / t ROM) Global recovery (t prod / waste + ROM) Others (USD / t) Mine (USD / t) Personnel (USD / t) Cost per ton moved (USD / t) Maintenance (USD / t) Diesel (trucks) (USD / t)

|

|

|

34 Those indicators are expected to further improve, thus enhancing Vale’s competitive position 1 2 Global Recovery Rate Metallic recovery 3 % % 4 5 Vale Peer 1 Peer 2 Peer 3 Vale Peer 1 Peer 2 Peer 3 50 35 45 30 40 25 35 20 30 25 15 2014 2015 1H16 2018 2014 2015 1H16 2018 Source: Vale, Woodmac, Peers reports

|

|

|

35 Growing share in new markets and portfolio management in mature ones will absorb the production growth with improved price realization 1 2 3 Initiatives 4 5 • Develop the option to sell in RMB from distribution centers in China, increasing capillarity into smaller plants • Adjust pellet product portfolio to market demand and analyze the resumption of Tubarão Plants 1 and 2 • Increase of CFR sales • Explore market opportunities through the optionality of blending • Capture premiums for Alumina content • Grow presence on iron ore spot sales • Leverage geographical advantage in natural markets

|

|

|

36 Supply chain integration allows flexibility and its continuous optimization will bring further margin improvements 1 2 3 4 Benefits 5 • Productivity improvement in Brazil operations, as the quality of final product is adjusted downstream • Freight reductions as a result of the increase of Valemax full discharge in China and the increase of vessels discharging at a single port • Vessel speed, utilization and productivity optimization positively impacting bunker consumption, freight and queues at ports Southeastern System • Management of the entire supply chain, allowing further cost reduction opportunities

|

|

|

37 Other initiatives aim to reduce Vale’s geographic disadvantage 1 2 3 4 5 • Increase spot and short tem chartering, taking advantage of the current low freight market rate Ongoing • Renew old contracts at competitive rates, as they expire • Cease operations of FTS (Floating Transfer Stations) in the Philippines • Start the operations of 30 new chartered Valemax to be delivered in 2018-2020 term - US$2.5/t lower freight rate1 - 20% more efficient in bunker consumption • Manage freight portfolio, adjusting the volumes of spot chartering and short term Contracts of Afreightement (COAs) according to market conditions • Contract freight at competitive levels via new eco-type VLOCs and additional 2nd generation Valemaxes 1 Based on the freight basis, excludes possible bunker oil fluctuations. initiative Medium Long s /

|

|

|

38 Vale will increase the proportion integrated supply chain of dry processing through its 1 2 3 4 5 Iron ore production breakdown Impacts • Avoids major capex to adapt the plants, as the new process will use two phases of the existing concentration plants (crushing and screening) Dry processing Wet processing • Enables a revision of the mine plan, with lower production costs and flexibility to adjust product quality • Decreases water use, thus reducing the need for future tailing dams • Reduces and postpones future sustaining investments 2016 2022E • Increases the life of mines, thus postponing replacement investments 30% 60% 70% 40%

|

|

|

39 Operational flexibility also allows a review of Vale’s mine plan 1 2 Impacts vs. previous mine plan Fe Content 3 % 66.5 4 5 • Lower production costs 66.0 • Postponement of replacement investments 65.5 • Adjustment of quality according to market - Volumes of lower quality ore from Southern and Southeastern systems higher than previous plan 65.0 64.5 - Volumes of higher quality ore from Carajás same as previous plan 64.0 • Increase of blending capacity allowing dynamic management of final product quality, according to market conditions 63.5 63.0 2008 2010 2012 2014 2016 2018 2020 2022 2024 Real / New projection 2015 Plan

|

|

|

40 Vale will continue to maintain discipline in capital concentrating mostly on sustaining investment Ferrous business segment capital expenditures, US$ billion allocation 1 2 Colunas1 3 Sustaining Others¹ S11D Sustaining per ton 4 5 -85% 8.5 2011 2015 2022E <3.0 3.8 10.1 1 Includes growth and replacement projects 2.2 4.9 5.3 1.1 1.3 – 1.7 0.9 3.0 1.0 – 1.3 1.0 0.3 – 0.4

|

|

|

41 S11D hot commissioning is on track with first commercial ore due to be shipped in January 2017 1 2 S11D Mine – Excavation, crushing and conveyor S11D – Hot commissioning on truckless system 3 4 5 S11D Plant S11D Port – Test berthing vessels

|

|

|

42 S11D will System Mtpy increase full-year logistics capacity in the Northern 1 2 3 4 5 230 1 1 1 1 2016E 2017E 2018E 2019E 2020E 1 Estimates may change until completion of current planning cycle and are subject to Board’s approval 218 206 175 153

|

|

|

43 Vale will maintain its competitiveness future in iron ore and pellets in the Iron ore and pellets cash margin in the future, US$/dmt 25 45 - 60 Iron ore price Iron ore and pellets cash break-even¹ Cash margin 1 Iron ore and pellets cash break-even on a landed-in-China basis considers: [Cash cost + Royalties + freight + distribution + expenses (SG&A + R&D + pre-operating and stoppage expenses) + moisture, adjusted for quality and pellets premiums, + sustaining investment] / [iron ore sales volume (ex ROM)]. 20 - 35

|

|

|

44 Closing remarks Luciano Siani Pires

|

|

|

45 Vale’s focus and managerial discipline allowed a substantial reduction in costs and expenses, despite the increase in volumes Costs¹ Expenses1,2 US$ billion US$ billion -80% -31% 22.7 6.9 21.2 20.5 17.0 15.6 – 15.8 4.5 3 3.5 4 1.9 1.3 – 1.4 5 5 2012 2013 2014 2015 2016E 2012 2013 2014 2015 2016E 1 Net of depreciation and amortization. 2 Includes SG&A, R&D, Pre-operating and stoppage and other expenses. Does not include gain/loss on sale of assets. 3 Positive impact of US$ 244 million from the goldstream transaction in 1Q13. 4 Positive impacts of US$ 230 million from the goldstream transaction in 1Q15 and US$ 331 million of Asset Retirement Obligations - ARO). 5 FX Rate of BRL/USD 3.30 for 2H16 on average, includes the positive impact of the goldstream transaction in 3Q16 in expenses.

|

|

|

46 Stabilized prices and continuous cost discipline boosted Vale’s EBITDA1 in Adjusted US$ billion 2016 LME Cash Nominal Nickel Prices (US$/t) Platts IODEX Iron Ore Price Average (US$/t) Adjusted EBITDA 17,188 16,554 13,698 111.5 10,500 10,005 82.3 8,661 60.5 8.2 50.8 50 – 55 51.9 5.2 4.5 – 5.4 4.4 3.8 3.3 1H14 2H14 1H15 2H15 1H16 2H16E² 2014 2015 2016 1 Adjusted EBITDA excludes gains and/or losses on sales of assets and non-recurring expenses and includes dividends received from non-consolidated affiliates. 2 FX Rate BRL/USD of 3.30 average in 2H16, nickel prices of US$ 10,500/t and copper prices of US$ 4,750/t.

|

|

|

47 Vale increased its discipline in capital allocation with significant reduction in Capex, US$ billion capital expenditures Sustaining Growth Projects 16.3 16.2 14.2 4.6 4.6 12.0 4.6 4.1 8.4 2.9 5.8 11.7 11.6 < 4.5 9.6 7.9 5.5 2011 2012 2013 2014 2015 2016E¹ 2017E 1 Considers exchange rate of BRL/USD 3.30 in 2H16.

|

|

|

48 Potential divestments and strategic transactions will help balance free cash flow and strengthen the balance sheet Divestments 2016-2017, US$ billion 5 - 7 Already concluded in 2016 Previously announced Potential transactions • • • • Coal JV Vessels Energy assets Fertilizers • Core assets 3 VLOCs Gold streaming 1.1 4 - 6

|

|

|

49 Vale will decrease its debt going forward, on track to reach the target of US$ Net Debt, US$ billion 15 - 17 billion of net debt 27.5 2015 year-end 2Q16 2016E year-end 2016E year-end 2017E without previously announced transactions with previously announced transactions 25.2 26 - 27 19 - 22 15 - 17

|

|

|

50 Vale expects to close the free cash flow¹ gap in 2016 FCF estimate for 2016 (before divestments), US$ billion 8.9 - 9.8 5.8 1.6 0.4 0.4 0.8 0.4 (0.4) - 0.5 Cash from operations 2016¹ CAPEX Interest payment Income tax REFIS Hedge bunker oil Others² FCF 1 For 2016, accumulated numbers up to July were used. For 2H16 FX Rate of 3.30 average in 2H16, nickel prices of US$ 10.500/t, copper prices of US$ 4.750/t and iron ore ranging from US$50/t to US$55/t. 2 Includes dividends related to MBR, interest paid on stockholders’ debentures and other loan costs.

|

|

|

51 Free cash flow¹ generation will be positive in the next years, adverse price scenarios even in FCF accumulated 2017-2020E (before divestments, dividends and debt amortization), US$ billion Iron ore price US$45/t Iron ore price US$60/t 27.5 – 28.0 5.9 – 6.1 Accumulated 2017-2020 Accumulated 2017-2020 dividends and/or debt 1 FCF before divestments, dividends and debt amortization. Assumes nickel prices of US$10,500/t in 2017, US$12,800/t in 2018, US$14,400/t in 2019 and US$15,500/t in 2020; copper prices of US$4,900/t in 2017, US$5,100/t in 2018, US$5,500/t in 2019 and US$6,000/t in 2020; bunker oil prices of US$302/t in 2017, US$366/t in 2018 and US$378/t in 2019 and 2020, exchange rate of BRL/US$ 3,37 from 2017 onwards. Marginal distribution of reduction High distribution of dividends and debt decreasing quickly

|

|

|

52 VALE

|

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ André Figueiredo

|

|

Date: September 02, 2016

|

|

Director of Investor Relations

|

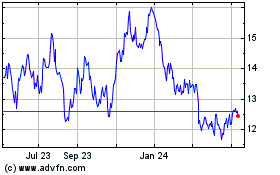

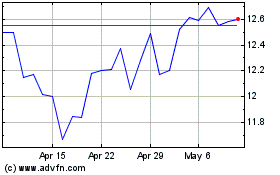

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024