Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

April 2015

Vale S.A.

Avenida Graça Aranha, No. 26

20030-900 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

|

(Check One) Form 20-F x |

|

Form 40-F o |

(Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1))

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

|

|

1Q15 ProductionReport |

Production Highlights

Rio de Janeiro, April 22, 2015 — Vale S.A. (Vale) production in 1Q15 was marked by a strong operational performance in iron ore of 74.5 Mt — excluding iron ore acquired from third parties and Samarco’s attributable production — achieving the best performance for a first quarter, in particular for Carajás, which produced 27.5 Mt and also reached a new record for a first quarter.

In December 2014, we started the operation of the N4WS mine which will not only lead to further production increases but will also lead to a reduction in strip ratios and in average haulage distances in Carajás. N4WS is part of the N4W ore body, a world-class asset, with 1.346 billion metric tons of proven and probable reserves and an average Fe content of 66.5%.

Excluding Samarco’s attributable production of 3.5 Mt, Vale’s pellet production reached 11.4 Mt in 1Q15, in line with 4Q14 and 1.5 Mt higher than in 1Q14 due to the ramp up of the Tubarão VIII pellet plant.

In 1Q15, we shut down our ferroalloys plants in Minas Gerais as existing energy contracts expired and higher energy prices impaired the economic viability of the plants. Consequently, the production of our manganese ore operations in Morro da Mina was affected.

Production of nickel reached 69,200 t in 1Q15, the best performance for a first quarter. The quarter was marked by a record in nickel oxide and total nickel production at Vale New Caledonia (VNC), a record production from a single-furnace at Onça Puma and the positive progress in the ramp-up at Long Harbour.

In 1Q15, copper output was 107,200 t(1), 1.6% and 21.1% higher than in 4Q14 and in 1Q14, respectively, reaching a historical production record.

Gold production amounted to 103,000 oz in 1Q15, 9.7% higher than in 4Q14, reaching the best performance ever, due to the ramp-up of Salobo.

Total coal output in 1Q15 was 1.7 Mt, 26.6% and 5.1% lower than in 4Q14 and 1Q14, respectively, due to the stoppage of the Integra Coal and Isaac Plains mines and an abnormal rainy season in Moatize.

(1) Including Lubambe’s attributable production.

Production Summary

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% change |

|

1Q15/1Q14

% change |

|

|

Iron ore(1) |

|

|

|

|

|

|

|

|

|

|

|

|

Own production |

|

74,523 |

|

82,973 |

|

71,064 |

|

-10.2 |

% |

4.9 |

% |

|

Third parties Purchases |

|

2,894 |

|

3,324 |

|

2,997 |

|

-12.9 |

% |

-3.4 |

% |

|

Total |

|

77,417 |

|

86,297 |

|

74,061 |

|

-10.3 |

% |

4.5 |

% |

|

Pellets(1) |

|

11,388 |

|

11,642 |

|

9,928 |

|

-2.2 |

% |

14.7 |

% |

|

Manganese |

|

592 |

|

723 |

|

470 |

|

-18.2 |

% |

25.9 |

% |

|

Coal |

|

1,695 |

|

2,310 |

|

1,785 |

|

-26.6 |

% |

-5.1 |

% |

|

Nickel |

|

69.2 |

|

73.6 |

|

67.5 |

|

-6.0 |

% |

2.5 |

% |

|

Copper(2) |

|

107.2 |

|

105.4 |

|

88.4 |

|

1.6 |

% |

21.1 |

% |

|

Potash |

|

108 |

|

147 |

|

109 |

|

-26.5 |

% |

-1.2 |

% |

|

Phosphate rock |

|

1,992 |

|

2,209 |

|

1,932 |

|

-9.8 |

% |

3.1 |

% |

(1) Excluding Samarco’s attributable production.

(2) Including Lubambe’s attributable production.

3

Table of Contents

Iron ore

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Northern System |

|

27,521 |

|

34,858 |

|

23,365 |

|

-21,0 |

% |

17,8 |

% |

|

Carajás |

|

27,521 |

|

34,858 |

|

23,365 |

|

-21,0 |

% |

17,8 |

% |

|

Southeastern System |

|

25,869 |

|

26,448 |

|

25,822 |

|

-2,2 |

% |

0,2 |

% |

|

Itabira |

|

7,305 |

|

9,628 |

|

7,827 |

|

-24,1 |

% |

-6,7 |

% |

|

Minas Centrais |

|

8,899 |

|

7,225 |

|

8,434 |

|

23,2 |

% |

5,5 |

% |

|

Mariana |

|

9,665 |

|

9,595 |

|

9,561 |

|

0,7 |

% |

1,1 |

% |

|

Southern System |

|

19,798 |

|

20,125 |

|

20,592 |

|

-1,6 |

% |

-3,9 |

% |

|

Paraopeba |

|

5,659 |

|

6,165 |

|

6,916 |

|

-8,2 |

% |

-18,2 |

% |

|

Vargem Grande |

|

5,888 |

|

6,159 |

|

5,474 |

|

-4,4 |

% |

7,6 |

% |

|

Minas Itabirito |

|

8,252 |

|

7,802 |

|

8,202 |

|

5,8 |

% |

0,6 |

% |

|

Midwestern System |

|

1,335 |

|

1,542 |

|

1,285 |

|

-13,4 |

% |

3,9 |

% |

|

Corumbá |

|

893 |

|

1,015 |

|

774 |

|

-12,0 |

% |

15,4 |

% |

|

Urucum |

|

442 |

|

527 |

|

511 |

|

-16,2 |

% |

-13,5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL IRON ORE |

|

74,523 |

|

82,973 |

|

71,064 |

|

-10,2 |

% |

4,9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Parties Purchase (TPP) |

|

2,894 |

|

3,324 |

|

2,997 |

|

-12.9 |

% |

-3.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL IRON ORE + TPP |

|

77,417 |

|

86,297 |

|

74,061 |

|

-10.3 |

% |

4.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Samarco(1) |

|

3,578 |

|

3,823 |

|

2,414 |

|

-6,4 |

% |

48,3 |

% |

(1) Vale’s attributable production capacity of 50%.

Production overview

Vale’s own iron ore production, excluding iron ore acquired from third parties and Samarco’s attributable production, reached a record for a first quarter of 74.5 Mt in 1Q15, 8.5 Mt lower than in 4Q14 due to the weather-related seasonality, but 3.5 Mt higher than in 1Q14.

Northern System

The production of 27.5 Mt in Carajás was the best performance ever for a first quarter, 4.2 Mt higher than in 1Q14 mostly due to ramp-ups of Plant 2 and Serra Leste. Output was 7.3 Mt lower than in 4Q14 as a result of the previously mentioned seasonally worse weather conditions.

In December 2014, we started the operation of the N4WS mine, mining and processing the first ore layer (“canga”) with 64.7% of Fe content and higher than normal phosphorus levels. In 2H15 we expect to be mining higher Fe content ores with lower contaminant levels.

Southeastern System

The Southeastern System, which encompasses the Itabira, Minas Centrais and Mariana mining hubs,

4

Table of Contents

produced 25.9 Mt in 1Q15, just 2.2% lower than in 4Q14 despite seasonality, and in line with 1Q14.

Production in the Itabira mining hub was 7.3 Mt, 2.3 Mt and 0.5 Mt lower than in 4Q14 and in 1Q14, respectively, as a result of the stoppage of Cauê´s existing operations for its connection with the new process stages of the Cauê Itabiritos project which shall start-up by the end of 2015.

Production in the Minas Centrais mining hub was 8.9 Mt in 1Q15, 23.2% and 5.5% higher than in 4Q14 and 1Q14, respectively, as a result of the recovery from the scheduled maintenance stoppage for the implementation of Brucutu´s 5th production line, carried out in 4Q14. Brucutu’s 5 th production line started up in January and will produce 4.9 Mt in 2015 compared with its nominal capacity of 6.5 Mt.

Output from the Mariana mining hub reached 9.7 Mt, in line with production in 4Q14 and in 1Q14.

Southern System

The Southern System, composed of the Paraopeba, Vargem Grande and Minas Itabirito mining hubs, produced 19.8 Mt in 1Q15, 1.6% and 3.9% lower than in 4Q14 and 1Q14, respectively. Output was down due to rain falls which affected the Vargem Grande mine and interrupted production at the Jangada plant.

Production at the Paraopeba mining hub was 8.2% and 18.2% lower than in 4Q14 and 1Q14, respectively, mostly due to the interruption of the Jangada plant. This production loss will be compensated by production in other mines without any impact on our target for the year.

Production at the Vargem Grande mining hub was 7.6% higher than in 1Q14, but 4.4% lower than in 4Q14 due to strong rainfalls in 1Q15.

Production at the Minas Itabirito mining hub was 5.8% and 0.6% higher than in 4Q14 and 1Q14, respectively, recovering from the preventive maintenance stoppage carried out in the last quarter and as a result of the good operational performance of the Pico and Fábrica beneficiation plants.

Midwestern System

The Midwestern System, comprising the Urucum and the Corumbá mining hubs, produced 1.3 Mt in 1Q15, 13.4% lower than in 4Q14, due to the lower physical availability of equipment, but 3.9% higher than in 1Q14.

Samarco

In 1Q15 Samarco´s pellet feed production (mostly dedicated to the production of Samarco´s pellets) was 3.6 Mt, 6.4% lower than in 4Q14 due to maintenance stoppages in the concentration plants.

5

Table of Contents

Pellets

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Southeastern System |

|

7,121 |

|

7,058 |

|

5,809 |

|

0.9 |

% |

22.6 |

% |

|

Tubarão VIII |

|

1,614 |

|

1,257 |

|

0 |

|

28.4 |

% |

n.m. |

|

|

Nibrasco |

|

2,241 |

|

2,382 |

|

2,402 |

|

-5.9 |

% |

-6.7 |

% |

|

Kobrasco |

|

1,088 |

|

1,200 |

|

1,170 |

|

-9.3 |

% |

-7.0 |

% |

|

Hispanobras(1) |

|

1,053 |

|

1,115 |

|

1,119 |

|

-5.5 |

% |

-5.9 |

% |

|

Itabrasco |

|

1,125 |

|

1,105 |

|

1,118 |

|

1.9 |

% |

0.6 |

% |

|

Southern System |

|

2,372 |

|

2,193 |

|

2,278 |

|

8.2 |

% |

4.1 |

% |

|

Fabrica |

|

855 |

|

780 |

|

802 |

|

9.7 |

% |

6.6 |

% |

|

Vargem Grande |

|

1,517 |

|

1,413 |

|

1,476 |

|

7.4 |

% |

2.8 |

% |

|

Oman |

|

1,895 |

|

2,391 |

|

1,842 |

|

-20.8 |

% |

2.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL PELLETS |

|

11,388 |

|

11,642 |

|

9,928 |

|

-2.2 |

% |

14.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Samarco(2) |

|

3,497 |

|

3,529 |

|

2,219 |

|

-0.9 |

% |

57.6 |

% |

(1) Production attributable to Vale on a pro forma basis. In July 2012, we entered into a leasing contract for the Hispanobras pelletizing operation. As a consequence, their production is being consolidated 100% on a pro forma basis.

(2) Vale’s attributable production capacity of 50%.

Production overview

Excluding Samarco’s attributable production of 3.5 Mt, Vale’s pellet production reached 11.4 Mt in 1Q15, in line with 4Q14 and 1.5 Mt higher than in 1Q14 due to the ramp up of the Tubarão VIII pellet plant.

Southeastern System

Production volumes at the Tubarão pellet plants — Nibrasco, Kobrasco, Hispanobras, Itabrasco and Tubarão VIII — was 7.1 Mt in 1Q15, 0.9% higher than in 4Q14 and 22.6% higher than in 1Q14, mostly due to the ramp-up of the Tubarão VIII pellet plant and the good operational performance of Itabrasco.

The production of Nibrasco was 2.2 Mt, 5.9% and 6.7% lower than in 4Q14 and in 1Q14, respectively, due to a maintenance stoppage in the mill.

The production of Kobrasco and Hispanobras was 9.3% and 5.5% lower than in 4Q14, respectively, due to scheduled maintenance stoppage.

Southern System

The Fábrica pellet plant produced 0.9 Mt of pellets in 1Q15, 9.7% and 6.6% higher than in 4Q14 and in 1Q14 respectively, given the better availability of pellet feed.

6

Table of Contents

The Vargem Grande pellet output was 1.5 Mt, 7.4% and 2.8% higher than in 4Q14 and in 1Q14 respectively, due to the recovery from a maintenance stoppage carried out in the last quarter.

Oman operations

The Oman operation produced 1.9 Mt of direct reduction pellets in 1Q15, 20.8% lower than in 4Q14, due to a scheduled maintenance stoppage in the pellet plant.

Samarco

In 1Q15 Samarco´s attributable production was 3.5 Mt, in line with 4Q14, but 57.6% higher than in 1Q14, due to the ramp-up of pellet plant IV.

7

Table of Contents

Manganese ore and ferroalloys

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MANGANESE ORE |

|

592 |

|

723 |

|

470 |

|

-18.2 |

% |

25.9 |

% |

|

Azul |

|

407 |

|

513 |

|

332 |

|

-20.6 |

% |

22.8 |

% |

|

Urucum |

|

184 |

|

177 |

|

130 |

|

4.2 |

% |

41.6 |

% |

|

Other mines |

|

0 |

|

33 |

|

8 |

|

n.m. |

|

n.m. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FERROALLOYS |

|

27 |

|

41 |

|

46 |

|

-33.5 |

% |

-40.6 |

% |

|

Brazil |

|

27 |

|

41 |

|

46 |

|

-33.5 |

% |

-40.6 |

% |

Production overview

In 1Q15, we shut down the ferroalloys plants in Minas Gerais as existing energy contracts expired and energy costs increased impairing the economic viability of the ferroalloy operations. Consequently, the production of our manganese ore operations in Morro da Mina was affected.

Manganese ore production

Output from the Carajás Azul manganese mine decreased by 20.6% when compared to 4Q14, reaching 407,000 t in 1Q15. This decrease was driven by the good performance in 4Q14 which resulted from the recovery of ore from the tailing dams which no longer occurred in 1Q15.

In 1Q15, output from the Urucum mine reached the record of 184,000 t, 4.2% higher than in 4Q14 and 41.6% higher than in 1Q14, mostly driven by better productivity and higher physical availability of equipment.

Ferroalloys production

As previously mentioned, ferroalloys production was affected by the stoppage of the ferroalloy plants Barbacena and Ouro Preto in Minas Gerais state.

Ferroalloys quarterly production was comprised of 12,000 t of ferrosilicon manganese alloys (FeSiMn), 9,000 t of high-carbon manganese alloys (FeMnHc) and 5,000 t of medium-carbon manganese alloys (FeMnMC).

8

Table of Contents

Nickel

Finished production by source

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada |

|

38.6 |

|

42.1 |

|

41.6 |

|

-8.4 |

% |

-7.2 |

% |

|

Sudbury |

|

11.4 |

|

15.1 |

|

17.6 |

|

-24.2 |

% |

-35.4 |

% |

|

Thompson |

|

5.8 |

|

6.5 |

|

7.6 |

|

-10.8 |

% |

-24.0 |

% |

|

Voisey’s Bay |

|

13.5 |

|

12.6 |

|

14.5 |

|

6.6 |

% |

-6.9 |

% |

|

Ore from third parties(1) |

|

7.9 |

|

8.0 |

|

1.9 |

|

-0.3 |

% |

326.8 |

% |

|

Indonesia |

|

18.0 |

|

20.3 |

|

16.4 |

|

-11.2 |

% |

9.5 |

% |

|

New Caledonia(2) |

|

6.5 |

|

6.2 |

|

4.1 |

|

4.8 |

% |

58.9 |

% |

|

Brazil |

|

6.1 |

|

5.0 |

|

5.4 |

|

21.3 |

% |

12.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL NICKEL |

|

69.2 |

|

73.6 |

|

67.5 |

|

-6.0 |

% |

2.5 |

% |

(1) External feed purchased from third parties and processed into finished nickel in our operations.

(2) On site production of 7,300 t in 1Q15.

Production overview

Production of nickel reached 69,200 t in 1Q15, the best performance for a first quarter. Highlights of nickel production were record nickel oxide and total nickel production at Vale New Caledonia (VNC), record single-furnace production at Onça Puma and positive progress on the ramp-up of Long Harbour.

Canadian operations

In 1Q15, production from the Sudbury mine was 11,400 t, 24.2% and 35.4% lower than in 4Q14 and 1Q14, respectively. Severe storms and heavy ice build-up in Canada’s Atlantic seaports delayed several shipments of feed from our Sudbury smelter to our refinery in Clydach, Wales. As a result, the Clydach refinery anticipated the maintenance shutdown previously planned for 2Q15. Feed inventories increased throughout this period and will be processed in Clydach in 2Q15 as the refinery returned to full operation.

Production from the Thompson mine was 5,800 t in 1Q15, 10.8% and 24.0% lower than in 4Q14 and 1Q14, respectively. The Thompson refinery experienced supply and quality problems with major reagent suppliers that resulted in outages. The refinery returned to full production and will run at an above-normal rate to consume the excess inventory that was built up between the smelter and the refinery during the above mentioned outages.

9

Table of Contents

Voisey’s Bay mine production amounted to 13,500 t in 1Q15, 6.6% higher than in 4Q14 and 6.9% lower than in 1Q14. The Voisey’s Bay mill executed unplanned maintenance in January to repair the SAG mill. The operation returned to full production.

The ramp-up of the Long Harbour Processing Plant is underway with the plant producing over 500 tonnes of finished nickel in 1Q15. The plant is currently operating on a blend of PTVI matte and Voisey’s Bay concentrate and will process only Voisey’s Bay concentrate as of the end of 2015.

Indonesian operation (PTVI)

In 1Q15, production of nickel in matte from our Indonesian operations at Sorowako totaled 17,500 t, 15.1% and 4.5% lower than in 4Q14 and 1Q14, respectively. During the month of March, furnace #4 was taken offline to complete roof repairs originally planned for 4Q14 and furnace #3 was also down for unplanned roof repairs. Both furnaces returned to normal operations by the end of March.

The production of finished nickel from matte sourced from PTVI reached 18,000 t, 11.2% lower than in 4Q14 and 9.5% higher than in 1Q14, respectively, as the unscheduled repair to furnace #4 limited the feed to the downstream refineries.

New Caledonia operations (VNC)

VNC production of NiO and NHC was 7,300 t in 1Q15, achieving records for nickel oxide (3,500 t) and total nickel production. Production of finished products (NHC and Utility Nickel) from VNC totaled 6,500 t in 1Q15. In June of 2015 VNC will execute a previously scheduled maintenance shutdown for approximately three weeks. The major works to be completed during this period are the permanent repairs to the ocean outfall pipeline stemming from the November 2013 pipeline incident and the regularly scheduled maintenance at the acid plant.

Brazilian operation (Onça Puma)

The output from the Onça Puma operation was 6,100 t in 1Q15, 21.3% and 12.7% higher than in 4Q14 and 1Q14, respectively, achieving a quarter production record for an one single furnace operation.

10

Table of Contents

Copper

Finished production by source

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

|

62.4 |

|

58.4 |

|

47.3 |

|

6.8 |

% |

31.9 |

% |

|

Sossego |

|

27.1 |

|

26.9 |

|

26.3 |

|

1.0 |

% |

3.3 |

% |

|

Salobo |

|

35.3 |

|

31.6 |

|

21.1 |

|

11.7 |

% |

67.4 |

% |

|

Canada |

|

42.2 |

|

44.6 |

|

38.6 |

|

-5.4 |

% |

9.3 |

% |

|

Sudbury |

|

25.3 |

|

23.3 |

|

24.5 |

|

8.7 |

% |

3.3 |

% |

|

Thompson |

|

0.1 |

|

0.4 |

|

0.3 |

|

-74.6 |

% |

-67.0 |

% |

|

Voisey’s Bay |

|

7.5 |

|

11.4 |

|

6.9 |

|

-34.4 |

% |

8.3 |

% |

|

Ore from third parties |

|

9.3 |

|

9.5 |

|

6.8 |

|

-2.4 |

% |

35.3 |

% |

|

Total |

|

104.6 |

|

103.0 |

|

85.9 |

|

1.5 |

% |

21.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lubambe (attributable production) |

|

2.6 |

|

2.4 |

|

2.5 |

|

7.7 |

% |

1.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COPPER |

|

107.2 |

|

105.4 |

|

88.4 |

|

1.6 |

% |

21.1 |

% |

Production overview

In 1Q15, copper output was 104,600 t, 1.5% and 21.7% higher than in 4Q14 and in 1Q14, respectively, reaching a historical production record.

Brazilian operations

Production of copper in 1Q15 at the Sossego mine totaled 27,100 t in the form of copper in concentrates, 1.0% and 3.3% higher than in 4Q14 and 1Q14, respectively.

Production of copper in 1Q15 at Salobo totaled 35,300 t, a new record for that operation as a result of the ongoing ramp-up of Salobo II. Despite a lower production in January and February of this year, Salobo’s output in March reached 14,200 t, supporting the achievement of our production forecast for the year.

Canadian operations

Copper produced from the Sudbury mine reached 25,300 t, 8.7% and 3.3% higher than in 4Q14 and in 1Q14 respectively.

Production from the Voisey’s Bay mine was 7,500 t of copper in concentrate, 34.4% lower than in

11

Table of Contents

4Q14 and 8.3% higher than in 1Q14. As previously mentioned, the Voisey’s Bay mill underwent unplanned maintenance in January to repair its SAG mill, thus reducing its production in 1Q15.

African Operation (Lubambe)

Lubambe, our Zambian JV, is ramping up and delivering 6,400 t of copper in concentrates on a 100% basis (attributable production of 2,600 t). Lubambe has a nominal capacity of 45,000 t per year.

12

Table of Contents

Nickel and copper by-products

Finished production by source

|

|

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COBALT (metric tons) |

|

970 |

|

1,266 |

|

857 |

|

-23.4 |

% |

13.2 |

% |

|

Sudbury |

|

212 |

|

226 |

|

173 |

|

-6.4 |

% |

22.3 |

% |

|

Thompson |

|

41 |

|

160 |

|

103 |

|

-74.1 |

% |

-60.0 |

% |

|

Voisey’s Bay |

|

128 |

|

242 |

|

282 |

|

-47.1 |

% |

-54.6 |

% |

|

VNC |

|

559 |

|

629 |

|

287 |

|

-11.1 |

% |

94.8 |

% |

|

Others |

|

29 |

|

9 |

|

11 |

|

229.0 |

% |

173.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLATINUM (000’ oz troy) |

|

42 |

|

52 |

|

49 |

|

-20.7 |

% |

-15.6 |

% |

|

Sudbury |

|

42 |

|

52 |

|

49 |

|

-20.7 |

% |

-15.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PALLADIUM (000’ oz troy) |

|

97 |

|

112 |

|

109 |

|

-12.6 |

% |

-10.7 |

% |

|

Sudbury |

|

97 |

|

112 |

|

109 |

|

-12.6 |

% |

-10.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GOLD (000’ oz troy) |

|

103 |

|

94 |

|

74 |

|

9.7 |

% |

39.3 |

% |

|

Sudbury |

|

27 |

|

24 |

|

20 |

|

12.2 |

% |

34.8 |

% |

|

Sossego |

|

21 |

|

20 |

|

18 |

|

4.0 |

% |

17.9 |

% |

|

Salobo |

|

54 |

|

49 |

|

36 |

|

10.9 |

% |

52.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SILVER (000’ oz troy) |

|

482 |

|

717 |

|

433 |

|

-32.8 |

% |

11.3 |

% |

|

Sudbury |

|

482 |

|

717 |

|

433 |

|

-32.8 |

% |

11.3 |

% |

Gold

Gold production amounted to 103,000 oz in 1Q15, 9.7% higher than in 4Q14, reaching the best performance ever, due to the ramp-up of Salobo.

Cobalt

Output of cobalt reached 970 t in 1Q15, 23.4% lower than in 4Q14, mainly reflecting the delays experienced in the Thompson refinery.

Platinum and palladium

Platinum output was 42,000 oz and palladium output was 97,000 oz, 20.7% and 12.6% lower than in 4Q14, respectively.

13

Table of Contents

Coal

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

METALLURGICAL COAL |

|

1,268 |

|

1,790 |

|

1,223 |

|

-29.2 |

% |

3.6 |

% |

|

Moatize |

|

727 |

|

987 |

|

595 |

|

-26.3 |

% |

22.2 |

% |

|

Carborough Downs |

|

541 |

|

573 |

|

73 |

|

-5.7 |

% |

636.4 |

% |

|

Integra Coal |

|

0 |

|

0 |

|

379 |

|

n.m. |

|

n.m. |

|

|

Isaac Plains |

|

0 |

|

230 |

|

176 |

|

n.m. |

|

n.m. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THERMAL COAL |

|

427 |

|

520 |

|

561 |

|

-17.9 |

% |

-23.9 |

% |

|

Moatize |

|

427 |

|

446 |

|

414 |

|

-4.3 |

% |

3.2 |

% |

|

Integra Coal |

|

0 |

|

0 |

|

48 |

|

n.m. |

|

n.m. |

|

|

Isaac Plains |

|

0 |

|

74 |

|

100 |

|

n.m. |

|

n.m. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COAL |

|

1,695 |

|

2,310 |

|

1,785 |

|

-26.6 |

% |

-5.1 |

% |

Production overview

Total coal output in 1Q15 was 1.7 Mt, 26.6% and 5.1% lower than in 4Q14 and 1Q14, respectively, due to the stoppage of the Integra Coal and the Isaac Plains mine and an abnormal rainy season in Moatize, which prevented us from accessing certain areas of the mine and therefore impacting coal quality.

Australian operations

In 1Q15, Carborough Downs, which is a 100% metallurgical coal underground mining operation, achieved 541,000 t in 1Q15, in line with 4Q14, and 468,000 t higher than in 1Q14, due to the longwall move and the roof fall in the beginning of 2014.

In 2Q14, the Integra Coal mine was placed in care and maintenance, which resulted in the suspension of its longwall activity. The open cut production continued throughout 3Q14 in a reduced capacity until coal production ceased.

In 3Q14, the Isaac Plains mine was also placed in care and maintenance. The open cut production continued throughout 4Q14, until coal production ceased.

Moatize operations

In 1Q15 Moatize achieved a new record for a first quarter of 1.154 Mt. The output was 279,000 t lower than in 4Q14, due to the abnormal rainy

14

Table of Contents

season and the lower physical availability of plant and equipment.

The ramp-up of the first phase of the Moatize coal project is currently restricted by the logistics infrastructure — railway and port — which do not allow for total utilization of the mine’s nominal capacity of 11 Mtpy.

Gradually the above-mentioned logistics bottleneck will be eliminated as we complete and ramp up the Nacala logistics corridor. Some brownfield sections in the railway, which were already upgraded, were washed away by the abnormal rainfalls that reached the region. These sections were fully recovered and the railway tests, which were delayed, are now performing according to our plans.

The greenfield sections of the Nacala Corridor achieved 99% while the Nacala Port reached 97% physical progress.

15

Table of Contents

Potash

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POTASH |

|

108 |

|

147 |

|

109 |

|

-26.5 |

% |

-1.2 |

% |

|

Taquari-Vassouras |

|

108 |

|

147 |

|

109 |

|

-26.5 |

% |

-1.2 |

% |

Phosphates

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHOSPHATE ROCK |

|

1,992 |

|

2,209 |

|

1,932 |

|

-9.8 |

% |

3.1 |

% |

|

Brazil |

|

1,101 |

|

1,205 |

|

1,026 |

|

-8.6 |

% |

7.3 |

% |

|

Bayóvar |

|

892 |

|

1,004 |

|

906 |

|

-11.2 |

% |

-1.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAP(1) |

|

291 |

|

278 |

|

276 |

|

4.6 |

% |

5.3 |

% |

|

TSP(2) |

|

231 |

|

254 |

|

207 |

|

-9.1 |

% |

11.8 |

% |

|

SSP(3) |

|

464 |

|

460 |

|

357 |

|

0.9 |

% |

29.9 |

% |

|

DCP(4) |

|

137 |

|

135 |

|

118 |

|

1.9 |

% |

16.3 |

% |

(1) Monoammonium phosphate

(2) Triple superphosphate

(3) Single superphosphate

(4) Dicalcium phosphate

Potash

In 1Q15, potash production totaled 108,000 t, in line with 1Q14, but 26.5% lower than in 4Q14, as we accessed lower quality ore.

Traditionally our production is weaker in the first half of the year driven by softer demand for nutrients in Brazil during this time of the year.

Phosphate Rock

Phosphate rock output was 2.0 Mt in 1Q15, 3.1% higher than in 1Q14, but 9.8% lower than in 4Q14, due to the scheduled maintenance stoppage in Tapira and Araxá, in Brazil, and Bayóvar, in Peru.

MAP

In 1Q15, the production of MAP (monoammonium phosphate) totaled 291,000 t, 4.6% and 5.3% higher than in 4Q14 and in 1Q14, respectively, as a result of operational improvements after several power outages in 4Q14.

TSP

The output of TSP (Triple superphosphate) was 231,000 t in 1Q15, 11.8% higher than in 1Q14, but

16

Table of Contents

9.1% lower than in 4Q14 as a result of low phosphate rock availability.

SSP

Production of SSP (single superphosphate) was in line with 1Q14 and 29.9% higher than in 4Q14, reflecting improvement in operational performance after the maintenance stoppage carried out in Araxá last quarter.

DCP

DCP (dicalcium phosphate) production amounted to 137,000 t in 1Q15, in line with last quarter.

17

Table of Contents

Nitrogen

|

000’ metric tons |

|

1Q15 |

|

4Q14 |

|

1Q14 |

|

1Q15/4Q14

% Change |

|

1Q15/1Q14

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMMONIA |

|

43 |

|

35 |

|

49 |

|

24.1 |

% |

-10.4 |

% |

|

NITRIC ACID |

|

114 |

|

120 |

|

113 |

|

-5.0 |

% |

0.9 |

% |

|

AMMONIUM NITRATE |

|

119 |

|

125 |

|

114 |

|

-4.9 |

% |

5.0 |

% |

Ammonia production

In 1Q15, ammonia production was 43,000 t, 24.1% higher than in 4Q14 after the maintenance stoppage carried out in the last quarter.

Nitric acid and ammonium nitrate production

Production of nitric acid and ammonium nitrate was 5.0% and 4.9% lower respectively than in 4Q14.

For further information.please contact:

+55-21-3814-4540

Rogério T. Nogueira: rogerio.nogueira@vale.com

Andre Figueiredo: andre.figueiredo@vale.com

Carla Albano Miller: carla.albano@vale.com

Fernando Mascarenhas: Fernando.mascarenhas@vale.com

Andrea Gutman: andrea.gutman@vale.com

Claudia Rodrigues: claudia.rodrigues@vale.com

Marcio Loures Penna: marcio.penna@vale.com

Mariano Szachtman: mariano.szachtman@vale.com

This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future and not on historical facts, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de ValoresMobiliários (CVM), the French Autorité des Marchés Financiers (AMF), and The Stock Exchange of Hong Kong Limited, and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

18

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A. |

|

|

(Registrant) |

|

|

|

|

|

|

By: |

/s/ Rogerio T. Nogueira |

|

Date: April 22, 2015 |

|

Rogerio T. Nogueira |

|

|

|

Director of Investor Relations |

19

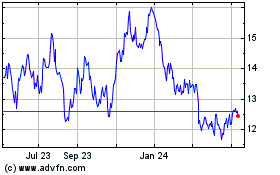

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

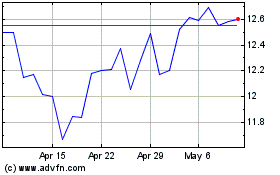

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024