Valspar Sales Slow Ahead of Merger

December 20 2016 - 9:20AM

Dow Jones News

By Imani Moise

Valspar Corp., which is merging with rival paint maker

Sherwin-Williams Co., said its revenue dropped in its

fourth-quarter, hurt by lower sales and foreign currency

effects.

The Minneapolis-based paint maker in March agreed to be acquired

for $9.3 billion in cash, a price tag that represented a 35%

premium. The deal gives Sherwin-Williams more access to

do-it-yourself painters who tend to buy supplies at retailers such

as Lowe's Cos. and Ace Hardware Corp., places where Valspar is

particularly strong.

In the quarter ended Oct. 28, Valspar said merger-related costs

totaled $3 million, including employee expenses, professional

services and regulatory fees. Additionally, restructuring costs

came up to $5 million during the quarter. Combined, these items

dented earnings 10 cents per share.

Across the company, volume decreased 2%. Revenue in its coatings

segment fell 2% to $626 million, and sales in its paints segment

dropped 7% to $421 million.

In all for the quarter ended Oct. 28, Valspar reported a profit

of $103.6 million, or $1.27 a share, up from $102.4 million, or

$1.26 a share, a year earlier. The company is no longer provided

adjusted figures.

Revenue fell 3.7%% to $1.11 billion.

Analysts polled by Thomson Reuters had forecast $1.17 billion in

revenue.

Shares closed at $103.64 and were inactive premarket. The stock

has risen 25% so far this year.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

December 20, 2016 09:05 ET (14:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

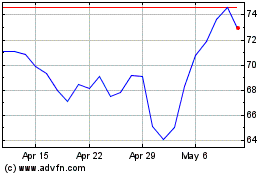

Valaris (NYSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

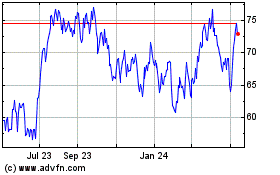

Valaris (NYSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024