Current Report Filing (8-k)

September 29 2016 - 4:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 27, 2016

THE VALSPAR CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-3011

|

|

36-2443580

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1101 South 3rd Street, Minneapolis, Minnesota

|

|

55415

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (612) 851-7000

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On September 27, 2016, the Compensation Committee of the Board of Directors of The

Valspar Corporation (“

Valspar

”) approved an amendment (the “

Amendment

”) to The Valspar Corporation Nonqualified Deferred Compensation Plan (the “

Deferred Compensation Plan

”) and the related Adoption

Agreement executed on April 1, 2014 (the “

Adoption Agreement

”).

The Amendment modifies the Deferred Compensation Plan to limit the

ability of Valspar to terminate it following the closing of the merger (the “

Merger

”) contemplated by the Agreement and Plan of Merger, dated as of March 19, 2016, by and among Valspar, The Sherwin-Williams Company and Viking

Merger Sub, Inc. Such modification is contingent on, and effective as of, the closing of the Merger.

The Amendment also modifies the Adoption Agreement

to increase the maximum percentage of base salary that may be deferred under the Deferred Compensation Plan from 50% to 80%. Such modification was effective immediately.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment

attached hereto as Exhibit 10.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

10.1

|

|

Amendment to Valspar Corporation Nonqualified Deferred Compensation Plan and Adoption Agreement, dated as of September 27, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

THE VALSPAR CORPORATION

|

|

|

|

/s/ Rolf Engh

|

|

Name: Rolf Engh

|

|

Title: Executive Vice President,

General

Counsel and Secretary

|

Dated: September 29, 2016

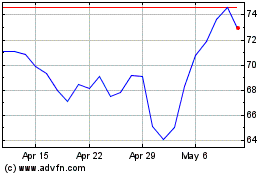

Valaris (NYSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

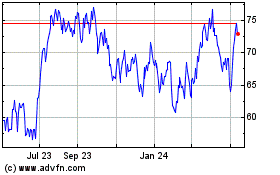

Valaris (NYSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024