Table of Contents

- 25 -

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS DOLLARS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS

Debt and Capital Resources

Our debt classified as current was $356,204 at January 30, 2015

compared to $606,356 and $540,162 at October 31, 2014 and January 24,

2014, respectively. Total debt was $1,706,285 at January 30, 2015 compared

to $1,556,391 and $1,552,516 at October 31, 2014 and January 24,

2014, respectively. The increase in total debt from October 31, 2014 was

primarily due to share repurchases, capital expenditures and normal seasonality

of operating cash flow. The ratio of total debt to capital was 63.9% at

January 30, 2015, compared to 60.6% at October 31, 2014 and 58.8% at January 24,

2014.

On January 21,

2015, we issued $250,000 of unsecured Senior Notes that mature on February 1,

2025 with a coupon rate of 3.30%, and $250,000 of unsecured Senior Notes that

mature on February 1, 2045 with a coupon rate of 4.40%. The net proceeds of

both issuances were $491,955 in the aggregate. The public offering was made

pursuant to a registration statement filed with the U.S. Securities and

Exchange Commission. We used the net proceeds to repay short-term borrowings

under our commercial paper program and credit facility in the first quarter of

2015.

We maintain an

unsecured revolving credit facility with a syndicate of banks. On December 16,

2013, we entered into an amended and restated $750,000 credit facility with a

syndicate of banks with a maturity date of December 14, 2018. Under certain

circumstances we have the option to increase this credit facility to

$1,000,000.

We maintain uncommitted bank lines of credit to meet short-term funding

needs in certain of our international locations. These arrangements are

reviewed periodically for renewal and modification.

Our credit facilities have covenants that require us to maintain

certain financial ratios. We were in compliance with these covenants as of

January 30, 2015. Our debt covenants do not limit, nor are they reasonably

likely to limit, our ability to obtain additional debt or equity financing.

We had $191,766 in cash and cash equivalents and $596,018 in unused

committed bank credit facilities, providing total committed liquidity of

$787,784 at the end of our 2015 first quarter, compared to $389,327 at the end

of fiscal year 2014. Our cash and cash equivalent balances consist of high

quality, short-term money market instruments and cash held by our international

subsidiaries. Cash and cash equivalents held by our international subsidiaries

are used to fund their day-to-day operating needs and have also been used to

finance acquisitions. Our investment policy on excess cash is to preserve

principal. As of January 30, 2015, $189,255 of the $191,766 of cash (on

the Condensed Consolidated Balance Sheets) was held by our international

subsidiaries. If these funds were repatriated to the U.S. we would be required

to accrue and pay income taxes. However, no deferred U.S. income taxes have

been provided on these earnings as they are considered to be reinvested for an

indefinite period of time or will be repatriated when it is tax effective to do

so.

We believe future cash flow from operations, existing lines of credit,

access to credit facilities and access to debt and capital markets will be

sufficient to meet our domestic and international liquidity needs. In the

current market conditions, we have demonstrated continued access to capital

markets.

We use derivative instruments with a number of counterparties

principally to manage interest rate and foreign currency exchange risks. We

evaluate the financial stability of each counterparty and spread the risk among

several financial institutions to limit our exposure. We will continue to

monitor counterparty risk on an ongoing basis. We do not have any credit-risk

related contingent features in our derivative contracts as of January 30,

2015.

Share Repurchases

Weighted-average common shares outstanding – diluted for the first

quarter of 2015 were 83,866,879, down 3,774,425 from the same period in the

prior year. During the quarter, we repurchased 982,500 shares for $83,582. On

November 21, 2014, the Board approved a new share repurchase program, with no

expiration date, authorizing us to purchase up to $1,500,000 of outstanding

shares of common stock. This new program was effective immediately and replaced

the previous repurchase authorization. As of January 30, 2015,

$1,432,603 remained available for purchases under the new authorization.

Table of Contents

- 26 -

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS DOLLARS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS

NON-GAAP FINANCIAL MEASURES

This section includes financial information prepared in accordance with

accounting principles generally accepted in the United States (GAAP), as well

as certain non-GAAP financial measures such as adjusted gross profit, adjusted

operating expense, adjusted earnings before interest and taxes (EBIT), adjusted

net income and adjusted net income per common share – diluted. Generally, a

non-GAAP financial measure is a numerical measure of financial performance that

excludes (or includes) amounts that are included in (or excluded from) the most

directly comparable measure calculated and presented in accordance with GAAP.

The non-GAAP financial measures should be viewed as a supplement to, and not a

substitute for, financial measures presented in accordance with GAAP. Non-GAAP

measures as presented herein may not be comparable to similarly titled measures

used by other companies.

We believe that the non-GAAP financial measures provide meaningful

information to assist investors in understanding our financial results and

assessing prospects for future performance without regard to restructuring

charges. We believe adjusted gross profit, adjusted operating expense, adjusted

EBIT, adjusted net income and adjusted net income per common share – diluted

are important indicators of our operations because they exclude items that may

not be indicative of or are unrelated to our core operating results and provide

a baseline for analyzing trends in our underlying business. To measure adjusted

gross profit, adjusted operating expense and adjusted EBIT, we remove the

impact of before-tax restructuring charges and gain on sale of certain assets.

Adjusted net income and adjusted net income per common share – diluted are

calculated by removing the after-tax impact of restructuring charges and gain

on sale of certain assets from our calculated net income and net income per common

share – diluted. Since non-GAAP financial measures are not standardized, it may

not be possible to compare these financial measures with other companies’

non-GAAP financial measures. These non-GAAP financial measures are an

additional way to view aspects of our operations that, when viewed with our

GAAP results and the reconciliations to corresponding GAAP financial measures

below, provide a more complete understanding of our business. We strongly

encourage investors and shareholders to review our financial statements and

publicly filed reports in their entirety and not to rely on any single

financial measure.

Table of Contents

- 27 -

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS DOLLARS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS

The following table reconciles gross profit, operating expense, EBIT,

net income and net income per common share – diluted (GAAP financial measures)

to adjusted gross profit, adjusted operating expense, adjusted EBIT, adjusted

net income and adjusted net income per common share – diluted (non-GAAP

financial measures) for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

January 30, 2015

|

|

|

January 24, 2014

|

|

|

|

|

Coatings Segment

|

|

|

|

|

|

|

|

|

|

|

|

Earnings

before interest and taxes (EBIT)

|

|

$

|

135,609

|

|

|

$

|

69,975

|

|

|

|

|

Restructuring

charges – cost of sales

|

|

|

2,390

|

|

|

|

4,265

|

|

|

|

|

Restructuring

charges – operating expense

|

|

|

963

|

|

|

|

4,355

|

|

|

|

|

Gain on sale

of certain assets

|

|

|

(48,001

|

)

|

|

|

—

|

|

|

|

|

Adjusted

EBIT

|

|

$

|

90,961

|

|

|

$

|

78,595

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paints Segment

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

|

$

|

25,329

|

|

|

$

|

30,997

|

|

|

|

|

Restructuring

charges – cost of sales

|

|

|

2,459

|

|

|

|

1,775

|

|

|

|

|

Restructuring

charges – operating expense

|

|

|

731

|

|

|

|

1,044

|

|

|

|

|

Adjusted

EBIT

|

|

$

|

28,519

|

|

|

$

|

33,816

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other and Administrative

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

|

$

|

(2,617

|

)

|

|

$

|

(5,783

|

)

|

|

|

|

Restructuring

charges – cost of sales

|

|

|

—

|

|

|

|

66

|

|

|

|

|

Restructuring

charges – operating expense

|

|

|

—

|

|

|

|

301

|

|

|

|

|

Adjusted

EBIT

|

|

$

|

(2,617

|

)

|

|

$

|

(5,416

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

$

|

333,292

|

|

|

$

|

319,053

|

|

|

|

|

Restructuring

charges – cost of sales

|

|

|

4,849

|

|

|

|

6,106

|

|

|

|

|

Adjusted

gross profit

|

|

$

|

338,141

|

|

|

$

|

325,159

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

expense

|

|

$

|

223,937

|

|

|

$

|

223,493

|

|

|

|

|

Restructuring

charges – operating expense

|

|

|

(1,694

|

)

|

|

|

(5,700

|

)

|

|

|

|

Adjusted

operating expense

|

|

$

|

222,243

|

|

|

$

|

217,793

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

|

$

|

158,321

|

|

|

$

|

95,189

|

|

|

|

|

Restructuring

charges – total

|

|

|

6,543

|

|

|

|

11,806

|

|

|

|

|

Gain on sale

of certain assets

|

|

|

(48,001

|

)

|

|

|

—

|

|

|

|

|

Adjusted

EBIT

|

|

$

|

116,863

|

|

|

$

|

106,995

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

103,974

|

|

|

$

|

53,553

|

|

|

|

|

After tax

restructuring charges – total1

|

|

|

4,118

|

|

|

|

7,581

|

|

|

|

|

After tax

gain on sale of certain assets1

|

|

|

(37,216

|

)

|

|

|

—

|

|

|

|

|

Adjusted net

income

|

|

$

|

70,876

|

|

|

$

|

61,134

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

per common share – diluted

|

|

$

|

1.24

|

|

|

$

|

0.61

|

|

|

|

|

Restructuring

charges – total

|

|

|

0.05

|

|

|

|

0.09

|

|

|

|

|

Gain on sale

of certain assets

|

|

|

(0.44

|

)

|

|

|

—

|

|

|

|

|

Adjusted net

income per common share – diluted

|

|

$

|

0.85

|

|

|

$

|

0.70

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 The tax effect

of the gain on sale of assets and restructuring charges is calculated using the

effective tax rate of the jurisdiction in which the charges were incurred.

See Note 15 in

Notes to Condensed Consolidated Financial Statements for further information on

restructuring.

Table of Contents

- 28 -

ITEM 2.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

CRITICAL

ACCOUNTING ESTIMATES

The discussion and

analysis of our financial condition and results of operations are based upon

our Condensed Consolidated Financial Statements, which have been prepared in

accordance with generally accepted accounting principles in the United States

(GAAP). The preparation of these financial statements requires us to make

estimates and assumptions that affect the reported amounts of assets and

liabilities, revenues and expenses, and related disclosure of any contingent

assets and liabilities at the date of the financial statements. We regularly

review our estimates and assumptions, which are based on historical experience

and on various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis for making judgments about

the carrying values of assets and liabilities that are not readily apparent

from other sources. Actual results may differ from these estimates under

different assumptions or conditions.

A comprehensive

discussion of our critical accounting estimates is included in the Management’s

Discussion and Analysis of Financial Condition and Results of Operations in our

Annual Report on Form 10-K for the year ended October 31, 2014. There were no

material changes to our critical accounting estimates in the first quarter of

fiscal year 2015.

OFF-BALANCE

SHEET ARRANGEMENTS

We do not have

off-balance sheet arrangements that have, or are reasonably likely to have, a

current or future material effect on our financial condition, changes in

financial condition, revenues or expenses, results of operations, liquidity,

capital expenditures or capital resources.

FORWARD-LOOKING

STATEMENTS

Certain statements

contained in “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and elsewhere in this report constitute “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for

forward-looking statements.

Forward-looking statements

are based on management’s current expectations, estimates, assumptions and

beliefs about future events, conditions and financial performance.

Forward-looking statements are subject to risks, uncertainties and other

factors, many of which are outside our control and could cause actual results

to differ materially from such statements. Any statement that is not historical

in nature is a forward-looking statement. We may identify forward-looking

statements with words and phrases such as “expects,” “projects,” “estimates,”

“anticipates,” “believes,” “could,” “may,” “will,” “plans to,” “intends,”

“should” and similar expressions.

These risks,

uncertainties and other factors include, but are not limited to, deterioration

in general economic conditions, both domestic and international, that may

adversely affect our business; fluctuations in availability and prices of raw

materials, including raw material shortages and other supply chain disruptions,

and the inability to pass along or delays in passing along raw material cost

increases to our customers; dependence of internal sales and earnings growth on

business cycles affecting our customers and growth in the domestic and

international coatings industry; market share loss to, and pricing or margin

pressure from, larger competitors with greater financial resources; significant

indebtedness that restricts the use of cash flow from operations for

acquisitions and other investments; dependence on acquisitions for growth, and

risks related to future acquisitions, including adverse changes in the results

of acquired businesses, the assumption of unforeseen liabilities and

disruptions resulting from the integration of acquisitions; risks and

uncertainties associated with operating in foreign markets, including achievement

of profitable growth in developing markets; impact of fluctuations in foreign

currency exchange rates on our financial results; loss of business with key

customers; damage to our reputation and business resulting from product claims

or recalls, litigation, customer perception and other matters; our ability to

respond to technology changes and to protect our technology; possible

interruption, failure or compromise of the information systems we use to

operate our business; changes in governmental regulation, including more

stringent environmental, health and safety regulations; our reliance on the

efforts of vendors, government agencies, utilities and other third parties to

achieve adequate compliance and avoid disruption of our business; unusual

weather conditions adversely affecting sales; changes in accounting policies

and standards and taxation requirements such as new tax laws or revised tax law

interpretations; the nature, cost and outcome of pending and future litigation

and other legal proceedings; and civil unrest and the outbreak of war and other

significant national and international events.

We undertake no

obligation to subsequently revise any forward-looking statement to reflect new

information, events or circumstances after the date of such statement, except

as required by law.

Table of Contents

- 29 -

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK

Our foreign sales and results of operations are

subject to the impact of foreign currency fluctuations. Generally our

underlying costs are denominated in the same currency as our sales. We have not used derivative financial instruments to

hedge our exposure to translation gains and losses. A 10% adverse change applied equally to all foreign currency

exchange rates is not expected to have a material effect on our net income or

financial position. A change of greater

than 10% in the exchange rates for individual currencies in geographies where

we have a significant presence could have a material impact on our net income

or financial position.

We are also subject to interest rate risk. At

January 30, 2015, approximately 12.1% of our total debt consisted of

floating rate debt. From time to time, we may enter into interest rate

derivatives to hedge a portion of either our variable or fixed rate debt.

Assuming the current level of borrowings, a 10% increase in interest rates from

those in effect at the end of the first quarter would not have a material

impact on our results of operations or financial position.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure controls and

procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) are our

controls and other procedures that are designed to ensure that information

required to be disclosed by us in the reports that we file or submit under the

Exchange Act is recorded, processed, summarized and reported within the time

periods specified in the Securities and Exchange Commission’s rules and forms.

Disclosure controls and procedures include, without limitation, controls and procedures

designed to ensure that information required to be disclosed by us in the

reports that we file or submit under the Exchange Act is accumulated and

communicated to our management, including our Chief Executive Officer and Chief

Financial Officer, as appropriate, to allow timely decisions regarding required

disclosure.

We have evaluated the

effectiveness of the design and operation of our disclosure controls and

procedures as of January 30, 2015. Based on that evaluation, the Chief

Executive Officer and Chief Financial Officer concluded that our disclosure

controls and procedures are effective.

There were no changes in

our internal control over financial reporting during the quarter ended

January 30, 2015 that have materially affected, or are reasonably likely

to materially affect, our internal control over financial reporting.

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

During the period covered

by this report, there were no legal proceedings instituted that are reportable,

and there were no material developments in any of the legal proceedings that

were previously reported on our Form 10-K for the year ended October 31, 2014.

ITEM 1A. RISK FACTORS

There were no material changes to the risk factors

disclosed in our Form 10-K for the year ended October 31, 2014.

Table of Contents

- 30 -

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE

OF PROCEEDS

(a)

Not applicable

(b) Not applicable

(c) We made the following repurchases of equity

securities during the quarter ended January 30, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period

|

|

Total

Number

of Shares

Purchased

|

|

Average

Price Paid

per Share

|

|

Total

Number of

Shares

Purchased as

Part

of Publicly

Announced

Plans or

Programs

|

|

Maximum

Number

of Shares that

May

Yet be Purchased

Under

the Plans or

Programs1

|

|

Maximum

Amount

that May Yet be

Spent Under the

Plans or Programs2

|

|

|

11/1/2014 - 11/21/2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase

Program

|

|

|

192,500

|

|

$

|

84.05

|

|

|

192,500

|

|

|

4,826,974

|

|

|

N/A

|

|

|

11/22/2014 - 11/28/2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase

Program

|

|

|

12,500

|

|

$

|

84.88

|

|

|

12,500

|

|

|

N/A

|

|

$

|

1,498,938,594

|

|

|

11/29/2014 - 12/26/2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase

Program

|

|

|

217,500

|

|

$

|

83.09

|

|

|

217,500

|

|

|

N/A

|

|

$

|

1,480,860,692

|

|

|

12/27/2014 - 1/30/2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase

Program

|

|

|

560,000

|

|

$

|

86.15

|

|

|

560,000

|

|

|

N/A

|

|

$

|

1,432,602,691

|

|

|

Other

Transactions3

|

|

|

54,772

|

|

$

|

83.87

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

1

|

On

December 5, 2012, the board approved a share repurchase authorization of

15,000,000 shares, with no predetermined end date. There were 192,500 shares

purchased in fiscal year 2015 and 4,826,974 shares remaining under that plan

on November 21, 2014 when it was replaced by a new plan.

|

|

|

|

|

2

|

On

November 21, 2014 the board authorized the purchase of up to $1.5 billion of

the corporation’s outstanding shares of common stock, with no expiration

date. This new program was effective

immediately and replaced the previous repurchase authorization. On January 30, 2015, there were 790,000

shares purchased under this program.

|

|

|

|

|

3

|

Our other transactions

include our acquisition of common stock in satisfaction of tax-payment

obligations upon vesting of restricted stock.

|

Table of Contents

- 31 -

ITEM 6. EXHIBITS

|

|

|

|

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

|

|

|

|

4.1

|

|

Fifth Supplemental

Indenture, among the Company, The Bank of New York Mellon Trust Company, N.A.

(as successor to Bank One Trust Company, N.A.) and U.S. Bank National

Association, as series trustee, dates as of January 21, 2015, to Indenture

dated as of April 24, 2002, between the Company and the Bank of New York

Mellon Trust Company, N.A. (as successor to Bank One Trust Company, N.A.)

(incorporated by reference to Form 8-K filed on January 21, 2015)

|

|

|

|

|

|

31.1 *

|

|

Section 302 Certification of the Chief Executive

Officer

|

|

|

|

|

|

31.2 *

|

|

Section 302 Certification of the Chief Financial

Officer

|

|

|

|

|

|

32.1 *

|

|

Certification of Chief

Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. §1350, as

Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

101.INS *

|

|

XBRL Instance Document

|

|

|

|

|

|

101.SCH *

|

|

XBRL Schema Document

|

|

|

|

|

|

101.CAL *

|

|

XBRL Calculation Linkbase Document

|

|

|

|

|

|

101.DEF *

|

|

XBRL Definition Linkbase Document

|

|

|

|

|

|

101.LAB *

|

|

XBRL Label Linkbase Document

|

|

|

|

|

|

101.PRE *

|

|

XBRL Presentation Linkbase Document

|

* Filed electronically herewith

Table of Contents

- 32 -

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

|

|

|

|

|

THE VALSPAR CORPORATION

|

|

|

|

|

Date: March 11, 2015

|

By

|

/s/ Rolf Engh

|

|

|

Rolf Engh

|

|

|

Executive Vice President, General Counsel and

Secretary

|

|

|

|

|

Date: March 11, 2015

|

By

|

/s/ James L. Muehlbauer

|

|

|

James L. Muehlbauer

|

|

|

Executive Vice President, Chief Financial and

Administrative Officer

|

Exhibit 31.1

SECTION 302 CERTIFICATION

|

|

|

|

|

I, Gary E. Hendrickson, certify that:

|

|

|

|

|

1.

|

I have

reviewed this quarterly report on Form 10-Q of The Valspar Corporation;

|

|

|

|

|

2.

|

Based on my

knowledge, this report does not contain any untrue statement of a material

fact or omit to state a material fact necessary to make the statements made,

in light of the circumstances under which such statements were made, not

misleading with respect to the period covered by this report;

|

|

|

|

|

3.

|

Based on my

knowledge, the financial statements, and other financial information included

in this report, fairly present in all material respects the financial

condition, results of operations and cash flows of the registrant as of, and

for, the periods presented in this report;

|

|

|

|

|

4.

|

The registrant’s

other certifying officer(s) and I are responsible for establishing and

maintaining disclosure controls and procedures (as defined in Exchange Act

Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting

(as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant

and have:

|

|

|

|

|

|

(a)

|

Designed

such disclosure controls and procedures, or caused such disclosure controls

and procedures to be designed under our supervision, to ensure that material

information relating to the registrant, including its consolidated

subsidiaries, is made known to us by others within those entities,

particularly during the period in which this report is being prepared;

|

|

|

|

|

|

|

(b)

|

Designed

such internal control over financial reporting, or caused such internal

control over financial reporting to be designed under our supervision, to

provide reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in

accordance with generally accepted accounting principles;

|

|

|

|

|

|

|

(c)

|

Evaluated

the effectiveness of the registrant’s disclosure controls and procedures and

presented in this report our conclusions about the effectiveness of the

disclosure controls and procedures, as of the end of the period covered by

this report based on such evaluation; and

|

|

|

|

|

|

|

(d)

|

Disclosed in

this report any change in the registrant’s internal control over financial

reporting that occurred during the registrant’s most recent fiscal quarter

(the registrant’s fourth fiscal quarter in the case of an annual report) that

has materially affected, or is reasonably likely to materially affect, the

registrant’s internal control over financial reporting; and

|

|

|

|

|

|

5.

|

The

registrant’s other certifying officer(s) and I have disclosed, based on our

most recent evaluation of internal control over financial reporting, to the

registrant’s auditors and the audit committee of the registrant’s board of

directors (or persons performing the equivalent functions):

|

|

|

|

|

|

(a)

|

All

significant deficiencies and material weaknesses in the design or operation

of internal control over financial reporting which are reasonably likely to

adversely affect the registrant’s ability to record, process, summarize and

report financial information; and

|

|

|

|

|

|

|

(b)

|

Any fraud,

whether or not material, that involves management or other employees who have

a significant role in the registrant’s internal control over financial

reporting.

|

|

|

|

|

|

Date: March

11, 2015

|

/s/ Gary E. Hendrickson

|

|

|

|

Gary E. Hendrickson

|

|

|

|

Chairman and Chief Executive Officer

|

|

Exhibit 31.2

SECTION 302 CERTIFICATION

|

|

|

|

|

I, James L.

Muehlbauer, certify that:

|

|

|

|

|

1.

|

I have

reviewed this quarterly report on Form 10-Q of The Valspar Corporation;

|

|

|

|

|

2.

|

Based on my

knowledge, this report does not contain any untrue statement of a material

fact or omit to state a material fact necessary to make the statements made,

in light of the circumstances under which such statements were made, not

misleading with respect to the period covered by this report;

|

|

|

|

|

3.

|

Based on my

knowledge, the financial statements, and other financial information included

in this report, fairly present in all material respects the financial

condition, results of operations and cash flows of the registrant as of, and

for, the periods presented in this report;

|

|

|

|

|

4.

|

The registrant’s

other certifying officer(s) and I are responsible for establishing and

maintaining disclosure controls and procedures (as defined in Exchange Act

Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting

(as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant

and have:

|

|

|

|

|

|

a.

|

(a) Designed

such disclosure controls and procedures, or caused such disclosure controls

and procedures to be designed under our supervision, to ensure that material

information relating to the registrant, including its consolidated

subsidiaries, is made known to us by others within those entities,

particularly during the period in which this report is being prepared;

|

|

|

|

|

|

|

b.

|

(b) Designed

such internal control over financial reporting, or caused such internal

control over financial reporting to be designed under our supervision, to

provide reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles;

|

|

|

|

|

|

|

c.

|

(c)

Evaluated the effectiveness of the registrant’s disclosure controls and

procedures and presented in this report our conclusions about the

effectiveness of the disclosure controls and procedures, as of the end of the

period covered by this report based on such evaluation; and

|

|

|

|

|

|

|

d.

|

(d)

Disclosed in this report any change in the registrant’s internal control over

financial reporting that occurred during the registrant’s most recent fiscal

quarter (the registrant’s fourth fiscal quarter in the case of an annual

report) that has materially affected, or is reasonably likely to materially

affect, the registrant’s internal control over financial reporting; and

|

|

|

|

|

|

5.

|

The

registrant’s other certifying officer(s) and I have disclosed, based on our

most recent evaluation of internal control over financial reporting, to the

registrant’s auditors and the audit committee of the registrant’s board of

directors (or persons performing the equivalent functions):

|

|

|

|

|

|

a.

|

(a) All

significant deficiencies and material weaknesses in the design or operation

of internal control over financial reporting which are reasonably likely to

adversely affect the registrant’s ability to record, process, summarize and

report financial information; and

|

|

|

|

|

|

|

b.

|

(b) Any

fraud, whether or not material, that involves management or other employees

who have a significant role in the registrant’s internal control over

financial reporting.

|

|

|

|

|

|

Date: March

11, 2015

|

/s/ James L. Muehlbauer

|

|

|

|

James L. Muehlbauer

|

|

|

|

Executive Vice President, Chief Financial

and

|

|

|

|

Administrative Officer

|

|

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. §1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of The Valspar Corporation (the

“Company”) on Form 10-Q for the quarter ended January 30, 2015 as filed with

the Securities and Exchange Commission on the date hereof (the “Report”), I,

Gary E. Hendrickson, Chief Executive Officer of the Company and I, James L.

Muehlbauer, Chief Financial Officer of the Company, certify, pursuant to 18

U.S.C. §1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of

2002, that:

|

|

|

|

1.

|

The Report

fully complies with the requirements of Section 13(a) or 15(d) of the

Securities Act of 1934; and

|

|

|

|

|

2.

|

The

information contained in the Report fairly presents, in all material

respects, the financial condition and results of operations of the Company.

|

|

|

|

|

|

|

/s/ Gary E. Hendrickson

|

|

|

|

Gary E. Hendrickson

|

|

|

|

Chairman and Chief Executive Officer

|

|

|

|

|

|

|

|

March 11, 2015

|

|

|

|

|

|

|

|

/s/ James L. Muehlbauer

|

|

|

|

James L. Muehlbauer

|

|

|

|

Executive Vice President, Chief Financial

and

|

|

|

|

Administrative Officer

|

|

|

|

|

|

|

|

March 11, 2015

|

|

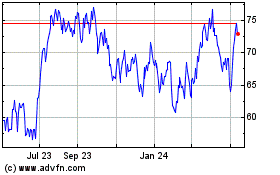

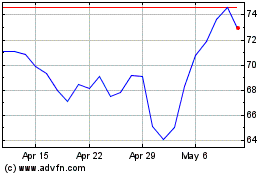

Valaris (NYSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valaris (NYSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024