Corporate-Bond Market Absorbs Nine Deals Tuesday

January 10 2012 - 12:01PM

Dow Jones News

Corporate issuance in 2012 continues at a robust pace, with nine

investment-grade borrowers selling debt in Tuesday's market.

Eight of the deals add up to $3.925 billion; the size of the

ninth, a four-part deal from SABMiller PLC (SAB.JO, SBMRY), has yet

to be determined, but one syndicate manager away from the deal

estimated its size at around $4 billion.

"Companies continue to term out their maturity profiles or, in

some cases, to prefund their acquisitions," said Scott Kimball,

portfolio manager at Miami-based Taplin, Canida & Habacht LLC,

which sub-advises the BMO/TCH corporate income fund.

Kimball said deals are coming with only moderate

concessions--the extra yield demanded by investors in the primary

market--indicating that appetite for credit is holding up fairly

well so far this year.

"But the market is not agnostic to credit risk," he said. "The

market is looking at specific issuers and making the riskier ones

offer a decent concession."

The diversity on Tuesday's docket includes energy, utility,

retail and beverage companies.

Larger deals include a $900 million offering from John Sevier

Combined Cycle Generation LLC, which is run by the Tennessee Valley

Authority, and an $800 million offering from Macy's Inc. (M), which

is selling 10- and 30-year bonds.

Enbridge Inc. (ENB), a Canadian energy-transport company, is

also marketing $550 million of 10-year bonds.

A key gauge of the corporate bond market, Markit's CDX North

America Investment-Grade Index, had improved 1.9% as of

mid-morning, while a similar index tracking the high-yield market

was up 0.4%.

Smaller deals include a $300 million, 10-year offering from

Valspar Corp. (VAL), a $250 million 30-year bond deal from Alabama

Power, a $300 million offering of five-year notes from Entergy

Corp. (ETR) and a $325 million 30-year deal from Arizona Public

Service.

BBVA Banco Continental SA is also marketing its $500 million

offering of five-year notes. The deal was supposed to be priced

Monday but was reportedly held back by a document delay.

The wide range of deals follows a busy Monday in which seven

companies floated $8.85 billion of debt, according to Dealogic. The

first week of the new year saw $22.6 billion of deals in just four

days.

A syndicate manager Tuesday his $20 billion volume estimate

remains unchanged despite the active start to the week, in part

because he expects issuers to front-load their deals early in the

week before the market slows down a bit ahead of the Martin Luther

King Jr. long weekend.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

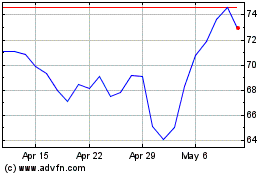

Valaris (NYSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

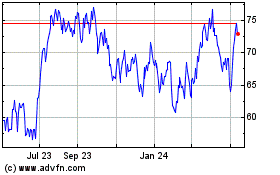

Valaris (NYSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024