Current Report Filing (8-k)

October 30 2015 - 8:28AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 8-K

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT REPORT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of earliest event reported): October 30, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES CELLULAR CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

|

1-9712

|

|

|

62-1147325

|

|

(State or other jurisdiction of

|

|

|

(Commission

|

|

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

File Number)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9410 West Bryn Mawr, Chicago, Illinois 60631

|

|

(Address of principal executive offices) (Zip code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant's telephone number, including area code: (773) 399-8900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 2.02. Results of Operations and Financial Condition

On October 30, 2015, United States Cellular Corporation (“U.S. Cellular”) issued a news release announcing its results of operations for the period ended September 30, 2015. A copy of the news release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

The information in this Item 2.02 of Form 8-K is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor will any such information or exhibits be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

- Exhibits:

In accordance with the provisions of Item 601 of Regulation S-K, any Exhibits filed or furnished herewith are set forth on the Exhibit Index attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

United States Cellular Corporation

(Registrant)

|

Date:

|

October 30, 2015

|

|

|

|

|

By:

|

/s/ Steven T. Campbell

|

|

|

Steven T. Campbell

|

|

|

Executive Vice President – Finance,

|

|

|

Chief Financial Officer and Treasurer

|

|

|

(principal financial officer)

|

|

EXHIBIT INDEX

|

|

|

|

|

|

The following exhibits are filed or furnished herewith as noted below.

|

|

|

|

|

|

Exhibit

|

|

|

|

No.

|

|

Description

|

|

99.1

|

|

Earnings Press Release dated October 30, 2015

|

|

|

|

|

|

99.2

|

|

Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement

|

|

|

|

|

Exhibit 99.1 NEWS RELEASE

As previously announced, U.S. Cellular will hold a teleconference October 30, 2015 at 9:30 a.m. CDT. Listen to the live call via the Events & Presentations page of investors.uscellular.com.

FOR IMMEDIATE RELEASE

U.S. Cellular reports third quarter 2015 results

Increases guidance for operating cash flow and adjusted EBITDA

CHICAGO, (October 30, 2015) — United States Cellular Corporation (NYSE:USM) reported total operating revenues of $1,068.9 million for the third quarter of 2015, versus $1,000.4 million for the same period one year ago. Net income (loss) attributable to U.S. Cellular shareholders and related diluted earnings per share were $63.6 million and $0.75, respectively, for the third quarter of 2015, compared to $(22.2) million and $(0.26), respectively, in the comparable period one year ago.

Effective September 1, 2015, U.S. Cellular discontinued it loyalty rewards program. All unredeemed rewards points expired and the deferred revenue related to the expired points was recognized as $58.2 million in service revenues in the quarter.

“This quarter we completed our 4G LTE network rollout. This was one of our major priorities for the year. It allows our customers, even in our very rural areas, to receive the benefits of our data services. The results of this customer focus manifests itself in high customer loyalty and lower churn,” said Kenneth R. Meyers, U.S. Cellular president and CEO. “We also continued to manage our expense levels, which contributed to the growth in operating cash flow.

“As we move into the holiday sales season, we plan to grow our customer base and increase revenue through our competitive pricing and promotions, that showcase our high-quality 4G network.”

2015 Estimated Results

U.S. Cellular’s estimates of full-year 2015 results are shown below. Such estimates represent management’s view as of October 30, 2015. Such forward‑looking statements should not be assumed to be current as of any future date. U.S. Cellular undertakes no duty to update such information, whether as a result of new information, future events or otherwise. There can be no assurance that final results will not differ materially from such estimated results.

|

|

|

2015 Estimated Results

|

|

|

|

Current

|

|

Previous

|

|

(Dollars in millions)

|

|

|

|

|

|

Total operating revenues

|

Approx. $

|

4,000

|

|

$4,000-$4,100

|

|

Operating cash flow (1)

|

$540-$620

|

|

$440-$540

|

|

Adjusted EBITDA (1)

|

$710-$790

|

|

$600-$700

|

|

Capital expenditures

|

Approx. $

|

600

|

|

Unchanged

|

|

|

|

|

|

|

|

The following tables provide a reconciliation to Operating Cash Flow and Adjusted EBITDA for 2015 estimated results, actual results for the nine months ended September 30, 2015 and 2014 actual results:

|

|

|

|

|

|

|

|

Actual Results

|

|

|

|

|

|

2015 Estimated

Results (2)

|

|

|

Nine Months Ended September 30, 2015

|

|

|

Year Ended

December 31, 2014

|

|

(Dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) (GAAP)

|

|

|

N/A

|

|

$

|

250

|

|

$

|

(47)

|

|

Add back:

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit)

|

|

|

N/A

|

|

|

161

|

|

|

(12)

|

|

Income (loss) before income taxes

(GAAP)

|

|

$

|

275-355

|

|

$

|

411

|

|

$

|

(59)

|

|

Add back:

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

80

|

|

|

61

|

|

|

57

|

|

|

Depreciation, amortization and

accretion expense

|

|

|

600

|

|

|

450

|

|

|

606

|

|

EBITDA

|

|

$

|

955-1,035

|

|

$

|

922

|

|

$

|

605

|

|

Add back (deduct):

|

|

|

|

|

|

|

|

|

|

|

|

(Gain) loss on sale of business and

other exit costs, net

|

|

|

(115)

|

|

|

(114)

|

|

|

(33)

|

|

|

(Gain) loss on license sales and

exchanges, net

|

|

|

(145)

|

|

|

(147)

|

|

|

(113)

|

|

|

(Gain) loss on assets disposals, net

|

|

|

15

|

|

|

12

|

|

|

21

|

|

Adjusted EBITDA

|

|

$

|

710-790

|

|

$

|

674

|

|

$

|

480

|

|

Deduct:

|

|

|

|

|

|

|

|

|

|

|

|

Equity in earnings of unconsolidated

entities

|

|

|

(135)

|

|

|

(110)

|

|

|

(130)

|

|

|

Interest and dividend income

|

|

|

(35)

|

|

|

(26)

|

|

|

(12)

|

|

Operating cash flow (3)

|

|

$

|

540-620

|

|

$

|

538

|

|

$

|

338

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Totals may not foot due to rounding differences.

|

|

|

|

|

|

|

|

|

|

|

|

|

- Operating cash flow is defined as net income, adjusted for the items set forth in the reconciliation below. Adjusted EBITDA is defined as net income, adjusted for the items set forth in the reconciliation below. Operating cash flow and Adjusted EBITDA exclude these items in order to show operating results on a more comparable basis from period to period. From time to time, U.S. Cellular may exclude other items from Operating cash flow and/or Adjusted EBITDA if such items help reflect operating results on a more comparable basis. U.S. Cellular does not intend to imply that any such items that are excluded are non-recurring, infrequent or unusual; such items may occur in the future. Operating cash flow and Adjusted EBITDA are not measures of financial performance under Generally Accepted Accounting Principles in the United States (“GAAP”) and should not be considered as alternatives to net income as indicators of the company’s operating performance or as alternatives to cash flows from operating activities, determined in accordance with GAAP, as indicators of cash flows or as measures of liquidity. U.S. Cellular believes Operating cash flow and Adjusted EBITDA are useful measures of U.S. Cellular’s operating results before significant recurring non-cash charges, gains and losses, and other items as indicated above.

- In providing 2015 Estimated Results, U.S. Cellular has not completed the above reconciliation to net income because it does not provide guidance for income taxes. U.S. Cellular believes that the impact of income taxes cannot be reasonably predicted; therefore, the company is unable to provide such guidance. Accordingly, a reconciliation to net income is not available without unreasonable effort.

- A reconciliation of Operating cash flow (Non-GAAP) to Operating income (GAAP) for September 30, 2015 actual results can be found on the company's website at investors.uscellular.com.

Conference Call Information

U.S. Cellular will hold a conference call on October 30, 2015 at 9:30 a.m. Central Time.

- Access the live call on the Events & Presentation page of investors.uscellular.com or at https://www.webcaster4.com/Webcast/Page/1145/11364.

- Access the call by phone at 877/407-8029 (US/Canada), no pass code required.

Before the call, certain financial and statistical information to be discussed during the call will be posted to investors.uscellular.com. The call will be archived on the Events & Presentations page of investors.uscellular.com.

About U.S. Cellular

United States Cellular Corporation provides a comprehensive range of wireless products and services, excellent customer support, and a high-quality network to 4.8 million customers in 23 states. The Chicago-based company had 6,400 full- and part-time associates as of September 30, 2015. At the end of the third quarter of 2015, Telephone and Data Systems, Inc. owned 84 percent of U.S. Cellular. For more information about U.S. Cellular, visit uscellular.com.

Contacts

Jane McCahon, Vice President, Corporate Relations and Corporate Secretary

312-592-5379

jane.mccahon@tdsinc.com

Julie Mathews, Investor Relations Director

312-592-5341

julie.mathews@tdsinc.com

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: All information set forth in this news release, except historical and factual information, represents forward-looking statements. This includes all statements about the company’s plans, beliefs, estimates, and expectations. These statements are based on current estimates, projections, and assumptions, which involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Important factors that may affect these forward-looking statements include, but are not limited to: impacts of any pending acquisitions/divestitures/exchanges of properties and/or licenses, including, but not limited to, the ability to obtain regulatory approvals, successfully complete the transactions and the financial impacts of such transactions; the ability of the company to successfully manage and grow its markets; the overall economy; competition; the ability to obtain or maintain roaming arrangements with other carriers on acceptable terms; the state and federal telecommunications regulatory environment; the value of assets and investments; adverse changes in the ratings afforded U.S. Cellular debt securities by accredited ratings organizations; industry consolidation; advances in telecommunications technology; uncertainty of access to the capital markets; pending and future litigation; changes in income tax rates, laws, regulations or rulings; changes in customer growth rates, average monthly revenue per user, churn rates, roaming revenue and terms, the availability of wireless devices, or the mix of products and services offered by U.S. Cellular. Investors are encouraged to consider these and other risks and uncertainties that are discussed in the Form 8-K Current Report used by U.S. Cellular to furnish this press release to the Securities and Exchange Commission (“SEC”), which are incorporated by reference herein.

For more information about U.S. Cellular, visit:

U.S. Cellular: www.uscellular.com

|

United States Cellular Corporation

|

|

Summary Operating Data (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of or for the Quarter Ended

|

9/30/2015

|

|

6/30/2015

|

|

3/31/2015

|

|

12/31/2014

|

|

9/30/2014

|

|

Retail Customers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postpaid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total at end of period

|

|

4,341,000

|

|

|

4,324,000

|

|

|

4,307,000

|

|

|

4,298,000

|

|

|

4,200,000

|

|

|

|

Gross additions

|

|

200,000

|

|

|

191,000

|

|

|

200,000

|

|

|

302,000

|

|

|

251,000

|

|

|

|

Net additions (losses)

|

|

17,000

|

|

|

17,000

|

|

|

9,000

|

|

|

98,000

|

|

|

52,000

|

|

|

|

ARPU (1)

|

$

|

58.12

|

|

$

|

53.62

|

|

$

|

54.87

|

|

$

|

56.51

|

|

$

|

56.37

|

|

|

|

ARPA (2)

|

$

|

147.00

|

|

$

|

133.85

|

|

$

|

134.94

|

|

$

|

136.13

|

|

$

|

132.99

|

|

|

|

Churn rate (3)

|

|

1.4%

|

|

|

1.3%

|

|

|

1.5%

|

|

|

1.6%

|

|

|

1.6%

|

|

|

|

Smartphone penetration (4)

|

|

72%

|

|

|

69%

|

|

|

67%

|

|

|

65%

|

|

|

62%

|

|

|

Prepaid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total at end of period

|

|

380,000

|

|

|

368,000

|

|

|

360,000

|

|

|

348,000

|

|

|

350,000

|

|

|

|

Gross additions

|

|

71,000

|

|

|

65,000

|

|

|

73,000

|

|

|

60,000

|

|

|

64,000

|

|

|

|

Net additions (losses)

|

|

12,000

|

|

|

8,000

|

|

|

12,000

|

|

|

(2,000)

|

|

|

(2,000)

|

|

|

|

ARPU (1)

|

$

|

35.64

|

|

$

|

35.98

|

|

$

|

35.72

|

|

$

|

35.33

|

|

$

|

34.40

|

|

|

|

Churn rate (3)

|

|

5.2%

|

|

|

5.2%

|

|

|

5.8%

|

|

|

5.9%

|

|

|

6.3%

|

|

Total customers at end of period

|

|

4,807,000

|

|

|

4,779,000

|

|

|

4,775,000

|

|

|

4,760,000

|

|

|

4,674,000

|

|

Billed ARPU (1)

|

$

|

55.42

|

|

$

|

51.29

|

|

$

|

52.29

|

|

$

|

53.63

|

|

$

|

53.24

|

|

Service revenue ARPU (1)

|

$

|

62.31

|

|

$

|

57.55

|

|

$

|

58.01

|

|

$

|

60.10

|

|

$

|

60.92

|

|

Smartphones sold as a percent of total

handsets sold

|

|

87%

|

|

|

87%

|

|

|

86%

|

|

|

87%

|

|

|

81%

|

|

Total population

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated markets (5) (8)

|

|

50,313,000

|

|

|

52,809,000

|

|

|

52,822,000

|

|

|

58,840,000

|

|

|

60,136,000

|

|

|

|

Consolidated operating markets (5)

|

|

31,814,000

|

|

|

31,814,000

|

|

|

31,814,000

|

|

|

31,729,000

|

|

|

31,729,000

|

|

Market penetration at end of period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated markets (6)

|

|

10%

|

|

|

9%

|

|

|

9%

|

|

|

8%

|

|

|

8%

|

|

|

|

Consolidated operating markets (6)

|

|

15%

|

|

|

15%

|

|

|

15%

|

|

|

15%

|

|

|

15%

|

|

Capital expenditures (000s)

|

$

|

134,816

|

|

$

|

133,666

|

|

$

|

66,460

|

|

$

|

181,655

|

|

$

|

142,452

|

|

Total cell sites in service

|

|

6,246

|

|

|

6,223

|

|

|

6,219

|

|

|

6,220

|

|

|

6,209

|

|

Owned towers (7)

|

|

3,957

|

|

|

3,940

|

|

|

3,936

|

|

|

4,280

|

|

|

4,487

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Average Revenue Per User (“ARPU”) metrics are calculated by dividing a revenue base by an average number of customers by the number of months in the period. These revenue bases and customer populations are shown below:

|

|

|

|

|

a.

|

Postpaid ARPU consists of total postpaid service revenues and postpaid customers.

|

|

|

|

|

b.

|

Prepaid ARPU consists of total prepaid service revenues and prepaid customers.

|

|

|

|

|

c.

|

Billed ARPU consists of total postpaid, prepaid and reseller service revenues and postpaid, prepaid and reseller customers.

|

|

|

|

|

d.

|

Service revenue ARPU consists of total postpaid, prepaid and reseller service revenues, inbound roaming and other service revenues and postpaid, prepaid and reseller customers.

|

|

(2)

|

Average Revenue Per Account (“ARPA”) metric is calculated by dividing total postpaid service revenues by the average number of postpaid accounts by the number of months in the period.

|

|

(3)

|

Churn metrics represent the percentage of the postpaid or prepaid customers that disconnect service each month. These metrics represent the average monthly postpaid or prepaid churn rate for each respective period.

|

|

(4)

|

Smartphones represent wireless devices which run on an Android, Apple, BlackBerry or Windows Mobile operating system, excluding connected devices. Smartphone penetration is calculated by dividing postpaid smartphone customers by total postpaid handset customers.

|

|

(5)

|

During the third quarter of 2015 U.S. Cellular reassessed population statistics with respect to markets which U.S. Cellular consolidates and revised its calculations to more accurately accumulate such population statistics. As a result, prior period population data and corresponding market penetration ratios were revised for markets that U.S. Cellular currently consolidates, or previously consolidated in the periods presented. The decrease in the population of Consolidated markets is due primarily to the license exchange transactions of certain non-operating licenses in North Carolina in December 2014 and Illinois and Indiana in March 2015. Total Population is used only to calculate market penetration of consolidated markets and consolidated operating markets, respectively. See footnote (6) below.

|

|

(6)

|

Market penetration is calculated by dividing the number of wireless customers at the end of the period by the total population of consolidated markets and consolidated operating markets, respectively, as estimated by Claritas.

|

|

(7)

|

During the quarters ended March 31, 2015 and December 31, 2014, U.S. Cellular sold 359 and 236 towers, respectively, in divested markets.

|

|

(8)

|

As licenses awarded in Auction 97 have not yet been granted, population statistics related to such licenses have not been included in population data.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States Cellular Corporation

|

|

Consolidated Statement of Operations Highlights

|

|

Three Months Ended September 30,

|

|

(Unaudited, dollars and shares in thousands, except per share amounts)

|

|

|

|

|

|

|

Change

|

|

|

|

|

2015

|

|

2014

|

|

Amount

|

|

Percent

|

|

Operating revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

Service

|

$

|

895,960

|

|

$

|

851,063

|

|

$

|

44,897

|

|

5%

|

|

|

Equipment sales

|

|

172,946

|

|

|

149,356

|

|

|

23,590

|

|

16%

|

|

|

|

Total operating revenues

|

|

1,068,906

|

|

|

1,000,419

|

|

|

68,487

|

|

7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

System operations (excluding Depreciation, amortization

and accretion reported below)

|

|

198,982

|

|

|

199,750

|

|

|

(768)

|

|

-

|

|

|

Cost of equipment sold

|

|

287,256

|

|

|

307,862

|

|

|

(20,606)

|

|

(7)%

|

|

|

Selling, general and administrative

|

|

374,585

|

|

|

397,545

|

|

|

(22,960)

|

|

(6)%

|

|

|

Depreciation, amortization and accretion

|

|

152,369

|

|

|

148,952

|

|

|

3,417

|

|

2%

|

|

|

(Gain) loss on asset disposals, net

|

|

2,618

|

|

|

7,947

|

|

|

(5,329)

|

|

(67)%

|

|

|

(Gain) loss on sale of business and other exit costs, net

|

|

(643)

|

|

|

(10,283)

|

|

|

9,640

|

|

94%

|

|

|

(Gain) loss on license sales and exchanges, net

|

|

(23,986)

|

|

|

–

|

|

|

(23,986)

|

|

|

|

|

|

Total operating expenses

|

|

991,181

|

|

|

1,051,773

|

|

|

(60,592)

|

|

(6)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

77,725

|

|

|

(51,354)

|

|

|

129,079

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment and other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in earnings of unconsolidated entities

|

|

39,674

|

|

|

35,971

|

|

|

3,703

|

|

10%

|

|

|

Interest and dividend income

|

|

9,299

|

|

|

3,572

|

|

|

5,727

|

|

>100%

|

|

|

Interest expense

|

|

(21,121)

|

|

|

(13,514)

|

|

|

(7,607)

|

|

(56)%

|

|

|

Other, net

|

|

78

|

|

|

95

|

|

|

(17)

|

|

(18)%

|

|

|

|

Total investment and other income

|

|

27,930

|

|

|

26,124

|

|

|

1,806

|

|

7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

105,655

|

|

|

(25,230)

|

|

|

130,885

|

|

>100%

|

|

|

Income tax expense (benefit)

|

|

40,634

|

|

|

(1,459)

|

|

|

42,093

|

|

>100%

|

|

Net income (loss)

|

|

65,021

|

|

|

(23,771)

|

|

|

88,792

|

|

>100%

|

|

|

Less: Net income (loss) attributable to noncontrolling

interests, net of tax

|

|

1,427

|

|

|

(1,606)

|

|

|

3,033

|

|

>100%

|

|

Net income (loss) attributable to U.S. Cellular shareholders

|

$

|

63,594

|

|

$

|

(22,165)

|

|

$

|

85,759

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding

|

|

84,333

|

|

|

84,233

|

|

|

100

|

|

-

|

|

Basic earnings (loss) per share attributable to

U.S. Cellular shareholders

|

$

|

0.75

|

|

$

|

(0.26)

|

|

$

|

1.02

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding

|

|

84,947

|

|

|

84,233

|

|

|

714

|

|

1%

|

|

Diluted earnings (loss) per share attributable to

U.S. Cellular shareholders

|

$

|

0.75

|

|

$

|

(0.26)

|

|

$

|

1.01

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States Cellular Corporation

|

|

Consolidated Statement of Operations Highlights

|

|

Nine Months Ended September 30,

|

|

(Unaudited, dollars and shares in thousands, except per share amounts)

|

|

|

|

|

|

|

Change

|

|

|

|

|

2015

|

|

2014

|

|

Amount

|

|

Percent

|

|

Operating revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

Service

|

$

|

2,548,544

|

|

$

|

2,548,149

|

|

$

|

395

|

|

-

|

|

|

Equipment sales

|

|

461,274

|

|

|

335,854

|

|

|

125,420

|

|

37%

|

|

|

|

Total operating revenues

|

|

3,009,818

|

|

|

2,884,003

|

|

|

125,815

|

|

4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

System operations (excluding Depreciation, amortization

and accretion reported below)

|

|

585,935

|

|

|

567,488

|

|

|

18,447

|

|

3%

|

|

|

Cost of equipment sold

|

|

779,228

|

|

|

850,314

|

|

|

(71,086)

|

|

(8)%

|

|

|

Selling, general and administrative

|

|

1,106,524

|

|

|

1,197,361

|

|

|

(90,837)

|

|

(8)%

|

|

|

Depreciation, amortization and accretion

|

|

450,035

|

|

|

465,042

|

|

|

(15,007)

|

|

(3)%

|

|

|

(Gain) loss on asset disposals, net

|

|

12,268

|

|

|

16,774

|

|

|

(4,506)

|

|

(27)%

|

|

|

(Gain) loss on sale of business and other exit costs, net

|

|

(113,825)

|

|

|

(27,694)

|

|

|

(86,131)

|

|

>(100)%

|

|

|

(Gain) loss on license sales and exchanges, net

|

|

(146,884)

|

|

|

(91,446)

|

|

|

(55,438)

|

|

(61)%

|

|

|

|

Total operating expenses

|

|

2,673,281

|

|

|

2,977,839

|

|

|

(304,558)

|

|

(10)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

336,537

|

|

|

(93,836)

|

|

|

430,373

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment and other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in earnings of unconsolidated entities

|

|

109,729

|

|

|

106,166

|

|

|

3,563

|

|

3%

|

|

|

Interest and dividend income

|

|

25,834

|

|

|

6,029

|

|

|

19,805

|

|

>100%

|

|

|

Interest expense

|

|

(61,239)

|

|

|

(42,712)

|

|

|

(18,527)

|

|

(43)%

|

|

|

Other, net

|

|

274

|

|

|

281

|

|

|

(7)

|

|

(2)%

|

|

|

|

Total investment and other income

|

|

74,598

|

|

|

69,764

|

|

|

4,834

|

|

7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

411,135

|

|

|

(24,072)

|

|

|

435,207

|

|

>100%

|

|

|

Income tax expense

|

|

161,214

|

|

|

746

|

|

|

160,468

|

|

>100%

|

|

Net income (loss)

|

|

249,921

|

|

|

(24,818)

|

|

|

274,739

|

|

>100%

|

|

|

Less: Net income (loss) attributable to noncontrolling

interests, net of tax

|

|

6,911

|

|

|

(3,346)

|

|

|

10,257

|

|

>100%

|

|

Net income (loss) attributable to U.S. Cellular shareholders

|

$

|

243,010

|

|

$

|

(21,472)

|

|

$

|

264,482

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding

|

|

84,224

|

|

|

84,262

|

|

|

(38)

|

|

-

|

|

Basic earnings (loss) per share attributable to

U.S. Cellular shareholders

|

$

|

2.89

|

|

$

|

(0.25)

|

|

$

|

3.14

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding

|

|

84,869

|

|

|

84,262

|

|

|

607

|

|

1%

|

|

Diluted earnings (loss) per share attributable to

U.S. Cellular shareholders

|

$

|

2.86

|

|

$

|

(0.25)

|

|

$

|

3.11

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States Cellular Corporation

|

|

Consolidated Balance Sheet Highlights

|

|

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

|

|

December 31,

|

|

|

|

2015

|

|

2014

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

596,766

|

|

$

|

211,513

|

|

|

Accounts receivable from customers and others, net

|

|

628,796

|

|

|

556,958

|

|

|

Inventory, net

|

|

176,259

|

|

|

267,068

|

|

|

Prepaid expenses

|

|

88,041

|

|

|

59,744

|

|

|

Net deferred income tax asset

|

|

82,719

|

|

|

93,058

|

|

|

Other current assets

|

|

18,730

|

|

|

90,834

|

|

|

|

|

1,591,311

|

|

|

1,279,175

|

|

|

|

|

|

|

|

|

|

Assets held for sale

|

|

–

|

|

|

107,055

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

|

|

|

|

|

Licenses

|

|

1,834,061

|

|

|

1,443,438

|

|

|

Goodwill

|

|

369,596

|

|

|

370,151

|

|

|

Investments in unconsolidated entities

|

|

347,710

|

|

|

283,014

|

|

|

|

|

2,551,367

|

|

|

2,096,603

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment

|

|

|

|

|

|

|

|

In service and under construction

|

|

7,511,997

|

|

|

7,458,740

|

|

|

Less: Accumulated depreciation

|

|

4,903,559

|

|

|

4,730,523

|

|

|

|

|

2,608,438

|

|

|

2,728,217

|

|

|

|

|

|

|

|

|

|

Other assets and deferred charges

|

|

187,268

|

|

|

276,218

|

|

|

|

|

|

|

|

|

|

Total assets

|

$

|

6,938,384

|

|

$

|

6,487,268

|

|

|

|

|

|

|

|

|

|

United States Cellular Corporation

|

|

Consolidated Balance Sheet Highlights

|

|

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

|

|

December 31,

|

|

|

|

|

2015

|

|

2014

|

|

Current liabilities

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

$

|

8,501

|

|

$

|

46

|

|

|

Accounts payable

|

|

|

|

|

|

|

|

|

Affiliated

|

|

7,874

|

|

|

9,774

|

|

|

|

Trade

|

|

362,268

|

|

|

306,845

|

|

|

Customer deposits and deferred revenues

|

|

236,568

|

|

|

287,562

|

|

|

Accrued taxes

|

|

121,177

|

|

|

36,652

|

|

|

Accrued compensation

|

|

57,547

|

|

|

66,162

|

|

|

Other current liabilities

|

|

92,617

|

|

|

149,853

|

|

|

|

|

|

886,552

|

|

|

856,894

|

|

|

|

|

|

|

|

|

|

|

Liabilities held for sale

|

|

–

|

|

|

20,934

|

|

|

|

|

|

|

|

|

|

|

Deferred liabilities and credits

|

|

|

|

|

|

|

|

Net deferred income tax liability

|

|

828,563

|

|

|

859,867

|

|

|

Other deferred liabilities and credits

|

|

287,873

|

|

|

284,002

|

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

1,368,656

|

|

|

1,151,819

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling interests with redemption features

|

|

910

|

|

|

1,150

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

U.S. Cellular shareholders' equity

|

|

|

|

|

|

|

|

Series A Common and Common Shares, par value $1 per share

|

|

88,074

|

|

|

88,074

|

|

|

Additional paid-in capital

|

|

1,490,651

|

|

|

1,472,558

|

|

|

Treasury shares

|

|

(159,705)

|

|

|

(169,139)

|

|

|

Retained earnings

|

|

2,135,145

|

|

|

1,910,498

|

|

|

|

Total U.S. Cellular shareholders' equity

|

|

3,554,165

|

|

|

3,301,991

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling interests

|

|

11,665

|

|

|

10,611

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

3,565,830

|

|

|

3,312,602

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

$

|

6,938,384

|

|

$

|

6,487,268

|

|

|

|

|

|

|

|

|

|

|

United States Cellular Corporation

|

|

Consolidated Statement of Cash Flows

|

|

Nine Months Ended September 30,

|

|

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Net income (loss)

|

$

|

249,921

|

|

$

|

(24,818)

|

|

|

Add (deduct) adjustments to reconcile net income to cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

Depreciation, amortization and accretion

|

|

450,035

|

|

|

465,042

|

|

|

|

|

Bad debts expense

|

|

78,370

|

|

|

74,357

|

|

|

|

|

Stock-based compensation expense

|

|

18,161

|

|

|

16,502

|

|

|

|

|

Deferred income taxes, net

|

|

(20,075)

|

|

|

(14,124)

|

|

|

|

|

Equity in earnings of unconsolidated entities

|

|

(109,729)

|

|

|

(106,166)

|

|

|

|

|

Distributions from unconsolidated entities

|

|

45,035

|

|

|

74,853

|

|

|

|

|

(Gain) loss on asset disposals, net

|

|

12,268

|

|

|

16,774

|

|

|

|

|

(Gain) loss on sale of business and other exit costs, net

|

|

(113,825)

|

|

|

(27,694)

|

|

|

|

|

(Gain) loss on license sales and exchanges, net

|

|

(146,884)

|

|

|

(91,446)

|

|

|

|

|

Noncash interest expense

|

|

1,206

|

|

|

845

|

|

|

|

|

Other operating activities

|

|

(391)

|

|

|

66

|

|

|

Changes in assets and liabilities from operations

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

(54,437)

|

|

|

73,741

|

|

|

|

|

Equipment installment plans receivable

|

|

(95,799)

|

|

|

(131,520)

|

|

|

|

|

Inventory

|

|

90,811

|

|

|

53,367

|

|

|

|

|

Accounts payable

|

|

116,740

|

|

|

21,677

|

|

|

|

|

Customer deposits and deferred revenues

|

|

(51,026)

|

|

|

28,486

|

|

|

|

|

Accrued taxes

|

|

161,237

|

|

|

(18,453)

|

|

|

|

|

Accrued interest

|

|

10,814

|

|

|

9,140

|

|

|

|

|

Other assets and liabilities

|

|

(86,977)

|

|

|

(89,998)

|

|

|

|

|

|

|

555,455

|

|

|

330,631

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

Cash used for additions to property, plant and equipment

|

|

(406,596)

|

|

|

(424,774)

|

|

|

Cash paid for acquisitions and licenses

|

|

(285,656)

|

|

|

(37,978)

|

|

|

Cash received from divestitures and exchanges

|

|

314,352

|

|

|

143,801

|

|

|

Cash received for investments

|

|

–

|

|

|

10,000

|

|

|

Other investing activities

|

|

990

|

|

|

804

|

|

|

|

|

|

|

(376,910)

|

|

|

(308,147)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

Issuance of long-term debt

|

|

225,000

|

|

|

–

|

|

|

Common shares reissued for benefit plans, net of tax payments

|

|

(868)

|

|

|

1,150

|

|

|

Common shares repurchased

|

|

(4,070)

|

|

|

(14,698)

|

|

|

Payment of debt issuance costs

|

|

(3,080)

|

|

|

(448)

|

|

|

Acquisition of towers in common control transaction

|

|

(2,437)

|

|

|

(76,298)

|

|

|

Distributions to noncontrolling interests

|

|

(6,097)

|

|

|

(439)

|

|

|

Other financing activities

|

|

(1,740)

|

|

|

(18)

|

|

|

|

|

|

|

206,708

|

|

|

(90,751)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents

|

|

385,253

|

|

|

(68,267)

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

|

|

|

|

|

Beginning of period

|

|

211,513

|

|

|

342,065

|

|

|

End of period

|

$

|

596,766

|

|

$

|

273,798

|

|

|

|

|

|

|

|

|

|

|

|

United States Cellular Corporation

|

|

Financial Measures and Reconciliations

|

|

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Nine Months Ended

|

|

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

$

|

131,486

|

|

$

|

117,771

|

|

$

|

555,455

|

|

$

|

330,631

|

|

Add: Sprint Cost Reimbursement

|

|

|

4,422

|

|

|

17,896

|

|

|

27,596

|

|

|

52,012

|

|

Less: Cash used for additions to property, plant

and equipment

|

|

|

147,361

|

|

|

162,377

|

|

|

406,596

|

|

|

424,774

|

|

|

Adjusted free cash flow (1)

|

|

$

|

(11,453)

|

|

$

|

(26,710)

|

|

$

|

176,455

|

|

$

|

(42,131)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Adjusted free cash flow is defined as Cash flows from operating activities (which includes cash outflows related to the Sprint decommissioning), as adjusted for cash proceeds from the Sprint Cost Reimbursement (which are included in Cash flows from investing activities in the Consolidated Statement of Cash Flows), less Cash used for additions to property, plant and equipment. Sprint decommissioning and Sprint Cost Reimbursement are further defined and discussed in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2015. Adjusted free cash flow is a non-GAAP financial measure which U.S. Cellular believes may be useful to investors and other users of its financial information in evaluating the amount of cash generated by business operations (including cash proceeds from the Sprint Cost Reimbursement), after Cash used for additions to property, plant and equipment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.2

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

SAFE HARBOR CAUTIONARY STATEMENT

This Form 8-K and/or press release attached to this Form 8-K contain statements that are not based on historical facts and represent forward-looking statements, as this term is defined in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, that address activities, events or developments that U.S. Cellular intends, expects, projects, believes, estimates, plans or anticipates will or may occur in the future are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. Such forward‑looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward‑looking statements. Such risks, uncertainties and other factors include those set forth below, as more fully discussed under “Risk Factors” in the most recent filing of U.S. Cellular’s Form 10-K, as updated by any U.S. Cellular Form 10-Q filed subsequent to such Form 10-K. However, such factors are not necessarily all of the important factors that could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the forward-looking statements contained in this document. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements. U.S. Cellular undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. You should carefully consider the Risk Factors in the most recent filing of U.S. Cellular’s Form 10-K, as updated by any U.S. Cellular Form 10-Q filed subsequent to such Form 10-K, the following factors and other information contained in, or incorporated by reference into, this Form 8-K and/or press release attached to this Form 8-K to understand the material risks relating to U.S. Cellular’s business.

- Intense competition in the markets in which U.S. Cellular operates could adversely affect U.S. Cellular’s revenues or increase its costs to compete.

- A failure by U.S. Cellular to successfully execute its business strategy (including planned acquisitions, divestitures and exchanges) or allocate resources or capital could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- U.S. Cellular offers customers the option to purchase certain devices under installment contracts, which creates certain risks and uncertainties which could have an adverse impact on U.S. Cellular's financial condition or results of operations.

- Changes in roaming practices or other factors could cause U.S. Cellular's roaming revenues to decline from current levels and/or impact U.S. Cellular's ability to service its customers in geographic areas where U.S. Cellular does not have its own network, which could have an adverse effect on U.S. Cellular's business, financial condition or results of operations.

- A failure by U.S. Cellular to obtain access to adequate radio spectrum to meet current or anticipated future needs and/or to accurately predict future needs for radio spectrum could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- To the extent conducted by the Federal Communications Commission (“FCC”), U.S. Cellular is likely to participate in FCC auctions of additional spectrum in the future as an applicant or as a noncontrolling partner in another auction applicant and, during certain periods, will be subject to the FCC’s anti-collusion rules, which could have an adverse effect on U.S. Cellular.

- Changes in the regulatory environment or a failure by U.S. Cellular to timely or fully comply with any applicable regulatory requirements could adversely affect U.S. Cellular’s business, financial condition or results of operations.

- An inability to attract people of outstanding potential, to develop their potential through education and assignments, and to retain them by keeping them engaged, challenged and properly rewarded could have an adverse effect on U.S. Cellular's business, financial condition or results of operations.

- U.S. Cellular’s assets are concentrated in the U.S. wireless telecommunications industry. As a result, its results of operations may fluctuate based on factors related primarily to conditions in this industry.

- U.S. Cellular’s lower scale relative to larger competitors could adversely affect its business, financial condition or results of operations.

- Changes in various business factors could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- Advances or changes in technology could render certain technologies used by U.S. Cellular obsolete, could put U.S. Cellular at a competitive disadvantage, could reduce U.S. Cellular’s revenues or could increase its costs of doing business.

- Complexities associated with deploying new technologies present substantial risk.

- U.S. Cellular is subject to numerous surcharges and fees from federal, state and local governments, and the applicability and the amount of these fees are subject to great uncertainty.

- Performance under device purchase agreements could have a material adverse impact on U.S. Cellular's business, financial condition or results of operations.

- Changes in U.S. Cellular’s enterprise value, changes in the market supply or demand for wireless licenses, adverse developments in the business or the industry in which U.S. Cellular is involved and/or other factors could require U.S. Cellular to recognize impairments in the carrying value of its licenses, goodwill and/or physical assets.

- Costs, integration problems or other factors associated with acquisitions, divestitures or exchanges of properties or licenses and/or expansion of U.S. Cellular’s business could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- U.S. Cellular’s investments in unproven technologies may not produce the benefits that U.S. Cellular expects.

- A failure by U.S. Cellular to complete significant network construction and systems implementation activities as part of its plans to improve the quality, coverage, capabilities and capacity of its network, support and other systems and infrastructure could have an adverse effect on its operations.

- Difficulties involving third parties with which U.S. Cellular does business, including changes in U.S. Cellular's relationships with or financial or operational difficulties of key suppliers or independent agents and third party national retailers who market U.S. Cellular services, could adversely affect U.S. Cellular’s business, financial condition or results of operations.

- U.S. Cellular has significant investments in entities that it does not control. Losses in the value of such investments could have an adverse effect on U.S. Cellular’s financial condition or results of operations.

- A failure by U.S. Cellular to maintain flexible and capable telecommunication networks or information technology, or a material disruption thereof, could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- U.S. Cellular has experienced and, in the future, expects to experience cyber-attacks or other breaches of network or information technology security of varying degrees on a regular basis, which could have an adverse effect on U.S. Cellular's business, financial condition or results of operations.

- The market price of U.S. Cellular’s Common Shares is subject to fluctuations due to a variety of factors.

- Changes in facts or circumstances, including new or additional information, could require U.S. Cellular to record charges in excess of amounts accrued in the financial statements, which could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- Disruption in credit or other financial markets, a deterioration of U.S. or global economic conditions or other events could, among other things, impede U.S. Cellular’s access to or increase the cost of financing its operating and investment activities and/or result in reduced revenues and lower operating income and cash flows, which would have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- Uncertainty of U.S. Cellular’s ability to access capital, deterioration in the capital markets, other changes in market conditions, changes in U.S. Cellular’s credit ratings or other factors could limit or restrict the availability of financing on terms and prices acceptable to U.S. Cellular, which could require U.S. Cellular to reduce its construction, development or acquisition programs.

- Settlements, judgments, restraints on its current or future manner of doing business and/or legal costs resulting from pending and future litigation could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- The possible development of adverse precedent in litigation or conclusions in professional studies to the effect that radio frequency emissions from wireless devices and/or cell sites cause harmful health consequences, including cancer or tumors, or may interfere with various electronic medical devices such as pacemakers, could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- Claims of infringement of intellectual property and proprietary rights of others, primarily involving patent infringement claims, could prevent U.S. Cellular from using necessary technology to provide products or services or subject U.S. Cellular to expensive intellectual property litigation or monetary penalties, which could have an adverse effect on U.S. Cellular’s business, financial condition or results of operations.

- There are potential conflicts of interests between TDS and U.S. Cellular.

- Certain matters, such as control by TDS and provisions in the U.S. Cellular Restated Certificate of Incorporation, may serve to discourage or make more difficult a change in control of U.S. Cellular.

- Any of the foregoing events or other events could cause revenues, earnings, capital expenditures and/or any other financial or statistical information to vary from U.S. Cellular’s forward-looking estimates by a material amount.

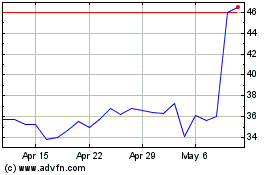

US Cellular (NYSE:USM)

Historical Stock Chart

From Mar 2024 to Apr 2024

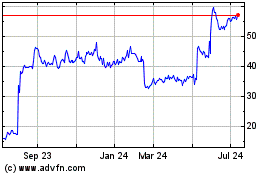

US Cellular (NYSE:USM)

Historical Stock Chart

From Apr 2023 to Apr 2024