FORM 8-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section

13 or 15(d) of

The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2015

UNITED STATES CELLULAR CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-9712

|

|

62-1147325

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

8410 West Bryn Mawr, Chicago, Illinois

|

|

60631

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including

area code: (773) 399-8900

Not Applicable

(Former name or

former address, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction

A.2. below):

|

¨

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 2.02. Results

of Operations and Financial Condition

On May 1, 2015,

United States Cellular Corporation (“U.S. Cellular”) issued a news release announcing

its results of operations for the period ended March 31, 2015. A copy of

the news release is attached hereto as Exhibit 99.1 and incorporated by

reference herein.

The information in

this Item 2.02 of Form 8-K is being furnished and shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as

amended, or otherwise subject to the liabilities of that Section.

Item 9.01. Financial

Statements and Exhibits

(d) Exhibits:

In accordance with the

provisions of Item 601 of Regulation S-K, any Exhibits filed or furnished

herewith are set forth on the Exhibit Index attached hereto.

Attached as Exhibit

99.2 is a safe harbor cautionary statement under the Private Securities

Litigation Reform Act of 1995.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned, thereto

duly authorized.

United States Cellular Corporation

(Registrant)

Date: May 1, 2015

|

By:

|

/s/ Steven T. Campbell

|

|

|

|

Steven T. Campbell

Executive Vice President – Finance,

Chief Financial Officer and Treasurer

(principal financial officer)

|

|

EXHIBIT INDEX

The following exhibits are filed

or furnished herewith as noted below.

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

Earnings Press Release dated May 1, 2015

|

|

|

|

|

|

99.2

|

|

Private Securities Litigation Reform Act of 1995 Safe Harbor

Cautionary Statement

|

|

|

|

|

Exhibit 99.l NEWS RELEASE

As previously announced,

U.S. Cellular will hold a teleconference May 1, 2015 at 9:30 a.m. CDT. Listen

to the live call via the Events & Presentations page of investors.uscellular.com.

FOR

IMMEDIATE RELEASE

U.S. cellular reports first quarter 2015 results

Increases guidance for operating cash flow and adjusted

EBITDA

CHICAGO, (May 1, 2015) —

United States Cellular Corporation (NYSE:USM) reported total operating revenues

of $965.2 million for the first quarter of 2015, versus $925.8 million for the same

period one year ago. Net income attributable to U.S. Cellular shareholders and

related diluted earnings per share were $160.1 million and $1.89, respectively,

for the first quarter of 2015, compared to $19.5 million and $0.23,

respectively, in the comparable period one year ago.

“We had another encouraging

quarter at U.S. Cellular, building on the turnaround in customer growth that we

achieved in 2014,” said Kenneth R. Meyers, U.S. Cellular president and CEO. “We

grew our postpaid customer base through strong sales of connected devices and

significantly lower customer churn, and we significantly increased operating

cash flow.

“We are pleased with the strong

adoption of shared data plans and increasing number of devices per account,

which are driving revenue growth. Our 4G LTE network will cover 98 percent of

customers by the end of the year.

“We are focused on continuing to grow our customer base

and increasing revenue and operating cash flow in 2015 by offering innovative

services and exciting devices that run on our high-quality network.”

2015

Estimated Results

U.S. Cellular’s estimates of

full-year 2015 results are shown below. Such estimates represent management’s view

as of May 1, 2015. Such forward‑looking statements should not be assumed

to be current as of any future date. U.S. Cellular undertakes no duty to

update such information, whether as a result of new information, future events

or otherwise. There can be no assurance that final results will not differ

materially from such estimated results.

|

|

|

2015 Estimated Results

|

|

|

|

Current

|

|

Previous

|

|

(Dollars in

millions)

|

|

|

|

|

Total operating

revenues

|

$4,000-$4,200

|

|

Unchanged

|

|

Operating cash

flow (1)

|

$400-$500

|

|

$350-$450

|

|

Adjusted EBITDA

(1)

|

$580-$680

|

|

$530-$630

|

|

Capital

expenditures

|

$600

|

|

Unchanged

|

(1)

Operating cash flow is defined as

net income, adjusted for the items set forth in the reconciliation below.

Adjusted EBITDA is defined as net income, adjusted for the items set forth in

the reconciliation below. Operating cash flow and Adjusted EBITDA exclude

these items in order to show operating results on a more comparable basis from

period to period. From time to time, U.S. Cellular may exclude other items from

Operating cash flow and/or Adjusted EBITDA if such items help reflect operating

results on a more comparable basis. U.S. Cellular does not intend to imply that

any such items that are excluded are non-recurring, infrequent or unusual; such

items may occur in the future. Operating cash flow and Adjusted EBITDA are not

measures of financial performance under Generally Accepted Accounting

Principles in the United States (“GAAP”) and should not be considered as

alternatives to net income as indicators of the company’s operating performance

or as alternatives to cash flows from operating activities, determined in

accordance with GAAP, as indicators of cash flows or as measures of liquidity.

U.S. Cellular believes Operating cash flow and Adjusted EBITDA are useful

measures of U.S. Cellular’s operating results before significant recurring

non-cash charges, gains and losses, and other items as indicated below. The

following tables provide a reconciliation to Operating cash flow and Adjusted

EBITDA for 2015 estimated results, actual results for the three months ended

March 31, 2015 and 2014 actual results:

|

|

|

|

|

Actual Results

|

|

|

|

2015 Estimated

Results (2)

|

|

Three Months Ended

March 31, 2015

|

|

Year Ended

December 31, 2014

|

|

(Dollars in

millions)

|

|

|

|

|

|

|

Net income

(loss) (GAAP)

|

N/A

|

|

$165

|

|

($47)

|

|

Add back:

|

|

|

|

|

|

|

|

Income tax

expense (benefit)

|

N/A

|

|

$108

|

|

($12)

|

|

Income

(loss) before income taxes (GAAP)

|

$140-$240

|

|

$273

|

|

($59)

|

|

Add back:

|

|

|

|

|

|

|

|

Interest

expense

|

$80

|

|

$20

|

|

$57

|

|

|

Depreciation,

amortization and accretion expense

|

$580

|

|

$147

|

|

$606

|

|

EBITDA

|

$800-$900

|

|

$440

|

|

$605

|

|

Add back

(deduct):

|

|

|

|

|

|

|

|

(Gain) loss on

sale of business and other exit costs, net

|

($110)

|

|

($111)

|

|

($33)

|

|

|

(Gain) loss on

license sales and exchanges, net

|

($125)

|

|

($123)

|

|

($113)

|

|

|

(Gain) loss on

assets disposals, net

|

$15

|

|

$4

|

|

$21

|

|

Adjusted EBITDA

|

$580-$680

|

|

$209

|

|

$480

|

|

Deduct:

|

|

|

|

|

|

|

|

Equity in

earnings of unconsolidated entities

|

($130)

|

|

($34)

|

|

($130)

|

|

|

Interest and

dividend income

|

($50)

|

|

($8)

|

|

($12)

|

|

Operating cash

flow (3)

|

$400-$500

|

|

$167

|

|

$338

|

|

|

|

|

|

|

|

|

|

Note: Totals

may not foot due to rounding differences.

|

|

|

|

|

|

|

|

|

(2)

In providing 2015

Estimated Results, U.S. Cellular has not completed the above reconciliation to net income because it does not provide guidance

for income taxes. U.S. Cellular believes that the impact of income taxes cannot

be reasonably predicted; therefore, the company is unable to provide such

guidance. Accordingly, a reconciliation to net income is not available without

unreasonable effort.

(3)

A reconciliation of Operating cash

flow (Non-GAAP) to Operating income (GAAP) for March 31, 2015 actual results

can be found on the company's website at investors.uscellular.com.

Conference

Call Information

U.S. Cellular will hold a

conference call on May 1, 2015 at 9:30 a.m. Central Time.

§ Access the live call on the Events & Presentation page

of investors.uscellular.com or at http://www.videonewswire.com/event.asp?id=102201.

§ Access the call by phone at 877/407-8029 (US/Canada),

no pass code required.

Before the call, certain

financial and statistical information to be discussed during the call will be

posted to investors.uscellular.com. The call will be archived on the Events &

Presentations page of investors.uscellular.com.

About U.S. Cellular

United States Cellular

Corporation provides a comprehensive range of wireless products and services,

excellent customer support, and a high-quality network to 4.8 million customers

in 23 states. The Chicago-based company had 6,600 full- and part-time

associates as of March 31, 2015. At the end of the first quarter of 2015,

Telephone and Data Systems, Inc. owned 84 percent of U.S. Cellular. For more

information about U.S. Cellular, visit uscellular.com.

Contacts

Jane McCahon, Vice President,

Corporate Relations and Corporate Secretary

312-592-5379

jane.mccahon@tdsinc.com

Julie Mathews, Investor

Relations Manager

312-592-5341

julie.mathews@tdsinc.com

Safe Harbor

Statement Under the Private Securities Litigation Reform Act of 1995: All information set forth in this news

release, except historical and factual information, represents forward-looking

statements. This includes all statements about the company’s plans, beliefs,

estimates, and expectations. These statements are based on current estimates,

projections, and assumptions, which involve certain risks and uncertainties

that could cause actual results to differ materially from those in the

forward-looking statements. Important factors that may affect these

forward-looking statements include, but are not limited to: impacts of any

pending acquisition and divestiture transactions, including, but not limited

to, the ability to obtain regulatory approvals, successfully complete the

transactions and the financial impacts of such transactions; the ability of the

company to successfully manage and grow its markets; the overall economy;

competition; the ability to obtain or maintain roaming arrangements with other

carriers on acceptable terms; the state and federal telecommunications regulatory

environment; the value of assets and investments; adverse changes in the

ratings afforded TDS and U.S. Cellular debt securities by accredited ratings

organizations; industry consolidation; advances in telecommunications

technology; uncertainty of access to the capital markets; pending and

future litigation; changes in income tax rates, laws, regulations or rulings;

acquisitions/divestitures of properties and/or licenses; changes in customer

growth rates, average monthly revenue per user, churn rates, roaming revenue

and terms, the availability of wireless devices, or the mix of products and

services offered by U.S. Cellular. Investors are encouraged to consider these

and other risks and uncertainties that are discussed in the Form 8-K Current

Report used by U.S. Cellular to furnish this press release to the Securities

and Exchange Commission (“SEC”), which are incorporated by reference herein.

|

United States Cellular Corporation

|

|

Summary Operating Data (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of or

for the Quarter Ended

|

3/31/2015

|

|

12/31/2014

|

|

9/30/2014

|

|

6/30/2014

|

|

3/31/2014

|

|

Retail

Customers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postpaid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total at end of

period

|

|

4,307,000

|

|

|

4,298,000

|

|

|

4,200,000

|

|

|

4,148,000

|

|

|

4,174,000

|

|

|

|

Gross additions

|

|

200,000

|

|

|

302,000

|

|

|

251,000

|

|

|

190,000

|

|

|

197,000

|

|

|

|

Net additions

(losses)

|

|

9,000

|

|

|

98,000

|

|

|

52,000

|

|

|

(26,000)

|

|

|

(93,000)

|

|

|

|

ARPU (1)

|

$

|

54.87

|

|

$

|

56.51

|

|

$

|

56.37

|

|

$

|

56.82

|

|

$

|

57.59

|

|

|

|

ARPA (2)

|

$

|

134.94

|

|

$

|

136.13

|

|

$

|

132.99

|

|

$

|

131.95

|

|

$

|

132.03

|

|

|

|

Churn rate (3)

|

|

1.5%

|

|

|

1.6%

|

|

|

1.6%

|

|

|

1.7%

|

|

|

2.3%

|

|

|

|

Smartphone

penetration (4)

|

|

66.9%

|

|

|

64.8%

|

|

|

61.7%

|

|

|

58.4%

|

|

|

55.8%

|

|

|

Prepaid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total at end of

period

|

|

360,000

|

|

|

348,000

|

|

|

350,000

|

|

|

352,000

|

|

|

356,000

|

|

|

|

Gross additions

|

|

73,000

|

|

|

60,000

|

|

|

64,000

|

|

|

65,000

|

|

|

85,000

|

|

|

|

Net additions

(losses)

|

|

12,000

|

|

|

(2,000)

|

|

|

(2,000)

|

|

|

(4,000)

|

|

|

13,000

|

|

|

|

ARPU (1)

|

$

|

35.72

|

|

$

|

35.33

|

|

$

|

34.40

|

|

$

|

34.02

|

|

$

|

32.22

|

|

|

|

Churn rate (3)

|

|

5.8%

|

|

|

5.9%

|

|

|

6.3%

|

|

|

6.5%

|

|

|

6.9%

|

|

Total

customers at end of period

|

|

4,775,000

|

|

|

4,760,000

|

|

|

4,674,000

|

|

|

4,653,000

|

|

|

4,684,000

|

|

Billed ARPU

(1)

|

$

|

52.29

|

|

$

|

53.63

|

|

$

|

53.24

|

|

$

|

53.36

|

|

$

|

53.93

|

|

Service

revenue ARPU (1)

|

$

|

58.01

|

|

$

|

60.10

|

|

$

|

60.92

|

|

$

|

60.32

|

|

$

|

60.19

|

|

Smartphones

sold as a percent of total

handsets

sold

|

|

85.7%

|

|

|

86.5%

|

|

|

80.8%

|

|

|

79.0%

|

|

|

78.2%

|

|

Total

population

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated

markets (5)

|

|

45,737,000

|

|

|

50,906,000

|

|

|

54,817,000

|

|

|

54,817,000

|

|

|

54,817,000

|

|

|

|

Consolidated

operating markets (5)

|

|

31,814,000

|

|

|

31,729,000

|

|

|

31,729,000

|

|

|

31,729,000

|

|

|

31,729,000

|

|

Market

penetration at end of period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated

markets (6)

|

|

10.4%

|

|

|

9.4%

|

|

|

8.5%

|

|

|

8.5%

|

|

|

8.5%

|

|

|

|

Consolidated operating

markets (6)

|

|

15.0%

|

|

|

15.0%

|

|

|

14.7%

|

|

|

14.7%

|

|

|

14.8%

|

|

Capital

expenditures (000s)

|

$

|

66,460

|

|

$

|

181,655

|

|

$

|

142,452

|

|

$

|

143,927

|

|

$

|

89,581

|

|

Total cell

sites in service

|

|

6,219

|

|

|

6,220

|

|

|

6,209

|

|

|

6,183

|

|

|

6,165

|

|

Owned towers

(7)

|

|

3,955

|

|

|

4,281

|

|

|

4,487

|

|

|

4,457

|

|

|

4,448

|

(1)

Average Revenue Per User (“ARPU”)

metrics are calculated by dividing a revenue base by an average number of

customers by the number of months in the period. These revenue bases and

customer populations are shown below:

a.

Postpaid ARPU consists of total

postpaid service revenues and postpaid customers.

b.

Prepaid ARPU consists of total

prepaid service revenues and prepaid customers.

c.

Billed ARPU consists of total

postpaid, prepaid and reseller service revenues and postpaid, prepaid and

reseller customers.

d.

Service revenue ARPU consists of

total postpaid, prepaid and reseller service revenues, inbound roaming and

other service revenues and postpaid, prepaid and reseller customers.

(2)

Average Revenue Per Account

(“ARPA”) metric is calculated by dividing total postpaid service revenues by

the average number of postpaid accounts by the number of months in the period.

(3)

Churn metrics represent the

percentage of the postpaid or prepaid customers that disconnect service each

month. These metrics represent the average monthly postpaid or prepaid churn

rate for each respective period.

(4)

Smartphones represent wireless

devices which run on an Android, Apple, BlackBerry or Windows Mobile operating

system, excluding connected devices. Smartphone penetration is calculated by

dividing postpaid smartphone customers by total postpaid handset customers.

(5)

The decrease in the population of

Consolidated markets is due primarily to the license exchange transactions of certain

non-operating licenses in North Carolina in December 2014 and Illinois and

Indiana in March 2015. Total Population is used only to calculate market

penetration of consolidated markets and consolidated operating markets,

respectively. See footnote (6) below.

(6)

Market penetration is calculated by

dividing the number of wireless customers at the end of the period by the total

population of consolidated markets and consolidated operating markets,

respectively, as estimated by Claritas. The increase in consolidated markets penetration

is due primarily to a lower denominator as a result of the license divestitures

described in footnote (5) above.

(7)

During the quarters ended March 31,

2015 and December 31, 2014, sold 359 and 236 towers, respectively, in divested

markets.

|

United States Cellular Corporation

|

|

Consolidated Statement of Operations

Highlights

|

|

Three Months Ended March 31,

|

|

(Unaudited, dollars and shares in

thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

Change

|

|

|

|

|

2015

|

|

2014

|

|

Amount

|

|

Percent

|

|

Operating

revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

Service

|

$

|

828,211

|

|

$

|

853,613

|

|

$

|

(25,402)

|

|

(3%)

|

|

|

Equipment sales

|

|

137,034

|

|

|

72,198

|

|

|

64,836

|

|

90%

|

|

|

|

Total operating

revenues

|

|

965,245

|

|

|

925,811

|

|

|

39,434

|

|

4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

System

operations (excluding Depreciation, amortization and accretion

reported

below)

|

|

190,677

|

|

|

180,607

|

|

|

10,070

|

|

6%

|

|

|

Cost of

equipment sold

|

|

238,301

|

|

|

270,474

|

|

|

(32,173)

|

|

(12%)

|

|

|

Selling, general

and administrative

|

|

368,968

|

|

|

395,564

|

|

|

(26,596)

|

|

(7%)

|

|

|

Depreciation,

amortization and accretion

|

|

147,085

|

|

|

167,753

|

|

|

(20,668)

|

|

(12%)

|

|

|

(Gain) loss on

asset disposals, net

|

|

4,251

|

|

|

1,934

|

|

|

2,317

|

|

>100%

|

|

|

(Gain) loss on

sale of business and other exit costs, net

|

|

(111,477)

|

|

|

(6,900)

|

|

|

(104,577)

|

|

>100%

|

|

|

(Gain) loss on

license sales and exchanges, net

|

|

(122,873)

|

|

|

(91,446)

|

|

|

(31,427)

|

|

(34%)

|

|

|

|

Total operating

expenses

|

|

714,932

|

|

|

917,986

|

|

|

(203,054)

|

|

(22%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

income

|

|

250,313

|

|

|

7,825

|

|

|

242,488

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment

and other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in

earnings of unconsolidated entities

|

|

34,471

|

|

|

37,075

|

|

|

(2,604)

|

|

(7%)

|

|

|

Interest and

dividend income

|

|

7,566

|

|

|

884

|

|

|

6,682

|

|

>100%

|

|

|

Interest expense

|

|

(19,964)

|

|

|

(14,862)

|

|

|

(5,102)

|

|

(34%)

|

|

|

Other, net

|

|

105

|

|

|

86

|

|

|

19

|

|

22%

|

|

|

|

Total investment

and other income

|

|

22,178

|

|

|

23,183

|

|

|

(1,005)

|

|

(4%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before

income taxes

|

|

272,491

|

|

|

31,008

|

|

|

241,483

|

|

>100%

|

|

|

Income tax

expense

|

|

107,501

|

|

|

12,604

|

|

|

94,897

|

|

>100%

|

|

Net income

|

|

164,990

|

|

|

18,404

|

|

|

146,586

|

|

>100%

|

|

|

Less: Net income

(loss) attributable to noncontrolling interests, net of tax

|

|

4,926

|

|

|

(1,078)

|

|

|

6,004

|

|

>(100%)

|

|

Net income

attributable to U.S. Cellular shareholders

|

$

|

160,064

|

|

$

|

19,482

|

|

$

|

140,582

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

weighted average shares outstanding

|

|

84,042

|

|

|

84,213

|

|

|

(171)

|

|

—

|

|

Basic

earnings per share attributable to U.S. Cellular shareholders

|

$

|

1.90

|

|

$

|

0.23

|

|

$

|

1.67

|

|

>100%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

weighted average shares outstanding

|

|

84,838

|

|

|

85,065

|

|

|

(227)

|

|

—

|

|

Diluted

earnings per share attributable to U.S. Cellular shareholders

|

$

|

1.89

|

|

$

|

0.23

|

|

$

|

1.66

|

|

>100%

|

|

United States Cellular Corporation

|

|

Consolidated Balance Sheet Highlights

|

|

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

December 31,

|

|

|

|

2015

|

|

2014

|

|

Current

assets

|

|

|

|

|

|

|

|

Cash and cash

equivalents

|

$

|

336,893

|

|

$

|

211,513

|

|

|

Accounts

receivable from customers and others

|

|

558,998

|

|

|

556,958

|

|

|

Inventory, net

|

|

164,900

|

|

|

267,068

|

|

|

Prepaid expenses

|

|

69,702

|

|

|

59,744

|

|

|

Net deferred

income tax asset

|

|

77,246

|

|

|

93,058

|

|

|

Other current

assets

|

|

18,112

|

|

|

90,834

|

|

|

|

|

1,225,851

|

|

|

1,279,175

|

|

|

|

|

|

|

|

|

|

Assets held

for sale

|

|

22,203

|

|

|

107,055

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

|

|

|

|

|

Licenses

|

|

1,827,102

|

|

|

1,443,438

|

|

|

Goodwill

|

|

370,151

|

|

|

370,151

|

|

|

Investments in unconsolidated

entities

|

|

304,501

|

|

|

283,014

|

|

|

|

|

2,501,754

|

|

|

2,096,603

|

|

|

|

|

|

|

|

|

|

Property,

plant and equipment

|

|

|

|

|

|

|

|

In service and

under construction

|

|

7,426,410

|

|

|

7,458,740

|

|

|

Less:

Accumulated depreciation

|

|

4,781,293

|

|

|

4,730,523

|

|

|

|

|

2,645,117

|

|

|

2,728,217

|

|

|

|

|

|

|

|

|

|

Other assets

and deferred charges

|

|

211,453

|

|

|

276,218

|

|

|

|

|

|

|

|

|

|

Total assets

|

$

|

6,606,378

|

|

$

|

6,487,268

|

|

United States Cellular Corporation

|

|

Consolidated Balance Sheet Highlights

|

|

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

December 31,

|

|

|

|

|

2015

|

|

2014

|

|

Current

liabilities

|

|

|

|

|

|

|

|

Current portion

of long-term debt

|

$

|

57

|

|

$

|

46

|

|

|

Accounts payable

|

|

|

|

|

|

|

|

|

Affiliated

|

|

8,044

|

|

|

9,774

|

|

|

|

Trade

|

|

245,170

|

|

|

306,845

|

|

|

Customer

deposits and deferred revenues

|

|

301,419

|

|

|

287,562

|

|

|

Accrued taxes

|

|

139,407

|

|

|

36,652

|

|

|

Accrued

compensation

|

|

36,957

|

|

|

66,162

|

|

|

Other current

liabilities

|

|

130,780

|

|

|

149,853

|

|

|

|

|

|

861,834

|

|

|

856,894

|

|

|

|

|

|

|

|

|

|

|

Liabilities

held for sale

|

|

---

|

|

|

20,934

|

|

|

|

|

|

|

|

|

|

|

Deferred

liabilities and credits

|

|

|

|

|

|

|

|

Net deferred

income tax liability

|

|

816,999

|

|

|

859,867

|

|

|

Other deferred

liabilities and credits

|

|

295,287

|

|

|

284,002

|

|

|

|

|

|

|

|

|

|

|

Long-term

debt

|

|

1,151,901

|

|

|

1,151,819

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling

interests with redemption features

|

|

6,619

|

|

|

1,150

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

U.S. Cellular

shareholders' equity

|

|

|

|

|

|

|

|

Series A Common

and Common Shares, par value $1 per share

|

|

88,074

|

|

|

88,074

|

|

|

Additional

paid-in capital

|

|

1,478,910

|

|

|

1,472,558

|

|

|

Treasury shares

|

|

(170,544)

|

|

|

(169,139)

|

|

|

Retained

earnings

|

|

2,067,455

|

|

|

1,910,498

|

|

|

|

Total U.S.

Cellular shareholders' equity

|

|

3,463,895

|

|

|

3,301,991

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling

interests

|

|

9,843

|

|

|

10,611

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

3,473,738

|

|

|

3,312,602

|

|

|

|

|

|

|

|

|

|

|

Total

liabilities and equity

|

$

|

6,606,378

|

|

$

|

6,487,268

|

|

United States Cellular Corporation

|

|

Consolidated Statement of Cash Flows

|

|

Three Months Ended March 31,

|

|

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

Cash flows

from operating activities

|

|

|

|

|

|

|

|

Net income

(loss)

|

$

|

164,990

|

|

$

|

18,404

|

|

|

Add (deduct)

adjustments to reconcile net income to cash flows from

operating

activities

|

|

|

|

|

|

|

|

|

|

Depreciation,

amortization and accretion

|

|

147,085

|

|

|

167,753

|

|

|

|

|

Bad debts

expense

|

|

29,132

|

|

|

20,492

|

|

|

|

|

Stock-based

compensation expense

|

|

5,740

|

|

|

4,955

|

|

|

|

|

Deferred income

taxes, net

|

|

(26,166)

|

|

|

(4,817)

|

|

|

|

|

Equity in

earnings of unconsolidated entities

|

|

(34,471)

|

|

|

(37,075)

|

|

|

|

|

Distributions

from unconsolidated entities

|

|

12,985

|

|

|

12,818

|

|

|

|

|

(Gain) loss on

asset disposals, net

|

|

4,251

|

|

|

1,934

|

|

|

|

|

(Gain) loss on

sale of business and other exit costs, net

|

|

(111,477)

|

|

|

(6,900)

|

|

|

|

|

(Gain) loss on

license sales and exchanges, net

|

|

(122,873)

|

|

|

(91,446)

|

|

|

|

|

Noncash interest

expense

|

|

386

|

|

|

269

|

|

|

|

|

Other operating

activities

|

|

—

|

|

|

47

|

|

|

Changes in

assets and liabilities from operations

|

|

|

|

|

|

|

|

|

|

Accounts

receivable

|

|

(1,437)

|

|

|

79,586

|

|

|

|

|

Equipment

installment plans receivable

|

|

(36,498)

|

|

|

2,394

|

|

|

|

|

Inventory

|

|

102,167

|

|

|

19,306

|

|

|

|

|

Accounts payable

|

|

(18,691)

|

|

|

(40,557)

|

|

|

|

|

Customer

deposits and deferred revenues

|

|

13,419

|

|

|

(1,510)

|

|

|

|

|

Accrued taxes

|

|

189,387

|

|

|

(15,403)

|

|

|

|

|

Accrued interest

|

|

9,504

|

|

|

9,182

|

|

|

|

|

Other assets and

liabilities

|

|

(71,955)

|

|

|

(75,896)

|

|

|

|

|

|

|

255,478

|

|

|

63,536

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from

investing activities

|

|

|

|

|

|

|

|

Cash used for

additions to property, plant and equipment

|

|

(116,079)

|

|

|

(109,498)

|

|

|

Cash paid for

acquisitions and licenses

|

|

(279,656)

|

|

|

(9,135)

|

|

|

Cash received

from divestitures and exchanges

|

|

274,111

|

|

|

103,042

|

|

|

Cash received

for investments

|

|

—

|

|

|

10,000

|

|

|

Other investing

activities

|

|

1,151

|

|

|

584

|

|

|

|

|

|

|

(120,473)

|

|

|

(5,007)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows

from financing activities

|

|

|

|

|

|

|

|

Common shares

reissued for benefit plans, net of tax payments

|

|

487

|

|

|

316

|

|

|

Common shares

repurchased

|

|

(2,302)

|

|

|

(2,000)

|

|

|

Payment of debt

issuance costs

|

|

(3,018)

|

|

|

—

|

|

|

Acquisition of

towers in common control transaction

|

|

(2,437)

|

|

|

—

|

|

|

Distributions to

noncontrolling interests

|

|

(225)

|

|

|

(346)

|

|

|

Other financing

activities

|

|

(2,130)

|

|

|

(23)

|

|

|

|

|

|

|

(9,625)

|

|

|

(2,053)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase

in cash and cash equivalents

|

|

125,380

|

|

|

56,476

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash

equivalents

|

|

|

|

|

|

|

|

Beginning of

period

|

|

211,513

|

|

|

342,065

|

|

|

End of period

|

$

|

336,893

|

|

$

|

398,541

|

|

United States Cellular Corporation

|

|

Financial Measures and Reconciliations

|

|

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

March 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows

from operating activities

|

|

$

|

255,478

|

|

$

|

63,536

|

|

|

Add: Sprint

Cost Reimbursement

|

|

|

15,712

|

|

|

11,254

|

|

|

Less: Cash

used for additions to property, plant and equipment

|

|

|

116,079

|

|

|

109,498

|

|

|

|

Adjusted free

cash flow (1)

|

|

$

|

155,111

|

|

$

|

(34,708)

|

(1)

Adjusted free cash flow is defined

as Cash flows from operating activities (which includes cash outflows related

to the Sprint decommissioning), as adjusted for cash proceeds from the Sprint

Cost Reimbursement (which are included in Cash flows from investing activities

in the Consolidated Statement of Cash Flows), less Cash used for additions to

property, plant and equipment. Adjusted free cash flow is a non-GAAP financial

measure which U.S. Cellular believes may be useful to investors and other users

of its financial information in evaluating the amount of cash generated by

business operations (including cash proceeds from the Sprint Cost Reimbursement),

after Cash used for additions to property, plant and equipment.

Exhibit 99.2

PRIVATE SECURITIES LITIGATION REFORM ACT

OF 1995

SAFE HARBOR CAUTIONARY STATEMENT

This Form 8-K and/or press

release attached to this Form 8-K contain statements that are not based on

historical facts and represent forward-looking statements, as this term is

defined in the Private Securities Litigation Reform Act of 1995. All

statements, other than statements of historical facts, that address activities,

events or developments that U.S. Cellular intends, expects, projects, believes,

estimates, plans or anticipates will or may occur in the future are

forward-looking statements. The words “believes,” “anticipates,”

“estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions

are intended to identify these forward-looking statements, but are not the

exclusive means of identifying them. Such forward‑looking statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results, events or developments to be significantly different from any

future results, events or developments expressed or implied by such forward‑looking

statements. Such risks, uncertainties and other factors include those set

forth below, as more fully discussed under “Risk Factors” in the most recent

filing of U.S. Cellular’s Form 10-K, as updated by any U.S. Cellular Form 10-Q

filed subsequent to such Form 10-K. However, such factors are not

necessarily all of the important factors that could cause actual results,

performance or achievements to differ materially from those expressed in, or

implied by, the forward-looking statements contained in this document.

Other unknown or unpredictable factors also could have material adverse effects

on future results, performance or achievements. U.S. Cellular undertakes

no obligation to update publicly any forward-looking statements whether as a

result of new information, future events or otherwise. You should

carefully consider the Risk Factors in the most recent filing of U.S.

Cellular’s Form 10-K, as updated by any U.S. Cellular Form 10-Q filed

subsequent to such Form 10-K, the following factors and other information

contained in, or incorporated by reference into, this Form 8-K and/or press

release attached to this Form 8-K to understand the material risks relating to U.S.

Cellular’s business.

·

Intense competition in the markets in which U.S. Cellular

operates could adversely affect U.S. Cellular’s revenues or increase its costs

to compete.

·

A failure by U.S. Cellular to successfully execute its

business strategy (including planned acquisitions, divestitures and exchanges)

or allocate resources or capital could have an adverse effect on U.S.

Cellular’s business, financial condition or results of operations.

·

U.S. Cellular offers customers the option to purchase

certain devices under installment contracts, which creates certain risks and

uncertainties which could have an adverse impact on U.S. Cellular's financial

condition or results of operations.

·

Changes in roaming practices or other factors could cause

U.S. Cellular's roaming revenues to decline from current levels and/or impact

U.S. Cellular's ability to service its customers in geographic areas where U.S.

Cellular does not have its own network, which could have an adverse effect on

U.S. Cellular's business, financial condition or results of operations.

·

A failure by U.S. Cellular to obtain access to adequate

radio spectrum to meet current or anticipated future needs and/or to accurately

predict future needs for radio spectrum could have an adverse effect on U.S. Cellular’s

business, financial condition or results of operations.

·

To the extent conducted by the Federal Communications

Commission (“FCC”), U.S. Cellular is likely to participate in FCC auctions of

additional spectrum in the future as an applicant or as a noncontrolling

partner in another auction applicant and, during certain periods, will be

subject to the FCC’s anti-collusion rules, which could have an adverse effect

on U.S. Cellular.

·

Changes in the regulatory environment or a failure by

U.S. Cellular to timely or fully comply with any applicable regulatory

requirements could adversely affect U.S. Cellular’s business, financial

condition or results of operations.

·

An inability to attract people of outstanding potential,

to develop their potential through education and assignments, and to retain

them by keeping them engaged, challenged and properly rewarded could have an

adverse effect on U.S. Cellular's business, financial condition or results of

operations.

·

U.S. Cellular’s assets are concentrated in the

U.S. wireless telecommunications industry. As a result, its results of

operations may fluctuate based on factors related primarily to conditions in

this industry.

·

U.S. Cellular’s lower scale relative to larger

competitors could adversely affect its business, financial condition or results

of operations.

·

Changes in various business factors could have an adverse

effect on U.S. Cellular’s business, financial condition or results of

operations.

·

Advances or changes in technology could render certain technologies

used by U.S. Cellular obsolete, could put U.S. Cellular at a competitive

disadvantage, could reduce U.S. Cellular’s revenues or could increase its

costs of doing business.

·

Complexities associated with deploying new technologies

present substantial risk.

·

U.S. Cellular is subject to numerous surcharges and fees

from federal, state and local governments, and the applicability and the amount

of these fees are subject to great uncertainty.

·

Performance under device purchase agreements could have a

material adverse impact on U.S. Cellular's business, financial condition or

results of operations.

·

Changes in U.S. Cellular’s enterprise value, changes

in the market supply or demand for wireless licenses, adverse developments in

the business or the industry in which U.S. Cellular is involved and/or

other factors could require U.S. Cellular to recognize impairments in the

carrying value of its licenses, goodwill and/or physical assets.

·

Costs, integration problems or other factors associated

with acquisitions, divestitures or exchanges of properties or licenses and/or

expansion of U.S. Cellular’s business could have an adverse effect on

U.S. Cellular’s business, financial condition or results of operations.

·

U.S. Cellular’s investments in unproven technologies

may not produce the benefits that U.S. Cellular expects.

·

A failure by U.S. Cellular to complete significant

network construction and systems implementation activities as part of its plans

to improve the quality, coverage, capabilities and capacity of its network,

support and other systems and infrastructure could have an adverse effect on

its operations.

·

Difficulties involving third parties with which U.S.

Cellular does business, including changes in U.S. Cellular's relationships with

or financial or operational difficulties of key suppliers or independent agents

and third party national retailers who market U.S. Cellular services, could

adversely affect U.S. Cellular’s business, financial condition or results

of operations.

·

U.S. Cellular has significant investments in

entities that it does not control. Losses in the value of such investments

could have an adverse effect on U.S. Cellular’s financial condition or

results of operations.

·

A failure by U.S. Cellular to maintain flexible and

capable telecommunication networks or information technology, or a material

disruption thereof, could have an adverse effect on U.S. Cellular’s business,

financial condition or results of operations.

·

Cyber-attacks or other breaches of network or information

technology security could have an adverse effect on U.S. Cellular's business,

financial condition or results of operations.

·

The market price of U.S. Cellular’s Common Shares is

subject to fluctuations due to a variety of factors.

·

Changes in facts or circumstances, including new or

additional information, could require U.S. Cellular to record charges in

excess of amounts accrued in the financial statements, which could have an

adverse effect on U.S. Cellular’s business, financial condition or results

of operations.

·

Disruption in credit or other financial markets, a

deterioration of U.S. or global economic conditions or other events could,

among other things, impede U.S. Cellular’s access to or increase the cost of

financing its operating and investment activities and/or result in reduced

revenues and lower operating income and cash flows, which would have an adverse

effect on U.S. Cellular’s business, financial condition or results of

operations.

·

Uncertainty of U.S. Cellular’s ability to access capital,

deterioration in the capital markets, other changes in market conditions,

changes in U.S. Cellular’s credit ratings or other factors could limit or

restrict the availability of financing on terms and prices acceptable to

U.S. Cellular, which could require U.S. Cellular to reduce its

construction, development or acquisition programs.

·

Settlements, judgments, restraints on its current or

future manner of doing business and/or legal costs resulting from pending and

future litigation could have an adverse effect on U.S. Cellular’s

business, financial condition or results of operations.

·

The possible development of adverse precedent in

litigation or conclusions in professional studies to the effect that radio

frequency emissions from wireless devices and/or cell sites cause harmful

health consequences, including cancer or tumors, or may interfere with various

electronic medical devices such as pacemakers, could have an adverse effect on

U.S. Cellular’s business, financial condition or results of operations.

·

Claims of infringement of intellectual property and

proprietary rights of others, primarily involving patent infringement claims,

could prevent U.S. Cellular from using necessary technology to provide products

or services or subject U.S. Cellular to expensive intellectual property

litigation or monetary penalties, which could have an adverse effect on U.S.

Cellular’s business, financial condition or results of operations.

·

There are potential conflicts of interests between TDS

and U.S. Cellular.

·

Certain matters, such as control by TDS and provisions in

the U.S. Cellular Restated Certificate of Incorporation, may serve to

discourage or make more difficult a change in control of U.S. Cellular.

·

Any of the foregoing events or other events could cause

revenues, earnings, capital expenditures and/or any other financial or

statistical information to vary from U.S. Cellular’s forward-looking

estimates by a material amount.

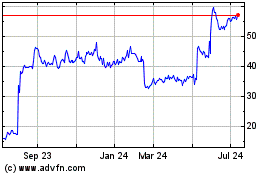

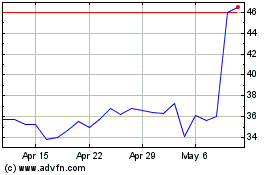

US Cellular (NYSE:USM)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Cellular (NYSE:USM)

Historical Stock Chart

From Apr 2023 to Apr 2024