UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

The Securities Exchange Act of

1934

Date of Report (Date of earliest event reported): March 20, 2015

UNITED STATES CELLULAR

CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-9712

|

|

62-1147325

|

|

(State or other

jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

8410 West Bryn

Mawr, Chicago, Illinois

|

|

60631

|

|

(Address of principal

executive offices)

|

|

(Zip Code)

|

Registrant's

telephone number, including area code: (773) 399-8900

Not

Applicable

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

|

|

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 7.01. Regulation

FD Disclosure.

On

March 20, 2015, United States Cellular Corporation (“U.S. Cellular”) announced

that it would discontinue its Rewards program for customers that are on service

plans eligible for Rewards points. All Rewards-eligible customers will be

impacted by this change.

The

decision to phase out the Rewards program was made after careful consideration

and input from many customers. The decision will allow U.S. Cellular to bring

its customers more of the things that matter to them the most, such as national

coverage, customer service excellence, the newest devices and the best overall

value,

Customers

will continue to earn Rewards points through April 30, 2015 for Rewards

eligible activity and will have the ability to redeem Rewards points through

September 1, 2015. After September 1, 2015, customers’ Rewards accounts will be

closed and any unredeemed Rewards points will expire as the program will be

officially discontinued.

For

additional information on the changes to the Rewards program, see

www.uscellular.com.

At

this time, the company is unable to reliably estimate the financial benefit to

its 2015 results of operations of discontinuing the Rewards program. Revenue

will increase due to the deferred point balance being recognized, but

redemption rates and how redeemed points are used as the program winds down are

uncertain and could vary widely. Direct and indirect costs related to ending

the program including temporarily increased customer service staffing levels,

customer churn, and churn mitigation programs could be significant and also

could vary widely. The company will continue to provide innovative plans,

products and services that will provide customers with exceptional value above

and beyond the Rewards program.

The

information in this Item 7.01 is being furnished and shall not be deemed

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liabilities of that Section.

Item 9.01. Financial Statements and

Exhibits

(d) Exhibits:

In accordance with the provisions of

Item 601 of Regulation S-K, any Exhibits filed or furnished herewith are set

forth on the Exhibit Index attached hereto.

|

SIGNATURES

|

|

|

|

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned, thereto

duly authorized.

|

|

|

|

|

|

United States

Cellular Corporation

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date:

|

March 20, 2015

|

|

|

|

|

|

|

By:

|

/s/ Steven T.

Campbell

|

|

|

|

Steven T.

Campbell

|

|

|

|

Executive Vice

President - Finance,

|

|

|

|

Chief Financial

Officer and Treasurer

|

|

|

(principal

financial officer)

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

The following exhibits are filed or

furnished herewith as noted below.

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Private

Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement

|

Exhibit

99.1

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

SAFE HARBOR CAUTIONARY STATEMENT

This Form 8-K and/or press

release attached to this Form 8-K contain statements that are not based on

historical facts and represent forward-looking statements, as this term is

defined in the Private Securities Litigation Reform Act of 1995. All

statements, other than statements of historical facts, that address activities,

events or developments that U.S. Cellular intends, expects, projects, believes,

estimates, plans or anticipates will or may occur in the future are

forward-looking statements. The words “believes,” “anticipates,”

“estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions

are intended to identify these forward-looking statements, but are not the

exclusive means of identifying them. Such forward‑looking statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results, events or developments to be significantly different from any

future results, events or developments expressed or implied by such forward‑looking

statements. Such risks, uncertainties and other factors include those set

forth below, as more fully discussed under “Risk Factors” in the most recent

filing of U.S. Cellular’s Form 10-K, as updated by any U.S. Cellular Form 10-Q

filed subsequent to such Form 10-K. However, such factors are not

necessarily all of the important factors that could cause actual results,

performance or achievements to differ materially from those expressed in, or

implied by, the forward-looking statements contained in this document.

Other unknown or unpredictable factors also could have material adverse effects

on future results, performance or achievements. U.S. Cellular undertakes

no obligation to update publicly any forward-looking statements whether as a

result of new information, future events or otherwise. You should

carefully consider the Risk Factors in the most recent filing of U.S.

Cellular’s Form 10-K, as updated by any U.S. Cellular Form 10-Q filed

subsequent to such Form 10-K, the following factors and other information

contained in, or incorporated by reference into, this Form 8-K and/or press

release attached to this Form 8-K to understand the material risks relating to U.S.

Cellular’s business.

·

Intense

competition in the markets in which U.S. Cellular operates could adversely

affect U.S. Cellular’s revenues or increase its costs to compete.

·

A failure

by U.S. Cellular to successfully execute its business strategy (including

planned acquisitions, divestitures and exchanges) or allocate resources or

capital could have an adverse effect on U.S. Cellular’s business, financial

condition or results of operations.

·

U.S. Cellular offers customers

the option to purchase certain devices under installment contracts, which

creates certain risks and uncertainties which could have an adverse impact on

U.S. Cellular's financial condition or results of operations.

·

Changes in

roaming practices or other factors could cause U.S. Cellular's roaming revenues

to decline from current levels and/or impact U.S. Cellular's ability to service

its customers in geographic areas where U.S. Cellular does not have its own

network, which could have an adverse effect on U.S. Cellular's business,

financial condition or results of operations.

·

A failure

by U.S. Cellular to obtain access to adequate radio spectrum to meet current or

anticipated future needs and/or to accurately predict future needs for radio

spectrum could have an adverse effect on U.S. Cellular’s business, financial

condition or results of operations.

·

To the

extent conducted by the Federal Communications Commission (“FCC”), U.S.

Cellular is likely to participate in FCC auctions of additional spectrum in the

future as an applicant or as a noncontrolling partner in another auction

applicant and, during certain periods, will be subject to the FCC’s

anti-collusion rules, which could have an adverse effect on U.S. Cellular.

·

Changes in

the regulatory environment or a failure by U.S. Cellular to timely or

fully comply with any applicable regulatory requirements could adversely affect

U.S. Cellular’s business, financial condition or results of operations.

·

An

inability to attract people of outstanding potential, to develop their

potential through education and assignments, and to retain them by keeping them

engaged, challenged and properly rewarded could have an adverse effect on U.S.

Cellular's business, financial condition or results of operations.

·

U.S. Cellular’s

assets are concentrated in the U.S. wireless telecommunications industry.

As a result, its results of operations may fluctuate based on factors related

primarily to conditions in this industry.

·

U.S. Cellular’s lower scale

relative to larger competitors could adversely affect its business, financial

condition or results of operations.

·

Changes in

various business factors could have an adverse effect on U.S. Cellular’s

business, financial condition or results of operations.

·

Advances

or changes in technology could render certain technologies used by

U.S. Cellular obsolete, could put U.S. Cellular at a competitive

disadvantage, could reduce U.S. Cellular’s revenues or could increase its

costs of doing business.

·

Complexities associated with

deploying new technologies present substantial risk.

·

U.S. Cellular is subject to

numerous surcharges and fees from federal, state and local governments, and the

applicability and the amount of these fees are subject to great uncertainty.

·

Performance

under device purchase agreements could have a material adverse impact on U.S.

Cellular's business, financial condition or results of operations.

·

Changes in U.S. Cellular’s

enterprise value, changes in the market supply or demand for wireless licenses,

adverse developments in the business or the industry in which

U.S. Cellular is involved and/or other factors could require

U.S. Cellular to recognize impairments in the carrying value of its

licenses, goodwill and/or physical assets.

·

Costs,

integration problems or other factors associated with acquisitions,

divestitures or exchanges of properties or licenses and/or expansion of

U.S. Cellular’s business could have an adverse effect on

U.S. Cellular’s business, financial condition or results of operations.

·

U.S. Cellular’s

investments in unproven technologies may not produce the benefits that

U.S. Cellular expects.

·

A failure

by U.S. Cellular to complete significant network construction and systems

implementation activities as part of its plans to improve the quality,

coverage, capabilities and capacity of its network, support and other systems

and infrastructure could have an adverse effect on its operations.

·

Difficulties

involving third parties with which U.S. Cellular does business, including

changes in U.S. Cellular's relationships with or financial or operational

difficulties of key suppliers or independent agents and third party national

retailers who market U.S. Cellular services, could adversely affect

U.S. Cellular’s business, financial condition or results of operations.

·

U.S. Cellular

has significant investments in entities that it does not control. Losses in the

value of such investments could have an adverse effect on U.S. Cellular’s

financial condition or results of operations.

·

A failure

by U.S. Cellular to maintain flexible and capable telecommunication networks or

information technology, or a material disruption thereof, could have an adverse

effect on U.S. Cellular’s business, financial condition or results of

operations.

·

Cyber-attacks

or other breaches of network or information technology security could have an

adverse effect on U.S. Cellular's business, financial condition or results of

operations.

·

The market

price of U.S. Cellular’s Common Shares is subject to fluctuations due to a

variety of factors.

·

Changes in

facts or circumstances, including new or additional information, could require

U.S. Cellular to record charges in excess of amounts accrued in the

financial statements, which could have an adverse effect on

U.S. Cellular’s business, financial condition or results of operations.

·

Disruption

in credit or other financial markets, a deterioration of U.S. or global

economic conditions or other events could, among other things, impede U.S.

Cellular’s access to or increase the cost of financing its operating and

investment activities and/or result in reduced revenues and lower operating

income and cash flows, which would have an adverse effect on U.S. Cellular’s

business, financial condition or results of operations.

·

Uncertainty

of U.S. Cellular’s ability to access capital, deterioration in the capital

markets, other changes in market conditions, changes in U.S. Cellular’s

credit ratings or other factors could limit or restrict the availability of

financing on terms and prices acceptable to U.S. Cellular, which could

require U.S. Cellular to reduce its construction, development or

acquisition programs.

·

Settlements,

judgments, restraints on its current or future manner of doing business and/or

legal costs resulting from pending and future litigation could have an adverse

effect on U.S. Cellular’s business, financial condition or results of

operations.

·

The

possible development of adverse precedent in litigation or conclusions in

professional studies to the effect that radio frequency emissions from wireless

devices and/or cell sites cause harmful health consequences, including cancer

or tumors, or may interfere with various electronic medical devices such as

pacemakers, could have an adverse effect on U.S. Cellular’s business,

financial condition or results of operations.

·

Claims of

infringement of intellectual property and proprietary rights of others,

primarily involving patent infringement claims, could prevent U.S. Cellular

from using necessary technology to provide products or services or subject U.S.

Cellular to expensive intellectual property litigation or monetary penalties,

which could have an adverse effect on U.S. Cellular’s business, financial

condition or results of operations.

·

There are

potential conflicts of interests between TDS and U.S. Cellular.

·

Certain

matters, such as control by TDS and provisions in the U.S. Cellular

Restated Certificate of Incorporation, may serve to discourage or make more

difficult a change in control of U.S. Cellular.

·

Any of the

foregoing events or other events could cause revenues, earnings, capital

expenditures and/or any other financial or statistical information to vary from

U.S. Cellular’s forward-looking estimates by a material amount.

U.S. Cellular undertakes no

obligation to update publicly any forward-looking statements whether as a result

of new information, future events or otherwise. Readers should evaluate

any statements in light of these important factors.

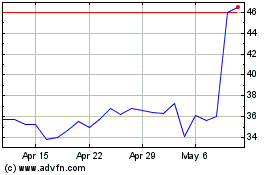

US Cellular (NYSE:USM)

Historical Stock Chart

From Mar 2024 to Apr 2024

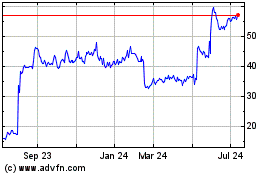

US Cellular (NYSE:USM)

Historical Stock Chart

From Apr 2023 to Apr 2024