Ahold Net Profit Up, US Remains Resilient

August 26 2010 - 1:51AM

Dow Jones News

Dutch retailer Koninklijke Ahold NV (AH.AE) Thursday continued

to grow sales in the U.S. in the second quarter at the expense of

rivals, as it reported a 3.1% rise in net profit on lower financial

expenses and boosted by currency effects, but refrained from giving

a full-year outlook.

"We continued to grow sales, volumes and market share in the

Netherlands and the United States. Market conditions remained

challenging with high levels of promotional activity," Ahold's

Chief Executive John Rishton said.

Net profit rose 3.1% to EUR202 million from EUR196 million a

year ago, below analysts' estimates for net profit of EUR219

million. The figure was negatively impacted by a EUR47 million tax

claim at Swedish retailer ICA AB (SD-ICA), in which Ahold holds a

60% stake.

Sales rose 10.8% to EUR7.1 billion, helped by the consolidation

of the 25 stores that Ahold acquired late last year from U.S.-based

Ukrop's Super Markets Inc. for around $140 million, and a currency

effect. At constant currencies, sales were up 4.4%.

In the U.S., where Ahold generates over half of its revenue,

sales increased 5.5% to $5.5 billion with identical sales up

1.4%.

As in the first quarter, Ahold again outperformed its main U.S.

competitors: Wal-Mart Stores Inc. (WMT), the world's biggest

retailer, reported a 1.4% sales decline, Belgian peer Delhaize

Group (DELB.BT) a drop of 3.6% and Supervalu Inc. (SVU) a fall of

7.2%.

Supervalu Chief Executive Craig Herkert said the sales

environment was "extraordinarily competitive." Another struggling

competitor, Great Atlantic & Pacific Tea Co. (GAP), recently

reported a 7.2% drop in same-store-sales and said it needs to sell

assets and refinance.

Ahold is active on the U.S. East Coast through its

Stop&Shop, Giant-Carlisle and Giant-Landover brands. Last year,

it acquired 25 stores from Ukrop in Virginia and in April it bought

five Shaw's supermarkets in Connecticut from Supervalu.

U.S. consumers, still jittery about high unemployment, continue

to load their baskets with discounted items and lower-priced

private-label products.

Ahold's U.S. underlying operating margin was unchanged from last

year at 4.8%.

Its domestic operations, Albert Heijn, reported a 4.4% rise in

sales to EUR2.3 billion, helped by a football World Cup loyalty

promotion and the success of the Dutch team in reaching the final.

Stripping out store openings and closings, sales grew 3.5%.

The underlying operating margin was unchanged from last year at

6.8%. Earnings before interest and tax, or EBIT, rose 17.6% to

EUR347 million.

Ahold's shares closed EUR9.67 on Wednesday, gaining 4.4%

year-to-date.

Analysts have said Ahold could use its over EUR2.6 billion cash

pile for acquisitions or another share buyback.

-By Anna Marij van der Meulen; Dow Jones Newswires; +31 20 5715

216; annamarij.vandermeulen@dowjones.com

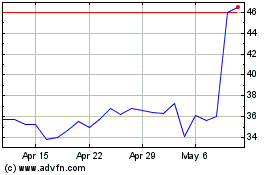

US Cellular (NYSE:USM)

Historical Stock Chart

From Mar 2024 to Apr 2024

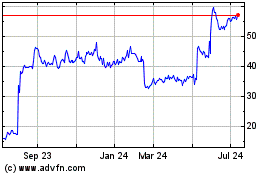

US Cellular (NYSE:USM)

Historical Stock Chart

From Apr 2023 to Apr 2024