Jumbo Mortgages: Big Banks Still Love Them

October 21 2016 - 1:56PM

Dow Jones News

By AnnaMaria Andriotis

Big mortgages are all the rage at the largest U.S. retail

banks.

Lending for jumbo mortgages, those that exceed $417,000 in most

U.S. markets, surged at J.P. Morgan Chase & Co. and Bank of

America Corp. in 2015, according to new data. The banks originated

$37.1 billion and $23.3 billion, respectively, of jumbos -- up 88%

and 68% from 2014. U.S. Bancorp's jumbo lending increased around

50% to $8.3 billion.

The figures are based on Inside Mortgage Finance's analysis of

recently released mortgage data by banks and other lenders under

the Home Mortgage Disclosure Act.

Banks have been increasingly targeting the jumbo loan market

since the housing bust. Jumbo borrowers tend to be among the

lowest-risk mortgage customers because they have higher credit

scores on average and make larger down payments. The loans also

have a lower delinquency and foreclosure rate than smaller loans,

according to mortgage-data firm Black Knight Financial

Services.

At some large banks, jumbos now account for a much larger share

of mortgages. At Citigroup Inc., for instance, jumbos accounted for

52% of total mortgage dollars originated in 2015, up from 42% a

year prior, according to Inside Mortgage Finance. The bank says its

total jumbo originations rose 53% in 2015 from the prior year to

$19.1 billion.

Regional banks are also ramping up jumbo lending. Regions

Financial Corp. says it originated about $1.5 billion in these

loans last year, up about 85% from a year earlier. SunTrust Banks

Inc. and Citizens Financial Group extended $3.8 billion and $2.3

billion, respectively, up 61% and 76%, according to Inside Mortgage

Finance.

By comparison, jumbo lending across all the institutions that

reported under the mortgage disclosure act increased 34% year over

year.

More recently, there has been a shake-up in the top ranks of

jumbo lenders. J.P. Morgan became the largest jumbo lender by

volume, based on the loans it originated and bought from other

lenders, in the first quarter of 2016. In doing so, it unseated

Wells Fargo &. Co., which had held that position since 2010,

according to Inside Mortgage Finance.

Most banks hold jumbos on their books, another appealing aspect

since banks profit from the difference between the loan's interest

payments and the interest they pay out on deposits. The loans are

also perceived by banks to be safer because they don't carry the

risk of buybacks, should things go wrong, like mortgages they sell

to Freddie Mac or Fannie Mae.

One of the results of increased jumbo lending has been the

decline in black and Hispanic mortgage borrowers. As jumbos have

grown to account for a greater share of mortgage lending, large

retail banks have been giving fewer mortgages to minority

borrowers, as The Wall Street Journal reported in June. The

recently released 2015 HMDA data show a slight uptick in the share

of black and Hispanic borrowers who received mortgages to purchase

homes.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

October 21, 2016 13:41 ET (17:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

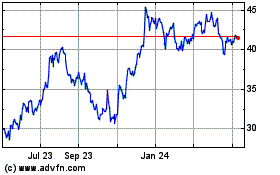

US Bancorp (NYSE:USB)

Historical Stock Chart

From Mar 2024 to Apr 2024

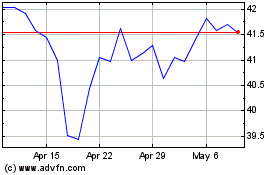

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2023 to Apr 2024