A Sore Spot for Regional Lenders -- WSJ

October 20 2016 - 3:02AM

Dow Jones News

Slowing demand for commercial loans takes a toll on results at

smaller banks

By Rachel Louise Ensign and Austen Hufford

A trading rebound drove growth at big banks in the third

quarter. Traditional lenders, lacking that prop, were left to

continue battling superlow interest rates.

Firms such as U.S. Bancorp., which reported earnings Wednesday,

faced slowing demand for commercial loans, a flattening yield curve

and declining net-interest margins. Net profit rose just 1% versus

a year earlier.

Morgan Stanley, meanwhile, reported a 57% gain in net income,

thanks in part to outsized gains in its bond-trading business.

That is a turn in fortunes. Regional banks such as

Minneapolis-based U.S. Bancorp typically fetch higher valuations

than firms with more volatile trading operations. And, since the

start of this year, U.S. Bancorp has had a larger market value than

either Morgan Stanley or Goldman Sachs Group Inc.

That, though, is also due to the fact that U.S. Bancorp has

posted higher returns on equity than bigger banks. Its return was

13.5% in the third quarter. While down from 14.1% a year earlier,

it was still miles ahead of returns of 11.6% and 11.2% at Wells

Fargo & Co. and Goldman Sachs Group Inc., respectively. Those

two had the highest returns of the biggest U.S. banks in the

quarter.

Still, the regional banks' lack of diversity worked against them

in the third quarter, especially as a second rate increase from the

Federal Reserve failed to materialize. U.S. Bancorp's net-interest

margin, a measure of the difference between what it pays out on

deposits and receives on loans and investments, fell to 2.98% in

the third quarter from 3.02% the prior one. That is the lowest the

margin has ever been at the bank, said finance chief Terry

Dolan.

The bank said it expects the margin figure to fall further in

the fourth quarter due to the shape of the yield curve. In recent

months, long-term rates have declined without a corresponding drop

in short-term interest rates, a phenomenon known as a flattening of

the yield curve. That squeezes bank profits.

To compensate, banks need loan growth. But business lending,

which has been one of the strongest areas of loan growth in recent

years, fell slightly in the quarter across the banking industry.

That was the first time this has happened in six years.

U.S. Bank Chief Executive Richard Davis said that likely

reflected the U.K.'s Brexit vote and the coming U.S. election. He

expects growth to pick up again in the fourth quarter.

Similar concerns surfaced at BB&T Corp. and M&T Bank

Corp., which also reported results Wednesday. Both showed

commercial-loan growth rates that flagged from the prior

quarter.

"Loan growth in today's market, to be honest, is just very, very

challenging," said Chief Executive Kelly King. Average total loans

at BB&T grew 0.3% on an annualized basis from the prior quarter

and fell in a number of commercial-loan segments.

Still, the regional banks managed to grind out profits in the

face of these headwinds. Winston-Salem, N.C.-based BB&T

reported earnings of $642 million, up from $533 million a year

earlier. Its total revenue, which is a combination of net interest

income and fee-based income, grew 13% to $2.77 billion, above

analyst expectations.

At M&T Bank, overall loans rose 1% from the prior quarter

and commercial loans were essentially flat. Results came in ahead

of Wall Street expectations, though. M&T reported earnings of

$350 million, up from $280.4 million a year earlier.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com and

Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 20, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

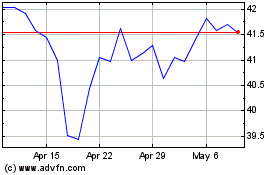

US Bancorp (NYSE:USB)

Historical Stock Chart

From Mar 2024 to Apr 2024

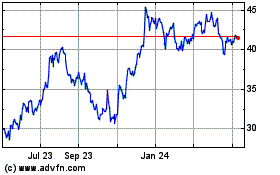

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2023 to Apr 2024