U.S. Bancorp Profit Declines on Bigger Energy-Related Provision -- Update

April 20 2016 - 1:33PM

Dow Jones News

By Lisa Beilfuss

U.S. Bancorp said its first-quarter profit slipped, as the

lender set aside more reserves to cover potential energy loan

losses and booked sharply lower mortgage-banking revenue amid

heightened competition.

The Minneapolis-based lender logged earnings of $1.39 billion,

down from $1.43 billion a year earlier. On a per-share basis,

profit was flat at 76 cents thanks to a lower share count.

Revenue edged 2.7% higher to $5.04 billion. Analysts projected

76 cents in earnings per share on $5.06 billion in revenue.

Shares rose more than 1% in morning trading as bank stocks

ticked up broadly.

U.S. Bank is one of the country's biggest banks, offering

commercial banking and retail branches across much of the West and

Midwest. The company said its energy-related commercial loan

portfolio deteriorated during the quarter, prompting it to push its

loan-loss provision up to $330 million -- 25% higher than a year

earlier and up 8.2% from the fourth quarter.

The company said Wednesday that as of March 31, roughly $3.4

billion of commercial loans were to customers in energy-related

businesses, representing 1.3% of its portfolio and up slightly from

the end of December. Reserves for these loans were 9.1% of U.S.

Bank's outstanding balances at the end of March, up from 5.4% three

months earlier. The bank also said that 52% of loans to the sector

were considered "criticized," meaning they were at higher risk of

default.

Analysts have been keeping a close eye on energy customers'

draws on their bank credit lines this quarter. At U.S. Bank, energy

loan balances were up after a handful of borrowers drew on their

lines, executives said, adding that such draws could continue.

Meanwhile, revenue from fee businesses inched 0.2% lower to

$2.15 billion as mortgage banking revenue dropped 22% on lower

originations and lower pricing. A 10% rise in fees from credit and

debit cards help to partially offset the mortgage slide; for U.S.

Bancorp, card fees make up the biggest chunk of noninterest

income.

Like many other lenders, the company has hoped the Fed's

decision to lift interest rates late last year -- albeit modestly

-- would bolster profitability. But a key measure of lending

profitability, net interest margin, slipped to 3.06% during the

period from 3.08% a year earlier. U.S. Bank attributed the decline

to a shift in its loan portfolio, which countered impact of higher

interest rates. From the fourth quarter, the metric held

steady.

The bank said it paid higher interest rates on deposits to some

commercial customers after the December increase.

Overall lending grew 5.8%, driven by commercial and credit card

lending.

--Rachel Louise Ensign contributed to this article.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

April 20, 2016 13:18 ET (17:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

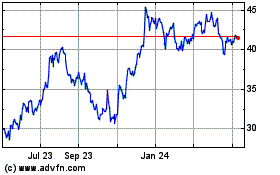

US Bancorp (NYSE:USB)

Historical Stock Chart

From Mar 2024 to Apr 2024

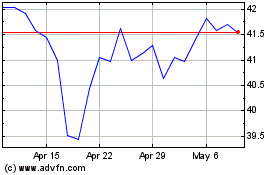

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2023 to Apr 2024