By AnnaMaria Andriotis

Federal programs designed to ease the burden of college loans

are causing snarls in the bond market and raising concerns that

banks may soon ratchet back lending.

The programs, which let struggling borrowers scale back their

repayments, have made student loans more affordable at a time when

millions of Americans are falling behind on their student

debts.

But that slowing stream of money is having a knock-on effect in

the market for bonds backed by that debt. Investors who own the

bonds are beginning to worry that they may not get repaid on time,

and they are balking at buying new bonds being offered by financial

institutions.

Without that revenue from selling off the student loans into

bonds, banks have less capital to turn into new loans.

Credit rating firms Moody's Investors Service Inc. and Fitch

Ratings Inc. have collectively placed more than $36 billion worth

of bonds backed by student loans on watch for a possible downgrade,

warning it is increasingly likely that borrowers won't pay their

loans off in full by their original due dates and that bonds backed

by those loans could end up in default.

The result is that investors are demanding better prices in the

esoteric but crucial market where banks raise capital by selling or

repackaging their loans.

Last week, U.S. Bancorp said it dropped an effort to sell a $3

billion portfolio of student loans because the bids were too low.

It has said it plans to take a write-down of $55 million to $60

million, reflecting the diminished value of those assets.

An inability to sell the federal loans, whether to other

companies or by turning them into bonds, will make it harder for

banks to increase their loan volumes.

U.S. Bancorp wouldn't comment on what it would have done with

the proceeds of the loan sale, but banks generally sell student

loan portfolios to raise cash so they can make new student loans or

other consumer loans, said Mark Kantrowitz, senior vice president

at Edvisors.com, which tracks the student loan market.

Loan originations could also be hurt if banks take a loss on

sales, he said. There could be "a lot of contagion effects," he

said. "The disruption of the capital markets may prevent some

consumers from getting loans if the uncertainty persists for too

much longer."

The Education Department didn't have immediate comment Wednesday

but in recent weeks has said that income-based repayment is

designed as a safety net for borrowers in tough times. Education

Secretary Arne Duncan said in August that the programs have helped

reduce the rate of short-term delinquencies for student loans.

"We've made it a priority to give Americans better options to

manage their student loans and make sure they know about those

options," Mr. Duncan said at the time.

Meanwhile, just one $203 million deal to repackage the affected

loans has gone through since late June, when Moody's warned of a

downgrade for the bulk of the more than $36 billion in bonds. That

compares with 13 deals totaling $4 billion in the same period last

year, according to Moody's.

Some analysts say this part of the securitization market could

stay frozen until Moody's finishes its review, possibly having

ripple effects into the ability of banks to increase new loan

originations to students and other consumers.

Moody's is expected to make a decision on whether to downgrade

the bonds as early as November. "It's very difficult to predict

cash flows on these loans because of the different payment programs

that have come up, " said Debash Chatterjee, managing director of

asset-backed securities surveillance at Moody's.

The loans under pressure are federal student loans made by

private lenders under the Federal Family Education Loan Program, or

FFELP.

The federal government brought the program to an end in 2010 by

moving all federal student loan origination to the Education

Department, but many firms still hold the old loans on their books

and have continued to securitize or sell some of them to free up

their balance sheets for new loans.

As of June, there were $371 billion of FFELP loans outstanding,

according to the Education Department. Overall, there are $1.27

trillion of outstanding student loans, 93% of which are federally

backed, according to MeasureOne, a San Francisco-based firm that

tracks the student loan market.

FFELP loans account for nearly one-third of all federal student

loans, based on Education Department data.

U.S. Bancorp stopped making new student loan originations in

2012, but continues to own FFELP student loans and was seeking to

free up capital for other purposes in its recent sales effort. "The

market broke," U.S. Bancorp Chief Executive Richard Davis said at

an investor conference last week. He said bids "came in at very,

very low levels."

The main income-based repayment program for FFELP borrowers

became available in 2009, shrinking their monthly payments to 15%

of their discretionary income over a payment period of 25 years.

But the push to get borrowers into the program accelerated in 2013,

when the Education Department reached out to more than three

million federal-student loan borrowers to inform them about

availability, according to an August 2015 report from the

Government Accountability Office.

Many of the loans in question are held by Navient Corp., the

largest U.S. servicer of student loans. Navient, which last year

spun off from SLM Corp.--Sallie Mae--has securitized 84% of its

roughly $100 billion in FFELP loans, which frees it up to buy more

loans from lenders.

Moody's has put $34 billion of these bonds on watch for a

downgrade this year through June. Since then, Navient's shares have

tumbled about 35%.

Navient was the largest buyer of FFELP student loans last year,

purchasing $11.3 billion of these loans from banks and other

institutions, according to the company. Wells Fargo & Co., the

second-largest private student loan originator by volume, sold $8.5

billion of FFELP loans to Navient late last year.

The company says it can withstand a long freeze in the

securitization market.

"There is some confusion here that if Moody's downgrades, that

the company won't be able to issue securitizations and won't be

able to meet debt obligations--my point is we have ample liquidity

to do that without needing to access the market," said Jack

Remondi, chief executive of Navient, in an interview.

Student loans and other parts of the bond market froze during

the recession, but this is the first time the FFELP market has been

singled out for the risk of widespread problems on securitized

bonds, said Mark Adelson, a New York-based securitization

expert.

The risk isn't one of ultimate losses for investors but rather

delays in payment that go past the maturity date of the bond. "It's

conceivable it could be a long time," he said.

J.P. Morgan Chase & Co. had more than $4.5 billion of the

federal student loans on its books as of June, according to bank

filings, with some $500 million in delinquency or default. A bank

spokeswoman said it has no plans to sell these loans at this time.

SunTrust Banks held $4.4 billion of these loans as of June. A bank

spokesman declined to comment on future plans for its loan

holdings.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 23, 2015 20:23 ET (00:23 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

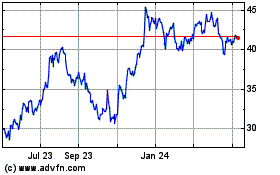

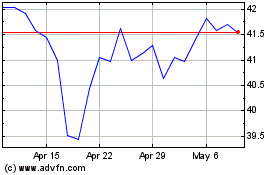

US Bancorp (NYSE:USB)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2023 to Apr 2024