Current Report Filing (8-k)

September 17 2015 - 7:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: September 17, 2015

(Date of earliest event reported)

U.S. BANCORP

(Exact name of registrant as specified in its charter)

Delaware

(State or other

jurisdiction of incorporation)

|

|

|

| 1-6880 |

|

41-0255900 |

| (Commission file number) |

|

(IRS Employer Identification No.) |

800 Nicollet Mall

Minneapolis, Minnesota 55402

(Address of principal executive offices, including zip code)

(651) 466-3000

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

As previously announced, Richard K. Davis, U.S. Bancorp’s Chairman,

President and Chief Executive Officer, and Kathleen A. Rogers, U.S. Bancorp’s Vice Chairman and Chief Financial Officer, will make a presentation at the Barclays 2015 Global Financial Services Conference in New York City, at 8:15 a.m. local

time on Thursday, September 17, 2015. A copy of the presentation slides, which will be discussed during the presentation, is attached hereto as Exhibit 99.1. These slides can also be accessed on U.S. Bancorp’s website at

usbank.com by clicking on “About U.S. Bank” and then “Webcasts & Presentations” under the “Investor/Shareholder Information” heading, which is located at the left side of the bottom of the page. A live

audio webcast of the presentation can also be accessed at this location on the website, and a replay of the webcast will be available at the same location on the website and will remain posted for 90 days.

The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not

be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, except as otherwise expressly stated in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

Barclays 2015 Global Financial Services Conference Slides |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| U.S. BANCORP |

|

|

| By: |

|

/s/ James L. Chosy |

|

|

James L. Chosy Executive Vice President,

General Counsel and

Corporate Secretary |

Date: September 17, 2015

3

| Barclays

2015 Global Financial

Services Conference September 17, 2015 Richard K. Davis Chairman, President and CEO Exhibit 99.1 |

|

2 U.S. BANCORP | Forward-looking Statements and Additional Information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995:

This presentation contains forward-looking statements about U.S. Bancorp.

Statements that are not historical or current facts, including statements

about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date made. These forward-looking statements cover, among other things, anticipated future

revenue and expenses and the future plans and prospects of U.S.

Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. A reversal or slowing of the current economic

recovery or another severe contraction could adversely affect U.S.

Bancorp’s revenues and the values of its assets and liabilities. Global financial markets could experience a recurrence of significant turbulence, which could reduce the availability of funding to certain financial institutions and

lead to a tightening

of credit, a reduction of business activity, and increased market volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets, could cause credit losses and deterioration in asset values. In addition, U.S. Bancorp’s business and financial performance is likely to be negatively impacted by recently enacted and future legislation and regulation. U.S.

Bancorp’s results could also be adversely affected by deterioration

in general business and economic conditions; changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of securities held in

its investment securities portfolio; legal and regulatory developments;

litigation; increased competition from both banks and non-banks; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical

accounting

policies and judgments; and management’s ability to effectively manage credit risk, residual value risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk.

For discussion of these and other risks that may cause actual results to differ from

expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2014, on file with the Securities and Exchange Commission, including the sections entitled

“Risk Factors” and “Corporate Risk Profile” contained

in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. Forward-looking statements speak only as of the date they are

made, and U.S. Bancorp undertakes no obligation to update them in light

of new information or future events. This

presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided within or in the appendix of the presentation. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other

companies. |

|

3 U.S. BANCORP | Agenda • Company Overview • Business Line Highlight: Payment Services • 3Q Update Long-term Goals |

|

4 U.S. BANCORP | U.S. Bancorp 2Q15 Dimensions Market value as of 9/15/15 NYSE Traded USB Founded 1863 Market Value $74B Branches 3,164 ATMs 5,020 Customers 18.5M Assets $419B Deposits $297B Loans $249B |

|

5 U.S. BANCORP | Industry Position Source: company reports, SNL and FactSet Assets and deposits as of 6/30/15, market value as of 9/15/15 Assets Market Value Deposits U.S. U.S. U.S. Rank Company $ Billions Rank Company $ Billions Rank Company $ Billions 1 J.P. Morgan 2,450 1 J.P. Morgan $1,287 1 Wells Fargo $274 2 Bank of America 2,149 2 Wells Fargo 1,186 2 J.P. Morgan 235 3 Citigroup 1,827 3 Bank of America 1,150 3 Bank of America 171 4 Wells Fargo 1,721 4 Citigroup 908 4 Citigroup 157 5 U.S. Bancorp 419 5 U.S. Bancorp 297 5 U.S. Bancorp 74 6 PNC 354 6 PNC 240 6 PNC 47 7 BB&T 191 7 SunTrust 145 7 BB&T 27 8 SunTrust 189 8 BB&T 133 8 SunTrust 21 9 Fifth Third 142 9 Fifth Third 103 9 Fifth Third 16 10 Regions 122 10 Regions 97 10 Regions 13 |

|

6 U.S. BANCORP | Capital Management Earnings Distribution Target 27% 29% 31% 32% 32% 35% 42% 41% 38% 44% 0% 25% 50% 75% 100% 2012 2013 2014 1Q15 2Q15 Dividends Share Repurchases 62% 70% 76% 71% 72% • Annual dividend increased from $0.98 to $1.02 per share in 2Q15, a 4.1% increase • Five-quarter authorization to repurchase up to $3.0 billion of outstanding stock effective April 1, 2015 Capital Actions Reinvest and Acquisitions Dividends Share Repurchases 20 - 40% 30 - 40% 30 - 40% Payout Ratio |

|

7 U.S. BANCORP | Industry Leading Returns 2Q15 Source: SNL and company reports; Peer banks: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC

Efficiency ratio computed as noninterest expense divided by the sum of net interest

income on a taxable-equivalent basis and noninterest income excluding

net securities gains (losses) Return on Average Assets

1.46% 1.33% 1.18% 1.04% 1.03% 1.02% 1.01% 0.99% 0.95% 0.90% USB Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 14.3% 12.7% 10.8% 9.7% 9.1% 8.7% 8.5% 8.2% 8.1% 6.7% USB Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 53.2% 58.2% 60.3% 60.6% 62.3% 64.4% 65.6% 65.6% 65.9% 69.8% USB Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Return on Average Common Equity Efficiency Ratio |

|

8 U.S. BANCORP | Profitability Drivers • Revenue Diversification • Best in Class Debt Ratings • Efficiency • Credit Quality |

|

Profitability Drivers: Revenue

Diversification Revenue Mix

By Business Line Fee Income / Total Revenue 46% 45% 45% 45% 35% 40% 45% 50% 55% 2012 2013 2014 1H15 2015 YTD, taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support Consumer and Small Business Banking 42% Payment Services 30% Wealth Mgmt and Securities Services 11% Wholesale Banking and Commercial Real Estate 17% 55% 45% 9 U.S. BANCORP | |

|

10 U.S. BANCORP | Profitability Drivers: Best in Class Debt Rating

Debt ratings: holding company as of 9/15/15

USB is highest rated peer bank across all rating agencies

• Funding advantage • Competitive advantages – Pricing – Flight-to-quality – Sales Force Confidence |

|

11 U.S. BANCORP | Profitability Drivers: Efficiency • USB efficiency ratio is best in class • Challenging revenue growth under current economic conditions supports our continued and expanding

efficiency efforts |

|

Profitability Drivers: Credit

Quality $ in millions

Net Charge-offs Net Charge-offs (Left Scale) NCOs to Avg Loans (Right Scale) Nonperforming Assets Nonperforming Assets (Left Scale) NPAs to Loans plus ORE (Right Scale) $349 $336 $308 $279 $296 0.58% 0.55% 0.50% 0.46% 0.48% 0.00% 0.75% 1.50% 2.25% 3.00% 0 130 260 390 520 2Q14 3Q14 4Q14 1Q15 2Q15 $1,943 $1,923 $1,808 $1,696 $1,577 0.80% 0.78% 0.73% 0.69% 0.63% 0.00% 0.75% 1.50% 2.25% 3.00% 0 700 1,400 2,100 2,800 2Q14 3Q14 4Q14 1Q15 2Q15 12 U.S. BANCORP | |

|

Profitability Drivers: Credit

Quality $ in millions

Allowance to Loans Allowance to NPAs 229% 230% 242% 257% 274% 0% 100% 200% 300% 400% 2Q14 3Q14 4Q14 1Q15 2Q15 Total Allowance for Credit Losses (Left Scale) Allowance % of period-end loans (Right Scale) Allowance to NPAs 4,449 4,414 4,375 4,351 4,326 1.82% 1.80% 1.77% 1.77% 1.74% 0.00% 1.00% 2.00% 3.00% 4.00% $1,500 $2,500 $3,500 $4,500 $5,500 2Q14 3Q14 4Q14 1Q15 2Q15 13 U.S. BANCORP | |

|

14 U.S. BANCORP | Growth Drivers: Loans $ in billions * Excluding the impact of the reclassification of approximately $3 billion of student loans to held for sale at the end of 1Q15

Average Balances Year-Over-Year Growth • Retail: Strengthening • Commercial: Remains Solid • CRE: Moderating • Shift in loan growth mix to consumer positively impacts net interest margin • Expect total loan linked 3Q growth in 1 - 1.5% range Key Points 12.4% 13.6% 15.5% 15.1% 11.0% 6.9% 6.1% 4.2% 6.5% 4.8% 10.5% 5.8% 2.2% (0.3%) (1.4%) 5.9% 4.9% 3.6% 2.4% 1.3% 2.3% 3.6% 3.6% 3.5% (1.8%) 0 70 140 210 280 2Q14 3Q14 4Q14 1Q15 2Q15 2.5% 6.8% 6.3% 5.9% 5.1% 4.0%* 5.7%* Covered Commercial CRE Res Mtg Retail Credit Card |

|

15 U.S. BANCORP | Agenda • Company Overview • Business Line Highlight: Payment Services • 3Q Update Long-term Goals |

| Leader in

Payment Services •

Fast growing, dynamic

industry •

Provides a full suite of diversified payment processing services to consumers, small businesses, corporations and merchants – a unique position versus other banks • Expanding internationally in merchant

acquiring through continued investment

in partnerships and our international

merchant payment platform

• Leading player in payments innovation

and emerging technologies including

enhanced security and authentication

Corporate Payment Systems 10% Revenue Contribution to USB Payment Services Revenue Mix 2015 YTD, taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support 16 U.S. BANCORP | Retail Payment Solutions 60% Global Merchant Acquiring 30% 30% |

|

17 U.S. BANCORP | Competitive Advantages Payment Services Full Suite of Payment Products and Services Innovation and Technology Platforms Breadth and Depth of Capabilities Financial Institution Distribution Visibility into Both Issuing and Acquiring Trends, Technology & Opportunities for Scale Relative Scale Relative Position vs. Other Banks Advantaged Competitive |

|

18 U.S. BANCORP | Advantage: Diversification of Product, Geography and Distribution • Distribution – 3,164 U.S. Bank branches – Elan has over 1,500 financial institution clients – a unique position vs other banks – Cobrand/affinity relationships with more than 60 customers – Merchant acquiring in 19 countries • Product – Issuing Credit, Debit, Prepaid, Corporate cards, Fleet, Payables, and Aviation – Full suite of merchant solutions for small business, travel, e-commerce, and public sector |

| Key

achievements •

Fifteen “Firsts” in the Industry

• Awards in seven of past eight years • Recognized Industry Leadership in Mobile, Digital, and Payments Innovation • Averaging two pilots per quarter • ~50% move to commercialization Why it matters • Key to winning marquee business • Among first to offer Apple Pay ™, Samsung Pay™ and Android Pay™ • Providing our customers with early to market solutions • Ability to collaborate on industry leading change (EMV, Tokenization, Faster Payments) Advantage: Payments Innovation 19 U.S. BANCORP | |

| Relative

Scale Matters Ranking

Annual Volume • #5 U.S. credit card issuer $64 billion • #5 U.S. debit card issuer $58 billion • #3 U.S. corporate card issuer $54 billion • #5 U.S. merchant acquirer • #4 European merchant acquirer Source: The Nilson Report (Visa and MasterCard issuers) $375 billion 20 U.S. BANCORP | |

|

21 U.S. BANCORP | Agenda • Company Overview • Business Line Highlight: Payment Services • 3Q Update Long-term Goals |

|

22 U.S. BANCORP | 3Q15 Student Loan Update • Disruption in the student loan securitization market occurred after the launch of the Company’s student loan sale • Company will return student loans to portfolio • A negative market adjustment of ($55 - $60) million will be recognized in 3Q15 and is expected to accrete to income over the remaining life of the loans Student Loan Sale Timeline April, 2015 July, 2015 July/August, 2015 August, 2015 Announced intent to Launched bidding Management intent to sell Student Loans process Market Disruption retain Student Loans |

|

23 U.S. BANCORP | 3Q15 Notable Events • Student Loan Market Adjustment ($55 - $60) million • Elevated 3Q15 Expenses ($50 - $60) million (not expected to repeat in 4Q) – Mortgage-related compliance – Talent upgrade costs • VISA Gain $120 - $130 million Total Impact Relatively Neutral |

|

24 U.S. BANCORP | 3Q15 Linked Quarter Performance • Loan Growth: 1-1.5% growth • Credit Quality: Relatively stable • Net Interest Margin: Relatively stable • Mortgage Fees: Slightly lower • Payment Fees: Seasonally higher • Noninterest Expense: Expense increasing vs. 2Q15 – Core expense flat * As presented on slide 23 3Q15 expense vs. 2Q15: • Seasonal increase in tax credit amortization: ~$15 - $20 million • 2Q partner reimbursement: ~$20 million • Elevated mortgage-related expense and talent upgrade costs: ~$50 - $60 million* |

|

25 U.S. BANCORP | Agenda • Company Overview • Business Line Highlight: Payment Services • 3Q Update • Long-term Goals |

|

26 U.S. BANCORP | Long-term Goals Long-term Goals • Optimal business line mix • Investments generating positive returns • Profitability: ROE 16-19% ROA 1.60-1.90% Efficiency Ratio low 50s • Capital distributions: Earnings distribution 60-80% Current Status • Four simple and stable business lines • Mortgage, wealth management, corporate banking, international payments, branch technology, internet and mobile channels, and select acquisitions • 2014 Profitability: ROE 14.7% ROA 1.54% Efficiency Ratio 53.2% • 2014 Capital distributions: Distributed 72% of earnings (dividends 31%, share repurchases 41%) |

|

27 U.S. BANCORP | Appendix |

|

28 U.S. BANCORP | Non-GAAP Financial Measures Line of Business Financial Performance Taxable-equivalent basis $ in millions Revenue Line of Business Financial Performance 2Q15 YTD Wholesale Banking and Commercial Real Estate 1,447 $ Consumer and Small Business Banking 3,545 Wealth Management and Securities Services 907 Payment Services 2,553 Treasury and Corporate Support 1,496 Consolidated Company 9,948 Less Treasury and Corporate Support 1,496 Consolidated Company excluding Treasury and Corporate Support 8,452 $ Percent of Total Wholesale Banking and Commercial Real Estate 14% Consumer and Small Business Banking 36% Wealth Management and Securities Services 9% Payment Services 26% Treasury and Corporate Support 15% Total 100% Percent of Total excluding Treasury and Corporate Support Wholesale Banking and Commercial Real Estate 17% Consumer and Small Business Banking 42% Wealth Management and Securities Services 11% Payment Services 30% Total 100% |

|

Barclays 2015 Global Financial Services Conference |

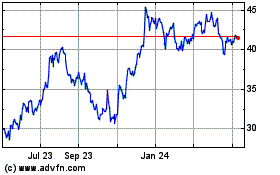

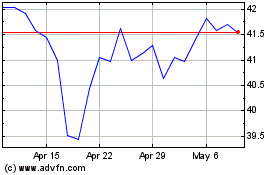

US Bancorp (NYSE:USB)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2023 to Apr 2024