Today's Top Supply Chain and Logistics News From WSJ

October 21 2016 - 6:39AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Union Pacific Corp. is seeing improving demand from some its

commodities shippers. Now it just wants those customers to start

paying more for cargo transport. The largest U.S. freight railroad

says its third-quarter earnings fell 13% as overall freight volume

declined 5.8% and revenue dropped off 7.2% from a year ago, the

WSJ's Tess Stynes reports. UP says it's seeing improvement in some

shipping sectors -- agriculture carloads jumped 11% year-over-year

-- but that "core pricing, " excluding basics like fuel surcharges,

increased 1.5% in the third quarter. That was behind the growth

rate earlier in the first and second quarters and below what

analysts at Cowen and Co. say is the "rail inflation" rate. UP

expects increases in energy-sector pricing to trigger higher

transport charges in the coming year, but the company in the

meantime is responding by paring its spending, trimming its capital

spending and writing off $17 million for projects that were started

and dropped.

Genesee & Wyoming Inc. is taking advantage of troubles in

Australia's coal industry to boost its foothold in the country. The

U.S. railroad operator will pay $874 million for Glencore PLC's

coal-haulage business in Australia's New South Wales, the latest

move by the mining company to sell off pieces of its business to

reduce its big debt load, the WSJ's Rhiannon Hoyle reports. GRail

hauls about 40 million metric tons of coal a year to the Port of

Newcastle, the world's biggest coal-export hub. Glencore says the

business has reduced its costs and improved the efficiency of its

coal supply chain, but the company has been scrambling to improve

its financial structure amid sagging commodities prices and

mounting debt. Connecticut-based Genesee & Wyoming is betting

big on a turnaround in the coal sector, meantime, and will add the

GRail business to some 3,000 miles of track it already operates in

the South Australia state and the Northern Territory.

Another big South Korean shipping business is in U.S. bankruptcy

court. STX Offshore & Shipbuilding Co. filed for bankruptcy

protection in Texas, the WSJ's Patrick Fitzgerald reports, as it

bids to stop creditors from seizing its assets in the U.S. while

the shipyard looks to sell its business overseas. The administrator

overseeing STX's Korean bankruptcy case says some creditors who

hired STX are trying to circumvent the Korean proceeding by taking

over the company's assets in the U.S. Among those with claims is

New York-listed Teekay Tankers Ltd., which hired STX in 2013 to

build four oil tankers and won a $32 million arbitration award last

year after the shipbuilder failed to deliver the vessels. Creditors

have pumped billions of dollars into STX to keep it afloat, but the

company continues to bleed red ink. STX is South Korea's

fourth-largest shipbuilder, and its bigger rivals are undergoing

corporate overhauls as the struggling under the global trade

downturn that has helped push Hanjin Shipping into bankruptcy.

SUPPLY CHAIN STRATEGIES

A major toy maker is taking action over concerns about the

financial health of a big customer. Jakks Pacific Inc. has halted

shipments of its products to Sears Holding Corp.'s Kmart chain, a

troubling sign for the retailer from a supplier heading into the

holiday season. Jakks isn't formally disclosing the target of the

action, only that it is stopping sales to a "major U.S. customer

that is experiencing challenges" to minimize risks. The WSJ's Paul

Ziobro and Suzanne Kapner report that Kmart is the business, and

that Jakks' decision marks a fresh blow to a company that has been

hurt hard by the growing toy sales at Wal-Mart Stores Inc., Toys

"R" Us Inc. and Amazon.com Inc. Financial stability of companies in

supply chains has been a growing concern since several retailers

foundered and failed in the wake of the recession, leaving

suppliers in the lurch. Jakks is trying to get ahead of such

troubles, but its decision may also make it harder for Kmart to

meet its goals during a crucial selling period.

QUOTABLE

IN OTHER NEWS

U.K. retail sales were unchanged in September from a strong

August, and were 4.1% ahead of last year. (WSJ)

American Airlines Group Inc.'s net profit f ell by more than

half in the third quarter, as cargo revenue declined 5.1% despite a

5.6% gain in cargo traffic. (WSJ)

Nissan Motor Co. completed its purchase of a controlling stake

in Mitsubishi Motors Corp. in a deal aimed at boosting scale to

take on the world's top auto makers. (WSJ)

Mattel Inc.'s third-quarter revenue nudged barely higher, with

Barbie and American Girl business plugging lost sales from two Walt

Disney Co. licenses. (WSJ)

Apple Inc. says nearly 90 percent of the Apple chargers and

cables it has bought under a test on Amazon.com are counterfeits.

(WSJ)

Hanjin Shipping plans to lay off half its white-collar staff as

it seeks to cut costs to stave off liquidation. (Korea Joongang

Daily)

The American Trucking Associations forecast that trucking

volumes will grow 27% over the next 10 years, behind the 35% growth

in overall freight tonnage. (Industry Week)

Volvo Trucks is laying off another 143 workers at its

Hagerstown, Md., factory, following job cuts at the plant earlier

this year. (Commercial Carrier Journal)

China's express delivery sector grew 44% in the first nine

months of the year based on revenue. (Xinhua)

Taiwan-based bicycle maker Giant Bicycle Inc. began selling

bikes online to U.S. consumers for pickup in brick-and-mortar

shops. (Internet Retailer)

Chinese apparel manufacturer Suzhou Tianyuan Garments Co. will

set up a $20 million factory in Arkansas that will employ 400

people. (Associated Press)

DHL Express opened a 250,000-square-foot automated parcel

sorting facility at Singapore Changi Airport to serve as its South

Asia hub. (Straits Times)

Investors in Rickmers Maritime are demanding the troubled

container line repay their notes with interest as the carrier's

trustee-manager considers liquidation. (Splash 24/)

Watco Transportation Services and Eastern Idaho Railroad are

upgrading regional services to cut delivery times for agriculture

shipments in half. (KMTV)

Global wine production has fallen 5% this year because of

"climatic events" that have hit producers in the southern

hemisphere. (The Guardian)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @lorettachao and @EEPhillips_WSJ, and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 21, 2016 06:24 ET (10:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

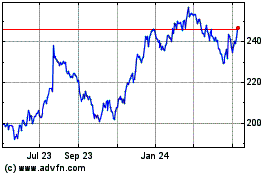

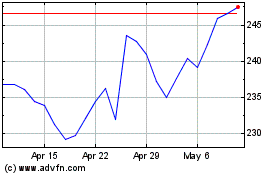

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024