Norfolk Southern Shares Rise on Surprise Profit Jump

April 22 2016 - 2:16PM

Dow Jones News

By Laura Stevens

Shares of Norfolk Southern Corp. rose 10% Friday after the

railroad reported strong first quarter results a week after

Canadian Pacific Railway Ltd. called off a proposed merger.

North America's No. 4 railroad by revenues reported a surprise

25% rise in profit Thursday to $387 million. Driving first-quarter

results were savings due to the company's profit-improvement plan,

better weather and cost savings on labor and materials,

specifically the company's locomotive repair program.

Shares were trading up at $91.04 Friday midday, their highest

level since December.

On April 11, Canadian Pacific Railway called off its nearly $30

billion pursuit of Norfolk Southern after it was unable to overcome

a wall of opposition from rival railroads, shippers and U.S.

politicians. Canadian Pacific said it didn't plan to initiate

further merger talks with other railroads in this climate.

Both BNSF Railway Co. and Union Pacific Corp. warned after the

bid surfaced that a major merger would likely trigger a final round

of industry consolidation, reducing the number of major freight

rails from seven to a handful.

"I wouldn't want to speculate on what the future may hold in

terms of other ideas of consolidation," Chief Executive Jim Squires

said in an interview. Canadian Pacific's proposal was inadequate in

value and wouldn't have received regulatory approvals, he

added.

"We certainly remain open to any and all alternatives that would

create value for our shareholders," Mr. Squires said.

Mr. Squires, who took over in June, however warned that the

second quarter will be tougher than the first as weak commodity

prices continue to take a toll.

"We'll be working hard to leverage our service to produce

growth, but against a pretty difficult backdrop overall," he

said.

There are opportunities to grow, particularly in intermodal --

the transportation of containers and trailers also moved by truck

-- and some consumer goods, Mr. Squires said. But volatile pricing

and weakness in commodities are driving volume decreases. In the

first quarter, coal volumes declined 23% and comprised less than

15% of total revenues, down from 29% in 2010.

In a bright spot, the company was able to charge more this year

for moving cargo as more of its trains run on time, spend less time

stuck in rail yards, and service levels improve.

"It really comes back to service," said Mr. Squires. "We're able

to deliver customers' goods in a more reliable and in a timely way,

so that they're willing to pay more."

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

April 22, 2016 14:01 ET (18:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

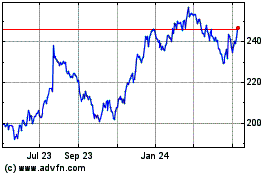

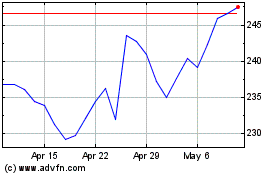

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024