Union Pacific Profit Falls on Weak Freight Demand

April 21 2016 - 1:29PM

Dow Jones News

By Anne Steele

Union Pacific Corp. Thursday reported a 15% drop in quarterly

profit due to weak freight demand, especially for coal and forecast

total volumes to be down this year.

The company's performance was hurt by big declines in

energy-related businesses, particularly coal, and oil and natural

gas shale fracking sand, which shrunk 34% and 49%, respectively in

the quarter. Industrial products were down 10%.

Even so, Chief Executive Lance Fritz pointed to several bright

spots in the U.S. economy such as healthy growth in industrial

chemicals and improving signs for construction, including more rock

and lumber shipments.

"Our book of business does indicate that the economy continues

to recover and grow, even though it's at a relatively slow rate,"

Mr. Fritz said in an interview. While housing starts are still at

historically low numbers, he said the business is

strengthening.

Shares of Union Pacific rose 5.6% in recent trading to $88.50,

and are up 13% so far this year.

Union Pacific said it expects total volumes for the year to

decline in the mid single digits.

As major transportation providers for cargoes representing all

facets of the U.S. economy, railroads have traditionally been seen

as an economic bellwether.

While low energy prices have caused Union Pacific's oil and

natural gas shale fracking business to skid, Mr. Fritz says that he

does expect a recovery -- and at lower oil prices than was

previously possible for domestic production. Union Pacific's

biggest piece of that business is shipping sand, pipes and steel

for drilling wells.

Shale drilling peaked about a year and a half ago with about

2,000 active drilling rigs, Mr. Fritz said, a number that has

plunged beneath 500 currently.

"I don't know if you get back to that kind of peak," Mr. Fritz

said. But "producers have really knocked down their operating cost,

so I think that strike price is lower than it was four years

ago."

Overall, revenue in the quarter decreased 14% to $4.83 billion

and profit fell to $979 million from $1.15 billion.

For the three months ended March 31, Union Pacific's total

freight volume skidded 14% as declines across sectors more than

offset growth in automotive, which rose 7%.

Anne Steele contributed to this article

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

April 21, 2016 13:14 ET (17:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

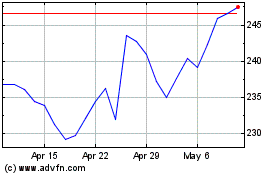

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

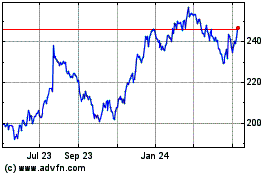

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024