By Laura Stevens And Betsy Morris

The dismal energy market slammed two of North America's biggest

freight railroads in the fourth quarter, prompting them to slash

jobs and driving profits below Wall Street's expectations.

Union Pacific Corp. said it furloughed 3,900 employees last year

amid steep declines in shipments of coal, crude oil and fracking

sand. These, plus a sharp drop in fuel-surcharge revenue, pressured

fourth-quarter profit down 22% to $1.12 billion.

Meanwhile, Canadian Pacific Railway Ltd., which has so far been

stymied in an effort to take over U.S. rival Norfolk Southern

Corp., said it would cut up to 1,000 jobs this year and posted a

nearly 30% drop in earnings to 319 million Canadian dollars ($220

million).

The reports come a week after executives at CSX Corp. said the

current pressures on rail volumes were at levels not seen outside

of a recession.

The effects of the oil-market bust on the rail industry's

crude-related businesses were especially evident in the latest

quarter.

At CP, whose network stretches across Canada and into the U.S.,

total carloads fell about 6% during the quarter, with declines in

all but three categories of cargo. Some of the greatest declines

were in CP's crude-oil shipments, which fell 17%, and its metals,

minerals and consumer-products shipments which plunged 24%.

"We've seen [in] the last three quarters of 2015 the economic

headwinds across all business segments except for a couple of

bright spots in forest products and Canadian grain," said CP Chief

Operating Officer Keith Creel. He said the strong U.S. dollar and

low commodity prices weighed on business in the company's bulk,

energy and metals segments.

At Union Pacific, which is most active in the Western U.S.,

shipments of crude oil plunged 42% and loads of fracking sand used

to drill oil and natural-gas wells fell by more than half in the

quarter. Shipments of coal, one of Union Pacific's largest

businesses, fell by a fifth as temperatures were warmer than

average and power plants used more natural gas.

"Another quarter of solid pricing gains were not enough to

offset the 9% decrease in total volumes," Chief Executive Lance

Fritz said on an earnings call with analysts.

The net impact of lower fuel prices, including the decline in

fuel-surcharge revenues, was estimated to have reduced Union

Pacific's earnings per share by 11 cents from a year before. It

earned $1.31 a share, coming in below the $1.42 forecast by

analysts polled by Thomson Reuters. Adjusted to exclude items such

as foreign exchange fluctuations, Canadian Pacific earned C$2.72 a

share, below the C$2.78 a share analysts expected.

Energy will continue to weigh on earnings in the first quarter,

Union Pacific executives said.

Coal volume is expected to decline by about 20% in the quarter

and full-year total volumes are expected to be slightly down,

depending on the overall economy.

CP's Mr. Creel said he expects total volumes to be "modestly

down" this year: "We see again modest single-digit reduction in

carloads," he told analysts. Crude oil is going to be a headwind.

"I don't see any shining stars out there in the economy."

Union Pacific executives said they were getting mixed economic

signals from U.S. consumers. It appears that consumer spending is

shifting away from goods, like retail, and more toward services,

they said. While auto shipments rose 8% in the quarter, executives

cautioned that auto sales might not be sustainable at current

record levels.

Both railroads fielded questions about Canadian Pacific's

contentious, roughly $30 billion bid for Norfolk Southern.

Though not commenting on CP's bid directly, Union Pacific's Mr.

Fritz echoed the fierce rail-industry opposition to a deal that has

developed in the U.S. He said he doesn't think a big rail merger

would improve rail safety or efficiency and that it would be a

"disincentive to capital investment."

The opposition has spread beyond the rail industry to

manufacturing and other trade associations. And CP's effort will be

scrutinized not only by the U.S. Surface Transportation Board,

which approves rail mergers, but other regulators and

lawmakers.

CP's chief executive, Hunter Harrison, said he might need to

change his strategy as a result of these developments. "Things have

changed, and so will that change potentially some of our strategy?

Absolutely," he said.

"Understand that when you're playing the game and somebody

changes the rules on you, you have to review your strategy as far

as going forward, and the rules are moving on us as we speak," he

said.

He specifically cited the concern, raised by the Federal

Railroad Administrator in The Wall Street Journal last week, that

combining two corporate safety cultures can result in problems.

"I've never heard that argument in my life," Mr. Harrison said.

Mr. Harrison said he has personally spoken to more than half of

all Norfolk Southern shareholders or their representatives, and

they have indicated "they would be in support of [it], but they

don't call all the shots," he added.

Union Pacific's stock closed 3.6% lower at $71.00, which is down

43% from the 52-week high hit in February. U.S.-traded shares of

Canadian Pacific, which fell more than 5% in early morning trading,

closed up 0.5% higher at $104.67.

Write to Laura Stevens at laura.stevens@wsj.com and Betsy Morris

at betsy.morris@wsj.com

(END) Dow Jones Newswires

January 21, 2016 20:28 ET (01:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

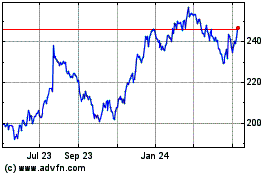

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

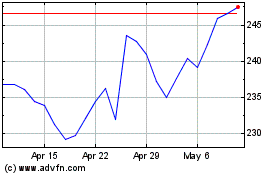

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024