Union Pacific Profit Falls 22% on Weak Freight Volume -- Update

January 21 2016 - 2:39PM

Dow Jones News

By Laura Stevens and Betsy Morris

The dismal energy environment slammed Union Pacific Corp. in the

fourth quarter, causing the railroad's earnings to fall 22% from a

year ago and the company to miss Wall Street expectations.

The company sustained steep declines in shipments of such

higher-margin businesses as coal, crude oil and fracking sand plus

a sharp drop in its fuel surcharge revenue, causing profit to fall

to $1.12 billion, or $1.31 per share. Analysts polled by Thomson

Reuters had expected earnings of $1.42 per share. The net impact of

lower fuel prices, including the decline in fuel surcharge

revenues, reduced earnings per share by 11 cents in the quarter

compared with last year.

"Another quarter of solid pricing gains were not enough to

offset the 9% decrease in total volumes," Chief Executive Lance

Fritz said on an earnings call with analysts.

The news sent Union Pacific's stock down more than 8% in early

trading, though shares recovered somewhat by early afternoon, when

they were down 3.1% at $71.31. Their 52-week high is $124.52.

The railroad said shipments of crude oil plunged 42%, and loads

of fracking sand used to drill wells fell by 52% in the quarter.

Coal, one of Union Pacific's largest businesses, fell by a fifth as

temperatures were higher than average and power plants used more

natural gas. Coal inventory levels reached 105 days through

December, 39 days above normal and 43 days above the same month a

year ago, executives said.

Energy will continue to weigh on earnings in the first quarter,

executives told analysts on the earnings call. Coal volume is

expected to decline by about 20% in the quarter, and full-year

total volumes are expected to be slightly down, depending on the

overall economy.

Union Pacific executives said they're getting mixed economic

signals from U.S. consumers. It appears that consumer spending is

shifting away from goods, such as retail, and more toward services,

they said, which is affecting their business mix. Auto shipments

rose 8% in the quarter as consumer demand remained strong, but the

executives cautioned that auto sales might not be sustainable at

current record levels.

When asked, the executives said they couldn't predict whether

the current rail downturn pointed toward a recession. "Certainly,

our volume drop-off, as the 2015 year progressed quarter-to-quarter

and as we're entering 2016, is dramatic," Mr. Fritz said on the

call. But "it's not approaching what we experienced in 2008 to

2009."

Union Pacific reiterated its opposition to rail mergers, saying

it doesn't think a big rail merger would improve safety or

efficiency and that it would be a "disincentive to capital

investment."

Without mentioning Canadian Pacific Railway Ltd.'s roughly $30

billion bid for Norfolk Southern Corp., executives said that one

big merger could trigger others, and it is monitoring the

situation.

"Our focus right now is on running a safe, efficient business,"

Mr. Fritz said in an interview. "We are monitoring this proposed

merger, and any proposed industry consolidation closely. As the

situation evolves, we'll do what is right for our shareholders and

our stakeholders."

Union Pacific's balance sheet is in excellent shape, he added.

"We know we'll be able to handle whatever we need to do looking

forward," he said.

Write to Laura Stevens at laura.stevens@wsj.com and Betsy Morris

at betsy.morris@wsj.com

(END) Dow Jones Newswires

January 21, 2016 14:24 ET (19:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

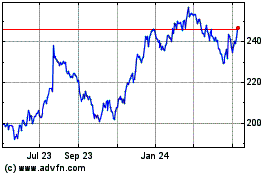

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

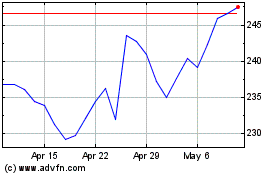

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024