Current Report Filing (8-k)

June 09 2016 - 5:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

—————————————

FORM 8-K

—————————————

Current Report

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 6, 2016

—————————————

UNITEDHEALTH GROUP INCORPORATED

(Exact name of registrant as specified in its charter)

—————————————

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-10864

|

|

41-1321939

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

UnitedHealth Group Center, 9900 Bren Road East, Minnetonka, Minnesota

|

55343

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (952) 936-1300

N/A

(Former name or former address, if changed since last report.)

—————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of CFO

On June 7, 2016, the Board of Directors of UnitedHealth Group Incorporated (the “Company”) appointed John F. Rex, age 54, to the position of Chief Financial Officer of the Company. Prior to this appointment, Mr. Rex served as Executive Vice President and Chief Financial Officer of Optum, a position that he has held since March 2012. Prior to joining Optum in 2012, Mr. Rex spent over a decade in the financial services industry, most recently as a Managing Director at JP Morgan.

In connection with his appointment, Mr. Rex entered into an amended and restated employment agreement setting forth the terms of his employment with the Company. The employment agreement provides that Mr. Rex will receive a base salary of $800,000 and will be eligible to receive an annual cash incentive award that has a target value of 115% of his base salary. Mr. Rex received equity awards with a fair value of $2.5 million in connection with his appointment as Chief Financial Officer. Mr. Rex will be eligible to participate in other compensation, severance and benefit plans available to Company executives in similarly situated positions, including future annual equity awards.

David S. Wichmann, who served as the Company’s Chief Financial Officer until June 7, 2016, continues to serve as the Company’s President. All terms of Mr. Wichmann’s employment, including his compensation, are unchanged.

Neither Mr. Rex nor Mr. Wichmann has been directly or indirectly involved in any transaction, proposed transaction, or series of similar transactions with the Company required to be disclosed pursuant to Item 404(a) of Regulation S-K.

SERP Amendment

Stephen J. Hemsley and the Company have had an Agreement For Supplemental Executive Retirement Pay (“SERP”) which entitled him to a cash lump sum payment, the value of which has been unchanged since 2006. The Company and Mr. Hemsley entered into an amendment to the SERP on June 7, 2016 to convert the cash lump sum benefit into deferred stock units. The number of deferred stock units issued to Mr. Hemsley was determined by dividing the cash value of the benefit by the average closing price of the Company’s common stock for the prior five trading days preceding June 7, 2016, and resulted in the issuance of 78,789 deferred stock units. As is the case with other deferred stock units issued by the Company, these deferred stock units will entitle Mr. Hemsley to dividend equivalents in the form of additional deferred stock units. These dividend equivalents will be paid at the same rate and at the same time that dividends are paid to Company shareholders. All other terms of the agreement are unchanged.

Item 5.07.

Submission of Matters to a Vote of Security Holders.

On June 6, 2016, the Company held its 2016 Annual Meeting of Shareholders (the “Annual Meeting”). There were 866,431,779 shares of common stock represented either in person or by proxy at the Annual Meeting. The shareholders of the Company voted as follows on the following matters at the Annual Meeting:

|

|

|

|

1.

|

Election of Directors.

The ten directors were elected at the Annual Meeting for a one-year term based upon the following votes:

|

|

|

|

|

|

|

|

|

|

Director Nominee

|

For

|

Against

|

Abstain

|

Broker

Non-Votes

|

|

William C. Ballard, Jr.

|

763,871,985

|

38,452,370

|

1,654,334

|

62,453,090

|

|

Edson Bueno, M.D.

|

784,565,981

|

18,794,429

|

618,279

|

62,453,090

|

|

Richard T. Burke

|

762,735,286

|

39,600,485

|

1,642,918

|

62,453,090

|

|

Robert J. Darretta

|

801,497,407

|

1,838,120

|

643,162

|

62,453,090

|

|

Stephen J. Hemsley

|

797,137,589

|

6,264,127

|

576,973

|

62,453,090

|

|

Michele J. Hooper

|

778,580,264

|

24,792,463

|

605,962

|

62,453,090

|

|

Rodger A. Lawson

|

799,201,550

|

4,090,260

|

686,879

|

62,453,090

|

|

Glenn M. Renwick

|

768,867,141

|

34,426,976

|

684,572

|

62,453,090

|

|

Kenneth I. Shine, M.D.

|

799,089,757

|

4,263,441

|

625,491

|

62,453,090

|

|

Gail R. Wilensky, Ph.D.

|

764,930,508

|

37,442,482

|

1,605,699

|

62,453,090

|

|

|

|

|

2.

|

Non-binding advisory vote on executive compensation.

The Company’s executive compensation was approved by a non-binding advisory vote based upon the following votes:

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker

Non-Votes

|

|

773,755,033

|

28,570,828

|

1,652,828

|

62,453,090

|

|

|

|

|

3.

|

Ratification of the appointment of Deloitte & Touche LLP.

The appointment of Deloitte & Touche LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2016 was ratified based upon the following votes:

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

|

857,238,890

|

8,265,410

|

927,479

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

UNITEDHEALTH GROUP INCORPORATED

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Dannette L. Smith

|

|

|

|

|

|

Dannette L. Smith

|

|

|

|

|

|

Secretary to the Board of Directors

|

Date: June 9, 2016

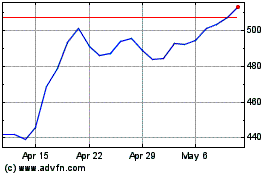

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024