Unilever Pressure Rises After Kraft Heinz Withdraws Bid

February 20 2017 - 12:13PM

Dow Jones News

By Saabira Chaudhuri

LONDON -- After the collapse of Kraft Heinz Co.'s short-lived

$143 billion attempt to buy Unilever PLC, pressure is mounting on

the Anglo-Dutch consumer-goods company to make bolder moves to buoy

the company's stock price.

Despite investor encouragement in recent years to sell

underperforming businesses and do a large acquisition, Unilever

Chief Executive Paul Polman has so far danced to his own tune.

"It's a wake-up call for Unilever and they need to respond,"

said Société Générale analyst Warren Ackerman.

The companies disclosed on Friday, following a media report,

that Unilever had rejected a $50-a-share preliminary offer from

Kraft Heinz. They said Sunday that Kraft Heinz had amicably

withdrawn its offer, given that Unilever had made clear it didn't

want to pursue a tie-up.

Unilever's shares have more than doubled between January 2009,

when Mr. Polman became CEO, and Thursday, before Kraft's approach

was made public. But Unilever's total shareholder return of 193%

over that period, according to Exane BNP Paribas data, is short of

those at other European home and personal-care companies: 464% at

Henkel AG, 290% at Reckitt Benckiser Group PLC and 215% at L'Oréal

SA.

Unilever's profit margins also have lagged behind those of some

of its U.S. and European peers, and the company rarely buys back

shares, a strategy analysts say Mr. Polman views as financial

engineering. Unilever last repurchased its shares in 2007 and last

paid a special dividend in 1999.

"Investors have been very patient yet have been given relatively

mediocre financial reward," said Exane analyst Jeff Stent. "This

should not be back to business as usual at Unilever."

Unilever declined to comment.

Not all investors have itchy feet. Mike Fox, a fund manager at

Royal London Asset Management, which holds 0.66% of Unilever's

U.K.-listed shares, said he has no major concerns with Unilever's

management or approach. "We'd expect shares to go through the value

of the Kraft offer and beyond in due course under the current

management and strategy," Mr. Fox said.

Unilever shares rose more than 13% in London trading on Friday,

to GBP37.97 ($47.20). They dropped as much as 9% earlier on Monday

and closed down 6.6% to GBP35.48.

Following Kraft Heinz's approach, Unilever could come under

increased pressure to sell, spin off or strike a joint venture for

its declining spreads business, which has struggled as consumers

eat less bread and, when they do, opt for butter. "Just because

it's declining doesn't mean you just sell it; you only sell it if

the price you can get for it is better than if you keep it," Mr.

Polman told reporters last year. "We're not a charity."

Analysts have also suggested Unilever could choose to divest

certain local tea brands -- such as PG Tips in the U.K. -- and

instead focus on launching premium tea brands more widely. Despite

being the world's largest tea company, Unilever has turned in

lackluster sales growth for years as consumers move away from

mainstream black tea into areas such as green and herbal teas, to

which Unilever has less exposure.

Mr. Polman has stayed away from large acquisitions in recent

years, instead opting for a series of deals up to $1 billion,

including last year's purchase of Dollar Shave Club Inc. But

Kraft's approach could propel Mr. Polman to look at bigger

acquisitions as a pathway to growth.

The company has long been rumored to be interested in buying

Colgate-Palmolive Co., which would significantly boost its exposure

to high-growth personal-care products and deliver major cost

savings. Analysts say now would be a good time for such a move

given that a January profit warning has pressured the toothpaste

maker's shares, borrowing costs are low and Unilever's balance

sheet is in good health.

Exane BNP Paribas on Monday raised its target price on Colgate

to $90 from $68 and upgraded its rating, saying "the likelihood of

Unilever seeking to acquire Colgate has now increased materially."

Colgate closed Friday at $71.98, giving it a market value of nearly

$64 billion.

Unilever has also long been floated as a natural buyer for

Edgewell Personal Care Co., which owns shaving brands such as

Schick, Edge and Skintimate along with sun-care brands such as

Banana Boat and Hawaiian Tropic. Edgewell has a market

capitalization of $4.6 billion.

Edgewell and Colgate didn't immediately respond to requests for

comment.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 20, 2017 11:58 ET (16:58 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

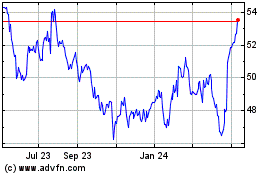

Unilever (NYSE:UL)

Historical Stock Chart

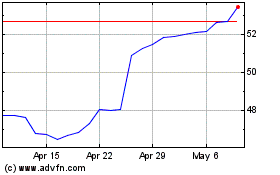

From Mar 2024 to Apr 2024

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024