Kraft Heinz Needs a Deal, But Can It Really Afford Unilever? -- Heard on the Street

February 17 2017 - 2:29PM

Dow Jones News

By Stephen Wilmot and Paul J. Davies

Even at the lowball price Kraft Heinz Co. has offered, buying

soap-to-soup giant Unilever PLC would stretch its balance sheet to

its limits. But the U.S. food group needs a deal.

Investors cheered news of the potential acquisition, sending

Kraft Heinz shares up 8% at the open. 3G Capital -- the Brazilian

investment firm that teamed up with Warren Buffett 's Berkshire

Hathaway to buy Heinz in 2013 and then merged it with Kraft two

years later -- is a legendary costcutter. Kraft Heinz's operating

margin last year was roughly 23%; before the merger Kraft's was

10%.

But it will take an aggressive sleight of hand even by 3G's

standards to acquire Unilever, which has roughly the same

enterprise value as Kraft Heinz.

Unilever said the U.S. food group had proposed $30.23 a share in

cash, plus 0.222 new shares, equivalent to $20.80 after the Friday

morning pop. Kraft Heinz already has $29 billion of net debt, and

would need to take on a further $90 billion to fund the cash

portion of the deal. Add in Unilever's debt, and the combined total

rises to $132 billion -- about 7.5 times combined earnings before

interest, taxes, depreciation and amortization.

That is a much higher leverage than in last year's

consumer-goods megadeal: Anheuser-Busch InBev's purchase of

SABMiller to create the world's biggest beer maker. The comparison

is apt because the beer giant was built by Carlos Brito, who

formerly worked for the three billionaires that run 3G Capital.

Before cost savings, ABI's near-$110 billion offer was expected to

leave the combined company with net debt at about 4.5-times

forecast Ebitda.

If Kraft Heinz succeeds in buying Unilever, axing costs would

boost expected profits. The London-based company has made much of

its use of "zero-based budgeting" -- the cost-cutting tactic

favored by 3G -- but its operating margin last year was 14.8%, well

below the level at Kraft Heinz or ABI. That said, finding savings

is much easier in the merger of two brewers than two producers of

packaged food -- and other products. Food, in which Kraft Heinz

specializes, accounts for only 43% of Unilever's portfolio, notes

Citi.

The debt-averse Warren Buffett might intervene to make the deal

possible. Berkshire Hathaway owns 26.8% of Kraft Heinz, has roughly

$85 billion in cash and helped fund the Kraft-Heinz merger. That

may explain the apparent lack of concern among Kraft Heinz's

independent shareholders.

However, a higher bid is needed. The $51 dollar-a-share offer

values Unilever at roughly 15.4 times expected Ebitda, compared

with almost 21 times for SABMiller. This month Unilever's

U.K.-listed peer Reckitt Benckiser offered 19 times for U.S.

infant-nutrition company Mead Johnson, calculates Barclays.

The food group is motivated by an inexorable logic: There is

little growth in consumer products, so the model appears to be:

Buy, cut costs and buy again. Kraft Heinz believes it needs a big

new target. It will likely prove a determined hunter.

Write to Stephen Wilmot at stephen.wilmot@wsj.com and Paul J.

Davies at paul.davies@wsj.com

(END) Dow Jones Newswires

February 17, 2017 14:14 ET (19:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

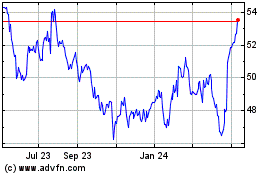

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

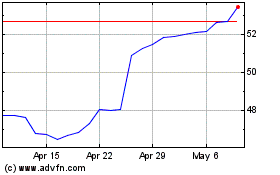

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024