By Saabira Chaudhuri

LONDON -- Consumer-products giant Unilever PLC is raising its

U.K. prices for everything from mayonnaise to shampoo after months

of discreet increases amid a Brexit-triggered currency rout that is

threatening Britons' buying power.

The Anglo-Dutch giant said on Thursday it is asking its top

grocery retailers here for price increases on its products, which

include household names such as Hellmann's mayonnaise, Dove soap

and Ben & Jerry's ice cream. It also makes Marmite, a popular

brown, salty spread with a cult following. It cited rising

commodity costs in dollars, which -- coupled with the sharp decline

in the pound -- have raised the cost of imported ingredients.

"The price increases have landed," said Unilever finance chief

Graeme Pitkethly on a call with analysts. Unilever, the world's

second-largest consumer goods maker after Procter & Gamble Co.,

didn't detail its pricing demands, but people familiar with the

discussions said it is asking for hikes of 10% on average,

according to people familiar with the matter.

The demand set the stage for a brief public standoff with Tesco

PLC, Britain's biggest grocer. Tesco on Wednesday pulled Unilever

brands from its website after refusing to accept the demand for

higher prices.

Late Thursday, though, Tesco and Unilever issued statements

saying they had resolved the pricing dispute, without giving

details. Analysts and industry insiders said they expect Unilever

got at least some of the higher prices it was asking for, given the

sharp drop in the pound and how the industry typically operates in

such currency moves.

Unilever also approached J Sainsbury PLC and other British

supermarkets about raising prices by around 10% on average,

according to a person familiar with those conversations. Sainsbury

hasn't yet reached a resolution with Unilever, according to this

person.

The price increase and Unilever's fight with Tesco -- splashed

across the front pages of British newspapers on Thursday and

trending online as "#Marmitegate" -- put the economic stakes of

Brexit for everyday Britons into suddenly high relief. With so many

details of London's planned split with the European Union still

subject to years of negotiations, the largest impact felt so far by

companies and consumers has been the pound's steep drop. The pound

is down roughly 15% against the dollar since the June 23 Brexit

vote.

That has triggered a tourism boom, as visitors enjoy cheaper

hotel stays and shopping. British exporters also have gained as

their goods are more competitive overseas. U.K.-based

multinationals benefit from higher revenue as overseas sales are

converted into sterling.

But for importers, the fall of the pound is painful. Changes in

exchange rates affect input prices almost immediately. The cost of

imported materials for businesses rose by 9.3% in August compared

with a year earlier. Such changes take time to filter through to

consumers. Consumer prices increased less than 1% in the

period.

Still, for many U.K. residents, Sterling's fall is already

causing discomfort. Overseas vacations are more expensive, keeping

more Britons at home. Retail prices of many imported goods, such as

electronic devices, wine and cars, have been ticking higher for

weeks.

Those increases so far have mostly involved discretionary

purchases. With Unilever's latest move, the prospect of higher

prices for staples suddenly looms larger. Sanford C. Bernstein

& Co. equity analyst Bruno Monteyne said the Unilever-Tesco

dispute presaged "inevitable Brexit-induced price inflation."

Last month, the Bank of England noted that retailers were "very

cautious about any increases in prices, given that consumers

remained highly price sensitive, and so the extent and timing of

pass-through would largely depend on competitors' actions,

particularly in food retail."

David Dines, a 56-year-old soccer coach voted in June to remain

in the European Union. Outside a Tesco store in south central

London, tossing an avocado he just bought, he said the prospect of

price fluctuations is "the consequence of Brexit, isn't it? It's

inevitable."

It was unclear whether the higher costs already have been passed

along to consumers in Britain's ultracompetitive grocery market --

or whether they ever will be. U.K. national chains have engaged in

costly price wars for years, fighting each other and a band of

ultra-low-price discounters for market share. If other

consumer-goods giants, such as P&G and Mondelez International

Inc., don't follow suit, shoppers would still enjoy plenty of

options for brands that keep budgets in check.

Still, what Unilever does matters. It commands significant

market share in a number of consumer-product sectors in Britain. It

enjoys a 37% share of Britain's ice cream market, for instance, and

21% of its table sauce market, according to market researcher

Euromonitor International.

Some analysts questioned the timing of Unilever's move. Brexit

and the weak pound aside, it comes as the company struggles with

lifting sales volume globally. On Thursday, Unilever posted

third-quarter sales growth on an underlying basis -- which strips

out the impact of acquisitions, disposals and exchange-rate changes

-- of 3.2%, down from a 5.7% gain in the same period a year

earlier. The price increases the company has pushed through so far

"are substantially less than we would need to cover the impact on

our own profitability," Mr. Pitkethly, the finance chief, said. He

said U.K. sales make up about 5% of Unilever global sales.

He said Unilever has incurred EUR600 million ($662 million) in

higher costs this year tied to currency devaluation, excluding the

effect from the pound's decline against other currencies.

Unilever's hedging arrangements typically protect it between four

and six months out, however, and the company may start seeing the

effect of higher sterling costs later this month.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 13, 2016 15:05 ET (19:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

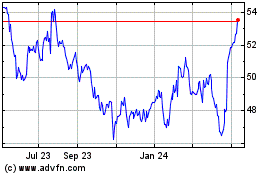

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

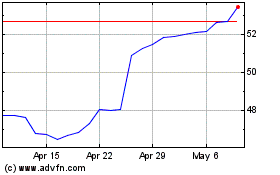

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024