Unilever Growth Slows on Competition in Emerging Markets -- 2nd Update

October 13 2016 - 4:05AM

Dow Jones News

By Saabira Chaudhuri

LONDON-- Unilever PLC Thursday reported a slowdown in

third-quarter revenue growth, as the world's second-largest

consumer goods company struggled with fierce competition in

emerging markets and the impact of currency devaluation in Latin

America.

The maker of Ben & Jerry's ice cream and Dove shampoo posted

third-quarter sales growth on an underlying basis--which strips out

the impact of acquisitions, disposals and exchange-rate changes--of

3.2%, down from 5.7% growth in the same period a year earlier.

Revenue climbed 3.4% at constant currency as the company offset

volume declines with higher prices. But including a negative

currency impact of 3.4%, revenue was flat at EUR13.4 billion ($14.8

billion). Profit figures weren't disclosed.

The results came as the Anglo-Dutch consumer goods giant has

been grappling with a slump in the pound following Britain's vote

to leave the European Union. Unilever's products were unavailable

on British grocer Tesco PLC's website as of Wednesday after

Unilever demanded Tesco raise prices and the grocer refused,

according to a person familiar with the standoff.

Chief Financial Officer Graeme Pitkethly in a Thursday interview

said pricing decisions are delegated to local markets, and that the

U.K. makes up about 5% of Unilever sales.

He declined to comment on when and on what terms the company

will restart supplies to Tesco, but said the company had seen a

EUR600 million rise in costs tied to currency devaluation and that

many of Unilever's products contain ingredients that are

internationally traded, such as plastics, flavors, fragrances and

tea.

Bernstein analyst Bruno Monteyne said the dispute between Tesco

and Unilever is "inevitable Brexit-induced price inflation," since

"a shampoo produced on the continent is now 17% more

expensive."

Unilever's negotiations with Tesco--Britain's largest

retailer--will no doubt set the tone for how prices rises are

passed along across the rest of the industry. Retailers are

unlikely to absorb the price increases, according to Mr. Monteyne,

meaning any cost increases passed along by Unilever will hit

consumers' pockets.

The world's second-largest consumer goods company after Procter

& Gamble has also approached J Sainsbury PLC--Britain's

second-largest supermarket chain--about raising prices by around

10% on average, according to a person familiar with those

conversations. Sainsbury is still in talks with Unilever.

Unilever's hedging arrangements typically protect the company

between four and six months ahead, meaning the company should start

to see the impact of cost increases later this month.

Unilever regularly both raises and cuts prices around the world,

according to Mr. Pitkethly. "It's always a combination of

underlying commodity movements and currency impacts," he said.

On an underlying basis, Unilever reported sales growth in

emerging markets weakened to 5.6% from 8.4% a year earlier.

Consumer demand in India was dampened by price increases on skin

cleaners while in China sales were down due to price competition in

laundry, according to the company.

Chief Executive Paul Polman described global markets as "soft

and volatile," in particular calling out currency devaluation in

Latin America as having squeezed disposable income.

Unilever has adopted so-called zero-base budgeting or justifying

each year's expenses from scratch to rein in costs as it works to

mitigate the impact of the turbulent macroeconomic environment.

In developed markets, underlying sales growth was flat compared

with a 2.1% rise a year earlier.

The company saw what it described as "high promotional

intensity" in Europe, hitting its home-care and personal-care

businesses. In the U.S., promotional activity in hair-care hurt

results, said Mr. Pitkethly.

Unilever has made a string of U.S.-focused acquisitions in

recent months that pit it squarely against rival Procter &

Gamble. Last month it agreed to buy Seventh Generation Inc., a

maker of plant-based detergents and household cleaners, and in July

it said it was buying Dollar Shave Club, an e-commerce business

that sells disposable razors and other grooming products.

Unilever has also been pushing deeper into personal-care

products such as shampoos and deodorants that appeal globally, and

away from slower-growing food brands.

But on Thursday the company said "intense competition" in many

of its markets had squeezed growth in its personal care arm.

Revenue climbed 3.1% on an underlying basis, which is half the

growth level in reported a year earlier.

The home-care and refreshments divisions performed better,

logging underlying sales growth of 3.9% and 4.5% respectively.

The food arm reported 1.7% growth, helped by cooking products in

emerging markets and organic dressings. But Unilever's spreads

business--which mainly consists of margarine--continued to decline

in both North America and Europe. The company has faced pressure

from analysts and investors to sell the declining business but has

so far refused, saying it hasn't received an acceptable offer.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 13, 2016 03:50 ET (07:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

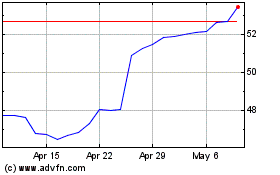

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

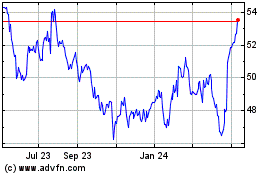

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024