Unilever Profit Up 2% in First Half of Year --2nd Update

July 21 2016 - 3:40AM

Dow Jones News

By Saabira Chaudhuri

LONDON-- Unilever PLC Thursday said its profit rose 2% for the

first half of the year, even as revenue slipped on currency

volatility, as the consumer goods giant's focus on controlling

costs paid off.

The maker of Magnum ice cream, Dove soap and Axe deodorant

posted a first-half net profit of EUR2.51 billion ($2.77 billion),

up from the EUR2.49 billion in the corresponding period a year

earlier, while revenue fell 2.6% to EUR26.3 billion as a result of

unfavorable currency movements.

The Anglo-Dutch consumer goods company has been working to

mitigate the impact of a turbulent macroeconomic environment by

raising prices and releasing premium versions of its products. The

company has also adopted so-called "zero-base budgeting" or

justifying each year's expenses from scratch to rein in costs.

Underlying sales--which strip out the impact of acquisitions,

disposals and currency movements--grew 4.7%, which was better than

the 2.9% that Unilever logged for the same period last year.

RBC analyst James Edwardes Jones described the results as

"solid," while Exane BNP Paribas analysts said it was "a good

quarter."

Chief Executive Paul Polman said he sees no sign of improvement

in the global economy, but underscored that Unilever's long-term

focus had helped it withstand a period of "high volatility and

accelerating change."

The results show that Unilever continues to struggle with a soft

environment in both North America and Europe, as well as in its

spreads business, although the company is benefiting from its slant

toward emerging markets.

Sales in emerging markets, where Unilever does the majority of

its business, grew 8% on an underlying basis, up from the 6% growth

the company reported last year.

In North America, Unilever's sales edged up 0.7% on an

underlying basis, while in Europe sales climbed just 0.1%.

The personal care arm--Unilever's largest--saw sales growth of

5.7% on an underlying basis, amid increases in both volume and

price. Volumes in the food business declined but Unilever offset

those by raising prices, translating into underlying sales growth

of 2.3%. Home-care and refreshment--which includes tea and ice

cream--reported underlying sales growth of 6.5% and 4.1%,

respectively.

Unilever's spreads division--which the company houses as a

separate unit with its own budget and management--continued to

struggle, posting a mid-single digit percentage decline in the

first half. Analysts have repeatedly called on Unilever to sell its

spreads business, which despite being highly cash-generative is a

drag on overall sales. "There's no real change in the trajectory,"

said Chief Financial Officer Graeme Pitkethly in a Thursday

interview, commenting on spreads.

Home-care and refreshment--which includes tea and ice

cream--reported underlying sales growth of 6.5% and 4.1%,

respectively. Unilever's tea business has been hit by declines in

oil-price sensitive areas like the Gulf states and Russia, from

which it has historically received much of its revenue. Thursday,

Mr. Pitkethly said the tea business logged low-to-mid-single digit

growth in the first half of the year.

Overall, Unilever has been taking incremental steps to shift its

product portfolio away from slower-growing food sales and toward

higher-margin personal care products and last year reclassified on

the S&P and MSCI indexes from packaged food to personal

products.

On Wednesday, the company said it had agreed to buy subscription

razor company Dollar Shave Club, giving it a foothold in the U.S.

market for razors as well as access to more customer data. That

deal, for a reported $1 billion, is expected to close in the third

quarter.

Mr. Pithkethly said Unilever plans to learn from Dollar Shave

Club's subscription model--through which it sends disposable razors

and other grooming products to its 3.2 million members for a flat

monthly fee--and eventually will use this for other products like

laundry and household care, bespoke prestige products and heavy

items.

"We think this gives us a real step change to build that

capability," he said of the acquisition. "There's a move from big

box to little box that goes through your letter box."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 21, 2016 03:25 ET (07:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

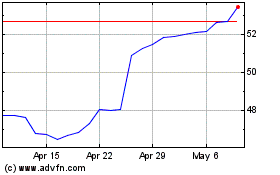

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

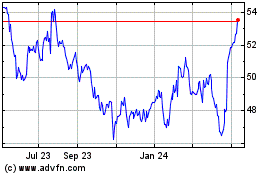

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024