Dollar Shave Club's $1 Billion Deal: A Victory for Simplicity Over Technology

July 20 2016 - 4:28PM

Dow Jones News

By Sharon Terlep

Unilever PLC's decision to pay $1 billion for the

trendy-but-unprofitable Dollar Shave Club Inc. is evidence that

simple, low-price razors have upended a global business long-built

on adding blades and raising prices.

"To say we didn't come out of the gate with a bull's-eye on

Gillette would be disingenuous," Michael Dubin, the 37-year-old

founder and chief executive of Dollar Shave Club, said in a recent

interview.

Dollar Shave Club, which has 190 employees, doesn't make any of

the products it sells. Unlike market leader Gillette, owned by

Procter & Gamble Co., which has 110,000 employees and uses 18

factories around the globe for its grooming products, the Venice,

Calif., startup shook up the razor market with a direct-to-consumer

model. It signs up customers with clever online marketing and low

prices, and relies on third parties to manufacture its

products.

"We can't help but wonder if this is a bold statement that

technology and product quality has reached a level where it is

doesn't matter as much as channel and business model," Barclay's

analyst Lauren Lieberman wrote in a note.

Now, the upstart will be backed by the deep pockets and vast

scale of Unilever, a European consumer-products giant with annual

sales of nearly $59 billion. The deal also gives Unilever, whose

brands include Dove soaps, Ben & Jerry's ice cream and Lipton

tea, entry to the razor business, adding a formidable rival for

Gillette and Schick, owned by Edgewell Personal Care Co.

P&G fought back with its own Gillette Shave Club, which it

unveiled in 2014, but has failed to stem a lengthy market-share

decline that accelerated when Dollar Shave Club and other online

razor services like Harry's Inc. came on the scene. Gillette

commanded about 59% of the U.S. men's razor and blades business

last year, down from 71% in 2010, according to Euromonitor. P&G

had no immediate comment.

Sales for P&G's grooming division, which includes razors and

blades, fell 10% to $1.6 billion in the most recent quarter despite

price increases, as volume declined by 6%. Sales for Edgewell's

shaving division slumped 5.1% in the first three months of the

year, and profit for the segment tumbled 22%.

P&G has invested heavily over the years in high-tech

offerings with ever-higher prices, such as its five-bladed Fusion

and the FlexBall handle. But greater acceptance of stubble in the

workplace and a shift to online shopping has made those devices a

tougher sell. Dollar Shave Club focused on selling disposable

blades that cost between $1 and $9 a month, and saved shoppers a

trip to the store.

The four-year-old service has been popular -- attracting 3.2

million subscribers -- but has also been unprofitable. Dollar Shave

Club has been losing money as it spends heavily to attract new

customers and market new products, people familiar with the company

said. The company had revenue of $152 million last year and is on

track to exceed $200 million in 2016, according to Unilever.

It is unclear whether Dollar Shave Club would have continued to

thrive on its own. Barclays's Ms. Lieberman estimates Dollar Shave

Club has a dropout rate around 25% and said the company could use

more marketing heft to improve the numbers.

Mr. Dubin said he was talking with Unilever about an investment

before deciding to sell the business. The company was in talks with

potential investors in part because it realized it needed

additional funds to continue its expansion and branch out into

other regions and categories, according to one person familiar with

the matter. Another person familiar with the company said it was on

track to turn a profit in the fourth quarter.

The deal also leaves Edgewell -- which also owns Wet Ones wipes

and Banana Boat sunscreen -- out in the cold. Wall Street viewed

the company, which has also lost share in recent years, as a prime

target for Unilever. It is possible Unilever could still attempt to

acquire Edgewell, which has a market value of about $5 billion,

though analysts said the move now seems less likely.

"This was a smart tactical move by Unilever in that it puts up

barriers to others who might want to acquire [Edgewell] while

leaving it as an option to come back to and build scale," Bernstein

Research analyst Ali Dibadj wrote in a note.

Shares of Edgewell dipped 1.5% Wednesday, while P&G's shares

slipped 0.3%.

In addition to Gillette and Schick, the company faces

competition from Harry's, which has raised more than $375 million

in venture capital and debt financing, in part to purchase and

expand the German-based factory where it makes its razors. A

funding round last summer valued Harry's at $750 million, according

to people familiar with the deal.

Rolfe Winkler and Paul Ziobro contributed to this article.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

July 20, 2016 16:13 ET (20:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

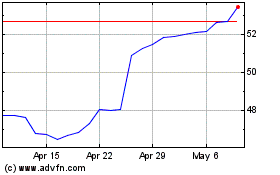

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

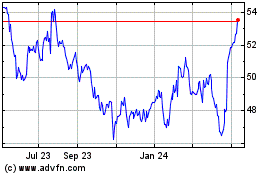

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024