Cokes Widens Diversity Push With Soy-Drinks Deal -- 2nd Update

June 01 2016 - 1:12PM

Dow Jones News

By Mike Esterl in Atlanta and Saabira Chaudhuri in London

Coca-Cola Co. is making its first foray into soy as the soda

giant widens its diversification drive, teaming up with a bottling

partner to acquire Unilever PLC's Latin American soy beverage

business for $575 million.

Atlanta-based Coke and Mexico's Coca-Cola Femsa SAB will each

own 50% of AdeS, Latin America's leading nondairy milk alternative

brand. AdeS, which sells soy milk and soy with fruit drinks, had

$284 million in revenue last year.

Coke is increasingly targeting faster-growing niches after its

soda volumes were flat in the first quarter, reversing five

straight quarters of increases. The maker of Coke, Sprite and Fanta

also is responding to growing efforts by governments around the

globe to tax sugary drinks in a bid to curb obesity and

diabetes.

Unilever has been shedding food brands in recent years and

making acquisitions in the higher-margin, personal-care sector

under Chief Executive Paul Polman, a strategy analysts have said

gives it stronger growth prospects.

The Anglo-Dutch company in 2014 agreed to sell its North

American pasta-sauces business under the Ragú and Bertolli brands

to Japan's Mizkan Group for $2.15 billion. Before that, Unilever

sold its Wish-Bone salad dressing to Pinnacle Foods Inc. for $580

million and Skippy peanut butter to Hormel Foods Corp. for $700

million.

"This sale is a step in reshaping our portfolio in Latin America

to deliver sustainable growth for Unilever and enables us to

sharpen our focus, said Miguel Kozuszok, Unilever's executive vice

president of Latin America.

Unilever's AdeS brand had a 46% share of Latin America's $1.19

billion market for nondairy milk alternatives last year, according

to data service Euromonitor. General Mills Inc.'s Mais Vita brand

was a distant second, with a 3.7% share, followed by Nestlé SA's

Sollys brand, with 2.6%. The category averaged 1.9% annual growth

between 2010 and 2015.

Coke still generates about 70% of its sales from soda, but also

is a leading seller of juice, bottled water and teas. It has struck

a recent string of deals to further branch out after missing growth

targets each of the last three years.

"The acquisition of AdeS marks another milestone for the

Coca-Cola system in providing increased choice of nutritious and

delicious products to our consumers," said Brian Smith, Coke's

Latin America president.

Coke agreed in January to buy a 40% stake in Nigeria's largest

juice maker, TGI Group's Chi Ltd., in a deal that valued the

company at a little less than $1 billion. In March it closed its

earlier-announced acquisition of China Culiangwang Beverages

Holdings Ltd., which specializes in multigrain beverages with

flavors such as red bean, walnuts and oats, paying about $400

million including debt.

Last summer the company paid $2.15 billion for a 16.7% stake in

U.S.-based energy drink maker Monster Beverage Corp. and shelled

out roughly $90 million for a nearly 30% stake in Suja Life LLC,

which makes organic, cold-pressed juices in the U.S.

But many of Coke's acquisitions are taking place overseas. That

is partly because the lion's share of the company's cash is parked

outside the U.S. and it faces a tax bill when repatriating profits.

Coke also has teamed up with bottling and distribution partners in

some of those deals, lowering its cost.

Coke has built up a small dairy business in recent years after

largely avoiding the category. It launched Fairlife,a lactose-free

milk with 50% more protein and 30% fewer calories than regular

milk, in the U.S. in late 2014.

In Latin America, the company teamed up with Coke bottler Arca

Continental SAB in 2014 to acquire the majority of Ecuadorean dairy

company Tonicorp. It partnered with Coca-Cola Femsa in 2012 to take

control of Mexico's Santa Clara, a maker of milk, yogurt and ice

cream.

Coca-Cola Femsa is Coke's largest bottler in Latin America, with

operations in Mexico, Central America and South America. It also

bottles and distributes Coke in the Philippines.

Write to Mike Esterl at mike.esterl@wsj.com and Saabira

Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

June 01, 2016 12:57 ET (16:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

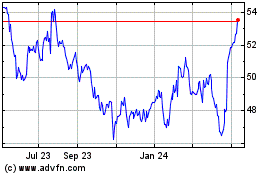

Unilever (NYSE:UL)

Historical Stock Chart

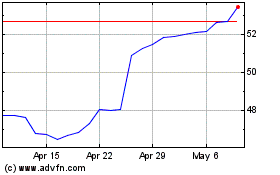

From Mar 2024 to Apr 2024

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024