By Saabira Chaudhuri

LONDON-- Unilever PLC has replaced the head of its flagging

margarine business, raising questions about the unit's future at

the world's No. 2 consumer-goods giant.

Margarine isn't just any business for the Procter & Gamble

Co. rival. Unilever was founded in 1929 through the merger of

British soap maker Lever Brothers and the Netherlands' Margarine

Unie, which began making the plant-derived spread in 1872. Today,

the company is the world's largest margarine maker, churning out

brands like Country Crock, Promise and Imperial.

But a sweeping shift in consumer tastes has hobbled Unilever's

efforts to turn the business around. Meanwhile, Chief Executive

Paul Polman has steered Unilever away from its slower-growing food

offerings and into higher-margin, faster-moving

home-and-personal-care products like mineral-oil-infused

moisturizers and $15 toothpaste.

Just over a year ago, Unilever announced it was hiving off its

U.S. and European margarine business into its own "baking, cooking

and spreads" unit that would allow it to manage its own costs and

make decisions independent of the rest of the company. Mr. Polman

put Sean Gogarty in charge, who had reported directly to him in the

past while marketing household cleaners. Mr. Polman introduced him

to analysts at the time as the company's "best marketer," according

to a person who attended one presentation.

Mr. Polman has likened separating out the margarine business to

putting a sick child in a separate room from siblings, and

showering extra care on them. But disclosing full-year earnings

Tuesday, Unilever said it wasn't "able to stem the sustained market

contraction in developed countries" in the margarine business. The

company has named Nicolas Liabeuf, formerly senior vice president

of marketing operations, to be Mr. Gogarty's replacement.

The Wall Street Journal first reported the management changes

early Tuesday.

A person familiar with Mr. Gogarty's departure said it was

motivated by incompatible views on how the spreads business should

be run. The disagreement came after Unilever's former boss of the

food business, Antoine de Saint-Affrique, left and was replaced by

Amanda Sourry in October. Unilever declined to comment.

On Tuesday, Exane BNP Paribas analyst Jeff Stent said Mr.

Gogarty leaving Unilever added to "inevitably increasing

speculation on an overall exit."

Unilever is working to boost margins for its home-care products,

strengthen its personal-care arm and cut costs across the company,

moves that analysts say reduce its dependence on the margarine

unit, which currently makes up 4% of sales. Margarine remains

highly profitable and has long been a cash cow for Unilever,

despite dragging down its food sales.

A big part of the problem for margarine is the revival of butter

after decades of being held up as the culprit for clogged arteries

and expanding waistlines.

Consumers have come to see it as more wholesome and natural than

margarine. Last year, unit sales of butter and butter blends in the

U.S. climbed 4.2% from a year earlier while sales of margarine

plummeted 8.9%, according to data from Chicago-based research firm

IRI.

In October, McDonald's Corp. said switching to butter from

margarine on its Egg McMuffins in the U.S. pushed sales of the

breakfast sandwich up by a double-digit percentage. "Customers

appreciated the change," McDonald's CEO Stephen Easterbrook said

last fall.

Meanwhile, butter prices in Europe last year fell below those of

margarine for the first time, according to Mr. Polman, after Russia

banned dairy imports from Europe.

In an interview, Unilever Chief Financial Officer Graeme

Pitkethly said the company has been trying to "expand out into

other more on-trend parts of the category beyond simply margarine,"

such as specialist baking brands, cholesterol-lowering margarine,

cooking-oil blends, and blends of vegetable oils and butter. The

moves haven't always paid off, with Unilever forced to backtrack on

its decision to reformulate its Flora brand in the U.K. after a

consumer backlash.

If Unilever were to decide to sell its margarine division--which

Société Générale estimates is worth EUR7 billion ($7.62

billion)--it isn't obvious who would want it.

"The one who buys it, if there was to be one who buys it, would

have the same dynamics to deal with: a declining bread market and

the dynamics with Russia," Mr. Polman said.

One option is for Unilever to strike a joint venture in which it

takes a 49% stake, which would allow it to "share in synergies but

deconsolidate the business, but without abandoning its heritage,"

said Société Générale analyst Warren Ackerman. Unilever's 27% share

of the margarine market makes it six times the size of its closest

rival, Bunge Ltd., so Mr. Ackerman said a joint venture seems

likelier than an outright sale.

Mr. Polman on Tuesday said the ultimate decision on the spreads

business would come down to hard numbers. "Just because it's

declining doesn't mean you just sell it; you only sell it if the

price you can get for it is better than if you keep it," Mr. Polman

said at a meeting with reporters in London. "We're not a charity,

so we need to make these calculations."

Unilever reported otherwise-strong earnings for 2015, with sales

buoyed by currency gains. The company logged robust growth in its

personal-care, home-care and refreshments arms.

The maker of Ben and Jerry's ice cream, Dove soap and Axe

deodorant posted a net profit of EUR4.91 billion, compared with

EUR5.17 billion last year, a period when it was buoyed by gains

from divestitures. Core operating profit, which excludes the impact

of acquisitions, disposals and other one-time items, climbed 12% to

EUR7.9 billion. Revenue of EUR53.3 billion was up 10%, or 3.9% at

constant currencies.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

January 19, 2016 11:00 ET (16:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

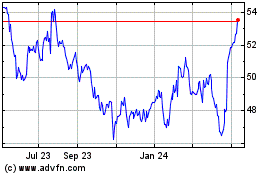

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

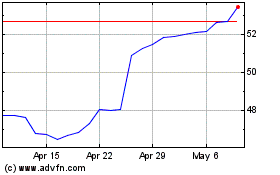

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024