Hospital Shares Slide Following HCA Warning

October 15 2015 - 2:48PM

Dow Jones News

By Anne Steele

Hospital shares fell Thursday after HCA Holdings Inc.'s warning

added to investor concerns about waning benefits from the country's

health-care reform.

Hospitals have benefited in recent years from an increase in the

number of insured patients under the Affordable Care Act. However,

in recent months, investors have grown concerned that the benefits

may be moderating.

HCA on Wednesday bolstered those worries by saying its per-share

earnings for the September quarter would fall 4% below analyst

expectations. The company blamed the shortfall, in part, on a less

favorable payer mix, saying same-facilty uninsured admissions rose

while more profitable managed-care admissions fell.

In addition, the company noted an increase in labor costs, which

it attributed to "less productivity" and a rise in contract

labor.

Because HCA is the largest publicly traded hospital operator its

comments about business trends tend to affect the whole sector.

"When HCA sneezes, the industry gets the flu," Mizuho Securities

USA analyst Sheryl Skolnick said Thursday. "The assumption is that

all of the hospitals will have something wrong with them."

HCA shares, which fell as much as 10% Thursday, recently slid

5.7% to $71.67 in afternoon trading.

Meanwhile, shares of other hospital operators also had bounced

off their lows for the day. Universal Health Services Inc. recently

dropped 1.7%, while stocks of Community Health Systems Inc., Tenet

Healthcare Corp. and LifePoint Health Inc. each fell more than

2.5%. Those stocks were each down more than 7% at one point

Thursday.

Ms. Skolnick said HCA's outlook raised questions about why the

hospital provider--widely regarded for its management--allowed

contract labor and costs to be "so out of whack."

She also questioned why HCA is seeing more uninsured patients,

as the country's health-care reform has been in place for two

years. The analyst doesn't expect to see that trend across the

industry.

Jefferies analyst Brian Tanquilut agreed that HCA's higher

uninsured admissions may be company-specific, and he noted that

overall volume trends were encouraging.

Mr. Tanquilut acknowledged that the upside from the Affordable

Care Act will likely be modest for hospitals over the next 12

months, but he noted that the stocks are now trading below

historical valuations.

Ms. Skolnick also said the selloff Thursday was an overreaction

but doesn't see investor opinions changing in the near term.

"Even when we get clarity with earnings reports it won't matter

because the sentiment with the group is so negative right now," she

said.

Write to Anne Steele at anne.steele@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 15, 2015 14:33 ET (18:33 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

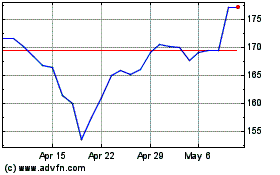

Universal Health Services (NYSE:UHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Universal Health Services (NYSE:UHS)

Historical Stock Chart

From Apr 2023 to Apr 2024