Report of Foreign Issuer (6-k)

January 27 2017 - 7:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: January 27, 2017

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants' Names)

Bahnhofstrasse 45, Zurich, Switzerland, and

Aeschenvorstadt 1, Basel, Switzerland

(Address of

principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20‑F or Form 40-F.

This Form 6-K consists of the 4Q16 UBS

Group AG (consolidated) capital instruments and TLAC-eligible senior unsecured

debt information, published today by the registrants, which appears immediately

following this page.

UBS Group AG (consolidated) capital instruments and TLAC-eligible

senior unsecured debt

Fourth quarter 2016

This document provides information

about the treatment of capital instruments and other instruments contributing

to the total loss-absorbing capacity (TLAC) of UBS Group AG (consolidated)

under the Swiss SRB framework as of 31 December 2016. Information on our Swiss

SRB going and gone concern requirements that are being phased in between 2016

and 2019 is available in our second quarter 2016 report. Details on our Swiss

SRB going and gone concern requirements and additional information as of 31

December 2016 will be disclosed in our Annual Report 2016, which will be

published on 10 March 2017.

Eligible capital and instruments contributing to our

loss-absorbing capacity

In addition to CET1 capital, our

capital instruments and instruments contributing to our loss-absorbing capacity

include:

–

Loss-absorbing additional tier 1 (AT1) capital

(high- and low-trigger)

–

Loss-absorbing tier 2 capital (high- and

low-trigger)

–

Non-Basel III-compliant tier 1 and tier 2

capital

–

TLAC-eligible senior unsecured debt

Under the Swiss SRB rules, going concern

capital includes CET1 and high-trigger AT1 capital.

Under the transitional rules for the Swiss

SRB framework, outstanding low-trigger AT1 capital instruments will remain

available to meet the going concern capital requirements until their first call

date, even if the first call date is after 31 December 2019. From their first

call date, existing low-trigger AT1 capital instruments may be used to meet the

gone concern requirements.

Outstanding low- and high-trigger tier 2

instruments will also remain available to meet the going concern capital

requirements until the earlier of (i) their maturity or first call date or (ii)

31 December 2019. From 1 January 2020, these instruments may be used to meet

the gone concern requirements until one year before maturity, with a haircut of

50% applied in the last year of eligibility.

Non-Basel III-compliant tier 1 and tier 2

capital are no longer subject to phase-out under the Swiss SRB framework

applicable as of 1 July 2016. They are eligible to meet the gone concern

requirements until one year prior to maturity, with a haircut of 50% applied in

the last year of eligibility.

TLAC-eligible senior unsecured debt is

eligible to meet the gone concern requirements.

|

Capital instruments and

TLAC-eligible senior unsecured debt¹

|

|

CHF million, except where

indicated

|

|

|

|

|

|

|

|

|

|

|

No.

|

Issuer

|

ISIN

|

Issue date

|

Outstanding amount as of 31.12.16

|

|

Additional tier 1 capital

|

|

|

|

|

1

|

UBS Group AG, Switzerland, or employing subsidiaries²

|

|

31.12.14

|

CHF 463

|

|

2

|

UBS Group AG, Switzerland

|

CH0271428317

|

19.02.15

|

USD 1,250

|

|

3

|

UBS Group AG, Switzerland

|

CH0286864027

|

07.08.15

|

USD 1,575

|

|

4

|

UBS Group AG, Switzerland, or employing subsidiaries²

|

|

31.12.15

|

CHF 517

|

|

5

|

UBS Group AG, Switzerland

|

CH0317921697

|

21.03.16

|

USD 1,500

|

|

6

|

UBS Group AG, Switzerland

|

CH0331455318

|

10.08.16

|

USD 1,100

|

|

7

|

UBS Group AG, Switzerland, or employing subsidiaries²

|

|

31.12.16

|

CHF 399

|

|

Total high-trigger

loss-absorbing additional tier 1 capital

|

|

|

|

|

1

|

UBS Group AG, Switzerland

|

CH0271428309

|

19.02.15

|

EUR 1,000

|

|

2

|

UBS Group AG, Switzerland

|

CH0271428333

|

19.02.15

|

USD 1,250

|

|

Total low-trigger

loss-absorbing additional tier 1 capital³

|

|

|

|

|

Total additional tier 1

capital

|

|

|

|

|

|

|

|

|

|

|

Non-Basel III-compliant tier

1 capital⁴

|

|

|

|

|

1

|

UBS Capital Securities (Jersey) Ltd

|

XS0336744650

|

21.12.07

|

EUR 600

|

|

Total non-Basel

III-compliant tier 1 capital

|

|

|

|

|

|

|

|

|

|

|

Tier 2 capital

|

|

|

|

|

1

|

UBS Group AG, Switzerland, or employing subsidiaries²

|

|

31.12.12

|

CHF 424

|

|

2

|

UBS Group AG, Switzerland, or employing subsidiaries²

|

|

31.12.13

|

CHF 467

|

|

Total high-trigger

loss-absorbing tier 2 capital⁵

|

|

|

|

|

1

|

UBS AG, Switzerland, Jersey branch

|

XS0747231362

|

22.02.12

|

USD 2,000

|

|

2

|

UBS AG, Switzerland, Stamford branch

|

US90261AAB89

|

17.08.12

|

USD 2,000

|

|

3

|

UBS AG, Switzerland

|

CH0214139930

|

22.05.13

|

USD 1,500

|

|

4

|

UBS AG, Switzerland

|

CH0236733827

|

13.02.14

|

EUR 2,000

|

|

5

|

UBS AG, Switzerland

|

CH0244100266

|

15.05.14

|

USD 2,500

|

|

Total low-trigger

loss-absorbing tier 2 capital⁵

|

|

|

|

|

1

|

UBS AG, Switzerland, New York branch

|

US870836AC77

|

21.07.95

|

USD 251

|

|

2

|

UBS AG, Switzerland, Jersey branch

|

XS0062270581

|

18.12.95

|

GBP 61

|

|

3

|

UBS AG, Switzerland, New York branch

|

US870845AC84

|

03.09.96

|

USD 218

|

|

4

|

UBS AG, Switzerland, New York branch

|

US87083KAM45

|

20.06.97

|

USD 220

|

|

5

|

UBS AG, Switzerland, Jersey branch

|

XS0331313055

|

19.11.07

|

GBP 130

|

|

6

|

UBS AG, Switzerland

|

CH0035789210

|

27.12.07

|

CHF 192

|

|

Total non-Basel

III-compliant tier 2 capital⁴

|

|

|

|

|

Total tier 2 capital

|

|

|

|

|

|

|

|

|

|

|

TLAC-eligible senior

unsecured debt

|

|

|

|

|

1

|

UBS Group Funding (Jersey) Limited - Jersey

|

US90351DAA54

|

24.09.15

|

USD 1,500

|

|

2

|

UBS Group Funding (Jersey) Limited - Jersey

|

US90351DAB38

|

24.09.15

|

USD 2,500

|

|

3

|

UBS Group Funding (Jersey) Limited - Jersey

|

US90351DAC11

|

24.09.15

|

USD 300

|

|

4

|

UBS Group Funding (Jersey) Limited - Jersey

|

CH0302790123

|

16.11.15

|

EUR 1,250

|

|

5

|

UBS Group Funding (Jersey) Limited - Jersey

|

CH0310451841

|

22.02.16

|

CHF 300

|

|

6

|

UBS Group Funding (Jersey) Limited - Jersey

|

CH0310451858

|

22.02.16

|

CHF 150

|

|

7

|

UBS Group Funding (Jersey) Limited - Jersey

|

CH0314209351

|

04.03.16

|

EUR 750

|

|

8

|

UBS Group Funding (Jersey) Limited - Jersey

|

US90351DAD93

|

05.04.16

|

USD 2,000

|

|

9

|

UBS Group Funding (Jersey) Limited - Jersey

|

US90351DAE76

|

05.04.16

|

USD 1,000

|

|

10

|

UBS Group Funding (Jersey) Limited - Jersey

|

US90351DAF42

|

05.04.16

|

USD 2,000

|

|

11

|

UBS Group Funding (Jersey) Limited - Jersey

|

US90351DAG25

|

10.08.16

|

USD 500

|

|

12

|

UBS Group Funding (Jersey) Limited - Jersey

|

US90351DAH08

|

10.08.16

|

USD 2,000

|

|

13

|

UBS Group Funding (Jersey) Limited - Jersey

|

CH0336602930

|

01.09.16

|

EUR 1,250

|

|

14

|

UBS Group Funding (Jersey) Limited - Jersey

|

CH0341440334

|

30.11.16

|

EUR 1,250

|

|

Total TLAC-eligible senior

unsecured debt

|

|

|

|

|

1 Refer to "Capital instruments" under

"Bondholder information" at www.ubs.com/investors for more

information on the key features and the terms and conditions of the capital

instruments included in the above table as of 31 December 2016. 2 Relates

to deferred contingent capital plan (DCCP) awards. 3 Outstanding low-trigger

loss-absorbing additional tier 1 capital instruments will remain available to

meet the going concern requirements under the transitional rules of the Swiss

SRB framework until their first call date, even if the first call date is

after 31 December 2019. From their first call date, they may be used to meet

the gone concern requirements. 4 Non-Basel III-compliant tier 1 and tier 2

capital instruments qualify as gone concern instruments. Under the Swiss SRB

rules, these instruments are no longer subject to phase-out. Instruments with

a maturity date are eligible to meet the gone concern requirements until one

year prior to maturity, with a haircut of 50% applied in the last year of

eligibility. 5 Outstanding high- and low-trigger loss-absorbing tier 2

capital instruments will remain available to meet the going concern

requirements under the transitional rules of the Swiss SRB framework until

the earlier of (i) their maturity or first call date or (ii) 31 December

2019. From 1 January 2020, these instruments may be used to meet the gone

concern requirements until one year before maturity, with a haircut of 50%

applied in the last year of eligibility.

|

|

Swiss SRB incl. transitional arrangements (phase-in)

|

Swiss SRB as of 1.1.20 (fully applied)

|

|

|

|

Going concern

|

Gone concern

|

Going concern

|

Gone concern

|

|

|

|

Amount recognized

in regulatory capital

as of 31.12.16

|

Amount eligible for

the gone concern requirement

as of 31.12.16

|

Amount recognized

in regulatory capital

as of 31.12.16

|

Amount eligible for

the gone concern requirement

as of 31.12.16

|

Maturity date

|

Optional call date

|

|

|

|

|

|

|

|

|

463

|

|

463

|

|

Perpetual

|

01.03.20

|

|

1,266

|

|

1,266

|

|

Perpetual

|

19.02.20

|

|

1,598

|

|

1,598

|

|

Perpetual

|

07.08.25

|

|

517

|

|

517

|

|

Perpetual

|

01.03.21

|

|

1,489

|

|

1,489

|

|

Perpetual

|

22.03.21

|

|

1,075

|

|

1,075

|

|

Perpetual

|

10.08.21

|

|

399

|

|

399

|

|

Perpetual

|

01.03.22

|

|

6,809

|

|

6,809

|

|

|

|

|

1,087

|

|

1,087

|

|

Perpetual

|

19.02.22

|

|

1,256

|

|

1,256

|

|

Perpetual

|

19.02.25

|

|

2,342

|

|

2,342

|

|

|

|

|

9,151

|

|

9,151

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

642

|

|

642

|

Perpetual

|

21.12.17

|

|

|

642

|

|

642

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

424

|

|

|

212

|

01.03.18

|

|

|

467

|

|

|

467

|

01.03.19

|

|

|

891

|

|

|

679

|

|

|

|

2,034

|

|

|

2,034

|

22.02.22

|

22.02.17

|

|

1,985

|

|

|

1,985

|

17.08.22

|

|

|

1,515

|

|

|

1,515

|

22.05.23

|

22.05.18

|

|

2,254

|

|

|

2,254

|

12.02.26

|

12.02.21

|

|

2,614

|

|

|

2,614

|

15.05.24

|

|

|

10,402

|

|

|

10,402

|

|

|

|

|

255

|

|

255

|

15.07.25

|

|

|

|

76

|

|

76

|

18.12.25

|

|

|

|

204

|

|

204

|

01.09.26

|

|

|

|

0

|

|

0

|

15.06.17

|

|

|

|

163

|

|

163

|

19.11.24

|

19.11.19

|

|

|

0

|

|

0

|

27.12.17

|

|

|

|

698

|

|

698

|

|

|

|

11,293

|

698

|

|

11,779

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,503

|

|

1,503

|

24.09.20

|

|

|

|

2,524

|

|

2,524

|

24.09.25

|

|

|

|

304

|

|

304

|

24.09.20

|

|

|

|

1,357

|

|

1,357

|

16.11.22

|

|

|

|

299

|

|

299

|

22.02.22

|

|

|

|

148

|

|

148

|

23.02.26

|

|

|

|

799

|

|

799

|

04.03.24

|

|

|

|

1,955

|

|

1,955

|

15.04.21

|

|

|

|

1,008

|

|

1,008

|

14.04.21

|

|

|

|

1,930

|

|

1,930

|

15.04.26

|

|

|

|

508

|

|

508

|

01.02.22

|

|

|

|

1,941

|

|

1,941

|

01.02.22

|

|

|

|

1,285

|

|

1,285

|

01.09.26

|

01.06.26

|

|

|

1,327

|

|

1,327

|

30.11.24

|

30.11.23

|

|

|

16,890

|

|

16,890

|

|

|

|

|

|

|

|

|

|

Notice to investors |

This document

and the information contained herein are provided solely for information

purposes, and are not to be construed as solicitation of an offer to buy or

sell any securities or other financial instruments in Switzerland, the United

States or any other jurisdiction. No investment decision relating to securities

of or relating to UBS Group AG, UBS AG or their affiliates should be made on

the basis of this document. Refer to UBS’s fourth quarter 2016 report and its

Annual Report 2015 for additional information. These reports are available at

www.ubs.com/investors.

Rounding |

Numbers presented

throughout this document may not add up precisely to the totals provided in the

tables and text. Percentages, percent changes and absolute variances are calculated

on the basis of rounded figures displayed in the tables and text and may not

precisely reflect the percentages, percent changes and absolute variances that

would be derived based on figures that are not rounded.

Tables |

Within tables, blank fields

generally indicate that the field is not applicable or not meaningful, or that

information is not available as of the relevant date or for the relevant

period. Zero values generally indicate that the respective figure is zero on an

actual or rounded basis. Percentage changes are presented as a mathematical

calculation of the change between periods.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized.

UBS Group AG

By:

_/s/ David Kelly_____________

Name: David Kelly

Title: Managing Director

By:

_/s/ Sarah M. Starkweather

_____

Name: Sarah M. Starkweather

Title: Executive Director

UBS AG

By:

_/s/ David Kelly_____________

Name: David Kelly

Title: Managing Director

By:

_/s/ Sarah M. Starkweather ____

Name: Sarah M. Starkweather

Title: Executive Director

Date: January 27, 2017

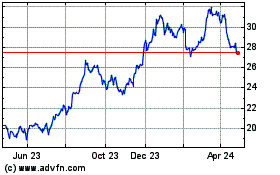

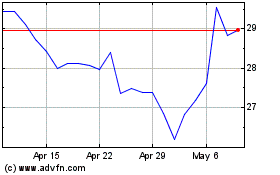

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024