CVC Offers $1.1 Billion to Buy Out Nirvana Asia

July 08 2016 - 9:50AM

Dow Jones News

HONG KONG—Private-equity firm CVC Capital Partners said Friday

that it offered $1.1 billion to buy out Nirvana Asia Ltd., Asia's

largest funeral-services provider by revenue.

CVC said in a statement on Friday that it would pay HK$3.00 a

share to take private Hong Kong-listed Nirvana—the same price per

share that the company initially listed at in December 2014. The

offer represents a more than 22% premium to where its shares last

exchanged hands.

Trading in Nirvana was suspended last week, pending information

regarding a takeover or merger, after its shares rose suddenly.

Nirvana said Friday in a separate statement to the Hong Kong

stock exchange that its shares rose by more than 3% every day

between June 27 and June 29 despite the broader Hang Seng Index

staying mostly flat. The stock's average daily trading volume was

more than 3 million shares, up from an average of 1.3 million in

the previous 30 trading days, it added. Nirvana said it was "not

aware of any reason" for the irregular trading.

CVC said Friday that Nirvana founder Tan Sri Kong would remain

as chief executive of the company.

London-headquartered CVC is a top global private-equity firm. It

owns a stake in motor-racing franchise Formula One Group and has

had a longstanding presence across Asia.

Nirvana, based in Kuala Lumpur, was the first funeral-services

company in Asia to offer packages to consumers while they are still

alive. Almost three-quarters of its revenue still comes from

Malaysia.

Since its listing in Hong Kong, however, Nirvana's shares have

sunk as the company struggled to expand in China, which has a

rapidly aging population but tight restrictions on the ownership of

burial plots.

UBS advised Nirvana, while J.P. Morgan Chase & Co. advised

CVC.

Write to Wayne Ma at wayne.ma@wsj.com

(END) Dow Jones Newswires

July 08, 2016 09:35 ET (13:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

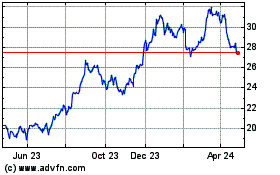

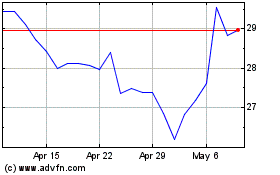

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024