Report of Foreign Issuer (6-k)

May 03 2016 - 6:49AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: May 3, 2016

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants' Names)

Bahnhofstrasse 45, Zurich, Switzerland, and

Aeschenvorstadt 1, Basel, Switzerland

(Address of

principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20‑F or Form 40-F.

This Form 6-K consists of the UBS Group AG

(consolidated) regulatory information as of 31 March 2016, published today by

the registrants, which appears immediately following this page.

UBS Group AG (consolidated) regulatory information

First quarter 2016

This document includes

the following disclosures in accordance with Pillar 3 requirements: (i) BIS

Basel III leverage ratio information, (ii) reconciliation

of the IFRS balance sheet to the balance sheet according to the regulatory

scope of consolidation and (iii) information about the composition of our

capital.

®

Refer to our first quarter 2016 report for information on our Swiss

SRB leverage ratio as of 31 March 2016

®

Refer to “UBS Group AG consolidated supplemental disclosures

required under Basel III Pillar 3 regulations” in the “Additional regulatory

information” section of our Annual Report 2015 for more information

BIS Basel III leverage ratio disclosure requirements

The tables

in the following section provide BIS leverage ratio information according to

the current disclosure requirements.

The BIS leverage ratio is calculated by

dividing the period-end tier 1 capital by the period-end leverage ratio

denominator (LRD). The LRD consists of IFRS on-balance sheet assets and

off-balance sheet items. Derivative exposures are adjusted for a number of

items, including replacement value and eligible cash variation margin netting,

the current exposure method add-on and net notional amounts for written credit

derivatives. Moreover, the LRD includes an additional charge for counterparty

credit risk related to securities financing transactions.

The table “Reconciliation of IFRS total

assets to BIS Basel III total on-balance sheet exposures excluding derivatives

and securities financing transactions” below shows the difference between total

IFRS assets per IFRS consolidation scope and the BIS total on-balance sheet

exposures, which are the starting point for calculating the BIS LRD as shown

in the “BIS Basel III leverage ratio common disclosure” table on the next page.

The difference is due to the application of the regulatory scope of

consolidation for the purpose of the BIS calculation. In addition, carrying

values for derivative financial instruments and securities financing

transactions are deducted from IFRS total assets. They are measured differently

under BIS leverage ratio rules and are therefore added back in separate

exposure line items in the “BIS Basel III leverage ratio common disclosure”

table on the next page.

®

Refer to our first quarter 2016 report for

information on our Swiss SRB leverage ratio as of 31 March 2016

®

Refer to the “UBS Group AG consolidated

supplemental disclosures required under Basel III Pillar 3 regulations” section

of our Annual Report 2015 for more information on the regulatory scope of

consolidation

BIS Basel III leverage ratio

As of 31

March 2016, our BIS Basel III leverage ratio was 4.1% on a fully applied basis

and 4.8% on a phase-in basis. The BIS Basel III LRD was CHF 906 billion on a

fully applied basis and CHF 910 billion on a phase-in basis.

®

Refer to our first quarter 2016 report for

information on our BIS Basel III leverage ratio movements

|

Reconciliation of IFRS total

assets to BIS Basel III total on-balance sheet exposures excluding

derivatives and securities financing transactions

|

|

CHF million

|

31.3.16

|

|

On-balance sheet exposures

|

|

|

IFRS total assets

|

966,873

|

|

Adjustment for investments in banking, financial, insurance or

commercial entities that are consolidated for accounting purposes but outside

the scope of regulatory consolidation

|

(16,174)

|

|

Adjustment for investments in banking, financial, insurance or

commercial entities that are outside the scope of consolidation for

accounting purposes but consolidated for regulatory purposes

|

1

|

|

Adjustment for fiduciary assets recognized on the balance sheet

pursuant to the operative accounting framework but excluded from the leverage

ratio exposure measure

|

0

|

|

Less carrying value of derivative financial instruments in IFRS

total assets¹

|

(205,998)

|

|

Less carrying value of securities financing transactions in IFRS

total assets²

|

(122,633)

|

|

Adjustments to accounting values

|

0

|

|

On-balance sheet items

excluding derivatives and securities financing transactions, but including

collateral

|

622,069

|

|

Asset amounts deducted in determining BIS Basel III tier 1

capital

|

(12,822)

|

|

Total on-balance sheet

exposures (excluding derivatives and securities financing transactions)

|

609,247

|

|

1 Consists of positive replacement values and cash collateral

receivables on derivative instruments in accordance with the regulatory scope

of consolidation. 2 Consists of cash collateral on securities borrowed,

reverse repurchase agreements, margin loans and prime brokerage receivables

related to securities financing transactions in accordance with the

regulatory scope of consolidation.

|

BIS Basel III

leverage ratio common disclosure

The naming

convention in the following table is based on BIS guidance and does not reflect

the UBS naming convention.

|

BIS Basel III leverage ratio

common disclosure

|

|

|

|

|

|

CHF million, except where

indicated

|

31.3.16

|

|

|

|

|

|

|

On-balance sheet exposures

|

|

|

1

|

On-balance sheet items excluding derivatives and SFTs¹, but

including collateral

|

622,069

|

|

2

|

(Asset amounts deducted in determining Basel III tier 1 capital)

|

(12,822)

|

|

3

|

Total on-balance sheet

exposures (excluding derivatives and SFTs¹)

|

609,247

|

|

|

|

|

|

|

Derivative exposures

|

|

|

4

|

Replacement cost associated with all derivatives transactions

(i.e., net of eligible cash variation margin)

|

53,050

|

|

5

|

Add-on amounts for PFE² associated with all derivatives

transactions

|

93,944

|

|

6

|

Gross-up for derivatives collateral provided where deducted from

the balance sheet assets pursuant to the operative accounting framework

|

41

|

|

7

|

(Deductions of receivables assets for cash variation margin

provided in derivatives transactions)

|

(12,965)

|

|

8

|

(Exempted CCP³ leg of client-cleared trade exposures)

|

(16,628)

|

|

9

|

Adjusted effective notional amount of all written credit

derivatives⁴

|

182,772

|

|

10

|

(Adjusted effective notional offsets and add-on deductions for

written credit derivatives)⁵

|

(174,233)

|

|

11

|

Total derivative exposures

|

125,980

|

|

|

|

|

|

|

Securities financing

transaction exposures

|

|

|

12

|

Gross SFT¹ assets (with no recognition of netting), after

adjusting for sale accounting transactions

|

177,233

|

|

13

|

(Netted amounts of cash payables and cash receivables of gross

SFT¹ assets)

|

(54,600)

|

|

14

|

CCR⁶ exposure for SFT¹ assets

|

11,196

|

|

15

|

Agent transaction exposures

|

0

|

|

16

|

Total securities financing

transaction exposures

|

133,829

|

|

|

|

|

|

|

Other off-balance sheet

exposures

|

|

|

17

|

Off-balance sheet exposure at gross notional amount

|

112,102

|

|

18

|

(Adjustments for conversion to credit equivalent amounts)

|

(71,159)

|

|

19

|

Total off-balance sheet

items

|

40,943

|

|

|

Total exposures (leverage

ratio denominator), phase-in

|

910,000

|

|

|

(Additional asset amounts deducted in determining Basel III tier

1 capital fully applied)

|

(4,199)

|

|

|

Total exposures (leverage

ratio denominator), fully applied

|

905,801

|

|

|

|

|

|

|

Capital and total exposures

(leverage ratio denominator), phase-in

|

|

|

20

|

Tier 1 capital

|

43,541

|

|

21

|

Total exposures (leverage ratio denominator)

|

910,000

|

|

|

Leverage ratio

|

|

|

22

|

Basel III leverage ratio

phase-in (%)

|

4.8

|

|

|

|

|

|

|

Capital and total exposures

(leverage ratio denominator), fully applied

|

|

|

20

|

Tier 1 capital

|

37,438

|

|

21

|

Total exposures (leverage ratio denominator)

|

905,801

|

|

|

Leverage ratio

|

|

|

22

|

Basel III leverage ratio

fully applied (%)

|

4.1

|

|

1 Securities financing transactions. 2 Potential future

exposure – Current exposure method (CEM add-on) based on notional amounts.

3 Central cleared counterparties. 4 Includes protection sold including

agency transactions. 5 Protection sold can be offset with protection

bought on the same underlying reference entity provided the conditions according

to the Basel III leverage ratio framework and disclosure requirements are

met. 6 Counterparty credit risk.

|

BIS Basel III

leverage ratio summary comparison

The naming convention in the following table is based on BIS

guidance and does not reflect the UBS naming convention.

|

BIS Basel III leverage ratio

summary comparison

|

|

CHF million

|

31.3.16

|

|

1

|

Total consolidated assets as per published financial statements

|

966,873

|

|

2

|

Adjustment for investments in banking, financial, insurance or

commercial entities that are consolidated for accounting purposes but outside

the scope of regulatory consolidation¹

|

(28,995)

|

|

3

|

Adjustment for fiduciary assets recognised on the balance sheet

pursuant to the operative accounting framework but excluded from the leverage

ratio exposure measure

|

0

|

|

4

|

Adjustments for derivative financial instruments

|

(80,018)

|

|

5

|

Adjustment for securities financing transactions (i.e., repos

and similar secured lending)

|

11,196

|

|

6

|

Adjustment for off-balance sheet items (i.e., conversion to

credit equivalent amounts of off-balance sheet exposures)

|

40,943

|

|

7

|

Other adjustments

|

1

|

|

8

|

Leverage ratio exposure

(leverage ratio denominator), phase-in

|

910,000

|

|

1 This item includes assets that are deducted from tier 1

capital.

|

|

BIS Basel III leverage ratio

|

|

|

|

|

|

CHF million, except where

indicated

|

|

Phase-in

|

31.3.16

|

31.12.15

|

30.9.15

|

30.6.15

|

|

Total tier 1 capital

|

43,541

|

44,559

|

44,125

|

40,593

|

|

BIS total exposures (leverage ratio denominator)

|

910,000

|

904,014

|

941,216

|

954,043

|

|

BIS Basel III leverage ratio (%)

|

4.8

|

4.9

|

4.7

|

4.3

|

|

|

|

|

|

|

|

Fully applied

|

31.3.16

|

31.12.15

|

30.9.15

|

30.6.15

|

|

Total tier 1 capital

|

37,438

|

36,198

|

36,526

|

34,042

|

|

BIS total exposures (leverage ratio denominator)

|

905,801

|

897,607

|

935,536

|

949,331

|

|

BIS Basel III leverage ratio (%)

|

4.1

|

4.0

|

3.9

|

3.6

|

Balance sheet

reconciliation and composition of capital

Table 29:

Reconciliation of

accounting balance sheet to balance sheet under the regulatory scope of

consolidation

The table below provides a

reconciliation of the IFRS balance sheet to the balance sheet according to the

regulatory scope of consolidation as defined by BIS and FINMA. Lines in the

balance sheet under the regulatory scope of consolidation are expanded and

referenced where relevant to display all components that are used in “Table 30:

Composition of capital.”

|

|

Balance sheet in accordance with IFRS scope of consolidation

|

Effect of deconsolidated entities for regulatory consolidation

|

Effect of additional consolidated entities for regulatory

consolidation

|

Balance sheet in accordance with regulatory scope of

consolidation

|

References¹

|

|

CHF million

|

31.3.16

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

Cash and balances with central banks

|

105,710

|

|

|

105,710

|

|

|

Due from banks

|

13,551

|

(291)

|

|

13,261

|

|

|

Cash collateral on securities borrowed

|

32,432

|

|

|

32,432

|

|

|

Reverse repurchase agreements

|

73,562

|

|

|

73,562

|

|

|

Trading portfolio assets

|

105,276

|

(15,706)

|

|

89,570

|

|

|

Positive replacement values

|

180,518

|

20

|

|

180,538

|

|

|

Cash collateral receivables on derivative instruments

|

25,460

|

|

|

25,460

|

|

|

Financial assets designated at fair value

|

40,976

|

|

|

40,976

|

|

|

Loans

|

304,873

|

37

|

|

304,910

|

|

|

Financial assets available for sale

|

31,266

|

(78)

|

|

31,189

|

|

|

Financial assets held to maturity

|

2,889

|

|

|

2,889

|

|

|

Consolidated participations

|

0

|

166

|

|

166

|

|

|

Investments in associates

|

953

|

|

|

953

|

|

|

of which: goodwill

|

347

|

|

|

347

|

4

|

|

Property, equipment and software

|

7,763

|

(76)

|

|

7,687

|

|

|

Goodwill and intangible assets

|

6,326

|

|

|

6,326

|

|

|

of which: goodwill

|

6,030

|

|

1

|

6,031

|

4

|

|

of which: intangible assets

|

295

|

|

|

295

|

5

|

|

Deferred tax assets

|

12,192

|

(1)

|

|

12,191

|

|

|

of which: deferred tax

assets recognized for tax loss carry-forwards

|

7,099

|

(1)

|

|

7,098

|

9

|

|

of which: deferred tax

assets on temporary differences

|

5,093

|

|

|

5,093

|

12

|

|

Other assets

|

23,123

|

(245)

|

|

22,878

|

|

|

of which: net defined

benefit pension and other post-employment assets

|

0

|

|

|

0

|

10

|

|

Total assets

|

966,873

|

(16,174)

|

1

|

950,700

|

|

Table 29:

Reconciliation of accounting balance sheet to balance sheet under the

regulatory scope of consolidation

(

continued)

|

|

Balance sheet in accordance with IFRS scope of consolidation

|

Effect of deconsolidated entities for regulatory consolidation

|

Effect of additional consolidated entities for regulatory

consolidation

|

Balance sheet in accordance with regulatory scope of

consolidation

|

References¹

|

|

CHF million

|

31.3.16

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

Due to banks

|

11,350

|

(52)

|

|

11,298

|

|

|

Cash collateral on securities lent

|

6,353

|

|

|

6,353

|

|

|

Repurchase agreements

|

6,516

|

|

|

6,516

|

|

|

Trading portfolio liabilities

|

33,157

|

|

|

33,157

|

|

|

Negative replacement values

|

179,018

|

(1)

|

|

179,018

|

|

|

Cash collateral payables on derivative instruments

|

36,690

|

|

|

36,690

|

|

|

Financial liabilities designated at fair value

|

57,761

|

69

|

|

57,830

|

|

|

Due to customers

|

401,504

|

(145)

|

|

401,359

|

|

|

Debt issued

|

101,316

|

(17)

|

|

101,298

|

|

|

of which: amount eligible

for high-trigger loss-absorbing additional tier 1 capital²

|

4,264

|

|

|

4,264

|

13

|

|

of which: amount eligible

for low-trigger loss-absorbing additional tier 1 capital²

|

2,360

|

|

|

2,360

|

13

|

|

of which: amount eligible

for low-trigger loss-absorbing tier 2 capital³

|

10,217

|

|

|

10,217

|

7

|

|

of which: amount eligible

for capital instruments subject to phase-out from tier 2 capital⁴

|

947

|

|

|

947

|

8

|

|

Provisions

|

3,961

|

|

|

3,961

|

|

|

Other liabilities

|

72,461

|

(15,889)

|

|

56,572

|

|

|

of which: amount eligible

for high-trigger loss-absorbing capital (Deferred Contingent Capital Plan

(DCCP))⁵

|

1,145

|

|

|

1,145

|

13

|

|

Total liabilities

|

910,088

|

(16,035)

|

|

894,053

|

|

|

Equity

|

|

|

|

|

|

|

Share capital

|

385

|

(1)

|

1

|

385

|

1

|

|

Share premium

|

30,784

|

(0)

|

|

30,784

|

1

|

|

Treasury shares

|

(2,138)

|

0

|

|

(2,138)

|

3

|

|

Retained earnings

|

30,041

|

(270)

|

|

29,771

|

2

|

|

Other comprehensive income recognized directly in equity, net of

tax

|

(4,228)

|

132

|

(1)

|

(4,097)

|

3

|

|

of which: unrealized gains /

(losses) from cash flow hedges

|

2,151

|

|

|

2,151

|

11

|

|

Equity attributable to UBS

Group AG shareholders

|

54,845

|

(139)

|

1

|

54,706

|

|

|

Equity attributable to non-controlling interests

|

1,941

|

1

|

|

1,942

|

6

|

|

Total equity

|

56,786

|

(138)

|

1

|

56,648

|

|

|

Total liabilities and equity

|

966,873

|

(16,174)

|

1

|

950,700

|

|

|

1 References link the lines of this table to the respective

reference numbers provided in the column "References" in

"Table 30: Composition of capital." 2 Represents IFRS book

value. 3 IFRS book value is CHF 10,239 million. 4 IFRS book value is CHF

2,156 million. 5 IFRS book value is CHF 1,198 million. Refer to the

"Compensation" section of our Annual Report 2015 for more

information on the DCCP.

|

Table 30:

Composition of

capital

The table below provides the

“Composition of capital” as defined by BIS and FINMA. The naming convention

does not always reflect UBS’s naming convention used in our external reports.

Reference is made to items reconciling to the balance sheet under the

regulatory scope of consolidation as disclosed in “Table 29: Reconciliation of

accounting balance sheet to balance sheet under the regulatory scope of

consolidation.” Where relevant, the effect of phase-in arrangements is

disclosed as well.

|

|

|

Numbers phase-in

|

Effect of the

transition phase

|

References¹

|

|

|

CHF million, except where

indicated

|

31.3.16

|

31.3.16

|

|

|

1

|

Directly issued qualifying common share (and equivalent for

non-joint stock companies) capital plus related

stock surplus

|

31,169

|

|

1

|

|

2

|

Retained earnings

|

29,771

|

|

2

|

|

3

|

Accumulated other comprehensive income (and other

reserves)

|

(6,235)

|

|

3

|

|

4

|

Directly issued capital subject to phase-out from common equity

tier 1 capital (only applicable to non-joint

stock companies)

|

|

|

|

|

5

|

Common share capital issued by subsidiaries and held by third

parties (amount allowed in group

common equity tier 1 capital)

|

|

|

|

|

6

|

Common equity tier 1 capital

before regulatory adjustments

|

54,706

|

|

|

|

7

|

Prudential valuation

adjustments

|

(86)

|

|

|

|

8

|

Goodwill, net of tax, less hybrid capital and additional tier 1

capital²

|

(3,793)

|

(2,529)

|

4

|

|

9

|

Intangible assets, net of tax²

|

(290)

|

|

5

|

|

10

|

Deferred tax assets recognized for tax loss carry-forwards³

|

(4,535)

|

(3,025)

|

9

|

|

11

|

Unrealized (gains) / losses from cash flow hedges, net of tax

|

(2,151)

|

|

11

|

|

12

|

Expected losses on advanced internal ratings-based portfolio

less general provisions

|

(334)

|

|

|

|

13

|

Securitization gain on sale

|

|

|

|

|

14

|

Own credit related to financial liabilities designated at fair

value and replacement values, net of tax

|

(548)

|

|

|

|

15

|

Defined benefit plans

|

|

|

10

|

|

16

|

Compensation and own shares-related capital components (not

recognized in net profit)

|

(1,255)

|

|

|

|

17

|

Reciprocal crossholdings in common equity

|

|

|

|

|

17a

|

Qualifying interest where a controlling influence is exercised

together with other owners (CET instruments)

|

|

|

|

|

17b

|

Consolidated investments (CET1 instruments)

|

|

|

|

|

18

|

Investments in the capital of banking, financial and insurance

entities that are outside the scope of regulatory

consolidation, net of eligible short positions, where the bank

does not own more than 10% of the issued share capital

(amount above 10% threshold)

|

|

|

|

|

19

|

Significant investments in the common stock of banking,

financial and insurance entities that are outside

the scope of regulatory consolidation, net of eligible short

positions (amount above 10% threshold)

|

|

|

|

|

20

|

Mortgage servicing rights (amount above 10% threshold)

|

|

|

|

|

21

|

Deferred tax assets arising from temporary differences (amount

above 10% threshold, net of related tax liability)⁴

|

(927)

|

(1,174)

|

12

|

|

22

|

Amount exceeding the 15% threshold

|

|

|

|

|

23

|

of which: significant

investments in the common stock of financials

|

|

|

|

|

24

|

of which: mortgage servicing

rights

|

|

|

|

|

25

|

of which: deferred tax

assets arising from temporary differences

|

|

|

|

|

26

|

Expected losses on equity investments treated according to the

PD/LGD approach

|

|

|

|

|

26a

|

Other adjustments relating to the application of an

internationally accepted accounting standard

|

(413)

|

|

|

|

26b

|

Other deductions

|

(3,792)

|

|

13

|

|

27

|

Regulatory adjustments applied to common equity tier 1 due to

insufficient additional tier 1 and tier 2 to cover deductions

|

|

|

|

|

28

|

Total regulatory adjustments

to common equity tier 1

|

(18,126)

|

(6,727)

|

|

|

29

|

Common equity tier 1 capital

(CET1)

|

36,580

|

(6,727)

|

|

Table 30:

Composition of capital (continued)

|

|

|

Numbers phase-in

|

Effect of the

transition phase

|

References¹

|

|

|

CHF million, except where

indicated

|

31.3.16

|

31.3.16

|

|

|

30

|

Directly issued qualifying additional tier 1 instruments plus

related stock surplus

|

7,585

|

|

|

|

31

|

of which: classified as

equity under applicable accounting standards

|

|

|

|

|

32

|

of which: classified as

liabilities under applicable accounting standards⁵

|

7,585

|

|

13

|

|

33

|

Directly issued capital instruments subject to phase-out from

additional tier 1

|

|

|

|

|

34

|

Additional tier 1 instruments (and CET1 instruments not included

in row 5) issued by subsidiaries and held

by third parties (amount allowed in group additional tier 1)

|

1,904

|

(1,904)

|

6

|

|

35

|

of which: instruments issued

by subsidiaries subject to phase-out

|

1,904

|

(1,904)

|

|

|

36

|

Additional tier 1 capital

before regulatory adjustments

|

9,490

|

(1,904)

|

|

|

37

|

Investments in own additional tier 1 instruments

|

|

|

|

|

38

|

Reciprocal crossholdings in additional tier 1 instruments

|

|

|

|

|

38a

|

Qualifying interest where a controlling influence is exercised

together with other owner (AT1 instruments)

|

|

|

|

|

38b

|

Holdings in companies which are to be consolidated (additional

tier1 instruments)

|

|

|

|

|

39

|

Investments in the capital of banking, financial and insurance

entities that are outside the scope of

regulatory consolidation, net of eligible short positions, where

the bank does not own more than 10% of

the issued common share capital of the entity (amount above 10%

threshold)

|

|

|

|

|

40

|

Significant investments in the capital of banking, financial and

insurance entities that are outside

the scope of regulatory consolidation (net of eligible short

positions)

|

|

|

|

|

41

|

National specific regulatory adjustments

|

(2,529)

|

2,529

|

|

|

42

|

Regulatory adjustments applied to additional tier 1 due to

insufficient tier 2 to cover deductions

|

|

|

|

|

|

Tier 1 adjustments on impact

of transitional arrangements

|

(2,529)

|

2,529

|

|

|

|

of which: prudential

valuation adjustment

|

|

|

|

|

|

of which: own CET1

instruments

|

|

|

|

|

|

of which: goodwill net of

tax, offset against hybrid capital and low-trigger loss-absorbing capital

|

(2,529)

|

2,529

|

|

|

|

of which: intangible assets

(net of related tax liabilities)

|

|

|

|

|

|

of which: gains from the

calculation of cash flow hedges

|

|

|

|

|

|

of which: IRB shortfall of

provisions to expected losses

|

|

|

|

|

|

of which: gains on sales

related to securitization transactions

|

|

|

|

|

|

of which: gains/losses in

connection with own credit risk

|

|

|

|

|

|

of which: investments

|

|

|

|

|

|

of which: expected loss

amount for equity exposures under the PD/LGD approach

|

|

|

|

|

|

of which: mortgage servicing

rights

|

|

|

|

|

42a

|

Excess of the adjustments which are allocated to the common

equity tier 1 capital

|

|

|

|

|

43

|

Total regulatory adjustments

to additional tier 1 capital

|

(2,529)

|

2,529

|

|

|

44

|

Additional tier 1 capital

(AT1)

|

6,961

|

624

|

|

|

45

|

Tier 1 capital (T1 = CET1 +

AT1)

|

43,541

|

(6,103)

|

|

|

46

|

Directly issued qualifying tier 2 instruments plus related stock

surplus⁶

|

11,129

|

|

7

|

|

47

|

Directly issued capital instruments subject to phase-out from

tier 2⁶

|

948

|

(948)

|

8

|

|

48

|

Tier 2 instruments (and CET1 and additional tier 1 instruments

not included in rows 5 or 34) issued by

subsidiaries and held by third parties (amount allowed in group

tier 2)

|

|

|

|

|

49

|

of which: instruments issued

by subsidiaries subject to phase-out

|

|

|

|

|

50

|

Provisions

|

|

|

|

|

51

|

Tier 2 capital before

regulatory adjustments

|

12,077

|

(948)

|

|

Table 30:

Composition of capital (continued)

|

|

|

Numbers phase-in

|

Effect of the

transition phase

|

References¹

|

|

|

CHF million, except where

indicated

|

31.3.16

|

31.3.16

|

|

|

52

|

Investments in own tier 2 instruments⁶

|

(17)

|

1

|

7, 8

|

|

53

|

Reciprocal cross holdings in tier 2 instruments

|

|

|

|

|

53a

|

Qualifying interest where a controlling influence is exercised

together with other owner (tier 2 instruments)

|

|

|

|

|

53b

|

Investments to be consolidated (tier 2 instruments)

|

|

|

|

|

54

|

Investments in the capital of banking, financial and insurance

entities that are outside the scope

of regulatory consolidation, net of eligible short positions,

where the bank does not own more than 10% of

the issued common share capital of the entity (amount above the

10% threshold)

|

|

|

|

|

55

|

Significant investments in the capital banking, financial and

insurance entities that are outside

the scope of regulatory consolidation (net of eligible short

positions)

|

|

|

|

|

56

|

National specific regulatory adjustments

|

|

|

|

|

56a

|

Excess of the adjustments which are allocated to the additional

tier 1 capital

|

|

|

|

|

57

|

Total regulatory adjustments

to tier 2 capital

|

(17)

|

1

|

|

|

58

|

Tier 2 capital (T2)

|

12,059

|

(947)

|

|

|

|

of which: high-trigger

loss-absorbing capital⁵

|

895

|

|

13

|

|

|

of which: low-trigger

loss-absorbing capital⁶

|

10,217

|

|

7

|

|

59

|

Total capital (TC = T1 + T2)

|

55,601

|

(7,050)

|

|

|

|

Amount with risk-weight pursuant the transitional arrangement

(phase-in)

|

|

(2,934)

|

|

|

|

of which: net defined

benefit pension assets

|

|

|

|

|

|

of which: DTA on temporary

differences

|

|

(2,934)

|

|

|

60

|

Total risk-weighted assets

|

216,493

|

(2,934)

|

|

|

|

Capital ratios and buffers

|

|

|

|

|

61

|

Common equity tier 1 (as a percentage of risk-weighted assets)

|

16.9

|

|

|

|

62

|

Tier 1 (Pos 45 as a percentage of risk-weighted assets)

|

20.1

|

|

|

|

63

|

Total capital (pos 59 as a percentage of risk-weighted assets)

|

25.7

|

|

|

|

64

|

CET1 requirement (base capital, buffer capital and

countercyclical buffer requirements) plus G-SIB

buffer requirement, expressed as a percentage of risk-weighted

assets

|

8.3

|

|

|

|

65

|

of which: capital buffer requirement⁷

|

3.6

|

|

|

|

66

|

of which: bank-specific

countercyclical buffer requirement

|

0.2

|

|

|

|

67

|

of which: G-SIB buffer

requirement⁷

|

0.3

|

|

|

|

68

|

Common equity tier 1 available to meet buffers (as a percentage

of risk-weighted assets)

|

17.1

|

|

|

|

68a–f

|

Not applicable for systemically relevant banks according to

FINMA RS 11/2

|

|

|

|

|

72

|

Non-significant investments in the capital of other financials

|

691

|

|

|

|

73

|

Significant investments in the common stock of financials

|

812

|

|

|

|

74

|

Mortgage servicing rights (net of related tax liability)

|

|

|

|

|

75

|

Deferred tax assets arising from temporary differences (net of

related tax liability)

|

5,297

|

|

|

|

|

Applicable caps on the

inclusion of provisions in tier 2

|

|

|

|

|

76

|

Provisions eligible for inclusion in tier 2 in respect of

exposures subject to standardised approach

(prior to application of cap)

|

|

|

|

|

77

|

Cap on inclusion of provisions in tier 2 under standardized

approach

|

|

|

|

|

78

|

Provisions eligible for inclusion in tier 2 in respect of

exposures subject to internal ratings-based

approach (prior to application of cap)

|

|

|

|

|

79

|

Cap for inclusion of provisions in tier 2 under internal

ratings-based approach

|

|

|

|

|

1 References link the lines of this table to the respective

reference numbers provided in the column “References” in “Table 29:

Reconciliation of accounting balance sheet to balance sheet under the

regulatory scope of consolidation". 2 The CHF 6,322 million (CHF

3,793 million and CHF 2,529 million) reported in line 8 includes goodwill on

investments in associates of CHF 347 million and DTL on goodwill of CHF 56

million. The CHF 290 million reported in line 9 includes DTL on intangible

assets of CHF 5 million. 3 The CHF 7,560 million (CHF 4,535 million and

CHF 3,025 million) deferred tax assets recognized for tax loss carry-forwards

reported in line 10 differ from the CHF 7,098 million deferred tax assets

shown in line "Deferred tax assets" in table 29 because the latter

figure is shown after the offset of deferred tax liabilities for cash flow

hedge gains (CHF 411 million) and other temporary differences, which are

adjusted out in line 11 and other lines of this table respectively. 4 The

CHF 2,101 million (CHF 927 million and CHF 1,174 million) deferred tax assets

arising from temporary differences in line 21 differ from the CHF 5,093

million deferred tax assets on temporary differences shown in the line

“Deferred tax assets” in table 29 as the former relates only to the amount

above the 10% threshold. 5 CHF 7,585 million and CHF 895 million reported

in line 32 and 58 respectively of this table, includes the following

positions: CHF 4,264 million and CHF 2,360 million recognized in the line

"Debt issued" in table 29, CHF 1,145 million DCCP recognized in the

line "Other liabilities" in table 29 and CHF 710 million recognized

in DCCP-related charge for regulatory capital purposes in line 16

"Compensation and own shares-related capital components (not recognized

in net profit)" of this table. 6 The CHF 12,077 million in line 51

includes CHF 10,234 million low-trigger loss-absorbing tier 2 capital

recognized in the line "Debt issued" in table 29, which is shown

net of CHF 16 million investments in own tier 2 instruments reported in line

52 of this table and CHF 948 million phase-out capital recognized in the line

"Debt issued" in table 29, which is shown net of CHF 1 million

investments in own tier 2 instruments reported in line 52 of this table and

high-trigger loss-absorbing capital of CHF 895 million reported in line

58. 7 The BCBS G-SIB requirements of 0.25% (line 67) are exceeded by

our Swiss SRB capital buffer requirements (line 65) and therefore have no

incremental impact on our buffer requirements.

|

Notice

to investors |

This

document and the information contained herein are provided solely for

information purposes, and are not to be construed as solicitation of an offer

to buy or sell any securities or other financial instruments in Switzerland,

the United States or any other jurisdiction. No investment decision relating to

securities of or relating to UBS Group AG, UBS AG or their affiliates should be

made on the basis of this document. Refer to UBS’s first quarter 2016 report

and its Annual Report 2015 for additional information. These reports are

available at www.ubs.com/investors.

Rounding

|

Numbers presented throughout this document may not add up precisely

to the totals provided in the tables and text. Percentages, percent changes and

absolute variances are calculated on the basis of rounded figures displayed in

the tables and text and may not precisely reflect the percentages, percent

changes and absolute variances that would be derived based on figures that are

not rounded.

Tables

|

Within

tables, blank fields generally indicate that the field is not applicable or not

meaningful, or that information is not available as of the relevant date or for

the relevant period. Zero values generally indicate that the respective figure

is zero on an actual or rounded basis.

Percentage

changes are presented as a mathematical calculation of the change between

periods.

This Form 6-K is hereby incorporated by

reference into (1) each of the registration statements of UBS AG on

Form F-3 (Registration Number 333-204908) and of UBS Group AG on

Form S-8 (Registration Numbers 333-200634; 333-200635; 333-200641; and

333-200665), and into each prospectus outstanding under any of the foregoing

registration statements, (2) any outstanding offering circular or similar

document issued or authorized by UBS AG that incorporates by reference any

Form 6-K’s of UBS AG that are incorporated into its registration

statements filed with the SEC, and (3) the base prospectus of Corporate

Asset Backed Corporation (“CABCO”) dated June 23, 2004 (Registration

Number 333-111572), the Form 8-K of CABCO filed and dated

June 23, 2004 (SEC File Number 001-13444), and the Prospectus

Supplements relating to the CABCO Series 2004-101 Trust dated May 10,

2004 and May 17, 2004 (Registration Number 033-91744 and

033-91744-05).

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized.

UBS Group AG

By:

_/s/ David Kelly_____________

Name: David Kelly

Title: Managing Director

By:

_/s/ Sarah M. Starkweather_____

Name: Sarah M. Starkweather

Title: Executive Director

UBS AG

By:

_/s/ David Kelly_____________

Name: David Kelly

Title: Managing Director

By:

_/s/ Sarah M. Starkweather_____

Name: Sarah M. Starkweather

Title: Executive Director

Date: May 3, 2016

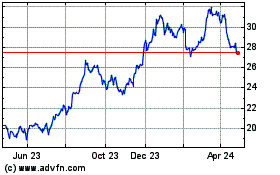

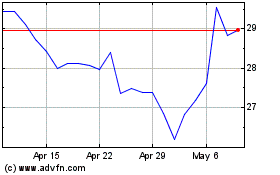

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024