Regulators Reject 'Living Wills' of Five Huge U.S. Banks

April 13 2016 - 8:40AM

Dow Jones News

WASHINGTON—Regulators ordered five huge U.S. banks to make

significant revisions to their so-called living wills by Oct. 1 or

face potential regulatory sanctions, a stern warning that will fuel

criticism the firms are "too big to fail."

J.P. Morgan Chase & Co., Wells Fargo & Co., Bank of

America Corp., Bank of New York Mellon Corp., and State Street

Corp. were found by the Federal Reserve and the Federal Deposit

Insurance Corp. to have plans for a possible bankruptcy that don't

meet the legal standard laid out in the 2010 Dodd-Frank law, which

requires that firms have credible plans to go through bankruptcy at

no cost to taxpayers.

They said those firms had until October to present plans

regulators find acceptable, or the agencies or regulators could

impose higher capital requirements, restrictions on growth or

activities, or other sanctions.

The regulators split in their assessments of Goldman Sachs Group

Inc. and Morgan Stanley. The FDIC said that Goldman Sachs's plan

didn't meet the legal standard, while the Fed didn't give that

negative assessment.

The two regulators took the opposite stance on Morgan Stanley.

The Fed "identified a deficiency" in Morgan Stanley's plan that it

said didn't meet the legal standard, but the FDIC didn't go that

far, the agencies said in a news release.

Citigroup Inc. was the only firm whose plan wasn't rejected by

both agencies, though the Fed and FDIC said the firm's plan had

"shortcomings that the firm must address" by July 2017.

Write to Ryan Tracy at ryan.tracy@wsj.com

(END) Dow Jones Newswires

April 13, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

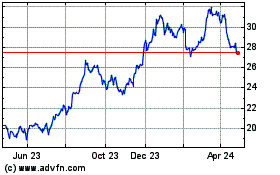

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

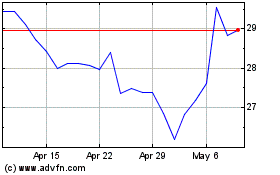

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024