Energy Bets Help Take Down Hedge Fund

November 17 2015 - 3:50PM

Dow Jones News

One of Chicago's biggest hedge funds is shutting down, victim of

a brutal pullback for energy bonds pummeling Wall Street investors

and international oil companies alike.

The roughly $900 million hedge fund at Achievement Asset

Management, run by former UBS Group AG executive Joseph Scoby, was

down about 7% through the end of October. Mr. Scoby said he opted

to hand back the remaining cash rather than "run a laboratory with

investors' money."

"Obviously, we did not make money in credit," Mr. Scoby said.

"The thing you zero is on is the crowded nature of this

market."

Achievement, which had more than $2 billion under management in

mid-2014, is the largest hedge-fund casualty to date from the

reversal of a trade that was supposed to carry the year for many

star investors. Many managers spotted an opportunity over the past

year in beaten-down debt from energy companies hit hard by oil's

slide. Yet crude continued to fall, leaving Wall Street traders in

the red and large oil companies reporting multibillion losses.

U.S. oil prices fell to near $40 a barrel Tuesday, partly on

concerns about the continuing oversupply of crude. The sudden end

for Achievement is among the first energy-related hedge fund

closures, though industry executives expect more in the weeks to

come.

Mr. Scoby, 50 years old, started his career at Chicago

option-trading firm O'Connor & Associates, later bought by a

predecessor to UBS. Mr. Scoby later served as the group's chief

risk officer.

Several former O'Connor traders formed Peak6 Investments in

1997. The Achievement Fund was a part of that firm until last

September, when Mr. Scoby spun it out.

Beyond energy, the fund's losses this year included relatively

low-rated technology, media and telecommunications corporate bond

positions. Over its three-year life, the fund's performance was

roughly flat overall.

Crain's Chicago Business earlier reported the fund's plans to

close.

Mr. Scoby cited a decline in the availability of liquidity, or

the ability to trade in and out of positions, from Wall Street

broker-dealers as a reason for the disappointing run.

Post-financial crisis regulations have encouraged a shrinking of

investment bank trading desks, which many traders have blamed for

exacerbating swings in even relatively commonly-traded

securities.

"It's going to take me some time to figure out" how to navigate

the new status quo, Mr. Scoby said.

The Achievement hedge fund plans to return at least half of its

money before the end of the month, and be left with de minimis

holdings by the first quarter, Mr. Scoby said. The firm will

continue to operate a $70 million portfolio of so-called liquid

alternatives aimed at less wealthy investors, including clients of

BlackRock Inc.

Write to Rob Copeland at rob.copeland@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 17, 2015 15:35 ET (20:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

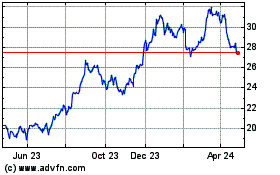

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

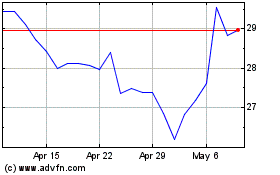

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024